Earnings summaries and quarterly performance for Bank of N.T. Butterfield & Son.

Research analysts who have asked questions during Bank of N.T. Butterfield & Son earnings calls.

David Feaster

Raymond James

4 questions for NTB

Also covers: ABCB, ALRS, AX +20 more

Timur Braziler

Wells Fargo

3 questions for NTB

Also covers: ASB, BANC, BKU +16 more

Timothy Switzer

KBW

2 questions for NTB

Also covers: CASH, CIVB, CNOB +14 more

TS

Tim Switzer

Keefe, Bruyette & Woods (KBW)

2 questions for NTB

Also covers: CASH, CIVB, CNOB +13 more

EN

Emily Noelle Lee

KBW

1 question for NTB

Also covers: UVSP

LC

Liam Cohill

Raymond James & Associates

1 question for NTB

Liam Coohill

Raymond James

1 question for NTB

Also covers: CVBF, FFWM, FHB +3 more

WN

William Nance

The Goldman Sachs Group, Inc.

1 question for NTB

Also covers: AFRM, AMTD, AVDX +20 more

Recent press releases and 8-K filings for NTB.

Butterfield announces agreement to acquire Rawlinson & Hunter Guernsey

NTB

M&A

New Projects/Investments

- The Bank of N.T. Butterfield & Son Limited (Butterfield) has entered into an agreement to acquire Rawlinson & Hunter in Guernsey (R&H Guernsey).

- This acquisition is expected to expand Butterfield's Channel Islands presence and strengthen its trust and fiduciary offering.

- R&H Guernsey will add approximately 50 colleagues, 71 client groups, and $9.0 billion of assets under administration.

- The transaction is anticipated to close in the first half of 2026, pending regulatory approvals and other customary closing conditions.

Feb 19, 2026, 9:30 PM

Butterfield to Acquire R&H Guernsey

NTB

M&A

New Projects/Investments

- The Bank of N.T. Butterfield & Son Limited (Butterfield) has entered into an agreement to acquire Rawlinson & Hunter in Guernsey (R&H Guernsey), an independently owned trust and corporate service provider.

- This acquisition is expected to expand Butterfield's Channel Islands presence and strengthen its trust and fiduciary offering, adding approximately 50 colleagues, 71 client groups, and $9.0 billion of assets under administration.

- The transaction is anticipated to be a significant fee revenue generator for Butterfield and is projected to close in the first half of 2026, subject to customary closing conditions and regulatory approvals.

Feb 19, 2026, 9:30 PM

Butterfield Reports Strong Q4 and Full-Year 2025 Results

NTB

Earnings

Share Buyback

M&A

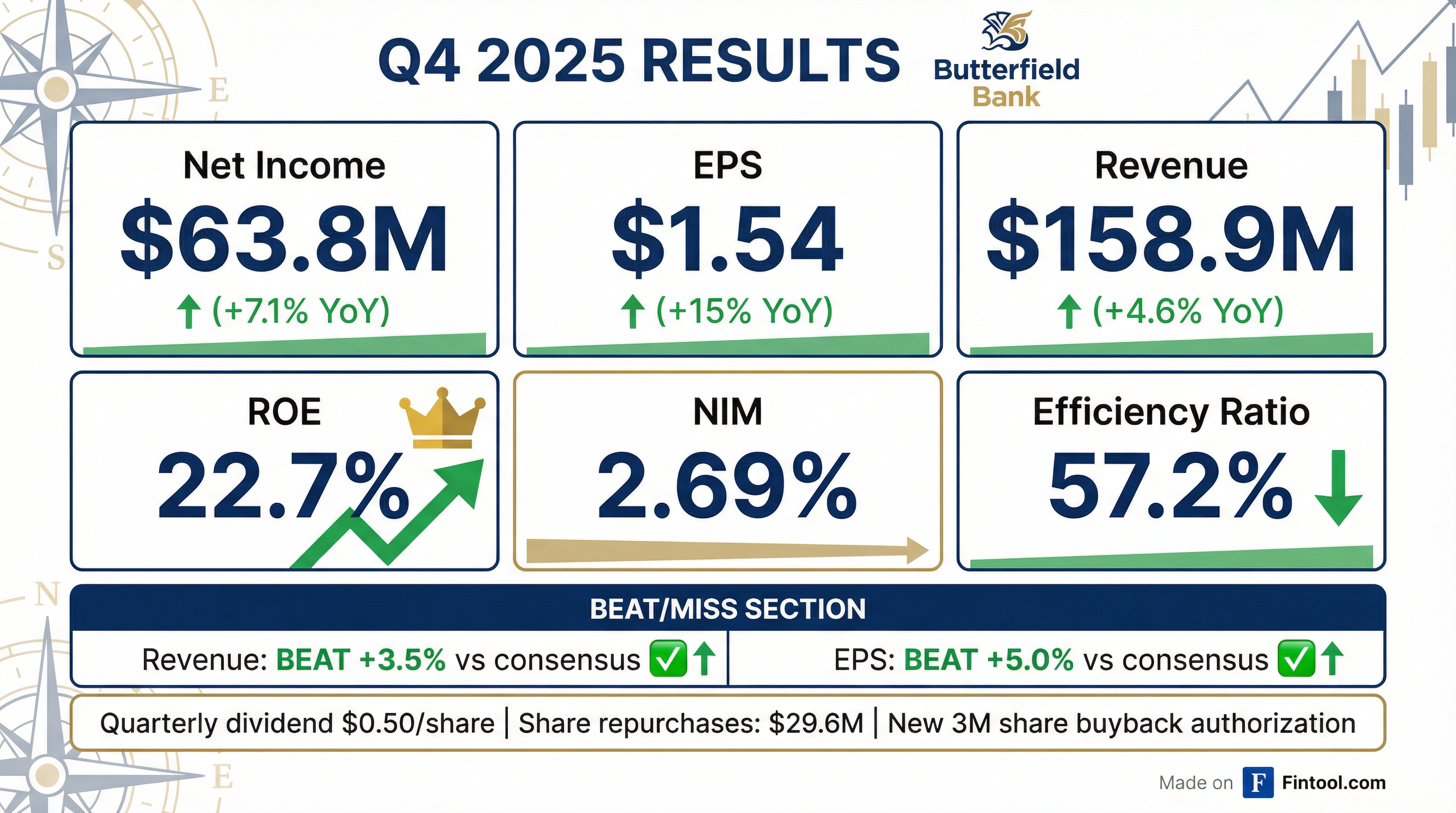

- Butterfield delivered strong financial results in 2025, with core net income per share growing 17.4% year on year to $5.60 and a core return on average tangible common equity of 24.2%. For Q4 2025, net income and core net income were $63.8 million, with EPS of $1.54.

- The company returned capital to shareholders through share repurchases totaling $146.7 million for 3.5 million shares in 2025, contributing to a 97% combined payout ratio. A new share repurchase authorization for 2026 of up to 3 million common shares or $140 million was approved, and a quarterly cash dividend of $0.50 per share was announced.

- The net interest margin for full-year 2025 increased 5 basis points to 2.69% from 2.64% in 2024, while the average cost of deposits fell to 150 basis points. Q4 2025 net interest margin was 2.69%, a decrease of 4 basis points from the prior quarter. Management anticipates quarterly core expenses to be around $90 million-$92 million over the next few quarters.

- Non-interest income in Q4 2025 increased $5.1 million over the prior quarter to $66.3 million, driven by higher banking fees, foreign exchange revenues, and asset management revenues. The company's M&A growth strategy remains on track, with active dialogue for potential trust and bank acquisitions focused on existing jurisdictions.

Feb 10, 2026, 3:00 PM

Bank of N.T. Butterfield & Son Reports Strong Full Year and Fourth Quarter 2025 Results

NTB

Earnings

Dividends

Share Buyback

- Bank of N.T. Butterfield & Son reported full year 2025 net income of $231.9 million or $5.47 per share, and core net income of $237.5 million or $5.60 per share. For the fourth quarter of 2025, net income and core net income were $63.8 million or $1.54 per share.

- The company demonstrated strong capital management, with aggregate annual dividends of $1.88 per share and share repurchases of 3.5 million shares totaling $146.7 million for the full year 2025. A new share repurchase authorization for up to 3.0 million common shares was also announced.

- Tangible book value per share increased to $26.41, representing a 21.7% increase from the end of 2024. The Total Capital Ratio remained robust at 27.8%, well above the BMA minimum of 13.5%.

- Operational efficiency was strong, with a core efficiency ratio of 57.2% in Q4 2025, which was favorable to the Bank's target of 60%. Asset quality remained sound, with non-accrual loans relatively flat at 2.1% and a negligible net charge-off ratio of 0.00%.

Feb 10, 2026, 3:00 PM

Butterfield Reports Strong Q4 and Full Year 2025 Financial Results

NTB

Earnings

Share Buyback

M&A

- For full-year 2025, Butterfield's core net income per share grew 17.4% year-on-year to $5.60, with a core return on average tangible common equity of 24.2%. In Q4 2025, net income and core net income were $63.8 million, yielding $1.54 EPS and a core return on average tangible common equity of 24.6%.

- The company repurchased 3.5 million shares for $146.7 million in 2025, and the board approved a new share repurchase authorization for 2026 of up to 3 million common shares or $140 million. A quarterly cash dividend of $0.50 per share was also announced.

- The net interest margin for full-year 2025 increased to 2.69% from 2.64% in 2024, with the average cost of deposits falling to 150 basis points. Q4 2025 non-interest income increased by $5.1 million over the prior quarter to $66.3 million, driven by higher banking fees, foreign exchange revenues, and asset management revenues.

- Management expects quarterly core expenses to settle between $90 million-$92 million over the next few quarters. The M&A growth strategy is on track, with active dialogue for potential targets and a focus on trust acquisitions in existing jurisdictions.

Feb 10, 2026, 3:00 PM

Butterfield Reports Strong Q4 and Full Year 2025 Results with Increased Dividends and Share Repurchases

NTB

Earnings

Dividends

Share Buyback

- Butterfield delivered strong financial results in 2025, with core net income per share growing 17.4% year-on-year to $5.60 and a core return on average tangible common equity of 24.2%.

- For Q4 2025, the company reported net income and core net income of $63.8 million and earnings per share of $1.54, with a core return on average tangible common equity of 24.6%.

- Capital management included a quarterly cash dividend of $0.50 per share and share repurchases totaling $146.7 million for 3.5 million shares in 2025, with a new authorization for up to 3 million common shares or $140 million in 2026.

- Net interest margin for Q4 2025 was 2.69%, while non-interest income increased by $5.1 million to $66.3 million over the prior quarter, driven by higher banking fees, foreign exchange revenues, and asset management revenues.

- The company anticipates quarterly core expenses to be around $90 million-$92 million over the next few quarters, following higher Q4 2025 expenses that included non-repeating items.

Feb 10, 2026, 3:00 PM

Butterfield Announces Fourth Quarter and Full Year 2025 Results

NTB

Earnings

Dividends

Share Buyback

- For the fourth quarter of 2025, net income and core net income were $63.8 million, or $1.54 per share. For the full year 2025, net income was $231.9 million, or $5.47 per share, and core net income was $237.5 million, or $5.60 per share.

- The company declared a quarterly cash dividend of $0.50 per share for the quarter ended December 31, 2025, contributing to aggregate annual dividends of $1.88 per share for FY 2025.

- Butterfield repurchased 0.6 million shares at a cost of $29.6 million in Q4 2025 and 3.5 million shares for $146.7 million in FY 2025. A new share repurchase authorization for up to 3.0 million common shares was approved through December 31, 2026, effective January 1, 2026.

- Key financial highlights for FY 2025 include a return on average common equity of 21.7%, a core return on average tangible common equity of 24.2%, and a net interest margin of 2.69%.

Feb 9, 2026, 9:30 PM

Butterfield Reports Fourth Quarter and Full Year 2025 Results

NTB

Earnings

Dividends

Share Buyback

Board Change

- Butterfield reported net income of $63.8 million, or $1.54 per share, for the fourth quarter of 2025, and $231.9 million, or $5.47 per share, for the full year 2025.

- The company demonstrated active capital management in 2025, with aggregate annual dividends of $1.88 per share and repurchases of 3.5 million shares at a total cost of $146.7 million. A new share repurchase authorization for up to 3.0 million common shares was also announced.

- Net interest margin (NIM) was 2.69% for both the fourth quarter and the full year ended December 31, 2025.

- Meroe Park was appointed as an Independent Director.

Feb 9, 2026, 9:30 PM

Butterfield Reports Strong Q3 2025 Results with Increased Net Interest Margin and Continued Capital Management

NTB

Earnings

Dividends

Share Buyback

- Butterfield reported net income of $61.1 million and core earnings per share of $1.51 for Q3 2025.

- The company's net interest margin increased by 9 basis points to 2.73% from the prior quarter, largely due to lower cost of deposits and the redemption of subordinated debt.

- Butterfield announced a quarterly cash dividend of $0.50 per share and repurchased 700,000 shares at a cost of $30.3 million during the quarter.

- Non-interest income increased to $61.2 million, and core non-interest expenses decreased compared to the prior quarter.

Oct 29, 2025, 2:00 PM

Butterfield Reports Strong Q3 2025 Results

NTB

Earnings

Dividends

Share Buyback

- Butterfield reported net income of $61.1 million and core earnings per share of $1.51 for the third quarter of 2025.

- The net interest margin (NIM) increased 9 basis points to 2.73%, primarily due to a 9 basis point decrease in the cost of deposits to 147 basis points.

- Non-interest income grew by $4.2 million to $61.2 million, resulting in a fee income ratio of 39.9%.

- The company declared a quarterly cash dividend of $0.50 per share and repurchased 700,000 shares at a cost of $30.3 million during the quarter.

- Tangible book value per share improved by 5.4% to $25.06, reflecting an $18.5 million improvement in net unrealized losses in the FS portfolio.

Oct 29, 2025, 2:00 PM

Quarterly earnings call transcripts for Bank of N.T. Butterfield & Son.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more