Earnings summaries and quarterly performance for LG Display.

Research analysts who have asked questions during LG Display earnings calls.

Dongwon Kim

KB Securities

4 questions for LPL

Hyon NamKung

Shinhan Investment & Securities

2 questions for LPL

Jong-hyun Yoon

UBS Securities

2 questions for LPL

Kangho Park

Daishin Securities

2 questions for LPL

Kyuha Lee

NH Investment & Securities

2 questions for LPL

Won Suk Chung

HI Investment & Securities

2 questions for LPL

Jinny Yoon

UBS

1 question for LPL

Minkyuk Kwan

SK Securities

1 question for LPL

Seong Kim

Kiwoom Securities

1 question for LPL

So-won Kim

Kiwoom Securities

1 question for LPL

So-Yeon Kim

Kiwoom Securities

1 question for LPL

Suan Kim

Kiwoom Securities

1 question for LPL

Sung Eun Kim

Meritz Securities

1 question for LPL

Sun Kim

Kiwoom Securities

1 question for LPL

Sunwoo Kim

Meritz Securities

1 question for LPL

Won-seok Jeong

IM Securities

1 question for LPL

Wonsok Jeong

IM Securities

1 question for LPL

Recent press releases and 8-K filings for LPL.

- LG Display Co., Ltd. received an unqualified audit opinion from Samil PricewaterhouseCoopers Accounting Corporation (PwC) for its separate financial statements for both fiscal year 2025 and 2024, with the audit report dated February 27, 2026.

- For fiscal year 2025, the company reported revenues of 24,115,926 million KRW, a decrease from 25,178,688 million KRW in fiscal year 2024.

- The company significantly reduced its operating loss to (624,135) million KRW in fiscal year 2025, an improvement from an operating loss of (1,800,625) million KRW in fiscal year 2024.

- Net loss also saw substantial improvement, narrowing to (98,205) million KRW in fiscal year 2025 from a net loss of (3,034,736) million KRW in fiscal year 2024.

- Total assets decreased to 24,811,122 million KRW as of December 31, 2025, from 29,799,051 million KRW as of December 31, 2024, while total liabilities also decreased to 21,039,417 million KRW from 26,003,253 million KRW over the same period.

- LG Display Co., Ltd. achieved a significant financial turnaround in FY 2025, reporting operating income of W516,977 million and net income of W303,807 million, a substantial improvement from losses in FY 2024.

- Basic earnings per share (EPS) turned positive at W453 in FY 2025, compared to a loss of W5,438 in FY 2024.

- Revenues for FY 2025 were W25,810,082 million, a decrease from W26,615,347 million in FY 2024.

- The company completed the disposal of LG Display (China) Co., Ltd. and LG Display Guangzhou Co., Ltd. on April 1, 2025, which contributed a gain on disposal of W759,387 million.

- In a subsequent event, an agreement was made on February 9, 2026, to transfer the Auto Display LCD module business of LG Display Nanjing Co., Ltd. to further enhance business structure and profitability.

- LG Display Co., Ltd. reported a significant financial turnaround for the year ended December 31, 2025, achieving an operating profit of W516,977 million compared to an operating loss of W560,596 million in 2024, and a net profit of W303,807 million compared to a net loss of W2,409,300 million in 2024.

- The company completed the disposal of an 80% stake in LG Display (China) Co., Ltd. and a 100% stake in LG Display Guangzhou Co., Ltd. to TCL CSOT on April 1, 2025, which resulted in a change in scope of consolidation of (W429,330 million) recognized directly in equity for 2025.

- Total assets decreased from W32,859,566 million as of December 31, 2024, to W26,916,700 million as of December 31, 2025, while total liabilities decreased from W24,786,759 million to W19,077,462 million over the same period.

- LG Display expanded its business scope by adding the Fire Protection Facility Construction Business to its company objectives.

- LG Display Co., Ltd. has decided to transfer its automotive display LCD module business unit from its subsidiary, LG Display Nanjing Co., Ltd., to Top Run Total Solution (Nanjing) Co., Ltd..

- The transfer price is KRW 104,109,530,000, with the stated purpose of upgrading the business structure and enhancing revenue.

- The board resolution for this transfer was made on February 9, 2026, and the scheduled transfer date is July 30, 2026.

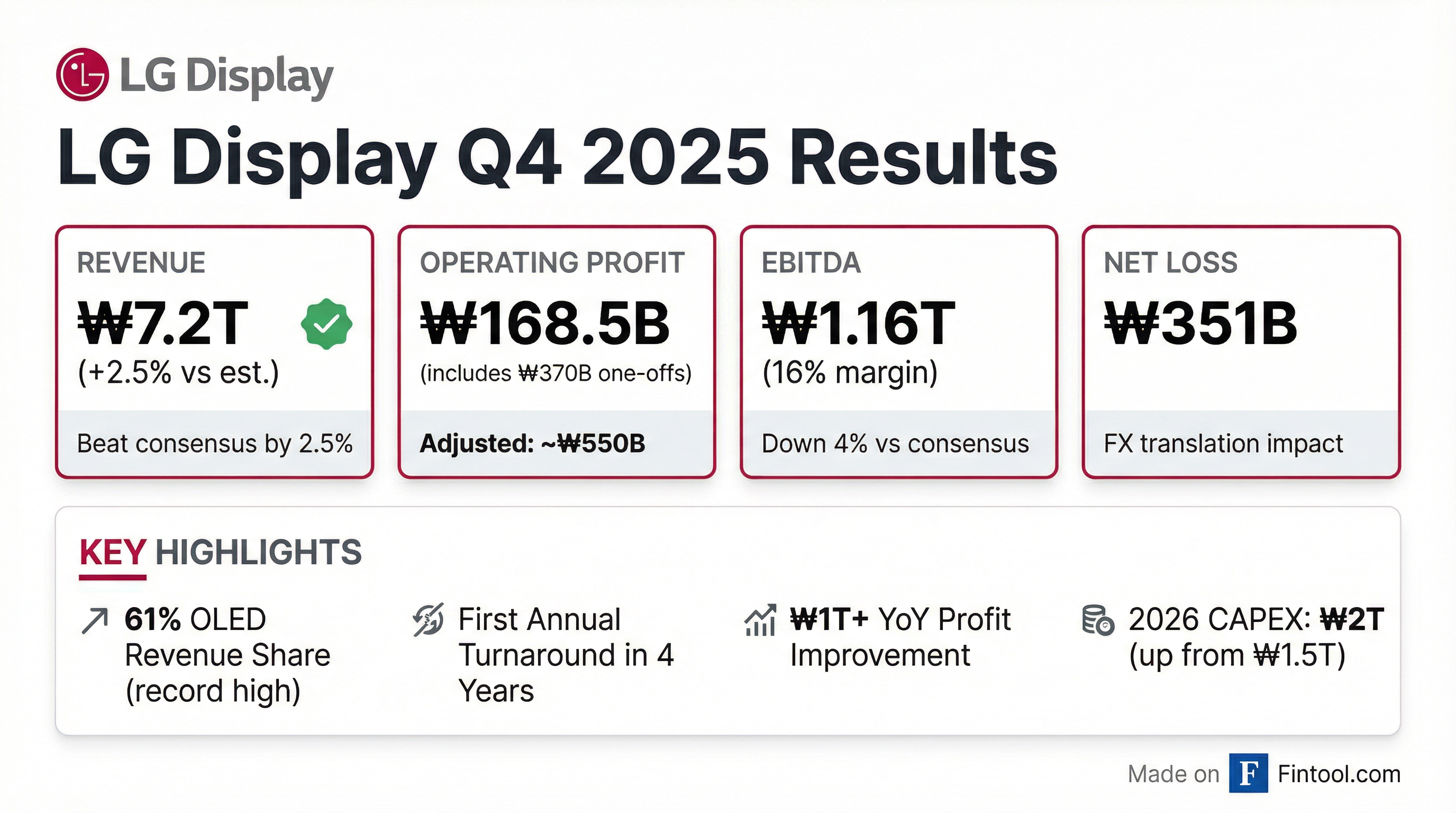

- LG Display reported revenues of KRW 7,201 billion and an operating profit of KRW 169 billion for the fourth quarter of 2025.

- For the full year 2025, the company achieved annual cumulative revenues of KRW 25.8 trillion and an operating profit of KRW 517 billion, marking its first return to full-year profitability in four years.

- OLED products accounted for a record-high 61% of total revenues in 2025, reflecting the company's strategic shift from LCD to OLED, which was further accelerated by its exit from the large-sized LCD business.

- In 2026, LG Display plans to leverage AX (AI transformation) to continuously enhance its technological and cost competitiveness, while strengthening management and operational efficiency to build a stable and sustainable profit structure.

- LG Display reported Q4 2025 revenue of ₩7.2008 trillion, a slight increase quarter-over-quarter (QOQ). Operating profit declined QOQ to ₩168.5 billion due to one-off costs, but excluding these, operating profit was roughly mid-₩500 billion, exceeding market expectations. The company recorded a net loss of ₩351.2 billion for the quarter, primarily due to foreign currency translation loss.

- The company demonstrated improved financial soundness in Q4 2025, with the debt-to-equity ratio improving to 243% (down 20 percentage points QOQ and 64 percentage points YOY) and the net debt-to-equity ratio improving to 141% (down 10 percentage points QOQ and 14 percentage points YOY). Total debt decreased by ₩1.886 trillion from the end of 2024 to ₩12.664 trillion.

- LG Display continued its strategic shift towards an OLED-centric business structure, with OLED products accounting for a record high 61% of total revenue for FY 2025. This is up from 55% in 2024 and 32% in 2020, supported by the termination of the large LCD business with the sell-off of the Gwangju LCD plant in 2025.

- For Q1 2026, total shipment area is projected to decrease by a low 20% level QOQ, and ASP per square meter is expected to decline by mid-single digits QOQ, but will remain above $1,200, representing more than 50% growth YOY.

- The company's CAPEX for 2025 was mid-₩1 trillion, and it is expected to increase to ₩2 trillion in 2026, focusing on strengthening OLED technological competitiveness and future readiness. However, LG Display is monitoring market conditions before making an 8.6 gen investment decision for IT OLED due to insufficient visibility into demand and external uncertainties.

- LG Display reported Q4 2025 revenue of ₩7.2008 trillion and an operating profit of ₩168.5 billion, which declined quarter-on-quarter. However, excluding one-off costs in the high ₩300 billion range, Q4 operating profit was approximately mid-₩500 billion, exceeding market expectations.

- The company recorded a net loss of ₩351.2 billion in Q4 2025, mainly due to foreign currency translation loss.

- The OLED-centric business structure continued to strengthen, with OLED products accounting for 65% of total revenue in Q4 2025 and 61% for the full year 2025.

- Financial soundness improved significantly, with total debt decreasing by ₩1.886 trillion from the end of 2024 to ₩12.664 trillion, and the debt-to-equity ratio improving to 243%.

- For Q1 2026, total shipment area is projected to decrease by a low 20% level quarter-on-quarter, while ASP per square meter is expected to decline by a mid-single digit % but remain above $1,200. CAPEX for 2026 is expected at the ₩2 trillion level, up year-on-year, focusing on OLED technology and business strengthening.

- LG Display reported Q4 2025 revenue of \u20a97.2008 trillion and a net loss of \u20a9351.2 billion, primarily due to foreign currency translation loss.

- Operating profit for Q4 2025 was \u20a9168.5 billion; however, excluding one-off costs in the high \u20a9300 billion range for workforce rationalization, incentive payments, and portfolio adjustments, operating profit was roughly mid-\u20a9500 billion, exceeding market expectations and showing QOQ and YOY improvement.

- The company continued its OLED-centric business structure shift, with OLED products accounting for 65% of Q4 2025 total revenue (up 5 percentage points YOY) and a record 61% for the full year 2025.

- Financial soundness strengthened, with the debt-to-equity ratio at 243% and net debt-to-equity ratio at 141% in Q4 2025, both improving QOQ and YOY.

- For Q1 2026, total shipment area is projected to decrease by low 20% QOQ, and ASP per square meter is expected to decline by mid-single digit % QOQ but remain above $1,200 (up over 50% YOY). CAPEX for 2026 is expected at \u20a92 trillion, up YOY, focused on OLED competitiveness and future readiness.

- LG Energy Solution has secured a $1.39 billion battery supply contract with Mercedes-Benz AG.

- This deal, spanning from March 2028 to June 2035, will provide batteries for Mercedes-Benz's mid- and entry-level electric vehicle models.

- The contract represents approximately 8% of LG Energy Solution's 2024 annual sales.

- This partnership supports Mercedes-Benz's electrification strategy and aims to strengthen LG Energy Solution's position in the North American and European markets.

- LG Display reported a consolidated profit of W654,986 million for the nine-month period ended September 30, 2025, with basic earnings per share of W1,165, marking a return to profitability from a loss in the prior year.

- The company completed the disposal of two subsidiaries, LG Display Guangzhou Co., Ltd. and LG Display (China) Co., Ltd., for W2,213,606 million in cash, recognizing a gain on disposal of W759,387 million during the first nine months of 2025.

- LG Display plans to reduce its capital expenditures in 2025 to the upper W1 trillion range, a decrease from W2.2 trillion in 2024.

- The separate total liabilities to equity ratio improved to 533% as of September 30, 2025, from 685% at the end of 2024, indicating an improvement in the company's capital structure.

Quarterly earnings call transcripts for LG Display.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more