Earnings summaries and quarterly performance for MUELLER INDUSTRIES.

Executive leadership at MUELLER INDUSTRIES.

Board of directors at MUELLER INDUSTRIES.

Research analysts covering MUELLER INDUSTRIES.

Recent press releases and 8-K filings for MLI.

Mueller Industries, Inc. Reports Record Fiscal 2025 Full Year Results

MLI

Earnings

Revenue Acceleration/Inflection

Guidance Update

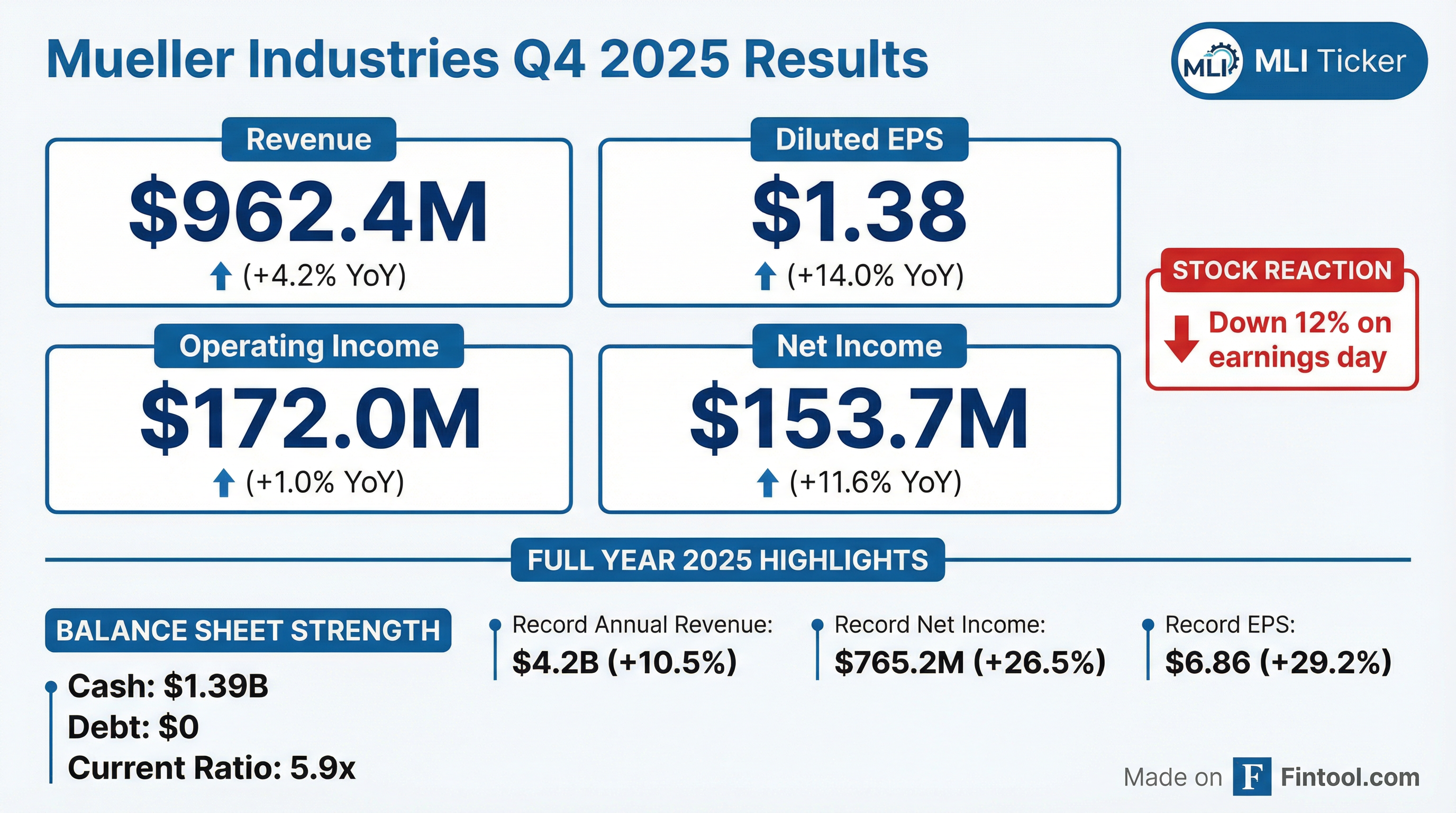

- Mueller Industries, Inc. reported a 4.2% increase in net sales to $962.4 million and a 14.0% increase in diluted EPS to $1.38 for Q4 2025 compared to Q4 2024. For the full year 2025, net sales grew 10.5% to $4.2 billion, and diluted EPS increased 29.2% to $6.86, marking the highest annual operating and net income in the company's history.

- The company generated $141.2 million of cash from operations during Q4 2025. At year-end December 27, 2025, cash and short-term investments totaled $1.39 billion, with a current ratio of 5.9 to 1 and no debt.

- Despite market conditions worsening in 2025 and an $18.2 million unrealized loss on hedge contracts due to rising copper prices, the CEO anticipates considerable improvements in 2026, supported by operational initiatives and a strong balance sheet for potential strategic acquisitions.

6 days ago

Mueller Industries Reports Fiscal 2025 Fourth Quarter and Full Year Results

MLI

Earnings

Revenue Acceleration/Inflection

Share Buyback

- Mueller Industries, Inc. reported record annual operating and net income for fiscal year 2025, with net sales reaching $4.2 billion, a 10.5% increase from 2024, and diluted EPS growing 29.2% to $6.86.

- For the fourth quarter of 2025, net sales increased 4.2% to $962.4 million, and diluted EPS rose 14.0% to $1.38 compared to the fourth quarter of 2024.

- The company generated $141.2 million of cash from operations during Q4 2025 and ended the year with a strong balance sheet, including $1.39 billion in cash and short-term investments and no debt.

- CEO Greg Christopher stated that while market conditions worsened in 2025, the company anticipates considerable improvements as 2026 progresses, supported by operational improvements and opportunities for strategic acquisitions.

6 days ago

Mueller Industries: Copper Products Market Projected to Reach $651.19 Billion by 2035

MLI

New Projects/Investments

Revenue Acceleration/Inflection

M&A

- The global copper products market was valued at $375.85 billion in 2025 and is projected to grow to $651.19 billion by 2035, with a CAGR of 5.65% from 2026 to 2035.

- Key growth drivers include rising demand for copper in renewable energy systems, electrification, infrastructure expansion, and the build-out of AI data centers.

- Asia Pacific dominated the market with a 75.55% share in 2025. The primary copper segment accounted for 84.8% of the revenue share, and the wire segment dominated with 61.7% in 2025.

- Global refined copper demand is projected to nearly double from over 25 MMt in 2021 to almost 49 MMt in 2035, with energy transition technologies accounting for about half of this growth.

- In August 2024, Mueller Industries acquired Elkhart Products Corporation (EPC), a US-based manufacturer of copper solder fittings, to strengthen its market position.

Nov 28, 2025, 10:28 AM

Mueller Industries Reports Strong Q3 2025 Earnings

MLI

Earnings

Demand Weakening

Share Buyback

- Mueller Industries, Inc. reported strong Q3 2025 financial results, with Net Sales of $1.08 billion, a Net Income of $208.1 million, and Diluted EPS of $1.88, all showing increases compared to Q3 2024.

- The company maintains a robust financial position, ending Q3 2025 with a cash balance of $1.3 billion, no debt, and a current ratio of 4.8 to 1.

- The increase in net sales was primarily driven by higher selling prices due to rising raw material costs and improved sales performance, despite softness in residential construction and an influx of imported products.

- For the nine months ended September 27, 2025, the company generated $614.2 million in net cash from operations and returned capital to shareholders through $81.7 million in dividends and $243.6 million in common stock repurchases.

Oct 21, 2025, 8:23 PM

Mueller Industries Reports Strong Q3 2025 Earnings

MLI

Earnings

New Projects/Investments

Demand Weakening

- Mueller Industries reported strong third-quarter 2025 earnings, with net income rising to $208.1 million and net sales reaching $1.08 billion, reflecting robust financial performance despite challenges such as softness in residential construction.

- The company is strategically expanding its U.S. manufacturing capabilities and reshoring operations, positioning itself well amid global trade uncertainties due to its limited reliance on imports.

- Analysts maintain a positive outlook, with consensus target prices indicating over 12% upside, and the stock has demonstrated strong momentum with a 28.43% total return over the past year.

- Mueller Industries maintains a strong balance sheet with no debt and significant cash reserves.

Oct 21, 2025, 11:21 AM

Mueller Industries Reports Strong Third Quarter 2025 Earnings

MLI

Earnings

Demand Weakening

New Projects/Investments

- Mueller Industries reported strong third quarter 2025 financial results, with net sales increasing to $1.08 billion from $997.8 million in Q3 2024, and diluted EPS rising to $1.88 from $1.48 in the prior year period.

- The company's net income grew to $208.1 million in Q3 2025, up from $168.7 million in Q3 2024, primarily driven by higher selling prices related to increased raw material costs, with COMEX copper averaging $4.83 per pound.

- Mueller Industries maintains a robust financial position, ending the quarter with a cash balance of $1.3 billion and no debt, supported by $310.1 million in net cash generated from operations.

- Despite experiencing softness in residential construction and an influx of imported products, the company is accelerating plans to increase U.S. manufacturing capabilities to enhance its ability to meet demand for domestically produced goods.

Oct 21, 2025, 11:00 AM

Mueller Industries Reports Q1 2025 Earnings

MLI

Earnings

Share Buyback

Revenue Acceleration/Inflection

- Net income increased to $157.4M in Q1 2025 versus $138.4M in Q1 2024, with operating income rising to $206.3M.

- Net sales climbed to $1.0B from $849.7M, driven by acquisitions and higher pricing.

- The company repurchased over 3 million shares using $243.6M and maintained a cash balance of $830.1M.

Apr 22, 2025, 12:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more