Earnings summaries and quarterly performance for Knowles.

Executive leadership at Knowles.

Jeffrey Niew

President & Chief Executive Officer

Daniel Giesecke

Senior Vice President & Chief Operating Officer

John Anderson

Senior Vice President & Chief Financial Officer

Raymond Cabrera

Senior Vice President & Chief Human Resources Officer

Robert Perna

Senior Vice President, General Counsel & Secretary

Board of directors at Knowles.

Research analysts who have asked questions during Knowles earnings calls.

Christopher Rolland

Susquehanna Financial Group

7 questions for KN

Anthony Stoss

Craig-Hallum Capital Group LLC

6 questions for KN

Bob Labick

CJS Securities

4 questions for KN

Robert Labick

CJS Securities

2 questions for KN

Tristan Gerra

Robert W. Baird & Co.

2 questions for KN

Tyler Bomba

Robert W. Baird & Co.

2 questions for KN

Will Gildea

CJS Securities

2 questions for KN

Tristan Guerra

Baird

1 question for KN

Recent press releases and 8-K filings for KN.

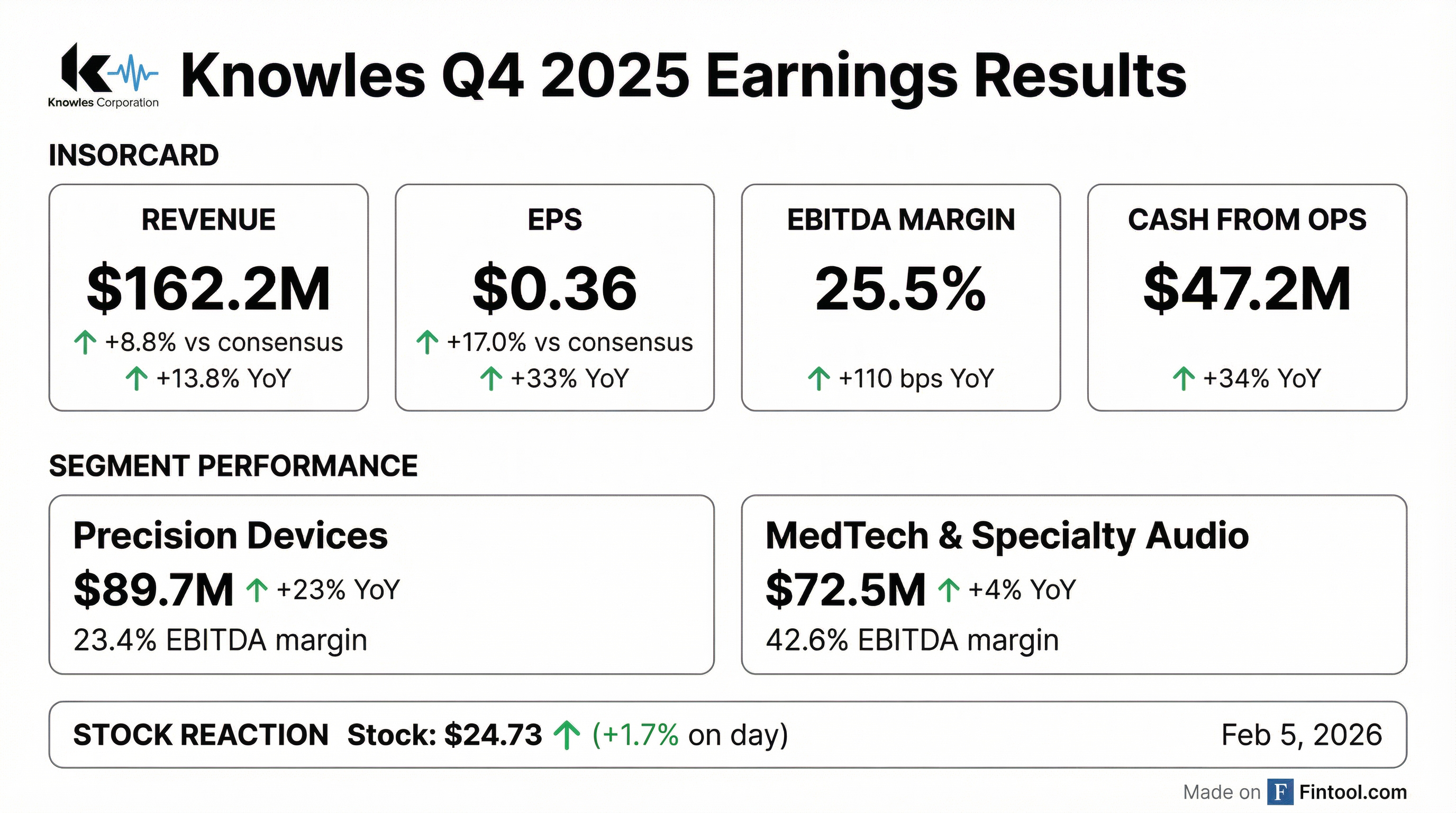

- Knowles Corporation reported strong financial performance for Q4 2025, with revenue of $162 million (up 14% year-over-year) and EPS of $0.36 (up 33% year-over-year), both exceeding guidance. Full-year 2025 revenue was $593 million (up 7% year-over-year) and EPS was $1.11 (up 21% year-over-year).

- Cash generated from operations was $47 million in Q4 2025 and $114 million for the full year, exceeding expectations.

- For Q1 2026, the company projects revenue between $149 million and $153 million (up 12% year-over-year at midpoint) and EPS between $0.22 and $0.26 per share (up 33% year-over-year at midpoint).

- Knowles completed its portfolio transformation at the end of 2024 and is experiencing strong momentum in key markets, with a book-to-bill greater than 1x in Q4 2025. The specialty film line, including a large energy order, is anticipated to contribute $50 million-$65 million in revenue in 2026, with full ramp-up by the end of Q2 2026.

- Knowles reported Q4 2025 revenue of $162.2 million and Non-GAAP Diluted EPS of $0.36, contributing to full-year 2025 revenue of $593.2 million and Non-GAAP Diluted EPS of $1.11.

- Both the MedTech & Specialty Audio and Precision Devices segments showed revenue growth in Q4 2025, with MedTech & Specialty Audio reaching $72.5 million and Precision Devices reaching $89.7 million.

- The company generated $47.2 million in net cash from operating activities in Q4 2025, with a full-year total of $114.0 million.

- For Q1 2026, Knowles projects revenue between $143 million and $153 million and Non-GAAP Diluted EPS between $0.22 and $0.26. The company also targets a 2026-2029 Revenue CAGR of 8-10% and Adjusted EBITDA CAGR of 10-14%.

- Knowles reported Q4 2025 revenues of $162.2 million, a 14% year-over-year increase, exceeding the high end of their guided range, and full year 2025 revenues of $593.2 million, up 7% year-over-year.

- Non-GAAP diluted EPS was $0.36 for Q4 2025 and $1.11 for the full year 2025.

- Net cash from operations for Q4 2025 was $47.2 million, exceeding guidance, with the full year reaching $114.0 million, or 19.2% of revenues.

- For Q1 2026, Knowles anticipates non-GAAP revenues between $143 million and $153 million and non-GAAP diluted EPS between $0.22 and $0.26.

- The company completed its transformation into an Industrial Technology company with the December 2024 divestiture of the Consumer MEMS Microphone business and has executed $271 million in share repurchases through Q4 2025.

- Knowles reported Q4 2025 revenues from continuing operations of $162.2 million and full year 2025 revenues from continuing operations of $593.2 million, marking a 7% year-over-year increase for the full year.

- Net cash from operations was $47.2 million for Q4 2025 and $114.0 million for the full year 2025, representing 19.2% of revenues.

- For Q1 2026, the company forecasts revenues from continuing operations between $143 million and $153 million, with non-GAAP diluted earnings per share from continuing operations projected to be $0.22 to $0.26.

- Knowles completed its transformation into a high-margin Industrial Technology company with the sale of the Consumer MEMS Microphone business in December 2024.

- Knowles (KN) has completed a portfolio transformation by selling its consumer electronics business last December, now focusing on high-margin, high-growth markets including medtech, defense, and industrial.

- The company targets an 8%-10% revenue CAGR and 30% EBITDA margins over the next three to five years, an increase from current EBITDA margins of approximately 24%.

- A significant growth driver is a $75 million order in alternative energy, which included a $20 million cash deposit to fund capacity expansion, with deliveries expected to reach a $10 million quarterly run rate after Q1.

- Knowles maintains a strong balance sheet with leverage below 1x and expects to generate over $100 million annually in cash flow, prioritizing M&A and share buybacks, having bought back $55 million this year and over $200 million in the last couple of years.

- Knowles (KN) has completed a portfolio transformation by divesting its consumer electronics business in December 2024, now focusing on higher-margin MedTech, Defense, and Industrial markets.

- For its continuing operations, Knowles achieved an 8% revenue CAGR and 11% EBITDA CAGR from 2017 to 2024, expanding EBITDA margins by 400 basis points to approximately 24%.

- The company targets an 8%-10% revenue CAGR and 30% EBITDA margins over the next three to five years, driven by organic growth in Precision Devices (6-8%) and MSA, supplemented by acquisitions.

- A $75 million alternative energy order is expected to contribute $3 million in deliveries in Q1 2026 and a $10 million quarterly run rate thereafter, significantly boosting Precision Devices' growth through 2027.

- Knowles maintains a strong balance sheet with net leverage projected at 0.5 times by the end of 2025 and expects to generate over $100 million in annual cash flow, supporting M&A and share buybacks.

- Knowles has completed a portfolio transformation, divesting non-core businesses to focus on high-margin, high-growth markets including MedTech, Defense, and Industrial.

- The company targets an 8-10% revenue CAGR and 30% EBITDA margins over the next three to five years, up from current ~24%.

- Growth is expected from organic expansion in Precision Devices (6-8%) and MSA (GDP plus), supplemented by 4% from acquisitions. A key driver is a $75 million order for alternative energy, with $20 million funded by the customer, expected to contribute $3 million in Q1 and reach a $10 million quarterly run rate.

- Capital allocation priorities include M&A, particularly in the fragmented Precision Devices segment, and share buybacks, with $55 million repurchased year-to-date and over $200 million in recent years. The company anticipates generating over $100 million annually in cash flow.

- Knowles Corporation reported strong Q3 2025 revenue of approximately $153 million, a 7% year-over-year increase, and adjusted EPS of $0.33, both exceeding Wall Street expectations.

- The Precision Devices segment led growth with an 11.9% revenue increase to $88.2 million and a 200 basis point expansion in adjusted EBITDA margin to 25.7%.

- The company demonstrated disciplined capital management by executing $20 million in share buybacks and reducing $15 million of debt.

- Knowles provided optimistic Q4 2025 guidance, projecting revenue around $156 million and adjusted EPS of $0.35.

- Despite strong quarterly results, net cash from operating activities declined nearly 45% year-over-year, and the company faces long-term revenue growth challenges with a multi-year annualized decline of about 3.7%-4%.

- Knowles Corporation reported Q3 2025 revenue of $153 million, a 7% year-over-year increase, and EPS of $0.33, a 22% year-over-year increase, both at the high end of their guidance range.

- For Q4 2025, revenue is projected to be between $151 million and $161 million, representing a 9% year-over-year increase at the midpoint, with EPS expected between $0.33 and $0.37 per share.

- The company anticipates full-year 2025 organic growth rates at the high end of its 4%-6% range and expects operating cash flow to be 16%-20% of revenues.

- In Q3 2025, cash from operations was $29 million, and Knowles purchased $20 million in shares.

- The Precision Devices segment revenue grew 12% year-over-year to $88 million in Q3 2025, driven by strong demand in defense and other end markets, and is expected to grow at the high end of its 6%-8% range for 2025.

- Knowles Corporation reported strong Q3 2025 results, with revenue of $153 million, up 7% year over year, and EPS of $0.33, up 22% year over year, both exceeding the midpoint of their guided range.

- The company provided Q4 2025 guidance, expecting revenues between $151 million and $161 million (up 9% at the midpoint year over year) and EPS between $0.33 and $0.37 per share.

- Knowles anticipates robust organic growth for the total company at the high end of 4% to 6% for 2026, supported by strong secular trends and new initiatives like the expansion of their specialty film production.

- Cash generation from operations was $29 million in Q3 2025, allowing for $20 million in share repurchases and a $15 million reduction in bank borrowings.

- The specialty film product line is projected to generate $25 million to $30 million in revenue for 2025 and at least $55 million to $60 million in 2026, including a $25 million energy order, with expected gross margin improvement by mid-2026.

Quarterly earnings call transcripts for Knowles.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more