Earnings summaries and quarterly performance for Mechanics Bancorp.

Research analysts who have asked questions during Mechanics Bancorp earnings calls.

Recent press releases and 8-K filings for MCHB.

Mechanics Bancorp Reports Strong Q4 2025 Results, Announces DUS Business Sale, and Provides 2026 Outlook

MCHB

Earnings

M&A

Dividends

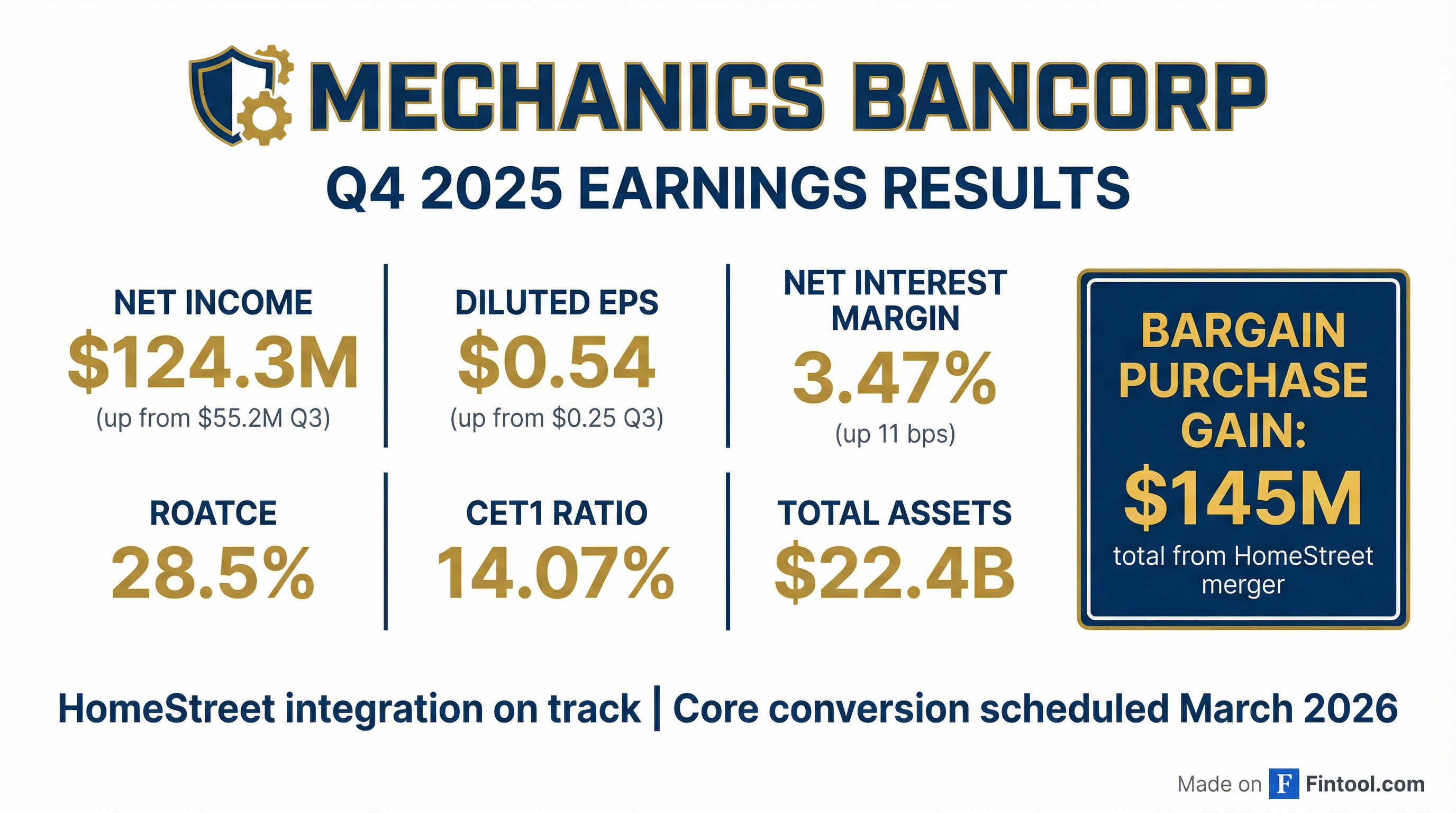

- Mechanics Bancorp reported $124.3 million in net income and $0.54 diluted EPS for Q4 2025, achieving a 2.2% ROAA and 28.5% ROTCE. Core net income for the quarter was just under $60 million, representing a core ROAA of 1.06% and a core ROTCE of 14.3%.

- The company agreed to sell its Fannie Mae Delegated Underwriting and Servicing (DUS) business to Fifth Third for $130 million and early adopted ASU 2025-08, which resulted in a $55.1 million after-tax bargain purchase gain and a $20.2 million one-time negative loan loss provision respectively.

- The integration of HomeStreet is proceeding smoothly, with core systems conversion scheduled for March 2026, which is expected to deliver $82 million in cost savings by Q4 2026. Total assets were $22.4 billion, with $19 billion in total deposits and a cost of deposits of 1.43% for Q4 2025, and a spot cost of 1.3% at December 31.

- Mechanics Bancorp anticipates modest NIM expansion in 2026 and expects to hit its target of $300 million of run rate earnings by Q4 2026, implying an 18% ROTCE and 1.44% ROAA. An estimated $0.39 dividend is expected in Q1 2026, with a dividend payout ratio of over 100% in 2026 due to excess capital from the DUS sale and balance sheet runoff, normalizing to approximately 80% in 2027 and beyond.

Jan 30, 2026, 4:00 PM

Mechanics Bancorp Reports Strong Q4 2025 Results and Strategic Progress

MCHB

Earnings

Dividends

Guidance Update

- Mechanics Bancorp reported net income of $124.3 million and diluted EPS of $0.54 for Q4 2025, with a Net Interest Margin (NIM) of 3.47%. Core net income, excluding one-time items, was just under $60 million.

- The company recorded a $55.1 million after-tax bargain purchase gain from the agreed sale of its Fannie Mae DUS business line and a $20.2 million one-time negative loan loss provision reversal due to early adoption of ASU 2025-08. Integration of HomeStreet is on track, with core systems conversion in March and $82 million in cost savings expected by Q4.

- Mechanics Bancorp restarted its dividend with $0.21 per share paid in December and anticipates an estimated $0.39 dividend in Q1 2026. Management expects a NIM increase of 10-15 basis points in Q1 2026, reaching around 3.75% by year-end 2026, and projects $300 million of run rate earnings by Q4 2026.

Jan 30, 2026, 4:00 PM

Mechanics Bancorp Reports Strong Q4 2025 Results and Provides Strategic Outlook

MCHB

Earnings

M&A

Dividends

- Mechanics Bancorp reported net income of $124.3 million for Q4 2025, with a 2.2% ROAA and 28.5% ROTCE, and diluted EPS of $0.54. Core net income, excluding one-time items, was approximately $60 million.

- The company agreed to sell its Fannie Mae DUS business to Fifth Third for $130 million, which is expected to close in Q1 2026, and recorded an additional $55.1 million after-tax bargain purchase gain in Q4. Integration of HomeStreet is proceeding, with core systems conversion in March, and $82 million in cost savings are expected by Q4 2026.

- The dividend was restarted in December with $0.21 per share paid, and a $0.39 dividend is expected in Q1 2026. The dividend payout ratio is projected to be over 100% in 2026, normalizing to 80% in 2027 and beyond, primarily due to capital return from the DUS sale and balance sheet adjustments.

- Management anticipates a Net Interest Margin (NIM) pickup of 10-15 basis points in Q1 2026, reaching approximately 3.75% by year-end 2026. The company targets $300 million of run rate earnings by Q4 2026, implying an 18% ROTCE and 1.44% ROAA.

Jan 30, 2026, 4:00 PM

Mechanics Bancorp Reports Strong Q4 2025 Results and Strategic Updates

MCHB

Earnings

M&A

Guidance Update

- Mechanics Bancorp reported net income of $124.3 million and fully diluted EPS of $0.54 for Q4 2025, with a ROAA of 2.20% and ROATCE of 28.5%.

- The merger with HomeStreet Bank was completed on September 2, 2025, contributing a $145 million total bargain purchase gain.

- The company early adopted ASU 2025-08, which resulted in a $20.2 million one-time negative loan loss provision in Q4 2025.

- Mechanics Bancorp agreed to sell its Fannie Mae DUS business line for $130 million, with the transaction expected to close in Q1 2026.

- The Net Interest Margin (NIM) increased to 3.47% in Q4 2025, and the company expects modest NIM expansion in 2026 and beyond.

Jan 30, 2026, 4:00 PM

Mechanics Bancorp Reports Strong Q4 and Full Year 2025 Results Driven by HomeStreet Merger

MCHB

Earnings

M&A

Accounting Changes

- Mechanics Bancorp reported net income of $124.3 million, or $0.54 per diluted share, for the fourth quarter of 2025, and $265.7 million, or $1.22 per diluted share, for the full year 2025.

- The company's financial results were materially impacted by the merger with HomeStreet Bank, completed on September 2, 2025, which contributed a preliminary bargain purchase gain of $145.5 million.

- Total assets stood at $22.4 billion at December 31, 2025, with strong capital ratios including a 14.07% CET1 capital ratio and 8.65% Tier 1 leverage ratio.

- Mechanics Bancorp agreed to sell its Fannie Mae DUS business line for $130 million, with the transaction expected to close in Q1 2026, and anticipates delivering $82 million in cost savings from the HomeStreet merger.

- The company early adopted ASU 2025-08 in Q4 2025, which resulted in a reversal of provision for credit losses of $23.5 million in the fourth quarter.

Jan 30, 2026, 12:04 AM

Mechanics Bancorp to Sell Fannie Mae DUS Business Line to Fifth Third

MCHB

M&A

New Projects/Investments

- Mechanics Bancorp's subsidiary, Mechanics Bank, entered into a definitive agreement on December 3, 2025, to sell its Fannie Mae Delegated Underwriting and Servicing (DUS) business line to Fifth Third Bancorp.

- The transaction is an all-cash sale with an aggregate purchase price of approximately $130 million, subject to adjustment.

- Fifth Third will acquire Mechanics Bank's approximately $1.8 billion DUS servicing portfolio and hire the employees operating the DUS Business.

- The sale is anticipated to close in the first quarter of 2026, contingent on customary closing conditions and Fannie Mae's approval.

Dec 9, 2025, 9:47 PM

Mechanics Bancorp Reports Q3 2025 Earnings and HomeStreet Merger Completion

MCHB

Earnings

M&A

Dividends

- Mechanics Bancorp reported net income of $55.2 million and fully diluted EPS of $0.25 for Q3 2025.

- The merger with HomeStreet Bank was completed on September 2, 2025, contributing a $90.4 million bargain purchase gain but also incurring significant one-time merger expenses of approximately $63.9 million.

- As of September 30, 2025, the company reported total assets of $22.7 billion, total deposits of $19.5 billion, and a CET1 ratio of 13.4%.

- Mechanics Bancorp plans to return ~80% of earnings as a regular, recurring dividend beginning in Q1 2026, with profitability estimates for 2026 and 2027 remaining unchanged at $302 million and $325 million, respectively.

Oct 31, 2025, 3:00 PM

Mechanics Bancorp reports Q3 2025 results following HomeStreet Bank merger

MCHB

Earnings

M&A

Guidance Update

- Mechanics Bancorp reported net income of $55.2 million and fully diluted EPS of $0.25 for Q3 2025, significantly impacted by a $90.4 million bargain purchase gain from the HomeStreet Bank merger, which closed on September 2, 2025.

- Q3 2025 results included $63.9 million in one-time merger-related expenses.

- As of September 30, 2025, the company reported total assets of $22.7 billion, total deposits of $19.5 billion, a CET1 ratio of 13.4%, and a loans-to-deposits ratio of 75%.

- The company maintains its profitability estimates for 2026 net income at $302 million and 2027 net income at $325 million, anticipating ~$82 million in cost savings fully phased-in by the end of Q2 2026.

- Mechanics Bancorp plans to initiate a regular, recurring dividend in Q1 2026, returning ~80% of earnings.

Oct 30, 2025, 9:22 PM

Mechanics Bancorp Reports Q3 2025 Results and HomeStreet Bank Merger Completion

MCHB

Earnings

M&A

New Projects/Investments

- Mechanics Bancorp completed its merger with HomeStreet Bank on September 2, 2025, which materially impacted its Q3 2025 financial results.

- For the third quarter of 2025, the company reported net income of $55.2 million and $0.25 per diluted share, an increase from $42.5 million and $0.20 per diluted share in the prior quarter.

- Post-merger, total assets increased by $6.1 billion to $22.7 billion, total deposits rose by $5.5 billion to $19.5 billion, and total loans grew by $5.3 billion.

- The company recognized a preliminary bargain purchase gain of $90.4 million from the merger, while incurring $63.9 million in non-recurring acquisition and integration costs.

- Book value per common share increased to $12.54 at September 30, 2025, from $11.96 at June 30, 2025, and preliminary regulatory capital ratios remained strong, including a 15.59% Total risk-based capital ratio.

Oct 30, 2025, 9:21 PM

HomeStreet Announces Q2 2025 Results and Merger Update

MCHB

Earnings

M&A

Guidance Update

- HomeStreet reported a net loss of $4.4 million, or $0.23 per share, and a core net loss of $3.1 million, or $0.16 per share, for Q2 2025.

- The company's net interest margin was 1.90% for the quarter.

- A merger with Mechanics Bank is estimated to close in the third quarter of 2025.

- As of June 30, 2025, uninsured deposits were $604 million, representing 10% of total deposits, and nonperforming assets to total assets were 0.76%.

- Book value per share was $21.30 and tangible book value per share was $20.97 as of June 30, 2025.

Jul 28, 2025, 11:00 AM

Quarterly earnings call transcripts for Mechanics Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more