Earnings summaries and quarterly performance for Proto Labs.

Executive leadership at Proto Labs.

Board of directors at Proto Labs.

Research analysts who have asked questions during Proto Labs earnings calls.

Brian Drab

William Blair & Company

6 questions for PRLB

Also covers: DCI, DDD, ENS +11 more

Greg Palm

Craig-Hallum Capital Group LLC

6 questions for PRLB

Also covers: ALNT, BELFA, BV +16 more

Troy Jensen

Cantor Fitzgerald

6 questions for PRLB

Also covers: DDD, DM, IONQ +13 more

JR

James Ricchiuti

Needham & Company, LLC

3 questions for PRLB

Also covers: AEIS, BELFA, BHE +20 more

JR

Jim Ricchiuti

Needham & Company

2 questions for PRLB

Also covers: AEIS, BHE, CECO +7 more

Recent press releases and 8-K filings for PRLB.

Protolabs Reports Record Q4 and Full-Year 2025 Revenue, Guides for 2026 Growth

PRLB

Earnings

Guidance Update

Revenue Acceleration/Inflection

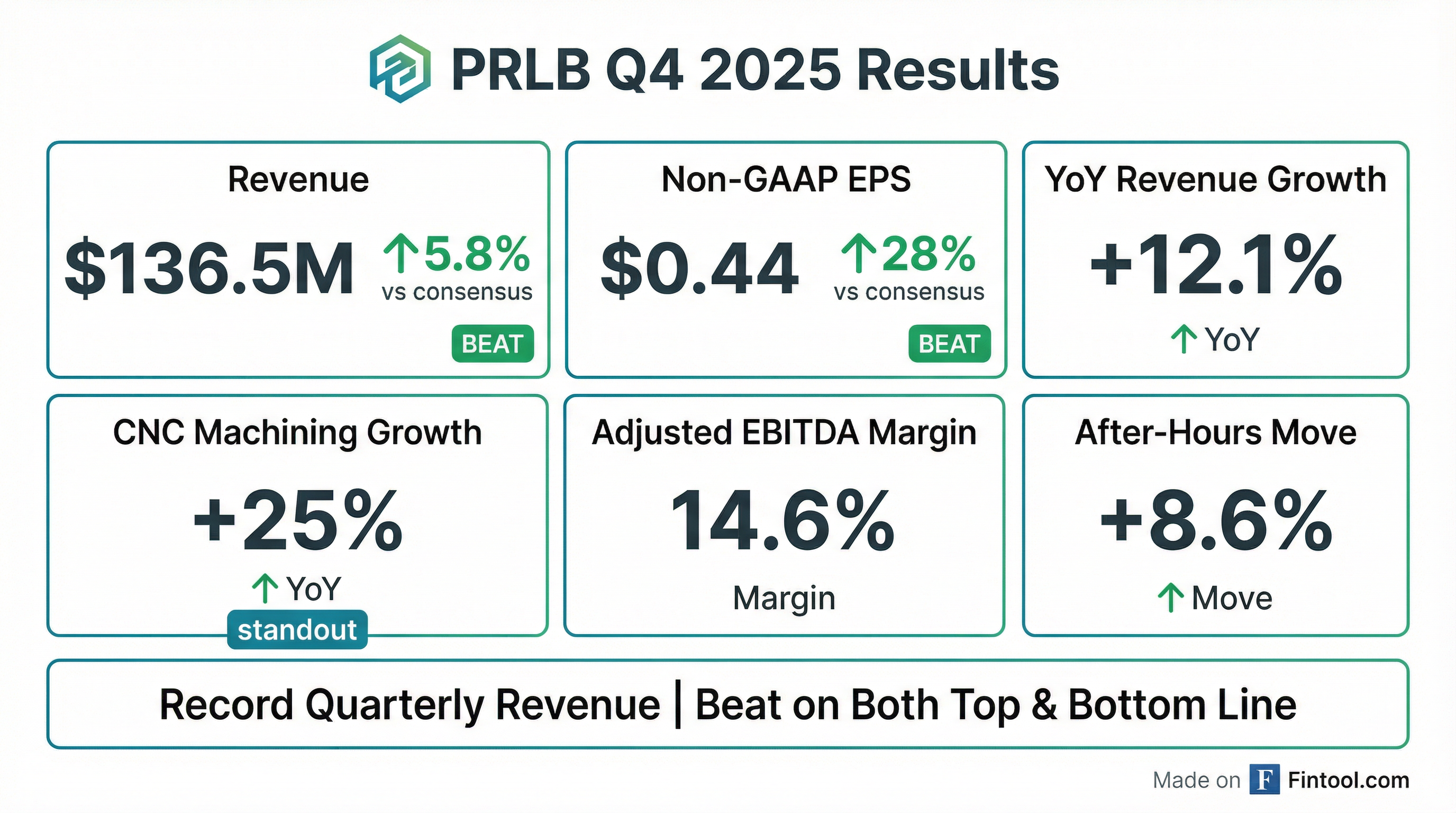

- Protolabs reported a strong finish to 2025, with Q4 revenue reaching a company record of $136.5 million, an 11% year-over-year increase in constant currencies, and full-year 2025 revenue of $533.1 million, up 5.7% in constant currencies. Non-GAAP EPS for Q4 was $0.44 and for the full year was $1.66.

- Growth was primarily driven by double-digit increases in CNC machining (16.7% year-over-year in constant currencies) and sheet metal (12% year-over-year), with U.S. CNC revenue growing 25%. Revenue per customer also increased 13% in 2025.

- The company outlined four strategic pillars for 2026, focusing on customer experience, innovation, production expansion, and operational efficiency, including a reset of the European business and establishing a Global Capability Center in India.

- Protolabs provided full-year 2026 GAAP revenue growth guidance of 6%-8% and expects Q1 2026 revenue between $130 million and $138 million with non-GAAP EPS between $0.36 and $0.44. The company aims for a path to $1 billion in annual revenue over time.

6 days ago

Protolabs Reports Record Q4 and Full Year 2025 Revenue, Provides 2026 Guidance

PRLB

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Protolabs reported record revenue of $136.5 million in Q4 2025, an 11% increase year-over-year in constant currencies, and $533.1 million for the full year 2025, up 5.7% in constant currencies. This marked the strongest quarterly and annual organic growth rates since 2018.

- The company experienced exceptional demand for CNC machining and sheet metal, with U.S. CNC revenue growing 25% in 2025 and 35% in Q4 2025. Growth was driven by innovation-led industries such as drones, space exploration, satellites, robotics, and data centers.

- Protolabs outlined a long-term strategy focused on serving customers across the entire part lifecycle, from prototype to production, supported by four strategic pillars. A significant step in expanding production was achieving ISO 13485 certification for its US factory injection molding operation in January, which opens opportunities in medical device production.

- For 2026, Protolabs anticipates full year GAAP revenue growth of 6%-8% and expects Q1 2026 revenue to be between $130 million and $138 million, with non-GAAP EPS between $0.36-$0.44. The company aims for a path to $1 billion in annual revenue over time with meaningful operating margin expansion.

6 days ago

Protolabs Reports Q4 and Full Year 2025 Financial Results

PRLB

Earnings

Share Buyback

Revenue Acceleration/Inflection

- Protolabs reported Q4 2025 revenue of $136.5 million, an 11.0% increase year-over-year.

- Non-GAAP EPS for Q4 2025 was $0.44, marking a $0.06 increase year-over-year.

- For the full year 2025, Protolabs achieved revenue of $533.1 million, up 5.7% year-over-year, and non-GAAP EPS of $1.66, a 1.5% increase year-over-year.

- The company generated $75 million in cash flow from operations and returned $43 million to shareholders via repurchases in FY 2025.

6 days ago

Proto Labs Reports Record Q4 2025 Revenue and Outlines 2026 Strategic Initiatives

PRLB

Earnings

Guidance Update

New Projects/Investments

- Proto Labs reported record Q4 2025 revenue of $136.5 million, an 11% year-over-year increase in constant currencies, contributing to a full-year 2025 revenue of $533.1 million and non-GAAP EPS of $1.66.

- For 2026, the company anticipates full-year GAAP revenue growth of 6%-8% and projects Q1 2026 non-GAAP EPS between $0.36-$0.44.

- Key strategic initiatives for 2026 include enhancing customer experience with ProDesk, accelerating innovation, expanding production capabilities through certifications like ISO 13485 for medical devices, and establishing a global capability center in India.

- The company aims for sustained double-digit revenue growth and a long-term target of $1 billion in annual revenue.

6 days ago

Protolabs Reports Record Q4 and Full Year 2025 Financial Results and Provides 2026 Outlook

PRLB

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Protolabs achieved record revenue for the fourth quarter of 2025, reaching $136.5 million, a 12.1% increase year-over-year, and record annual revenue of $533.1 million for 2025, a 6.4% increase over 2024.

- For the fourth quarter of 2025, the company reported GAAP net income of $6.0 million or $0.25 per diluted share, and Non-GAAP net income of $10.7 million or $0.44 per diluted share.

- For the full year 2025, GAAP net income was $21.2 million or $0.88 per diluted share, and Non-GAAP net income was $40.2 million or $1.66 per diluted share.

- Looking ahead, Protolabs expects fiscal year 2026 revenue growth between 6% and 8%. For the first quarter of 2026, revenue is projected to be between $130.0 million and $138.0 million, with non-GAAP diluted net income per share between $0.36 and $0.44.

6 days ago

Protolabs Reports Record Q4 and Full Year 2025 Financial Results

PRLB

Earnings

Revenue Acceleration/Inflection

Guidance Update

- Protolabs achieved record revenue for the fourth quarter of 2025 at $136.5 million, marking a 12.1% increase year-over-year, and record annual revenue for 2025 of $533.1 million, a 6.4% increase over 2024.

- The company reported net income of $6.0 million or $0.25 per diluted share for Q4 2025, a significant improvement from a net loss of $(0.4) million in Q4 2024. For the full year 2025, net income was $21.2 million or $0.88 per diluted share, up from $16.6 million in 2024.

- Protolabs provided financial guidance for fiscal year 2026, expecting revenue growth between 6% and 8%. For the first quarter of 2026, revenue is projected to be between $130.0 million and $138.0 million, with diluted net income per share between $0.17 and $0.25.

6 days ago

Proto Labs Reports Q3 2025 Earnings with Revenue Growth Amidst Stock Drop

PRLB

Earnings

Guidance Update

Demand Weakening

- Proto Labs reported third-quarter 2025 revenue of $135.4 million, a 7.8% increase, with net income of $7.22 million, or $0.30 per share, consistent with the prior year.

- Despite beating Wall Street estimates and providing solid fourth-quarter guidance, the company's shares dropped 11.33% to $47.02 due to investor concerns over long-term growth prospects, sluggish historical sales growth, and poor returns on invested capital.

- Revenue growth was driven by higher average order values in the U.S. and strong performance in CNC Machining (up 18.2%), while 3D Printing revenue declined by 6.3%.

- For the nine months ended September 30, 2025, Proto Labs reported revenue of approximately $396.63 million and net income of $15.24 million, which was slightly down compared to the prior year.

Oct 31, 2025, 5:41 PM

Proto Labs Reports Record Q3 2025 Revenue and Exceeds Earnings Expectations

PRLB

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Proto Labs reported record quarterly revenues of $135.4 million in Q3 2025, an increase of 7.8% year-over-year, and exceeded earnings expectations with non-GAAP EPS of $0.47.

- The company's non-GAAP gross margin improved to 45.9%, up 110 basis points sequentially, driven by improvements in both factory and network margins.

- Strong demand for CNC machining services led revenue growth, with CNC machining revenue increasing 18.2% year-over-year globally and 24% in the U.S..

- Proto Labs generated $29.1 million in cash from operations and returned $12.8 million to shareholders through repurchases in Q3 2025, ending the quarter with $138.4 million in cash and investments and zero debt.

- For Q4 2025, the company expects revenue between $125 million and $133 million and non-GAAP earnings per share between $0.30 and $0.38.

Oct 31, 2025, 12:30 PM

Proto Labs Reports Record Q3 2025 Revenue and Exceeds Earnings Expectations

PRLB

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Proto Labs reported record quarterly revenue of $135.4 million for Q3 2025, marking a 7.8% year-over-year increase, alongside non-GAAP earnings per share of $0.47.

- The company's non-GAAP gross margin improved sequentially by 110 basis points to 45.9% in Q3 2025, with both factory and network margins contributing to the gain.

- Revenue growth was notably strong in U.S. CNC machining, which increased 18.2% year-over-year, and sheet metal offerings, driven by demand in sectors like aerospace and defense, and industrial and commercial machinery.

- For Q4 2025, Proto Labs anticipates revenue between $125 million and $133 million and non-GAAP earnings per share between $0.30 and $0.38.

- Strategic developments include expanding CNC machining capacity, launching advanced CNC machining capabilities, and the appointment of Mark Kermish as Chief Technology and AI Officer to enhance AI and automation.

Oct 31, 2025, 12:30 PM

Protolabs Reports Q3 2025 Results and Provides Q4 2025 Outlook

PRLB

Earnings

Guidance Update

New Projects/Investments

- Protolabs reported Q3 2025 revenue of $135.4 million, a 6.8% year-over-year increase in constant currencies, with Non-GAAP EPS of $0.47, which was flat year-over-year.

- For Q4 2025, the company projects revenue between $125 million and $133 million and Non-GAAP EPS between $0.30 and $0.38.

- The company's Q3 2025 operating cash flow was $29.1 million, and it maintained a strong liquidity position with $138.4 million in cash and investments and no debt.

- Protolabs expanded its factory CNC Machining capabilities and secured Amazon's Prime Air drone team as a client for quick-turn CNC machining and 3D printing services.

Oct 31, 2025, 12:30 PM

Quarterly earnings call transcripts for Proto Labs.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more