Earnings summaries and quarterly performance for NOV.

Executive leadership at NOV.

Clay Williams

Chief Executive Officer

Christy Novak

Vice President, Corporate Controller, and Chief Accounting Officer

Craig Weinstock

Senior Vice President, Secretary, and General Counsel

Jose Bayardo

President and Chief Operating Officer

Joseph Rovig

President, Energy Equipment

Rodney Reed

Senior Vice President and Chief Financial Officer

Scott Livingston

President, Energy Products and Services

Board of directors at NOV.

Research analysts who have asked questions during NOV earnings calls.

Jim Rollyson

Raymond James Financial

5 questions for NOV

Arun Jayaram

JPMorgan Chase & Co.

4 questions for NOV

Marc Bianchi

TD Cowen

4 questions for NOV

Stephen Gengaro

Stifel

4 questions for NOV

Daniel Kutz

Morgan Stanley

3 questions for NOV

Stephen Gengaro

Stifel Financial Corp.

3 questions for NOV

Doug Becker

Capital One

2 questions for NOV

James Rollyson

Raymond James Financial, Inc.

2 questions for NOV

Jeff LeBlanc

TPH&Co.

2 questions for NOV

Roger Read

Wells Fargo & Company

2 questions for NOV

Connor Jensen

Raymond James Financial, Inc.

1 question for NOV

Douglas Becker

Capital One

1 question for NOV

Grant Hynes

JPMorgan Chase & Co.

1 question for NOV

John Daniel

Daniel Energy Partners

1 question for NOV

Kurt Hallead

The Benchmark Company

1 question for NOV

Neil Mehta

Goldman Sachs

1 question for NOV

Scott Gruber

Citigroup

1 question for NOV

Waqar Syed

ATB Capital Markets

1 question for NOV

Recent press releases and 8-K filings for NOV.

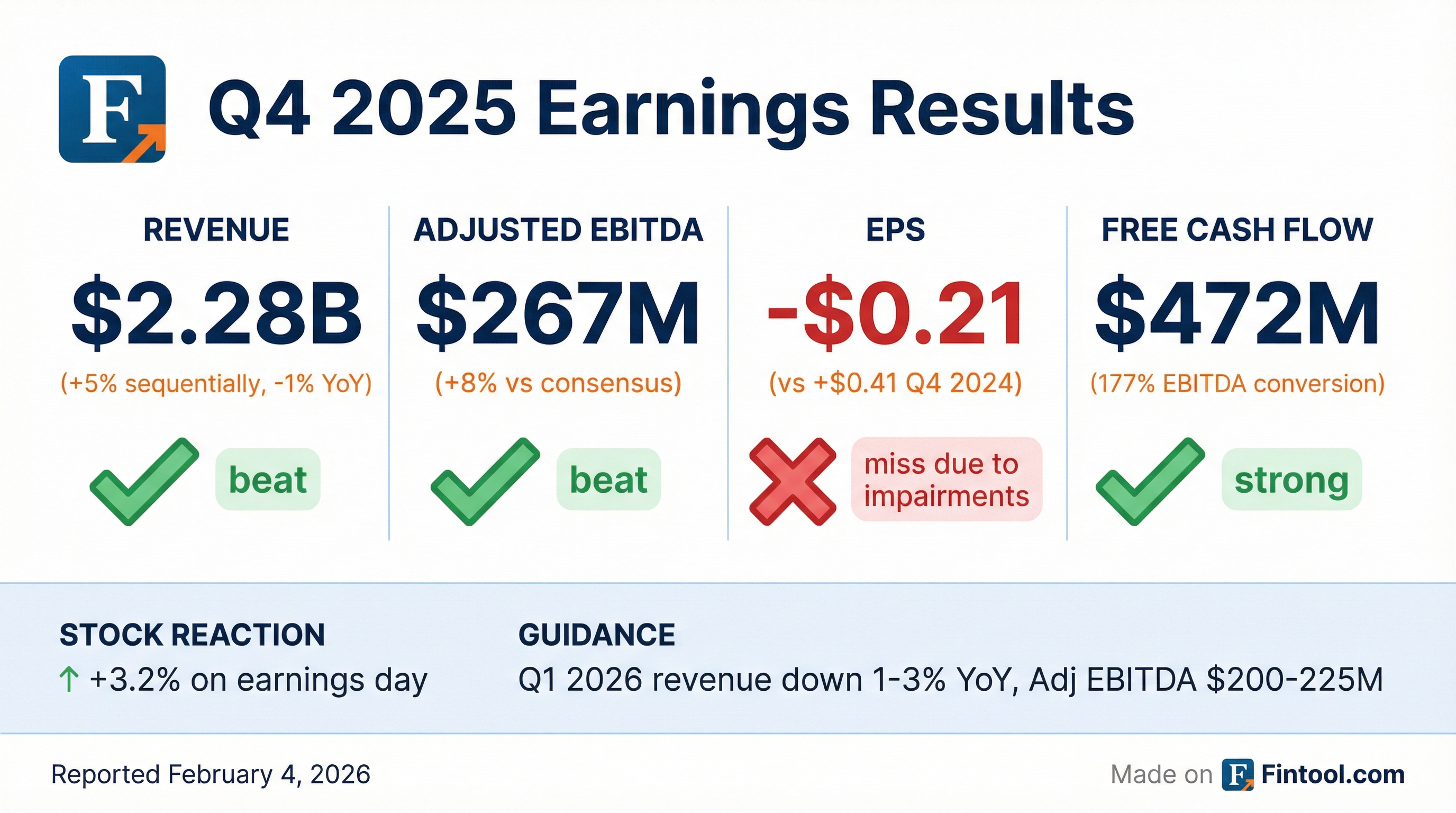

- NOV reported Q4 2025 revenues of $2.28 billion and a net loss of $78 million (or $0.21 per share), with full-year 2025 revenues of $8.74 billion and net income of $145 million (or $0.39 per share).

- For 2026, the company anticipates slightly lower revenue and full-year EBITDA in line to slightly lower than 2025, with projected capital expenditures between $315 million and $345 million.

- NOV expects its EBITDA free cash flow conversion to decrease to between 40%-50% in 2026, following a strong over 85% conversion rate in 2025.

- The company returned $505 million to shareholders in 2025 through share repurchases and dividends, maintaining a strong balance sheet with net debt to EBITDA at 0.2x.

- Despite a cautious near-term market, NOV sees a compelling mid to longer-term outlook, particularly in offshore markets with potential for up to 10 FPSO Final Investment Decisions (FIDs) in 2026, and is advancing its ATOM RTX robotics platform.

- NOV reported Q4 2025 revenues of $2.28 billion and a net loss of $78 million (or 21 cents per fully diluted share), contributing to full-year 2025 revenues of $8.74 billion and net income of $145 million (or 39 cents per fully diluted share).

- The company generated $876 million in free cash flow for the full year 2025, achieving an EBITDA free cash flow conversion rate exceeding 85%, and concluded the year with a total backlog of $4.34 billion.

- For 2026, NOV anticipates slightly lower revenue and full-year EBITDA in line to slightly lower than 2025, with EBITDA free cash flow conversion projected to decrease to between 40%-50%.

- Jose Bayardo was appointed as the new Chairman, President, and CEO, succeeding Clay Williams.

- NOV anticipates a challenging market environment in early 2026 with a slight decline in global industry spend and drilling activity, but expects oil markets to rebalance in the second half of 2026, leading to a healthier market in 2027 and beyond, particularly in offshore.

- The company ended 2025 with a $4.34 billion backlog. For Q1 2026, the Energy Equipment segment revenue is projected to increase 3%-5% year-over-year, with EBITDA between $145 million-$165 million. NOV forecasts 40%-50% free cash flow conversion for 2026, with CapEx in the $315 million-$345 million range.

- NOV did not complete any acquisitions in 2025, indicating a higher standard for future M&A. The company is focused on internal efficiencies, technology leadership, and investing in areas with clear competitive advantages and high growth potential.

- Strong indicators point to an extended offshore market recovery, including a significant increase in floater contracts awarded (59 from September 2025 through January 2026 compared to 33 in the prior year period) and a potential for up to 10 FPSO Final Investment Decisions (FIDs) in 2026.

- NOV Inc. reported total revenue of $2.277 billion and Adjusted EBITDA of $267 million for the fourth quarter of 2025, representing a sequential revenue increase of 5%.

- The company generated $472 million in Free Cash Flow in Q4 2025 and $876 million in Excess Free Cash Flow for the full year 2025.

- NOV returned $505 million to shareholders in 2025 and expects to return at least 50% of Excess Free Cash Flow.

- Significant achievements in Q4 2025 included the Downhole Broadband Solutions technology drilling record annual footage of over 750,000 ft in 2025 and being awarded the drilling equipment package for the Kingdom 4 jack-up rig.

- For the first quarter of 2026, NOV anticipates total Adjusted EBITDA between $200 million and $225 million , with overall revenue expected to be down one to three percent year-over-year.

- NOV reported fourth quarter 2025 revenues of $2.28 billion and a net loss of $78 million, or $0.21 per share. For the full-year 2025, revenues were $8.74 billion and net income was $145 million, or $0.39 per share.

- The company generated $573 million in cash flow from operations and $472 million in free cash flow in the fourth quarter of 2025. Full-year 2025 cash flow from operations was $1.25 billion and free cash flow was $876 million.

- NOV returned $505 million of capital to shareholders during the full-year 2025, including $315 million in share repurchases and $190 million in dividends.

- For the first quarter of 2026, NOV expects consolidated revenues to decline between one to three percent year-over-year and Adjusted EBITDA to be between $200 million and $225 million.

- NOV Inc. reported fourth quarter 2025 revenues of $2.28 billion, a 1% decrease year-over-year, resulting in a net loss of $78 million, or $0.21 per diluted share.

- For the full-year 2025, revenues were $8.74 billion, down 1% from 2024, with net income of $145 million, or $0.39 per share.

- The company generated $1.25 billion in cash flow from operations and $876 million in free cash flow for the full-year 2025, returning $505 million of capital to shareholders.

- For the first quarter of 2026, NOV anticipates a year-over-year consolidated revenue decline of one to three percent, with Adjusted EBITDA expected between $200 million and $225 million.

- Management projects full-year 2026 Adjusted EBITDA to be in-line to slightly lower than 2025 levels.

- NOV Inc. sold its Shepherd Power subsidiary to Natura Resources LLC and simultaneously entered into an agreement to advance the commercialization of Natura's molten salt reactor (MSR) technology.

- The agreement will align NOV's manufacturing, supply chain, and project management expertise with Natura's reactor design to support the delivery of multiple gigawatts of small modular reactors (SMRs) for data center and industrial applications between 2029 and 2032.

- As part of the transaction, NOV will become an investor in Natura and will appoint a representative to Natura's Board of Directors.

- NOV announced the sale of its advanced nuclear development company, Shepherd Power, to Natura Resources.

- As part of the transaction, NOV will become an investor in Natura and appoint a representative to Natura’s Board of Directors.

- NOV and Natura signed a Memorandum of Understanding (MOU) to establish a supply chain agreement, where NOV will leverage its manufacturing, supply chain, and project management expertise to support the scaled deployment of Natura's advanced nuclear reactors.

- This supply chain agreement is expected to support Natura’s plans to deploy 100-megawatt molten salt reactor units for data center and industrial markets, starting in 2029 and reaching scale in 2032.

- NOV reported Q3 2025 revenues of $2.18 billion and EBITDA of $258 million, representing 11.9% of revenue.

- The company generated $245 million in free cash flow in Q3 2025 and returned $393 million to shareholders year-to-date, including $80 million in share repurchases and $28 million in dividends during the quarter.

- The Energy Equipment segment saw strong demand, with Q3 2025 revenue of $1.25 billion (up 2% year-over-year) and EBITDA of $180 million (14.4% of sales). Capital equipment orders were $951 million, resulting in a 141% book-to-bill ratio for the quarter, and the segment's backlog reached a record $4.56 billion.

- For Q4 2025, NOV anticipates Energy Equipment revenue to decline 2%-4% year-over-year with EBITDA between $160 million and $180 million, and Energy Products and Services revenue to decline 8%-10% year-over-year with EBITDA between $120 million and $140 million.

- NOV expects adjusted EBITDA to be roughly $1 billion for both 2025 and 2026, despite expectations of market conditions remaining soft through the next few quarters.

- NOV reported Q3 2025 consolidated revenue of $2.18 billion, operating profit of $107 million, and adjusted EBITDA of $258 million.

- The company anticipates soft market conditions through the next few quarters, with global drilling activity potentially drifting lower, but foresees strengthening demand in offshore and international land markets from the second half of 2026 and beyond.

- The Energy Equipment segment's revenue was $1.25 billion, up 2% year-over-year, driven by offshore production equipment, and achieved a record backlog of $4.56 billion.

- NOV generated $245 million in free cash flow during Q3 2025, repurchased $80 million in shares, and paid $28 million in dividends, expecting to exceed its 50% excess free cash flow return threshold for 2025.

Quarterly earnings call transcripts for NOV.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more