Earnings summaries and quarterly performance for MOSAIC.

Executive leadership at MOSAIC.

Bruce M. Bodine

President and Chief Executive Officer

Karen A. Swager

Executive Vice President - Operations

Luciano Siani Pires

Executive Vice President and Chief Financial Officer

Philip E. Bauer

Senior Vice President, General Counsel and Corporate Secretary

Walter F. Precourt III

Senior Vice President and Chief Administrative Officer

Yijun ("Jenny") Wang

Executive Vice President - Commercial

Board of directors at MOSAIC.

Cheryl K. Beebe

Director

David T. Seaton

Director

Emery N. Koenig

Director

Gregory L. Ebel

Independent Chair of the Board

Gretchen H. Watkins

Director

João Roberto Gonçalves Teixeira

Director

Jody L. Kuzenko

Director

Kathleen M. Shanahan

Director

Kelvin R. Westbrook

Director

Sonya C. Little

Director

Timothy S. Gitzel

Director

Research analysts who have asked questions during MOSAIC earnings calls.

Andrew Wong

RBC Capital Markets

6 questions for MOS

Joel Jackson

BMO Capital Markets

6 questions for MOS

Vincent Andrews

Morgan Stanley

6 questions for MOS

Edlain Rodriguez

Mizuho Securities

5 questions for MOS

Kristen Owen

Oppenheimer & Co. Inc.

5 questions for MOS

Christopher Parkinson

Wolfe Research

4 questions for MOS

Jeffrey Zekauskas

JPMorgan Chase & Co.

4 questions for MOS

Lucas Beaumont

UBS Group AG

4 questions for MOS

Richard Garchitorena

Wells Fargo

4 questions for MOS

Steve Byrne

Bank of America

3 questions for MOS

Ben Isaacson

Scotiabank

2 questions for MOS

Benjamin Theurer

Barclays Corporate & Investment Bank

2 questions for MOS

Chris Parkinson

Wolfe Research, LLC

2 questions for MOS

David Simmons

BNP Paribas

2 questions for MOS

David Symonds

BNP Paribas

2 questions for MOS

Duffy Fischer

Goldman Sachs

2 questions for MOS

Jeff Zekauskas

JPMorgan

2 questions for MOS

Mike Sison

Wells Fargo

2 questions for MOS

Rahi Parikh

Barclays

2 questions for MOS

Aron Ceccarelli

Berenberg

1 question for MOS

Joshua Spector

UBS

1 question for MOS

Recent press releases and 8-K filings for MOS.

- In Q4 2025, phosphate production was 1.7 million tons, with 2026 guidance of at least 7 million tons of phosphate and about 9 million tons of potash production.

- Phosphate cash cost of conversion in Q4 was $112/ton, down ~$20/ton from earlier 2025 highs; potash cash cost averaged $75/ton, and Mosaic Fertilizantes blended rock cost was $97/ton.

- Working capital build of $960 million reduced full-year cash flow, increasing net debt by $829 million; Q1 2026 EBITDA faces a headwind of ~$250 million from higher sulfur costs, but a $300–500 million working-capital release is expected in 2026.

- 2026 capital expenditures are expected at around $1.5 billion for mine and disposal-area expansions, with ARO and environmental spending declining by $50 million; targets include reducing capital outlays to $1 billion by 2030.

- Achieved $150 million of cost savings in 2025 and targets an additional $100 million in 2026; Mosaic Biosciences doubled net sales to $68 million in 2025 and aims to double again in 2026.

- Q4 phosphate demand in the U.S. fell sharply, leading to weaker-than-expected results, but spring inquiries are rising and global agricultural fundamentals remain solid.

- Despite an extended turnaround at Bartow, Mosaic produced 1.7 million tons of phosphate in Q4 and achieved a phosphate cash conversion cost of $112/ton, and it now expects at least 7 million tons of phosphate and 9 million tons of potash in 2026.

- 2025 working capital builds reduced cash flow by $960 million, increasing net debt by $829 million; Mosaic raised $900 million via 3- and 5-year notes in November 2025 and forecasts a $300–500 million working capital release in 2026 to drive cash flow improvement.

- 2026 capital expenditures will be modestly higher—driven by new gypstack investments—while asset retirement obligations and environmental reserve spending decline; Mosaic aims to reduce total CapEx to $1 billion and ARO/enviro reserves to $200 million by decade-end.

- Divestitures of non-core assets—including Patos de Minas, Taquari, and the pending Carlsbad sale—are complete, refocusing capital on core operations.

- Q4 2025 highlighted by 1.7 Mt phosphate production, $112/t cash conversion cost (improved by ~$20/t), robust potash output; net debt rose by $829 M following a $960 M working capital build.

- Full-year 2026 targets include ≥ 7 Mt phosphate and ~ 9 Mt potash production, $1.5 B CapEx (peaking due to gypstack and clay settling projects), declining to $1 B by 2030, and free cash flow above dividends.

- Operational efficiencies drove $150 M cost savings in 2025 with an additional $100 M planned for 2026; Q1 2026 EBITDA faces a $250 M headwind from elevated sulfur costs.

- Strategic progress includes Mosaic Biosciences doubling sales to $68 M in 2025 and targeting another doubling in 2026 with 8–10 new product launches, alongside $170 M in non-core asset divestiture proceeds.

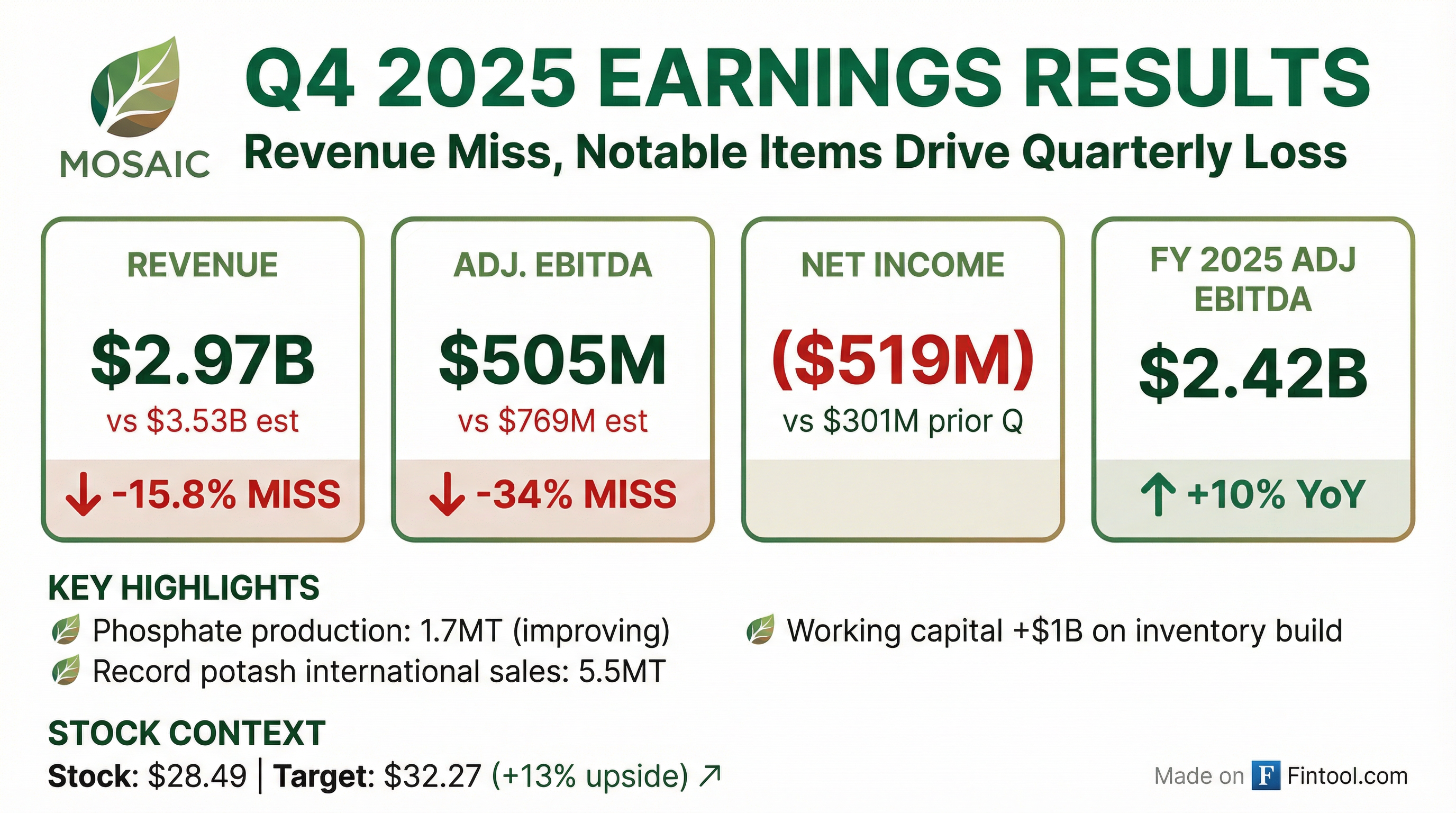

- Mosaic reported Q4 2025 consolidated revenues of $2,974 M, a net loss of $519 M, and adjusted EBITDA of $505 M.

- Segment adjusted EBITDA in Q4: $336 M for Potash, $144 M for Phosphate, and $45 M for Mosaic Fertilizantes on revenues of $686 M, $1,015 M, and $1,146 M respectively.

- For full-year 2025, Mosaic delivered revenues of $12,052 M, net income of $541 M, and adjusted EBITDA of $2,421 M.

- Q1 2026 guidance includes phosphate sales volumes of 1.7–1.9 MT (DAP prices $640–670/ton) and potash sales volumes of 2.0–2.2 MT (MOP prices $255–275/ton).

- Mosaic reports full-year 2025 net income of $541 million (EPS $1.70) and adjusted EBITDA of $2.4 billion, while Q4 2025 saw a net loss of $519 million (EPS $(1.64)) and adjusted EBITDA of $505 million.

- Potash segment delivered 2025 production of 8.8 million tonnes, net sales of $2.7 billion, and adjusted EBITDA of $1.183 billion; phosphate segment produced 1.7 million tonnes in Q4 and generated full-year adjusted EBITDA of $917 million.

- Company expects Q1 2026 phosphate sales volumes to recover to 1.7–1.9 million tonnes and potash sales volumes to be 2.0–2.2 million tonnes with MOP prices of $255–$275/tonne.

- Capital expenditures were $1.36 billion in 2025, and 2026 capex is forecast at approximately $1.5 billion, partly offset by lower ARO spending.

- Phosphate sales volumes of ~1.3 million tonnes and potash sales volumes of ~2.2 million tonnes in Q4, down sharply on weak North American demand and early winter weather.

- Brazil full-year sales of ~9 million tonnes were flat, but Q4 volumes fell short amid credit constraints and an influx of low-analysis phosphate from China.

- Production remained stable Q/Q after Mosaic adjusted its phosphate production plan and redirected product to stronger markets.

- Outlook for 2026 is constructive with balanced to tight phosphate and potash markets, anticipated grower nutrient replenishment, and Chinese export restrictions supporting prices.

- On November 13, 2025, Mosaic closed the sale of $500 million 4.350% Senior Notes due 2029 and $400 million 4.600% Senior Notes due 2030.

- The offering was led by J.P. Morgan Securities, Citigroup Global Markets, BMO Capital Markets and Goldman Sachs as representatives of the underwriters.

- The Company expects net proceeds of approximately $893.5 million, to be used for general corporate purposes, including debt repayment.

- Mosaic reported Q3 2025 revenues of $3,452 M, operating earnings of $340 M, net income of $411 M, and adjusted EBITDA of $806 M.

- Phosphate segment delivered $1,290 M revenue and $280 M adjusted EBITDA, Potash recorded $695 M revenue with $329 M adjusted EBITDA, and Mosaic Fertilizantes posted $1,592 M revenue and $241 M adjusted EBITDA.

- Potash cash cost of production fell to $71/tonne, down from $75/tonne in Q2 2025 , and phosphate cash cost of conversion was $131/tonne.

- Q4 2025 guidance expects phosphate sales volumes of 1.7–1.9 Mt with DAP prices of $700–730/tonne, and potash sales volumes of 2.3–2.6 Mt with MOP prices of $270–280/tonne.

- Net income of $411 million and adjusted EBITDA of $806 million, up from $122 million and $448 million year-ago, driven by higher prices and strong Brazil performance.

- Phosphate production rose sequentially, with trailing three-month volumes reaching ~1.8 million tons; Q4 phosphate sales guidance of 1.7–1.9 million tons and earnings expected above prior-year quarter.

- Initial cost savings of $150 million achieved, on track for $250 million target by end of 2026, and disciplined capital allocation including sale of Taquari ($27 million) and Patos de Minas ($111 million) assets.

- Working capital build of >$400 million weighed on Q3 cash flow ($229 million); expected to partially reverse in Q4, with cash flow and free cash flow improving significantly in 2026.

- Mosaic Co reported Q3 net income of $411 million (EPS $1.29), adjusted EBITDA of $806 million and adjusted EPS of $1.04

- Phosphate production improved to 1.7 million tonnes in Q3, with trailing three-month output of ~1.8 million tonnes, and segment adjusted EBITDA of $280 million

- Potash segment delivered operating earnings of $229 million and adjusted EBITDA of $329 million, with 2025 potash production expected at 9.1–9.4 million tonnes

- Mosaic Fertilizantes achieved operating income of $96 million (up 71%) and adjusted EBITDA of $241 million (up 190% year-on-year)

- Closed sales of Patos de Minas and Taquari mines, generating $63 million in immediate proceeds

Quarterly earnings call transcripts for MOSAIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more