Earnings summaries and quarterly performance for METLIFE.

Executive leadership at METLIFE.

Michel A. Khalaf

President and Chief Executive Officer

Adrienne O'Neill

Executive Vice President and Chief Accounting Officer

Bill Pappas

Executive Vice President and Head of Global Technology and Operations

Eric Clurfain

Regional President, Latin America

John D. McCallion

Executive Vice President and Chief Financial Officer

Lyndon Oliver

Regional President, Asia

Marlene Debel

Executive Vice President and Chief Risk Officer

Michael Roberts

Executive Vice President and Chief Marketing Officer

Monica Curtis

Executive Vice President and Chief Legal Officer

Nuria Garcia

Regional President, EMEA

Ramy Tadros

Regional President, U.S. Business and Head of MetLife Holdings

Shurawl Sibblies

Executive Vice President and Chief Human Resources Officer

Board of directors at METLIFE.

Carla A. Harris

Director

Carlos M. Gutierrez

Director

Christian Mumenthaler

Director

Denise M. Morrison

Director

Diana L. McKenzie

Director

Jeh C. Johnson

Director

Laura J. Hay

Director

Mark A. Weinberger

Director

R. Glenn Hubbard

Chairman of the Board

William E. Kennard

Director

Research analysts who have asked questions during METLIFE earnings calls.

Suneet Kamath

Jefferies

8 questions for MET

Wesley Carmichael

Autonomous Research

8 questions for MET

Joel Hurwitz

Dowling & Partners Securities, LLC

7 questions for MET

Ryan Krueger

KBW

7 questions for MET

Thomas Gallagher

Evercore

7 questions for MET

Alex Scott

Barclays PLC

5 questions for MET

Jimmy Bhullar

JPMorgan Chase & Co.

4 questions for MET

Elyse Greenspan

Wells Fargo

3 questions for MET

Jamminder Bhullar

JPMorgan Chase & Co.

3 questions for MET

Cave Montazeri

Deutsche Bank

2 questions for MET

Tom Gallagher

Evercore ISI

2 questions for MET

Wilma Burdis

Raymond James Financial

2 questions for MET

Wilma Jackson Burdis

Raymond James

2 questions for MET

John Barnidge

Piper Sandler

1 question for MET

Nick Anido

Wells Fargo & Company

1 question for MET

Recent press releases and 8-K filings for MET.

- MetLife’s U.S. business comprises two core segments—Group Benefits and Retirement & Income Solutions—which collectively accounted for 60% of adjusted earnings.

- Group Benefits, the largest U.S. player with $25 billion of premium (three times the next competitor), drives above-market growth through scale-driven capability investments ($2 billion over five years), broker consolidation tailwinds, and expanding low double-digit participation in voluntary products.

- Retirement & Income Solutions leverages demographic tailwinds, writing $14 billion in Pension Risk Transfers last year and expanding into retail annuity reinsurance via Chariot Re (initial $11 billion of transactions), converting spread-based liabilities into fee-based income with third-party capital support.

- MetLife is deploying AI-infused reengineering across underwriting, claims, and customer engagement to boost speed, accuracy, and top-line growth, and has built a Leave Management solution to serve state mandates for a population set to grow from 37 million today to 100 million by 2027.

- US Business (Group Benefits and Retirement & Income Solutions) drives 60% of adjusted earnings; Group Benefits wrote $25 billion of premium last year (3× the next competitor) and accounted for 25% of MetLife’s earnings.

- Group Benefits growth is fueled by $2 billion in capability investments over the past five years, employer and broker consolidation, and low double-digit product participation—80% of sales come from existing customers with an average tenure over 20 years.

- Leave Management addresses state-mandated leave complexity, scaling from 37 million covered Americans in 2019 to an expected 100 million by 2027; clients purchasing this service buy 4–5 additional MetLife products on average.

- Retirement solutions leverage demographic tailwinds: completed $14 billion in Pension Risk Transfers from a $3 trillion DB universe, and expanded institutional annuity reinsurance via Chariot Re with $11 billion of transactions, converting spread income into fee-based revenue.

- MetLife’s U.S. Group Benefits and Retirement & Income Solutions businesses drive 60% of adjusted earnings, with Group Benefits generating $25 billion in premiums and 25% of MetLife’s earnings last year.

- MetLife is the largest Group Benefits provider, 3× the size of its next competitor, having invested $2 billion over five years in digital, underwriting and distribution capabilities to sustain a 25% market share in national accounts and derive 80% of sales from existing customers with >20-year average tenure.

- Key growth drivers in Group Benefits include employer demand to “do more with fewer,” ongoing broker/channel consolidation, and low-double-digit employee participation rates that MetLife is lifting via technology, data analytics and AI-driven guided advice during open enrollment.

- In Retirement & Income Solutions, MetLife wrote $14 billion of Pension Risk Transfers last year as corporate plan sponsors de-risk, and is expanding institutional annuity reinsurance through Chariot Re—with $11 billion of seed transactions to access third-party capital and generate fee-based revenues.

- MetLife has launched an AI-infused reengineering across claims, call centers, underwriting and customer engagement to improve speed, accuracy and top-line growth by closing the employee benefits “confusion gap”.

- $1.0 billion 5.850% Fixed-to-Fixed Reset Rate Subordinated Debentures due March 15, 2056 issued at 100.000% of par.

- Settlement on February 26, 2026 (T+2) with $990 million net proceeds after 1.000% underwriting discount.

- Interest resets on March 15, 2036 and every five years thereafter at the five-year Treasury rate + 1.817%, with semiannual payments and an optional deferral feature of up to five years per period.

- Debt ranks subordinated unsecured, junior to senior indebtedness and pari passu with MetLife’s 6.350% fixed-to-fixed reset subordinated debentures due 2055.

- MetLife’s New Frontier strategy delivered $10 billion in free cash flow for 2025 and shaved 40 bps off direct expenses, while maintaining targets of double-digit EPS growth, 15–17% ROE, and reducing the expense ratio to 11.3% by the end of the plan.

- MetLife Investment Management closed the PineBridge acquisition on December 30, 2025, boosting AUM from $600 billion to over $740 billion and targeting $240–280 million in EBITDA synergies through expanded CLO, multi-asset and alternative capabilities.

- In group benefits, early persistency actions led to strong 1-to-1 renewals, and leave & absence solutions now average 4–5 products bundled per sale, supporting growth within the 4–7% annual target range.

- MetLife reported a record $14 billion in PRT transactions for 2025 with returns aligned to enterprise targets, achieved 17% growth in Japan’s third-sector market, and maintained LATAM momentum toward $1 billion in earnings.

- Under New Frontier, MetLife delivered 10% EPS growth, strong free cash flow and 40 bps reduction in its direct expense ratio in 2025.

- Group Benefits growth was driven by leave and absence enhancements—with 4–5 products bundled per sale—and improved persistency, underpinning a 4–7% medium-term growth target.

- MetLife Investment Management closed the PineBridge acquisition on December 30, 2025, boosting AUM from ~$600 bn to $740 bn+ and generating $22 bn of net flows.

- Retirement solutions achieved 17% Third Sector growth in Japan and completed record $14 bn in PRT transactions, while leveraging reinsurance deals to support origination platforms.

- International markets—including Mexico, Brazil, Japan and Korea—sustained mid-to-high single-digit growth via diversified, U.S. dollar-denominated products.

- MetLife’s New Frontier strategy delivered $10 billion in free cash flow and cut direct expenses by 40 bps in 2025, supporting efficiency and growth in group benefits, asset management, and international markets.

- The company set a double-digit EPS growth target, underpinned by a 60/40 split between earnings growth and capital management, while shrinking its legacy retail runoff business.

- MetLife reaffirmed its 15–17% ROE goal, driven by high-ROE new business returns and efficiency gains; it reduced its expense ratio to 11.7% in 2025 and targets 11.3% by year-end.

- MetLife completed the PineBridge acquisition on Dec 30, raising AUM to $740 billion+ with $22 billion net inflows, and forecast $240–280 million of EBITDA growth in 2026 from revenue synergies.

- In international markets, MetLife recorded 17% growth in Japan’s third sector, strong momentum in Mexico and Brazil despite VAT headwinds, and is on track toward a $1 billion earnings goal in Latin America.

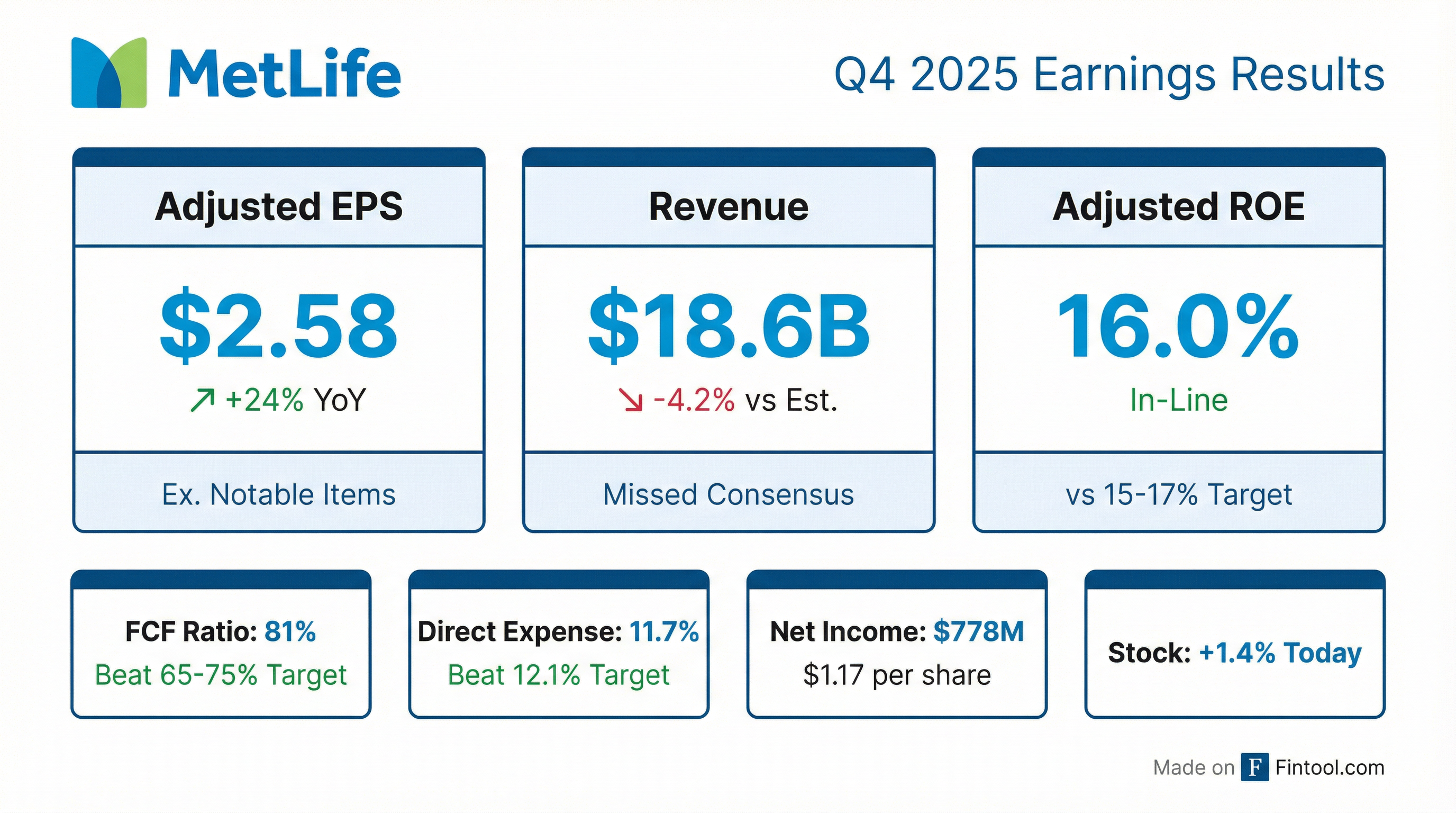

- Adjusted EPS of $2.58 ex-notable items in Q4 (up 24% y/y) on $1.6 billion of adjusted earnings; full-year 2025 adjusted EPS was $8.89 (+10% y/y) on $6.0 billion of adjusted earnings ex-notables.

- Adjusted premiums, fees & other revenues (PFOs) rose 8% to $12.8 billion in Q4 (29% to $18.6 billion including PRT); segment Q4 adjusted earnings were Group Benefits $465 million (+12%), RIS $454 million (+18%), Asia $444 million (+1% cc), Latin America $227 million (+13%), EMEA $97 million (+64%).

- Strong capital management with $3.6 billion of holding-company liquidity at year-end, retirement of $500 million debt, $430 million of share buybacks and $370 million of dividends in Q4, plus an additional $200 million repurchased in January.

- 2026 outlook targets: double-digit adjusted EPS growth, 15%–17% ROE, 65%–75% two-year average free cash flow ratio, 12.1% direct expense ratio and $1.6 billion of pre-tax variable investment income.

- Adjusted EPS of $2.49 and $2.58 ex-notables, up 24% YoY, with $1.6 billion in adjusted earnings in Q4 2025.

- Full-year 2025 adjusted EPS of $8.89, up ~10%, with 16% adjusted ROE and 11.7% direct expense ratio—both ahead of targets.

- PFOs rose 8% to $12.8 billion in Q4 (29% including retained PRT), driven by robust volume growth across businesses.

- Q4 segment adjusted earnings: Group Benefits $465 million, Retirement & Income Solutions $454 million, Asia $444 million, Latin America $227 million, EMEA $97 million, and MetLife Investment Management $60 million.

- 2026 guidance includes double-digit adjusted EPS growth, 15%–17% ROE, a 65%–75% free cash flow ratio, ~12.1% direct expense ratio, and ~$1.6 billion pre-tax variable investment income.

- MetLife delivered 10% adjusted EPS growth and achieved an adjusted ROE of 16.0% in FY25, surpassing targets, with FY25 adjusted EPS of $8.83 per share.

- Q4 2025 adjusted earnings excluding notable items rose 18% YoY to $1,709 million ( $2.58 per share), driven by underwriting and investment margin expansion across core segments.

- FY25 free cash flow ratio reached 81%, above the 65–75% target; direct expense ratio improved to 11.7%, beating the 12.1% goal.

- Q4 variable investment income was $393 million (pre-tax), including $497 million from private equity, contributing to $1.187 billion VII for FY25 (post-tax).

- Segment adjusted earnings ex-notable items in Q4: Group Benefits +12% to $465 million; Retirement & Income Solutions +18% to $454 million; EMEA +64% to $97 million; MetLife Investment Management +275% to $60 million.

Fintool News

In-depth analysis and coverage of METLIFE.

Quarterly earnings call transcripts for METLIFE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more