Earnings summaries and quarterly performance for RB GLOBAL.

Executive leadership at RB GLOBAL.

Jim Kessler

Chief Executive Officer

Chris Carlson

Chief Accounting Officer

Darren Watt

Chief Legal Officer

Drew Fesler

Chief People Officer

Eric Guerin

Chief Financial Officer

Jeff Jeter

Chief Revenue Officer

Nancy King

Chief Technology Officer

Steve Lewis

Chief Operations Officer

Board of directors at RB GLOBAL.

Research analysts who have asked questions during RB GLOBAL earnings calls.

Krista Friesen

CIBC

7 questions for RBA

Sabahat Khan

RBC Capital Markets

7 questions for RBA

Steven Hansen

Raymond James

7 questions for RBA

Craig Kennison

Robert W. Baird & Co. Incorporated

6 questions for RBA

Maxim Sytchev

National Bank Financial, Inc.

6 questions for RBA

Gary Prestopino

Barrington Research

5 questions for RBA

Michael Feniger

Bank of America

5 questions for RBA

John Gibson

BMO Capital Markets

2 questions for RBA

John Healy

Northcoast Research

2 questions for RBA

Recent press releases and 8-K filings for RBA.

- Ritchie Bros. Auctioneers, a subsidiary of RB Global, generated more than US$265+ million in gross transaction value (GTV) at its Feb. 16-20, 2026, global auction in Orlando, FL.

- The auction sold over 14,500 equipment items, trucks, and vehicles and attracted more than 19,500 participants from 80+ countries.

- The event saw 86% of assets sold to U.S. buyers and 14% to international buyers, signaling a strong start and providing insight into the 2026 equipment market.

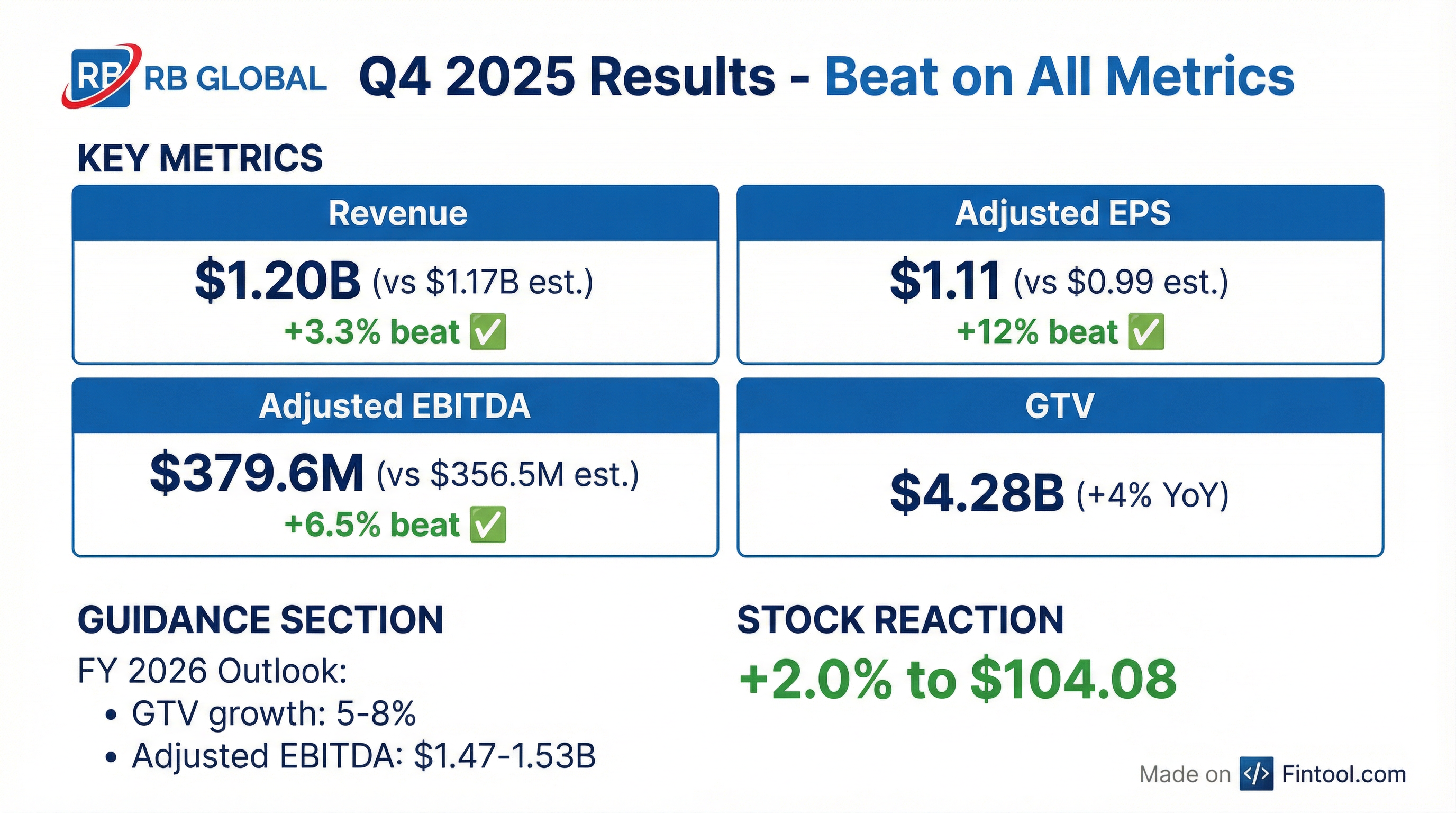

- RB Global reported a 10% increase in Adjusted EBITDA and a 4% increase in total Gross Transaction Value (GTV) for Q4 2025, with Adjusted earnings per share rising 17%.

- For the full year 2026, the company expects GTV to grow between 5% and 8%, and Adjusted EBITDA to be between $1.47 billion and $1.53 billion, representing approximately 7% growth at the midpoint.

- Strategic progress in 2025 included signing a new multi-year agreement with one of its largest partners and reaching an agreement in principle with another, alongside plans to launch the IAA Total Loss Predictor in 2026 and expand international channels with a new reserved auction format. The company anticipates gaining market share in 2026.

- Expected full-year 2026 capital expenditures are between $350 million and $400 million, with approximately one-third allocated to technology-related investments and two-thirds to traditional PP&E.

- RB Global reported strong Q4 2025 results, with Adjusted EBITDA increasing 10% on a 4% increase in gross transaction value (GTV), and Adjusted EPS up 17%. For the full year 2025, Adjusted EBITDA grew 7% and total GTV 2%.

- For 2026, the company forecasts full-year GTV growth between 5% and 8% and Adjusted EBITDA between $1.47 billion and $1.53 billion, representing approximately 7% growth at the midpoint.

- Key strategic developments include new multi-year agreements with major partners, the upcoming 2026 launch of the IAA Total Loss Predictor for dynamic vehicle routing, and the expansion of international channels with a new reserved auction format.

- Capital expenditures for full-year 2026 are projected to be between $350 million and $400 million, with roughly one-third allocated to technology and two-thirds to traditional property, plant, and equipment.

- RB Global reported Q4 2025 Adjusted EBITDA increased 10% on a 4% increase in Gross Transaction Value (GTV), reflecting continued operating leverage and cost management. For the full year 2025, Adjusted EBITDA grew 7% and GTV grew 2%.

- For full-year 2026, the company expects GTV to grow between 5% and 8% and Adjusted EBITDA to be between $1.47 billion and $1.53 billion, representing approximately 7% growth at the midpoint.

- Strategic highlights include signing a new multi-year agreement with one of its two largest automotive partners and reaching an agreement in principle with the other, with expectations to gain incremental market share.

- New initiatives for 2026 include the rollout of IAA Total Loss Predictor for dynamic vehicle routing and expanding international channels by launching a new reserved auction format on rbauction.com.

- RB Global reported Q4 2025 Total Gross Transaction Value (GTV) of $4,281 million and Adjusted EBITDA of $380 million.

- The company's Adjusted Diluted Earnings Per Share for Q4 2025 was $1.11.

- For 2026, RB Global anticipates GTV growth of 5% to 8% and Adjusted EBITDA between $1,470 million and $1,530 million.

- The company finished the year with strong momentum, signed a new multi-year agreement with one of its two largest partners, and observed increasing seller confidence in commercial construction and transportation end markets.

- RB Global reported Q4 2025 total revenue of $1.2 billion, a 5% increase year-over-year, with total gross transaction value (GTV) up 4% to $4.3 billion.

- For Q4 2025, net income decreased 8% to $109.4 million, resulting in diluted EPS of $0.53, a 9% decrease. However, diluted adjusted EPS increased 17% to $1.11, and Adjusted EBITDA rose 10% to $379.6 million.

- For the full year 2025, total revenue increased 7% to $4,590.7 million, and diluted adjusted EPS grew 15% to $4.00.

- The company provided a 2026 outlook, projecting GTV growth of 5% to 8% and Adjusted EBITDA between $1,470 million and $1,530 million.

- RB Global reported strong Q3 2025 results, with adjusted EBITDA increasing 16% and Gross Transactional Value (GTV) up 7%. Adjusted earnings per share also increased by 31%.

- The company raised its full-year 2025 adjusted EBITDA guidance to $1.35 billion-$1.38 billion, while tightening its GTV growth forecast to 0%-1%.

- A significant expansion of its partnership with the US General Services Administration (GSA) is expected to add disposition services for approximately 35,000 remarketed vehicles annually, reaching full run rate by Q2 2026.

- RB Global announced the acquisition of Smith Broughton Auctioneers and Allied Equipment Sales for approximately $38 million, strengthening its presence in Western Australia.

- A new operating model has been implemented, projected to generate over $25 million in total run rate savings by the second quarter of 2026.

- RB Global reported strong Q3 2025 financial results, with adjusted EBITDA increasing 16% and gross transactional value (GTV) up 7%. Adjusted earnings per share increased by 31%.

- The company expanded its partnership with the US General Services Administration (GSA) to provide disposition services for approximately 35,000 remarketed vehicles annually, expected to reach full run rate in Q2 2026.

- RB Global announced the acquisition of Smith Broughton Auctioneers and Allied Equipment Sales for approximately $38 million, strengthening its geographic footprint in Western Australia.

- A new transformative operating model is expected to generate over $25 million in total run rate savings by the second quarter of 2026.

- For full-year 2025, RB Global raised its adjusted EBITDA guidance to $1.35 billion-$1.38 billion and narrowed its GTV growth forecast to 0% to 1%.

- RB Global reported Q3 2025 Total GTV of $3,894 million, Service Revenue of $845 million, Adjusted EBITDA of $328 million, and Adjusted Diluted Earnings Per Share of $0.93.

- The company launched a new operating model designed to increase speed and efficiency, which is expected to generate ~$25 million in annual run-rate savings by the second quarter of 2026.

- RB Global updated its 2025 outlook, projecting GTV growth of 0 to 1% compared to full-year 2024 results, and Adjusted EBITDA between $1,350 million and $1,380 million.

- RB Global reported strong Q3 2025 results, with Adjusted EBITDA increasing 16% on a 7% increase in gross transactional value (GTV). Adjusted earnings per share also increased by 31%.

- The company raised its full-year 2025 Adjusted EBITDA guidance range to $1.35 billion-$1.38 billion, while narrowing its full-year GTV growth forecast to 0% to 1%.

- RB Global announced a significant expansion of its partnership with the US General Services Administration (GSA), expecting to provide disposition services for approximately 35,000 remarketed vehicles annually, reaching full run rate by Q2 2026.

- A new operating model is expected to generate over $25 million in total run rate savings by Q2 2026, with some savings anticipated in Q4 2025. The company also announced the acquisition of Smith Broughton Auctioneers and Allied Equipment Sales for approximately $38 million.

Quarterly earnings call transcripts for RB GLOBAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more