Earnings summaries and quarterly performance for Oaktree Specialty Lending.

Executive leadership at Oaktree Specialty Lending.

Armen Panossian

Chief Executive Officer and Co-Chief Investment Officer

Ashley Pak

Chief Compliance Officer

Brett McKeone

Chief Operating Officer

Christopher McKown

Chief Financial Officer and Treasurer

Mathew Pendo

President

Raghav Khanna

Co-Chief Investment Officer

Board of directors at Oaktree Specialty Lending.

Research analysts who have asked questions during Oaktree Specialty Lending earnings calls.

Melissa Wedel

JPMorgan Chase & Co.

7 questions for OCSL

Finian O'Shea

Wells Fargo Securities

6 questions for OCSL

Paul Johnson

Keefe, Bruyette & Woods

4 questions for OCSL

Ethan Kaye

Lucid Capital Markets

2 questions for OCSL

Finian O'Shea

Wells Fargo

2 questions for OCSL

Melissa Waddell

JPMorgan Chase & Co.

2 questions for OCSL

Sean-Paul Adams

Not Provided in Transcript

2 questions for OCSL

Matthew Hurwit

Jefferies

1 question for OCSL

Recent press releases and 8-K filings for OCSL.

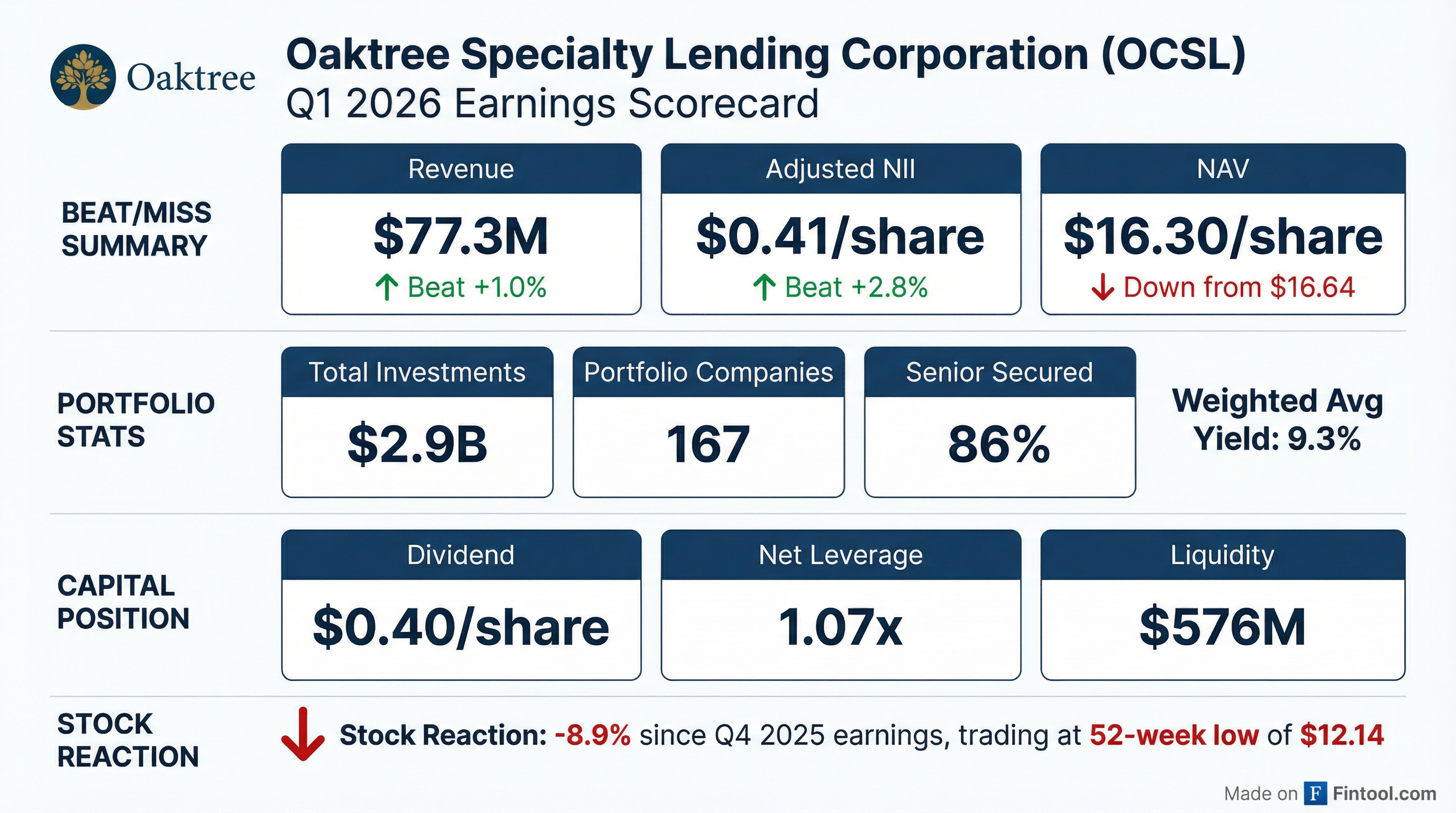

- OCSL reported Adjusted Net Investment Income of $0.41 per share for Q1 2026, which fully covered its declared quarterly cash dividend of $0.40 per share.

- The company's new funded investments totaled $314 million, resulting in $135 million of net new investments and an increase in portfolio size to $2.95 billion.

- Non-accruals represented 3.1% of the total debt portfolio at fair value, a decrease of nearly 85 basis points year-over-year, while the net leverage ratio increased to 1.07 times.

- Management anticipates stable to potentially widening private credit spreads in 2026 and is closely monitoring the impact of AI on the software sector, leading to increased selectivity in new software investments.

- OCSL reported Adjusted Net Investment Income of $36.1 million, or $0.41 per share, for the first fiscal quarter of 2026, which fully covered its $0.40 per share quarterly dividend.

- The company demonstrated strong capital deployment with $314 million in new funded investments, growing its portfolio by approximately $100 million to $2.95 billion, and maintained over $576 million in available liquidity.

- The net leverage ratio increased to 1.07 times (from 0.97 times in the prior quarter), remaining within the target range of 0.9-1.25 times, and non-accruals were 3.1% of the total debt portfolio at fair value, down nearly 85 basis points year-over-year.

- PIK interest represented 6.3% of adjusted total investment income, below the public BDC industry average, and the company remains selective in software investments, which comprise 23% of investments at fair value, with 94% in first lien term loans.

- OCSL reported GAAP net investment income of $0.42 per share and adjusted net investment income of $0.41 per share for the quarter ended December 31, 2025.

- A quarterly cash distribution of $0.40 per share was declared, payable on March 31, 2026.

- Net Asset Value (NAV) per share decreased to $16.30 as of December 31, 2025, from $16.64 in the prior quarter.

- The net debt to equity ratio rose to 1.07x (from 0.97x), remaining within the target range of 0.90x to 1.25x.

- The investment portfolio totaled $2.9 billion at fair value across 167 companies, with a 9.3% weighted average yield on debt investments.

- OCSL reported Adjusted Net Investment Income of $36.1 million, or $0.41 per share, for Q1 2026, which fully covered its $0.40 per share quarterly dividend.

- New funded investments, including drawdowns, totaled $314 million in Q1 2026, an increase from $220 million in the prior quarter, resulting in $135 million of net new investments.

- The company's non-accrual rate was 3.1% of the total debt portfolio at fair value at quarter-end, representing a decrease of nearly 85 basis points year-over-year. The weighted average yield on debt investments was 9.3%.

- Software investments constitute approximately 23% of the portfolio at fair value, with a weighted average LTV ratio of 47% as of December 31.

- Oaktree Specialty Lending Corporation reported adjusted net investment income of $0.41 per share and GAAP net investment income of $0.42 per share for the first fiscal quarter of 2026.

- The company's Net Asset Value (NAV) per share was $16.30 as of December 31, 2025, down from $16.64 as of September 30, 2025.

- New investment commitments totaled $316.6 million with a weighted average yield on new debt investments of 8.7% for the quarter ended December 31, 2025.

- OCSL's liquidity as of December 31, 2025, was $576 million, consisting of $81 million in unrestricted cash and cash equivalents and $495 million of undrawn capacity under its credit facility.

- A quarterly cash distribution of $0.40 per share was declared, payable on March 31, 2026.

- Oaktree Specialty Lending Corporation reported total investment income of $75.1 million ($0.85 per share) and GAAP net investment income of $36.7 million ($0.42 per share) for the first fiscal quarter ended December 31, 2025.

- Adjusted net investment income was $36.1 million ($0.41 per share) for the quarter ended December 31, 2025, an increase from $35.4 million ($0.40 per share) in the prior quarter.

- Net asset value (NAV) per share was $16.30 as of December 31, 2025, a decrease from $16.64 as of September 30, 2025, primarily due to unrealized depreciation on certain debt and equity investments.

- The company originated $316.6 million of new investment commitments during the quarter ended December 31, 2025.

- A quarterly cash distribution of $0.40 per share was declared, payable on March 31, 2026.

- Oaktree Specialty Lending Corporation (OCSL) achieved adjusted net investment income of $0.40 per share for the fourth fiscal quarter ending September 30, 2025, an increase from $0.37 in the prior quarter, and the board approved a dividend of $0.40 per share for the quarter.

- The company continued to reduce non-accruals, which were 2.8% of the portfolio measured at fair value at year-end, down 100 basis points from last year.

- OCSL's leverage ratio at quarter-end was 0.97 times, within its target range of 0.9 times-1.25 times, and it maintained ample liquidity of approximately $695 million.

- New-funded investment commitments, including drawdowns, amounted to $220 million, with a weighted average spread on deployments of approximately SOFR plus 570, and 88% of new originations were first-lien loans.

- OCSL reported adjusted net investment income of $0.40 per share for Q4 2025, an increase from $0.37 in the prior quarter, and declared a $0.40 per share dividend.

- Non-accruals decreased to 2.8% of the portfolio at fair value at year-end, a 20 basis point reduction from the previous quarter.

- The company's leverage ratio stood at 0.97 times, within its target range, and it had $695 million in liquidity at quarter end.

- New-funded investment commitments rose 54% to $220 million in Q4, with a weighted average spread on deployments of approximately SOFR plus 570.

- The portfolio is primarily composed of 83% first-lien senior-secured debt, yielding a weighted average of 9.8%.

- For the quarter ended September 30, 2025, OCSL reported GAAP net investment income of $0.41 per share and adjusted net investment income of $0.40 per share.

- The company declared a quarterly cash distribution of $0.40 per share and its Net Asset Value (NAV) was $16.64 per share as of September 30, 2025.

- OCSL's portfolio stood at $2.8 billion at fair value across 143 portfolio companies, with $208 million of new investment commitments and $220 million of new investment fundings during the quarter.

- The net debt to equity ratio was 0.97x, and liquidity totaled $695 million as of September 30, 2025.

- Oaktree implemented an incentive fee cap in the first fiscal quarter of 2025, which has retained $20.4 million in Part I incentive fees that would have otherwise been paid to Oaktree.

- Oaktree Specialty Lending Corporation (OCSL) reported adjusted net investment income of $0.40 per share for the fourth fiscal quarter of 2025, an increase from $0.37 in the prior quarter, and approved a $0.40 per share dividend for the quarter.

- Non-accruals decreased to 2.8% of the portfolio measured at fair value at year-end, down 20 basis points from the third quarter and 100 basis points from last year.

- New-funded investment commitments totaled $220 million in Q4 2025, a 54% increase from the prior quarter, with 88% of new originations being first-lien loans and a weighted average spread on deployments of approximately SOFR plus 570.

- The company's leverage ratio was 0.97 times at quarter-end, slightly up from 0.93 times last quarter, remaining at the low end of their target range of 0.9 times to 1.25 times, providing ample financial flexibility.

Quarterly earnings call transcripts for Oaktree Specialty Lending.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more