Earnings summaries and quarterly performance for Merchants Bancorp.

Executive leadership at Merchants Bancorp.

Michael Petrie

Detailed

Chairman and Chief Executive Officer

CEO

DT

Darin Thomas

Detailed

Chief Accounting Officer

JK

Jerry Koors

Detailed

President – Merchants Mortgage

KL

Kevin Langford

Detailed

Chief Administrative Officer

MS

Martin Schroeter

Detailed

President – Warehouse Lending

MD

Michael Dunlap

Detailed

President and Chief Operating Officer

MD

Michael Dury

Detailed

President and Chief Executive Officer, Merchants Capital

SE

Scott Evans

Detailed

Chief Operating Officer, Merchants Bank

SS

Sean Sievers

Detailed

Chief Financial Officer

TO

Terry Oznick

Detailed

General Counsel

Board of directors at Merchants Bancorp.

Research analysts covering Merchants Bancorp.

Recent press releases and 8-K filings for MBIN.

Merchants Bancorp Announces Stock Repurchase Program

MBIN

Share Buyback

- Merchants Bancorp's Board of Directors has approved a stock repurchase program.

- The program authorizes the repurchase of up to $100 million of common stock.

- This repurchase program is valid until December 31, 2027.

- The program is discretionary and may be modified, suspended, or discontinued at any time.

Jan 28, 2026, 9:10 PM

Merchants Bancorp Reports Fourth Quarter and Full Year 2025 Results

MBIN

Earnings

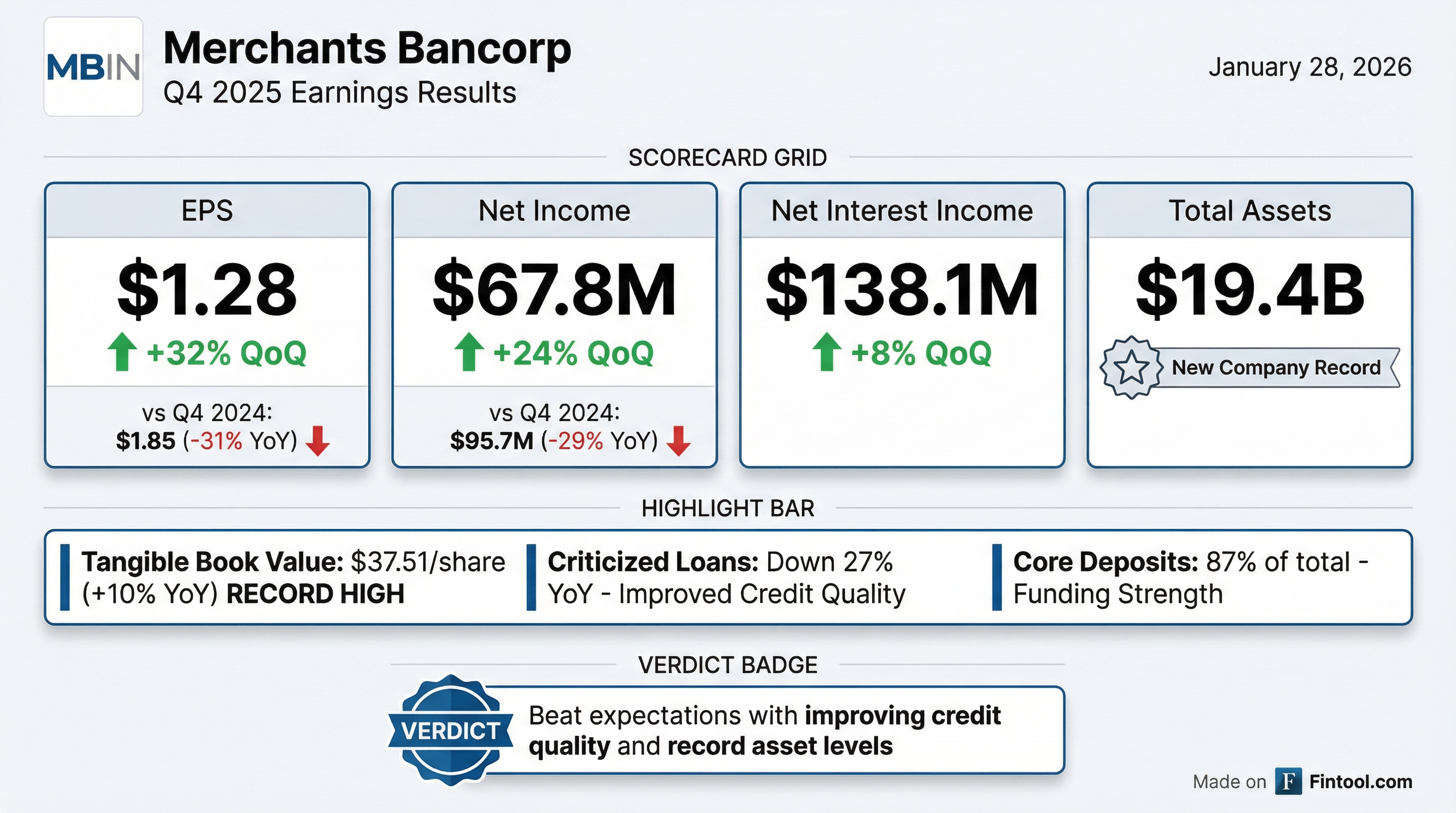

- Merchants Bancorp reported Q4 2025 net income of $67.8 million and diluted earnings per common share of $1.28, representing a 24% increase in net income and a 32% increase in diluted EPS compared to Q3 2025.

- For the full year 2025, net income was $218.8 million and diluted EPS was $3.78, which decreased by 32% and 40%, respectively, compared to 2024.

- Asset quality improved meaningfully, with criticized loans receivable decreasing by 13% to $508.2 million and total loan delinquencies decreasing by 38% to $206.8 million compared to September 30, 2025.

- Total assets reached a new company milestone of $19.4 billion as of December 31, 2025, and tangible book value per common share hit a record-high of $37.51.

Jan 28, 2026, 9:05 PM

Merchants Bancorp Reports Fourth Quarter and Full Year 2025 Results

MBIN

Earnings

Demand Weakening

- Merchants Bancorp reported net income of $67.8 million and diluted earnings per common share of $1.28 for the fourth quarter of 2025, representing a 24% increase in net income and a 32% increase in diluted EPS compared to the third quarter of 2025.

- For the full year 2025, net income was $218.8 million and diluted earnings per common share was $3.78, which decreased 32% and 40% respectively, compared to 2024.

- Total assets reached a new milestone of $19.4 billion at December 31, 2025, an increase of 3% compared to December 31, 2024.

- Asset quality improved meaningfully, with criticized loans receivable decreasing 13% and total loan delinquencies decreasing 38% compared to September 30, 2025.

- Tangible book value per common share reached a record-high of $37.51 at December 31, 2025, up 10% from the fourth quarter of 2024.

Jan 28, 2026, 9:05 PM

Merchants Bancorp Announces Q3 2025 Results

MBIN

Earnings

Revenue Acceleration/Inflection

- Merchants Bancorp reported net income of $54.7 million and diluted earnings per common share of $0.97 for the third quarter of 2025. This represents a 44% increase in net income and a 62% increase in diluted EPS compared to the second quarter of 2025.

- Total assets reached a record-high of $19.4 billion as of September 30, 2025, reflecting a 1% increase from June 30, 2025.

- Core deposits grew by 12% to $12.8 billion compared to June 30, 2025, and now account for 92% of total deposits.

- Tangible book value per common share reached a record-high of $36.31 as of September 30, 2025, an increase of 3% from the second quarter of 2025 and 12% from the third quarter of 2024.

- The company's financial performance was bolstered by a 45% decrease in the total provision for credit losses compared to Q2 2025, and a 47% increase in gain on sale of loans compared to Q3 2024.

Oct 28, 2025, 8:10 PM

Merchants Bancorp Reports Third Quarter 2025 Results

MBIN

Earnings

New Projects/Investments

- Merchants Bancorp reported net income of $54.7 million and diluted earnings per common share of $0.97 for the third quarter of 2025.

- Total assets reached a record high of $19.4 billion as of September 30, 2025.

- Tangible book value per common share also reached a record high of $36.31, an increase of 12% compared to the third quarter of 2024.

- The total provision for credit losses decreased 45%, or $23.8 million, compared to the third quarter of 2024.

- Core deposits increased to $12.8 billion, representing 92% of total deposits, and grew 12% compared to June 30, 2025.

Oct 28, 2025, 8:05 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more