Earnings summaries and quarterly performance for MID AMERICA APARTMENT COMMUNITIES.

Executive leadership at MID AMERICA APARTMENT COMMUNITIES.

Brad Hill

Chief Executive Officer and President

Amber Fairbanks

Executive Vice President, Property Management

Clay Holder

Executive Vice President, Chief Financial Officer

H. Eric Bolton, Jr.

Executive Chairman

Joe Fracchia

Executive Vice President, Chief Technology & Innovation Officer

Melanie Carpenter

Executive Vice President, Chief Human Resources Officer

Robert DelPriore

Executive Vice President, Chief Administrative Officer and General Counsel

Timothy Argo

Executive Vice President, Chief Strategy & Analysis Officer

Board of directors at MID AMERICA APARTMENT COMMUNITIES.

Alan B. Graf, Jr.

Lead Independent Director

Claude B. Nielsen

Director

David P. Stockert

Director

Deborah H. Caplan

Director

Edith Kelly-Green

Director

Gary S. Shorb

Director

John P. Case

Director

Sheila K. McGrath

Director

Tamara Fischer

Director

Research analysts who have asked questions during MID AMERICA APARTMENT COMMUNITIES earnings calls.

Alexander Goldfarb

Piper Sandler

6 questions for MAA

Brad Heffern

RBC Capital Markets

6 questions for MAA

John Kim

BMO Capital Markets

6 questions for MAA

Eric Wolfe

Citi

5 questions for MAA

Haendel St. Juste

Mizuho Financial Group

5 questions for MAA

Adam Kramer

Morgan Stanley

4 questions for MAA

Ann Chan

Green Street

4 questions for MAA

Austin Wurschmidt

KeyBanc Capital Markets Inc.

4 questions for MAA

Buck Horne

Raymond James Financial, Inc.

4 questions for MAA

Julien Blouin

The Goldman Sachs Group, Inc.

4 questions for MAA

Linda Tsai

Jefferies

4 questions for MAA

Michael Goldsmith

UBS

4 questions for MAA

Rich Hightower

Barclays

4 questions for MAA

Steve Sakwa

Evercore ISI

4 questions for MAA

Alexander Kim

Zelman & Associates

3 questions for MAA

Daniel Tricarico

Scotiabank

3 questions for MAA

Mason P. Guell

Baird

3 questions for MAA

Alex Kim

Zelman & Associates

2 questions for MAA

Cooper Clark

Wells Fargo

2 questions for MAA

James Feldman

Wells Fargo

2 questions for MAA

Jamie Feldman

Wells Fargo & Company

2 questions for MAA

Michael Lewis

Truist Securities, Inc.

2 questions for MAA

Nick Yulico

Scotiabank

2 questions for MAA

Rob Stevenson

Janney Montgomery Scott

2 questions for MAA

Wesley Golladay

Robert W. Baird & Co.

2 questions for MAA

Anne Chang

Green Street

1 question for MAA

Annie Zhang

Green Street

1 question for MAA

Jana Galan

Bank of America

1 question for MAA

Jana Gallen

Bank of America

1 question for MAA

Jeff Spector

Bank of America

1 question for MAA

Joshua Dennerlein

BofA Securities

1 question for MAA

Michael Gorman

BTG Pactual

1 question for MAA

Michael Stefany

Mizuho Financial Group

1 question for MAA

Nicholas Yulico

Scotiabank

1 question for MAA

Nick Kerr

Citigroup Inc.

1 question for MAA

Omotayo Okusanya

Deutsche Bank AG

1 question for MAA

Richard Anderson

Wedbush Securities

1 question for MAA

R. Nick Kerr

Citigroup

1 question for MAA

Recent press releases and 8-K filings for MAA.

- 2026 Core FFO per share guidance of $8.35–$8.71 (midpoint $8.53), with Q1 2026 expected at $2.05–$2.17, underpinned by 35 bps of effective rent growth and 55 bps of property revenue growth.

- 2025 same-store trends show four consecutive quarters of YOY improvement in blended lease pricing and a 4Q occupancy of 95.7%, driven by low turnover and easing concessions.

- Active development pipeline includes 723 units in lease-up and 2,522 units under construction at a total expected cost of $932 million, targeting $55–$65 million of stabilized incremental NOI and $207 million of value creation.

- 2026 capital allocation plans encompass $45–$55 million for unit redevelopments, $16–$20 million for property repositioning, $250 million each for acquisitions and dispositions, and $33.8 million of share repurchases YTD.

- On February 27, 2026, Mid-America Apartments, L.P. issued and sold $200 million aggregate principal amount of 4.650% Senior Notes due January 15, 2033, as additional notes under its existing indenture.

- The Notes pay 4.650% interest semi-annually on January 15 and July 15, beginning July 15, 2026, and will be fungible with the initial $400 million series issued on November 10, 2025, under the same CUSIP.

- The Operating Partnership may redeem the Notes at any time before November 15, 2032, at a “make-whole” premium, and thereafter at 100% of principal plus accrued interest.

- Mid-America Apartment Communities’ operating partnership priced $200 million of 4.650% senior unsecured notes due January 15, 2033 at 100.237% of par, yielding 4.606% (reoffer).

- The notes will join the existing $400 million 4.650% senior notes issued on November 10, 2025 as a single series under the same indenture and CUSIP.

- Net proceeds will repay borrowings under the company’s unsecured commercial paper program; any remaining funds will support general corporate purposes, including further debt repayment and apartment community acquisitions.

- The offering is expected to close on February 27, 2026, with J.P. Morgan, Citigroup, PNC, TD Securities and Wells Fargo as joint book-running managers.

- MAALP, MAA’s operating partnership, priced a $200 million offering of 4.650% senior unsecured notes due January 15, 2033 under its existing indenture.

- The notes were issued at 100.237% of par with a reoffer yield of 4.606%, and the offering is expected to close on February 27, 2025.

- Net proceeds will be used to repay borrowings under the unsecured commercial paper program, with any remaining funds for general corporate purposes, including other debt repayment and apartment community investments.

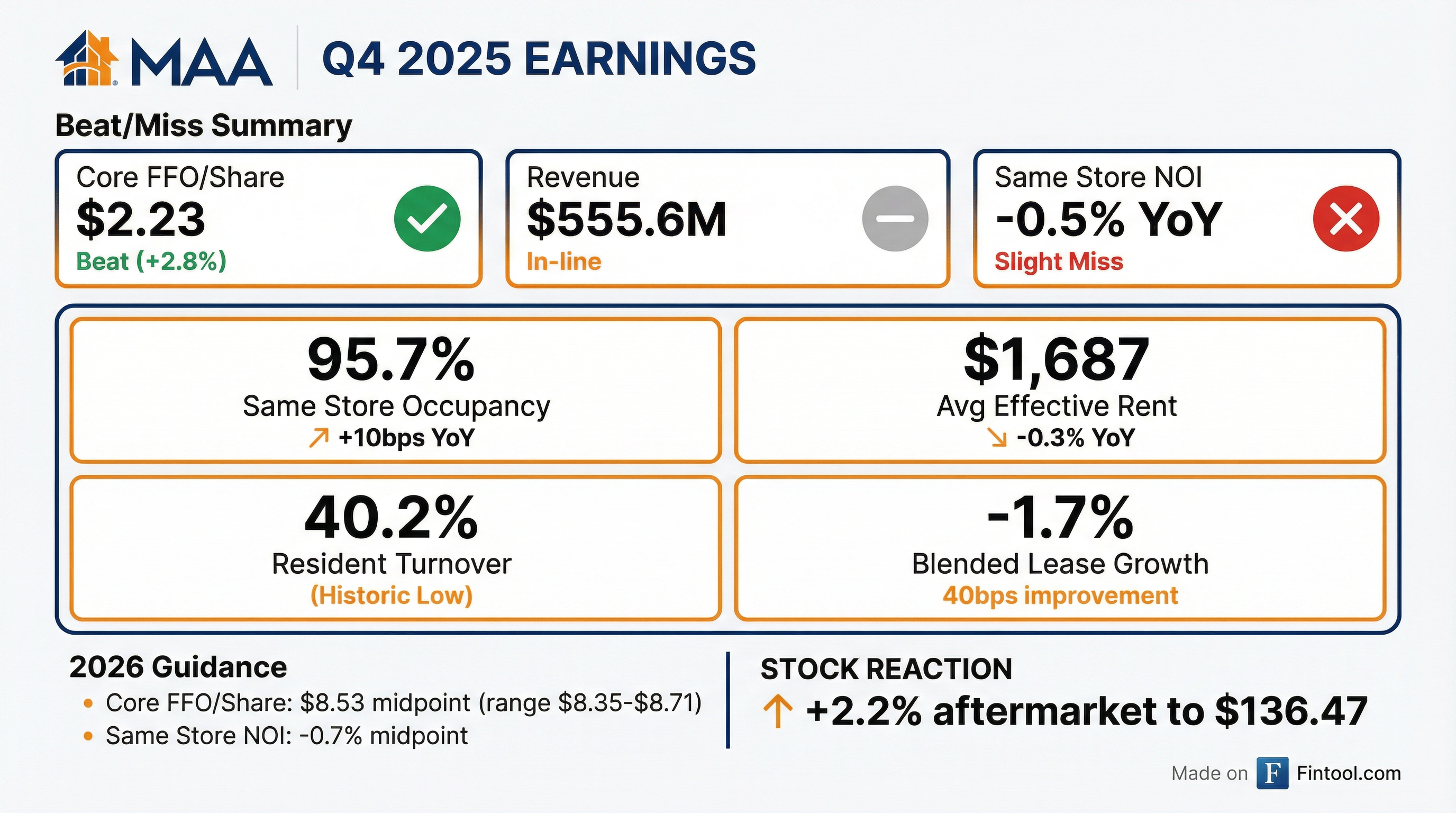

- Q4 Core FFO was $2.23 per diluted share, contributing to full-year Core FFO of $8.74 per share.

- Operating fundamentals showed 95.7% average occupancy (up 10 bps Y/Y) and +40 bps blended same-store lease rate growth, as new deliveries decelerate (down >60% in 2026 vs. peak) and the development pipeline stands at $932 million.

- 2026 guidance was updated to Core FFO of $8.35–$8.71 per share (midpoint $8.53); same-store revenue growth of 0.55% and a 0.75% decline in same-store NOI at midpoint.

- Capital actions included $81 million funded on the current development pipeline, $880 million of liquidity, net debt/EBITDA of 4.3x, issuance of $400 million seven-year bonds at ~4.75%, and repurchase of 207,000 shares at an average of $131.61 (first buyback since 2001).

- Core FFO of $2.23 per share in Q4 and $8.74 for FY 2025; 2026 Core FFO guidance of $8.35–$8.71 per share (midpoint $8.53).

- Average occupancy of 95.7%, up 10 bps QoQ and YoY; same-store blended lease rates improved 40 bps YoY; net delinquency at 0.3% of billings.

- Active development pipeline at $932 million, with $81 million funded in Q4 and $306 million remaining to fund; projects expected to deliver stabilized NOI yields of 6–6.5%.

- Ended Q4 with $880 million in combined cash and revolver capacity, net debt/EBITDA of 4.3×, and issued $400 million of 7-year bonds at ~4.75% to refinance maturing paper.

- MAA reported Core FFO of $2.23 per share for Q4 and $8.74 per share for FY 2025, and issued initial 2026 Core FFO guidance of $8.35–$8.71 per share (midpoint $8.53).

- Fourth quarter average physical occupancy was 95.7%, up 10 basis points year-over-year, with blended lease rates improving 40 basis points, and net delinquency at 0.3% of billings.

- At quarter end, MAA had $880 million of combined cash and borrowing capacity, a net debt-to-EBITDA ratio of 4.3x, 87% of outstanding debt fixed at a 6.4-year average maturity (3.8% rate); issued $400 million of 7-year bonds at ~4.75%, and repurchased 207,000 shares at an average price of $131.61.

- The company’s active development pipeline reached $932 million, with $81 million funded in Q4 and $306 million remaining, including shovel-ready acquisitions in Scottsdale and Arlington (287-unit project).

- MAA settled the RealPage multi-district lawsuit without admitting wrongdoing or altering operations; two state attorney general matters remain pending.

- MAA reported Q4 2025 diluted EPS of $0.48, FFO per diluted share of $1.79 and Core FFO per diluted share of $2.23, and full-year 2025 diluted EPS of $3.78, FFO of $8.32 and Core FFO of $8.74 per share.

- Same Store effective physical occupancy was 95.7%, average effective rent per unit $1,687, with effective blended lease rate growth of –1.7% year-over-year in Q4 2025.

- MAA issued $400 M of 7-year unsecured senior notes at 4.65%, extended its unsecured revolving credit facility to $1.5 B maturing January 2030, and repurchased 0.2 M common shares at an average price of $131.61 for $27 M in Q4 2025.

- MAA’s 2026 guidance includes a Core FFO midpoint of $8.53 per diluted share and Q1 2026 Core FFO guidance midpoint of $2.11 per share.

- During Q4 2025, MAA completed the initial lease-up of MAA Vale in Raleigh, began construction on a Phoenix multifamily community, and acquired Northern Virginia land for a 287-unit development.

- MAA reported Q4 net income available to common shareholders of $56.6 million (EPS $0.48), Total NOI of $349.8 million; for FY 2025, net income was $443.2 million (EPS $3.78), and Total NOI was $1.371 billion.

- FFO per diluted share was $1.79 in Q4 and $8.32 for the year, Core FFO per share was $2.23 in Q4 and $8.74 for FY 2025; MAA declared its 128th consecutive quarterly dividend at $1.53 per share (annual rate $6.12).

- In Q4, MAA repurchased 0.2 million shares for $27 million, expanded its unsecured revolver to $1.5 billion (accordion to $2.0 billion), issued $400 million of 4.65% senior notes due 2033, and closed 2025 with $879.2 million of cash and revolver capacity; net debt/adjusted EBITDAre was 4.3x.

- MAA provided initial 2026 guidance of $4.11–$4.47 in diluted EPS, $8.35–$8.71 in Core FFO per share, $7.32–$7.68 in Core AFFO per share, and same-store NOI growth of -1.7% to 0.3%.

- Mid-America Apartment Communities will pay $53 million to settle the In Re: RealPage antitrust class action in two equal $26.5 million installments, subject to preliminary and final court approval.

- The settlement includes prospective commitments on nonpublic data disclosure and revenue management software usage, which align with current practices and trigger revision or termination rights if opt-out levels exceed specified thresholds.

- The Company will boost its loss contingency reserve to $62.5 million in its year-end 2025 financials—recorded in other non-operating expense and accrued liabilities—without affecting 2025 Core FFO or FAD.

- Management does not expect the settlement to impair credit ratings, liquidity, leverage ratios, debt covenants, or its dividend policy, viewing the payment as manageable within its capital plan.

Quarterly earnings call transcripts for MID AMERICA APARTMENT COMMUNITIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more