Earnings summaries and quarterly performance for BRC Group Holdings.

Executive leadership at BRC Group Holdings.

Bryant R. Riley

Detailed

Chairman and Co-Chief Executive Officer

CEO

Thomas J. Kelleher

Detailed

Co-Chief Executive Officer

CEO

AN

Alan N. Forman

Detailed

Executive Vice President, General Counsel and Secretary

HW

Howard Weitzman

Detailed

Senior Vice President, Chief Accounting Officer

SY

Scott Yessner

Detailed

Executive Vice President and Chief Financial Officer

Board of directors at BRC Group Holdings.

Research analysts who have asked questions during BRC Group Holdings earnings calls.

Recent press releases and 8-K filings for RILY.

BRC Group Holdings, Inc. Shares Preliminary Q4 and Full Year 2025 Financial Estimates

RILY

Earnings

Guidance Update

Revenue Acceleration/Inflection

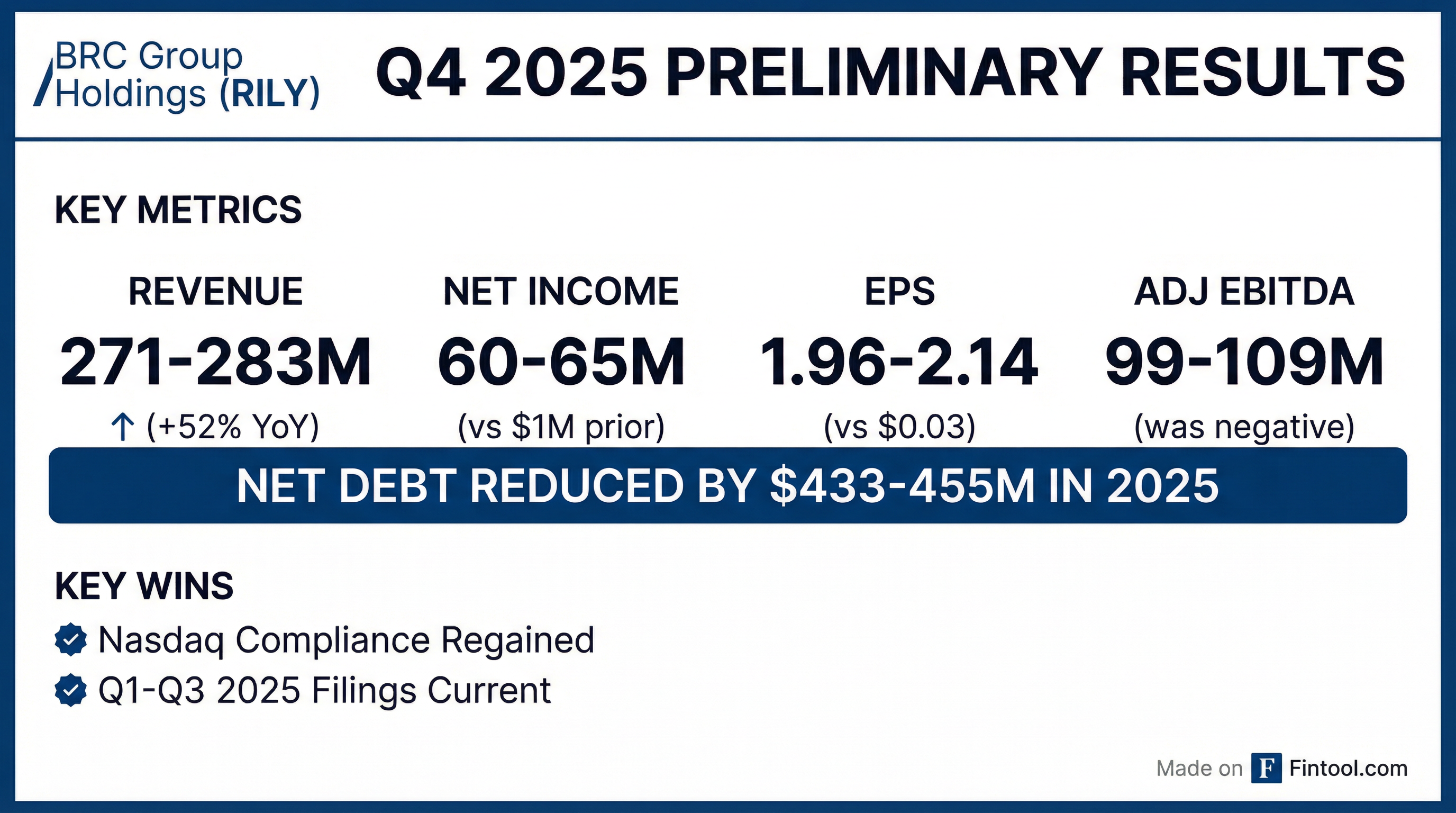

- BRC Group Holdings, Inc. (RILY) announced preliminary financial estimates for Q4 and Full Year 2025, indicating significant improvements over 2024.

- The company expects Net Debt to decline, ranging from $609.0 million to $631.0 million as of December 31, 2025, compared to $1.06 billion at December 31, 2024.

- BRC also regained Nasdaq compliance with the Periodic Filing Rule on January 27, 2026, after filing its Q1, Q2, and Q3 2025 Form 10-Qs between November 2025 and January 2026.

The preliminary financial estimates are as follows:

| Metric | Q4 2024 | Q4 2025 (Low Estimate) | Q4 2025 (High Estimate) | FY 2024 | FY 2025 (Low Estimate) | FY 2025 (High Estimate) |

|---|---|---|---|---|---|---|

| Net Income Available to Common Shareholders ($USD Millions) | 0.877 | 60.0 | 65.4 | (772.334) | 274.534 | 279.934 |

| Revenues ($USD Millions) | 178.582 | 271.0 | 282.5 | 746.421 | 960.236 | 971.736 |

| Adjusted EBITDA ($USD Millions) | (113.838) | 98.9 | 109.4 | (568.292) | 225.802 | 236.302 |

| Diluted EPS ($USD) | 0.03 | 1.96 | 2.14 | (25.46) | 8.98 | 9.16 |

Jan 29, 2026, 1:20 PM

BRC Group Holdings, Inc. Provides Preliminary Q4 and Full Year 2025 Financial Estimates

RILY

Guidance Update

Revenue Acceleration/Inflection

Delisting/Listing Issues

- BRC Group Holdings, Inc. (RILY) expects Net Income Available to Common Shareholders for the fourth quarter of 2025 to be between $60.0 million and $65.4 million, and Adjusted EBITDA to range from $98.9 million to $109.4 million.

- For the full year 2025, the company anticipates Net Income Available to Common Shareholders to be between $274.5 million and $279.9 million, with Adjusted EBITDA ranging from $225.8 million to $236.3 million.

- The company estimates a significant decline in Net Debt for the full year 2025, between $433 million and $455 million, with Net Debt expected to be between $609 million and $631 million as of December 31, 2025.

- BRC Group Holdings, Inc. regained Nasdaq compliance on January 27, 2026, after filing its outstanding Form 10-Qs for Q1, Q2, and Q3 2025.

Jan 29, 2026, 1:01 PM

BRC Group Holdings, Inc. Reports Strong Third Quarter 2025 Financial Results and Achieves Nasdaq Compliance

RILY

Earnings

Debt Issuance

Delisting/Listing Issues

- BRC Group Holdings, Inc. (RILY) reported strong financial results for the third quarter of 2025, with net income available to common shareholders of $89.1 million and basic and diluted EPS of $2.91, a significant turnaround from a net loss of $(286.4) million and EPS of $(9.39) in Q3 2024.

- The company successfully reduced total debt to $1.44 billion and net debt to $702.9 million as of September 30, 2025, down from $1.77 billion and $1.06 billion, respectively, at December 31, 2024.

- BRC Group Holdings, Inc. achieved Nasdaq compliance by filing its Q1, Q2, and Q3 2025 Form 10-Qs within 120 days, bringing its SEC periodic reporting current ahead of the January 20, 2026 deadline.

- The Capital Markets segment was a key driver of performance, generating $65.4 million in services and fee revenues and segment income of $60.7 million in Q3 2025.

Jan 14, 2026, 9:10 PM

BRC Group Holdings, Inc. Reports Third Quarter 2025 Financial Results and Achieves NASDAQ Compliance

RILY

Earnings

Delisting/Listing Issues

Debt Issuance

- BRC Group Holdings, Inc. (f/k/a B. Riley Financial, Inc.) reported net income available to common shareholders of $89.1 million for the third quarter of 2025, a significant improvement from a net loss of $(286.4) million in the third quarter of 2024.

- The company achieved NASDAQ compliance by filing its Q1, Q2, and Q3 2025 Form 10-Qs within 120 days, bringing its SEC periodic reporting current ahead of the deadline.

- Total revenues for Q3 2025 were $277.9 million, up from $175.4 million in Q3 2024, and Adjusted EBITDA reached $112.2 million compared to $(89.5) million in the prior year period.

- The Capital Markets segment was a strong performer, generating $65.4 million in services and fee revenues and $60.7 million in segment income.

- As of September 30, 2025, total debt was $1.44 billion, and net debt was $702.9 million, with net debt reduced by over $120 million in the third quarter.

Jan 14, 2026, 9:01 PM

B. Riley Financial Reports Q2 2025 Results and Debt Reduction

RILY

Earnings

Debt Issuance

Delisting/Listing Issues

- B. Riley Financial reported second-quarter 2025 net income of $137.5 million, a significant reversal from a loss in the prior year, and filed its Form 10-Q ahead of Nasdaq's December compliance deadline.

- The company reduced total debt by approximately $314 million since year-end 2024 and increased cash balances, indicating balance-sheet stabilization.

- Operating adjusted EBITDA from continuing operations improved year over year, with management signaling confidence in meeting the January 2026 deadline for third-quarter reporting, shifting the narrative toward financial normalization.

Dec 16, 2025, 2:45 PM

B. Riley Financial Reports Q2 2025 Results

RILY

Earnings

Debt Issuance

Delisting/Listing Issues

- B. Riley Financial, Inc. reported net income of $137.5 million and basic and diluted earnings per common share (EPS) of $4.50 for the second quarter of 2025, a significant improvement from a net loss of $(435.6) million and EPS of $(14.35) in the second quarter of 2024.

- Revenues for Q2 2025 were $225.3 million, up from $94.9 million in Q2 2024.

- The company successfully filed its Q2 2025 Form 10-Q ahead of Nasdaq's December 23, 2025 deadline and expects to file its Q3 2025 Form 10-Q by January 20, 2026, to become current on financial reporting.

- Total debt was reduced by $314 million to $1.46 billion as of June 30, 2025, compared to $1.77 billion as of December 31, 2024.

Dec 15, 2025, 9:15 PM

B. Riley Financial Reports Second Quarter 2025 Financial Results

RILY

Earnings

Debt Issuance

Delisting/Listing Issues

- B. Riley Financial reported net income of $137.5 million for the second quarter of 2025, a significant improvement from a net loss of $(435.6) million in the second quarter of 2024.

- Revenues increased to $225.3 million in Q2 2025, compared to $94.9 million in Q2 2024.

- Basic and diluted earnings per common share (EPS) were $4.50 for Q2 2025, up from $(14.35) in Q2 2024.

- The company reduced its total debt by $314 million to $1.46 billion as of June 30, 2025, compared to December 31, 2024.

- The Second Quarter 2025 Form 10-Q was filed ahead of Nasdaq's December 23, 2025 deadline, and the company expects to file the Third Quarter 2025 Form 10-Q by January 20, 2026, to become current with financial reporting.

Dec 15, 2025, 9:01 PM

B. Riley Financial Files Q1 2025 Report

RILY

Earnings

Delisting/Listing Issues

Auditor Change

- B. Riley Financial, Inc. (RILY) filed its Quarterly Report on Form 10-Q for the three-month period ended March 31, 2025, on November 18, 2025.

- This filing represents an important step towards timely financial reporting and compliance with Nasdaq listing requirements.

- The company completed a mid-year transition to BDO as its new auditor.

- B. Riley Financial Inc. is scheduled to change its name to BRC Group Holdings, Inc. on January 1, 2026.

Nov 18, 2025, 9:15 PM

B. Riley Securities Reports Q3 2025 Financial Highlights and Announces CEO Appointment

RILY

Earnings

Dividends

Management Change

- B. Riley Securities announced preliminary unaudited Q3 2025 financial results, reporting total revenue of $109.1 million and net income of $41.8 million.

- As of September 30, 2025, the company held $145.9 million in cash and securities and continued to operate with no outstanding debt.

- The Board approved a dividend of $0.40 per common share, amounting to approximately $7.4 million in total distribution.

- Jimmy Baker has been appointed CEO, effective January 1, 2026, while Andy Moore will remain Chairman of the BRS Board of Directors.

Nov 6, 2025, 9:06 PM

B. Riley Financial Enters New Revolving Credit Agreement

RILY

Debt Issuance

- B. Riley Financial, Inc. is party to a new Revolving Credit, Receivables Purchase, Security and Guaranty Agreement dated August 20, 2025.

- The agreement involves Targus International LLC, Targus US LLC, Hyper Products Inc., and Targus (Canada) Ltd. as Borrowers, among other entities.

- Proceeds from the advances are designated for refinancing existing indebtedness, covering transaction fees and expenses, and supporting working capital and general corporate purposes.

- The indebtedness under this agreement is intended to be senior secured Indebtedness.

Aug 26, 2025, 12:00 AM

Quarterly earnings call transcripts for BRC Group Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more