Earnings summaries and quarterly performance for LITTELFUSE INC /DE.

Executive leadership at LITTELFUSE INC /DE.

Greg Henderson

President and Chief Executive Officer

Abhi Khandelwal

Executive Vice President and Chief Financial Officer

Deepak Nayar

Senior Vice President and General Manager, Electronics Business

Karim Hamed

Senior Vice President and General Manager, Semiconductor Business

Maggie Chu

Senior Vice President and Chief Human Resources Officer

Ryan Stafford

Executive Vice President, Mergers & Acquisitions, Chief Legal Officer and Corporate Secretary

Board of directors at LITTELFUSE INC /DE.

Research analysts who have asked questions during LITTELFUSE INC /DE earnings calls.

Christopher Glynn

Oppenheimer & Co. Inc.

7 questions for LFUS

David Williams

The Benchmark Company

7 questions for LFUS

Luke Junk

Robert W. Baird & Co.

6 questions for LFUS

David Silver

CL King & Associates

2 questions for LFUS

Saree Boroditsky

Jefferies

2 questions for LFUS

Grant Smith

Jefferies Financial Group Inc.

1 question for LFUS

Luke Young

Robert W. Baird & Co.

1 question for LFUS

Matthew Sheerin

Stifel

1 question for LFUS

William Kerwin

Morningstar

1 question for LFUS

Recent press releases and 8-K filings for LFUS.

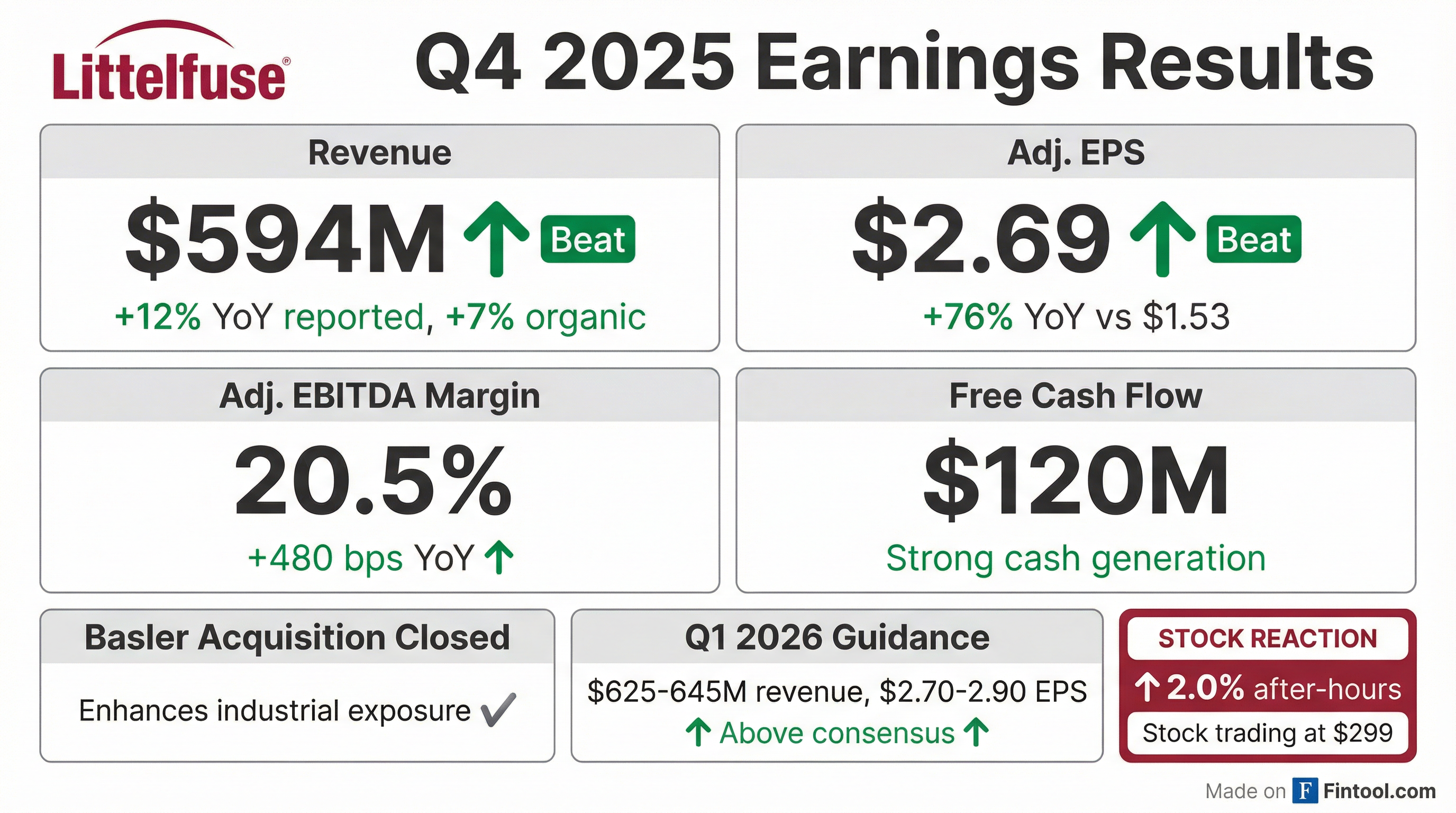

- LFUS reported Q4 2025 adjusted diluted EPS of $2.69 and a GAAP diluted loss per share of ($9.72), which included a $301 million non-cash goodwill impairment charge.

- Total revenue for Q4 2025 was $593.9 million, representing a 12% reported increase and 7% organic growth compared to the prior year.

- The company achieved an Adjusted EBITDA margin of 20.5% in Q4 2025 and generated $119.7 million in free cash flow for the quarter, contributing to a full-year 2025 free cash flow of $366.1 million, up 26% from the previous year.

- LFUS completed the strategic acquisition of Basler Electric during Q4 2025.

- Littelfuse reported strong Q4 2025 revenue of $594 million, an increase of 12% year-over-year, with adjusted diluted earnings of $2.69.

- The company completed the acquisition of Basler Electric in December, which is projected to add $130 million to $135 million in revenue and 10-15 cents of adjusted earnings in 2026.

- For Q1 2026, Littelfuse forecasts sales in the range of $625 million to $645 million and EPS between $2.70 and $2.90.

- Littelfuse is experiencing double-digit revenue growth in high-growth markets including data center, grid and utility infrastructure, and renewables, and observes emerging signs of a broad-based industrial recovery into 2026.

- The company will host an Investor Day on May 14th in New York to present a detailed review of its strategy and long-term financial goals.

- Littelfuse reported Q4 2025 revenue of $594 million, an increase of 12% year-over-year, and adjusted diluted earnings of $2.69. For the full year 2025, revenue grew 9% and adjusted EBITDA margin expanded 260 basis points to 20.9%.

- The company closed the acquisition of Basler Electric in December, which is projected to contribute $130 million to $135 million in revenue and 10-15 cents of adjusted earnings in 2026.

- Littelfuse issued Q1 2026 sales guidance of $625 million to $645 million and EPS guidance of $2.70 to $2.90, anticipating double-digit first quarter revenue growth and significant earnings expansion. This outlook is supported by Q4 bookings up more than 20% versus the prior year.

- The company noted emerging signs of broad-based industrial recovery into 2026, alongside continued strong performance in data center, grid and utility infrastructure, and renewables markets. A non-cash goodwill impairment charge of $301 million was recorded in Q4 2025 related to the IXYS and Dortmund acquisitions.

- Littelfuse reported Q4 2025 revenue of $594 million, an increase of 12% year-over-year (7% organically), with an Adjusted EBITDA margin of 20.5% and adjusted diluted earnings of $2.69.

- The company completed the acquisition of Basler Electric in December 2025, which is projected to contribute $130 million to $135 million in revenue and $0.10 to $0.15 in adjusted earnings for 2026.

- Littelfuse issued Q1 2026 sales guidance in the range of $625 million to $645 million and EPS guidance between $2.70 and $2.90.

- A non-cash goodwill impairment charge of $301 million was recorded in Q4 2025, related to the IXYS and Dortmund acquisitions, reflecting weaker sales and profitability than original expectations.

- The company is observing broad-based industrial recovery into 2026, with Q4 bookings up more than 20% versus the prior year, and continues to drive momentum in high-growth markets such as data center, grid, and utility infrastructure.

- Littelfuse reported Q4 revenue of $593.9 million, marking a 12% year-over-year increase driven by 7% organic growth, and achieved an adjusted EPS of $2.69.

- The company completed the Basler Electric acquisition, aligning with its strategic focus on higher-power electrical solutions, power semiconductors, and electric-vehicle charging infrastructure.

- Despite improved adjusted profitability, Littelfuse recorded a net GAAP loss of $242.1 million for the quarter, primarily due to a sizable goodwill impairment.

- Littelfuse announced a cash dividend of $0.75 per share. However, company insiders have been net sellers, executing 14 open-market sales in the past six months.

- Littelfuse reported Q4 2025 net sales of $594 million and adjusted diluted earnings per share of $2.69. The company recorded a GAAP diluted loss per share of ($9.72), which includes a non-cash goodwill impairment charge of $301 million related to the Semiconductor Products business within the Electronics Segment.

- For the full year 2025, net sales were $2,386 million and adjusted diluted earnings per share reached $10.68.

- The company provided Q1 2026 guidance, expecting net sales in the range of $625 million to $645 million and adjusted diluted earnings per share between $2.70 and $2.90.

- The recently closed Basler Electric acquisition is anticipated to contribute $130-135 million in revenue and $0.10 - $0.15 adjusted EPS accretion in 2026.

- Littelfuse reported Q4 2025 net sales of $594 million and adjusted diluted earnings per share of $2.69, with full year 2025 net sales reaching $2,386 million and adjusted diluted earnings per share of $10.68.

- The company recorded a non-cash goodwill impairment charge of $301 million in Q4 2025 related to the Semiconductor Products business, resulting in a GAAP diluted loss per share of ($9.72) for the quarter and ($2.89) for the full year 2025.

- For Q1 2026, Littelfuse expects net sales in the range of $625 - $645 million and adjusted diluted EPS in the range of $2.70 - $2.90.

- A cash dividend of $0.75 per share will be paid on March 5, 2026.

- Littelfuse, Inc. (NASDAQ: LFUS) acquired Basler Electric Company for a cash consideration of approximately $350 million.

- The transaction closed on December 11, 2025.

- Basler Electric is a manufacturer of electrical control and protection solutions, founded in 1942, with approximately 700 employees.

- The acquisition is expected to enhance Littelfuse's presence in mission-critical, high-growth end markets and serve as a platform for expansion in high-power applications.

- Littelfuse, Inc. (NASDAQ: LFUS) has completed its previously announced acquisition of Basler Electric Company ("Basler").

- Basler, a designer and manufacturer of electrical control and protection technologies, will become part of the Littelfuse Industrial Segment.

- The acquisition is expected to strengthen Littelfuse's high-power application capabilities and expand its presence in high-growth industrial markets like grid and utility infrastructure, power generation, and data centers.

- This acquisition is anticipated to be accretive to Adjusted EPS in 2026.

- LFUS reported strong Q3 2025 financial results, with revenue growing 10% (6.5% organic) to $624.6 million and Adjusted EPS reaching $2.95, an increase of 9% year-over-year.

- The company demonstrated strong cash generation, with Q3 free cash flow of $131 million, a 102% increase year-over-year, and a year-to-date free cash flow conversion of 145%.

- LFUS announced the strategic acquisition of Basler Electric for approximately $350 million in an all-cash transaction, which is expected to close by the end of Q4 2025 and be accretive to Adjusted EPS in 2026.

- For Q4 2025, the company provided guidance for sales between $570 million and $590 million and Adjusted EPS between $2.40 and $2.60.

Quarterly earnings call transcripts for LITTELFUSE INC /DE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more