Earnings summaries and quarterly performance for NGL Energy Partners.

Research analysts who have asked questions during NGL Energy Partners earnings calls.

DW

Derrick Whitfield

Texas Capital

7 questions for NGL

Also covers: AMTX, ARIS, BG +21 more

NM

Nevin Mathew

JPMorgan Chase & Co.

7 questions for NGL

GB

Gregg Brody

Bank of America Merrill Lynch

1 question for NGL

Also covers: BORR, CLMT, CRK

JA

James Anthony Spicer

TD Securities

1 question for NGL

Ned Baramov

Wells Fargo & Company

1 question for NGL

Also covers: AM, SUN, WES

Recent press releases and 8-K filings for NGL.

NGL Energy Partners Reports Strong Q3 2026 Results with Increased EBITDA and Strategic Progress

NGL

Earnings

Guidance Update

New Projects/Investments

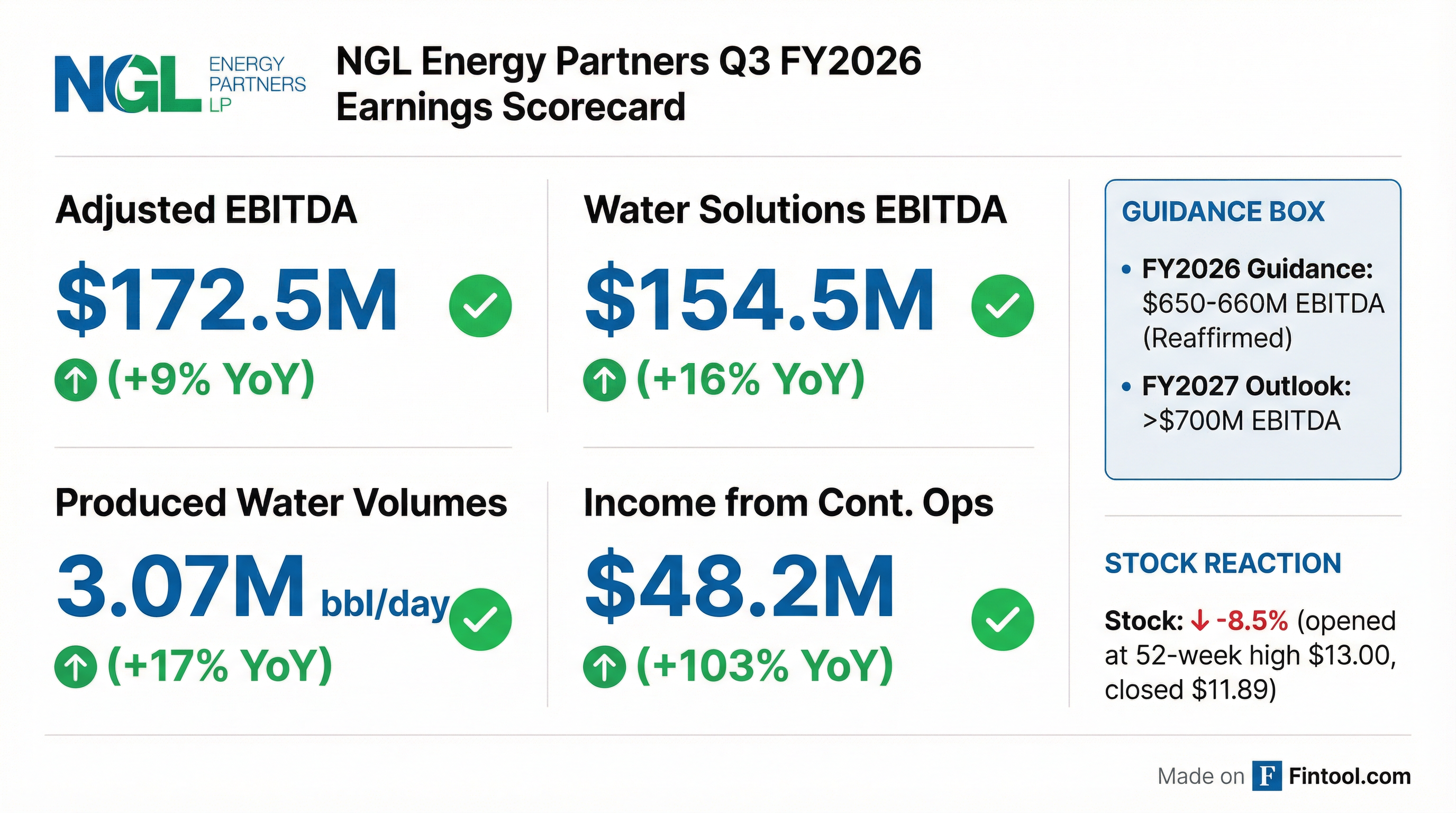

- NGL Energy Partners reported Adjusted EBITDA from continuing operations of $172.5 million for Q3 2026, marking a 9.2% increase from the prior year.

- The Water Solutions segment significantly contributed to growth, with its Adjusted EBITDA increasing by 16.5% to $154.5 million and setting a physical disposal volume record of 3.07 million barrels per day in Q3 2026.

- The company is actively executing its financial strategy by redeeming 18,506 Class D Preferred Units and repurchasing 1.6 million common units during the quarter, with a future focus on eliminating the remaining Class D Preferred Units.

- NGL maintains its full-year fiscal 2026 EBITDA guidance in the range of $650 million to $660 million and projects to exceed $700 million in fiscal 2027.

- Strategic initiatives include the completion of the Western Express Pipeline expansion and an MOU with Natura Resources to explore large-scale produced water treatment using nuclear power and thermal desalination, with no CapEx demand to NGL on the nuclear side.

3 days ago

NGL Energy Partners Reports Strong Q3 2026 Results with Increased EBITDA and Strategic Progress

NGL

Earnings

Guidance Update

New Projects/Investments

- NGL Energy Partners reported Adjusted EBITDA from continuing operations of $172.5 million for Q3 2026, marking a 9.2% increase from the prior year, with the Water Solutions segment's Adjusted EBITDA growing 16.5% to $154.5 million.

- The company maintained its full-year fiscal 2026 EBITDA guidance of $650 million to $660 million and anticipates exceeding $700 million of EBITDA for fiscal 2027.

- Financial strategy execution included redeeming an additional 18,506 Class D Preferred Units and repurchasing 1.6 million common units in Q3 2026, with a continued focus on eliminating Class D Preferred Units.

- The Water Solutions segment achieved record physical disposal volumes of 3.07 million barrels per day in Q3 2026 and an all-time daily record of over 3.5 million barrels per day in January.

- Strategic developments include the completion of the Western Express Pipeline expansion, an MOU with Natura Resources for large-scale produced water treatment, and the ongoing development of an AI machine-based learning project to enhance operational efficiencies.

3 days ago

NGL Energy Partners Reports Strong Q3 2026 Results with Record Water Volumes and Reaffirms Guidance

NGL

Earnings

Guidance Update

New Projects/Investments

- NGL Energy Partners reported Adjusted EBITDA of $172.5 million for Q3 2026, marking a 9.2% increase from the prior year, primarily driven by a 16.5% increase in Water Solutions Adjusted EBITDA to $154.5 million.

- The company achieved record physical water disposal volumes of approximately 3.07 million barrels per day in Q3 2026, and in early January, disposal volumes eclipsed 3.5 million barrels per day.

- NGL reaffirmed its full-year fiscal 2026 EBITDA guidance in the range of $650 million-$660 million and projects to exceed $700 million in EBITDA for fiscal 2027.

- In line with its financial strategy, NGL redeemed an additional 18,506 Class D Preferred Units during the quarter and repurchased 1.6 million common units, bringing total common unit repurchases to 8.7 million units since program inception.

- Strategic initiatives include the completion of the Western Express Pipeline expansion and an MOU with Natura Resources for large-scale produced water treatment, with an AI machine-based learning project also expected to contribute to operational efficiencies this calendar year.

3 days ago

NGL Energy Partners LP Reports Q3 FY'26 Adjusted EBITDA and Recent Strategic Actions

NGL

Earnings

Debt Issuance

Share Buyback

- NGL Energy Partners LP reported consolidated Adjusted EBITDA of $172,561 for Q3 FY'26, with the Water Solutions segment contributing $154,496.

- The company completed non-core asset sales totaling approximately $270 million as of May 5, 2025.

- NGL reduced its Term Loan B SOFR margin from 4.5% to 3.75% on August 5, 2024, and further to 3.50% on September 18, 2025.

- A common unit repurchase program of up to $50.0 million was authorized on June 5, 2024, and approximately 15% of outstanding Class D preferred units were repurchased as of October 17, 2025.

3 days ago

NGL Energy Partners LP Announces Third Quarter Fiscal 2026 Results

NGL

Earnings

Guidance Update

Share Buyback

- NGL Energy Partners LP reported income from continuing operations of $48.2 million for the third quarter of Fiscal 2026, an increase from $23.7 million in the third quarter of Fiscal 2025.

- Adjusted EBITDA from continuing operations grew to $172.5 million for the third quarter of Fiscal 2026, up from $158.0 million in the prior year period.

- The Water Solutions segment achieved record produced water volumes physically disposed of approximately 3.07 million barrels per day, representing a 17.1% increase compared to the third quarter of Fiscal 2025.

- The company reaffirmed its full-year Fiscal 2026 Adjusted EBITDA guidance of between $650 million to $660 million and anticipates Adjusted EBITDA to exceed $700 million in Fiscal 2027.

- NGL repurchased an additional 1,611,088 common units during the quarter, bringing the total repurchased under the program to 8,698,477 common units.

3 days ago

NGL Energy Partners Subsidiary Forms Partnership for Advanced Water Treatment

NGL

New Projects/Investments

- NGL Water Solutions Permian LLC, a subsidiary of NGL Energy Partners LP, has signed an agreement with Natura Resources LLC to combine Natura's 100-megawatt molten salt reactor with thermal desalination technology.

- This partnership aims to pursue opportunities for large-scale produced water treatment and power generation in the Permian Basin, leveraging NGL's existing infrastructure and expected Texas Pollutant Discharge Elimination System (TPDES) permit.

- The collaboration seeks to address the challenge of over 20 million barrels of produced water daily in the Permian Basin by creating a scalable solution for beneficial use, including power generation and critical mineral extraction.

4 days ago

NGL Energy Partners Reports Q3 Fiscal 2026 Results

NGL

Earnings

Share Buyback

- NGL Energy Partners reported Q3 fiscal 2026 revenue of $909.8 million, exceeding analyst estimates of $818.0 million, but its non-GAAP EPS of $0.10 missed the consensus of $0.1616, leading to a more than 9% share decline in after-hours trading.

- The company achieved Consolidated Adjusted EBITDA of $172.5 million and net income of $48.2 million, reflecting improved profitability compared to the prior year despite a consolidated revenue decline.

- The Water Solutions segment was a key growth driver, disposing of a record 3.07 million barrels per day of produced water and contributing $154.5 million in Adjusted EBITDA.

- The board authorized a common unit repurchase program of up to $50 million.

4 days ago

NGL Energy Partners Reports Q2 FY2026 Results and Raises FY2026 EBITDA Guidance

NGL

Earnings

Guidance Update

Share Buyback

- NGL Energy Partners LP reported mixed Q2 fiscal 2026 financial results, with revenue exceeding forecasts at $674.68 million, but earnings per share of $0.02 missed analyst expectations.

- The company's consolidated Adjusted EBITDA for Q2 fiscal 2026 rose 12% year-over-year to $167.38 million, primarily driven by the Water Solutions segment, which contributed 85% of total EBITDA and showed significant operational improvements.

- NGL increased its full-year fiscal 2026 Adjusted EBITDA guidance to $650-$660 million and projects fiscal 2027 Adjusted EBITDA to exceed $700 million.

- Growth capital expenditures were raised to $160 million to support new contracts, and the company is actively redeeming Class D preferred equity and repurchasing common units.

Nov 5, 2025, 3:54 AM

NGL Reports Q2 FY'26 Adjusted EBITDA and Strategic Financial Actions

NGL

Earnings

Debt Issuance

Share Buyback

- NGL reported Consolidated Adjusted EBITDA of $167,381 thousand for Q2 FY'26, with the Water Solutions segment contributing $151,902 thousand, representing 85% of the total value presented in the segment breakdown.

- The company executed several strategic financial actions, including amending its Term Loan B agreement on September 18, 2025, to reduce the SOFR margin from 3.75% to 3.50%, and repurchasing 88,506 Class D preferred units (approximately 15% of outstanding) as of October 17, 2025.

- NGL also announced non-core asset sales for approximately $270 million on May 5, 2025, and brought the LEX II water pipeline project into service on October 15, 2024, with an initial capacity of 200,000 barrels per day.

- The Water Solutions segment is characterized by its extensive network in the Delaware Basin, including over 800 miles of pipelines and ~6.5 million bpd total permitted disposal capacity, supported by long-term, fixed-fee contracts with ~80% of current throughput from Investment Grade Counterparties.

Nov 4, 2025, 10:00 PM

NGL Energy Partners Reports Strong Q2 2026 Results and Raises Full-Year Guidance

NGL

Earnings

Guidance Update

Share Buyback

- NGL Energy Partners reported Q2 2026 Consolidated Adjusted EBITDA of $167.3 million, a 12% increase from the prior year, primarily driven by its Water Solutions business segment.

- The company increased its full-year Adjusted EBITDA guidance from $615-$625 million to $650-$660 million and provided initial fiscal 2027 Adjusted EBITDA guidance of at least $700 million.

- The Water Solutions segment's Adjusted EBITDA grew 18% to $151.9 million in Q2 2026, with physical disposal volumes reaching 2.8 million barrels per day and total volumes paid to dispose increasing 14% to 3.15 million barrels per day.

- NGL is actively managing its capital structure by purchasing 88,506 Class D preferred units (15% of outstanding) for $10.4 million in annual distribution savings and repricing its term loan B, resulting in $15 million in annual interest savings.

- Additionally, the company repurchased an additional 4.4 million common units in the quarter, bringing the total to approximately 6.8 million units (5% of outstanding) at an average price of $4.57 since the plan's inception.

Nov 4, 2025, 10:00 PM

Quarterly earnings call transcripts for NGL Energy Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more