Earnings summaries and quarterly performance for RAYMOND JAMES FINANCIAL.

Executive leadership at RAYMOND JAMES FINANCIAL.

Paul M. Shoukry

Chief Executive Officer

Bella Loykhter Allaire

Chief Administrative Officer

James E. Bunn

President, Capital Markets

Jonathan N. Santelli

Executive Vice President, General Counsel and Secretary

Jonathan W. Oorlog, Jr.

Chief Financial Officer

Paul C. Reilly

Executive Chair

Scott A. Curtis

Chief Operating Officer

Board of directors at RAYMOND JAMES FINANCIAL.

Anne Gates

Director

Art A. Garcia

Director

Benjamin C. Esty

Director

Cecily M. Mistarz

Director

Gordon L. Johnson

Director

Jeffrey N. Edwards

Lead Independent Director

Mark W. Begor

Director

Marlene Debel

Director

Raj Seshadri

Director

Raymond W. McDaniel, Jr.

Director

Roderick C. McGeary

Director

Research analysts who have asked questions during RAYMOND JAMES FINANCIAL earnings calls.

Devin Ryan

Citizens JMP

8 questions for RJF

Michael Cyprys

Morgan Stanley

8 questions for RJF

Michael Cho

JPMorgan Chase & Co.

6 questions for RJF

Alexander Blostein

Goldman Sachs

5 questions for RJF

Dan Fannon

Jefferies & Company Inc.

5 questions for RJF

James Mitchell

Seaport Global Holdings LLC

5 questions for RJF

Kyle Voigt

Keefe, Bruyette & Woods

5 questions for RJF

Steven Chubak

Wolfe Research

5 questions for RJF

William Katz

TD Cowen

5 questions for RJF

Brennan Hawken

UBS Group AG

4 questions for RJF

Bill Katz

TD Securities

3 questions for RJF

Craig Siegenthaler

Bank of America

3 questions for RJF

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for RJF

Ben Budish

Barclays PLC

2 questions for RJF

Jim Mitchell

Seaport Global

2 questions for RJF

Michael

TD Cowen

2 questions for RJF

Michael Blostein

Goldman Sachs

1 question for RJF

Recent press releases and 8-K filings for RJF.

- The meeting convened with over 186.4 million shares (94% of outstanding) represented, constituting a quorum.

- CEO Paul Shoukry reported fiscal 2025 net revenues of $14.1 billion and net income of $2.13 billion, marking the fifth consecutive year of record results and 152 consecutive profitable quarters.

- The firm is investing over $1 billion annually in technology, including the launch of its proprietary AI operations agent, “Ray,” to enhance advisor services.

- Shareholders approved all five proposals, including election of 12 directors, advisory approval of executive compensation, amendments to equity plans, and ratification of KPMG LLP as auditor for FY 2026.

- Client assets under administration reached $1.80 trillion as of January 31, 2026, up 13% year-over-year and 2% sequentially.

- Private Client Group AUA totaled $1.74 trillion, increasing 14% year-over-year and 2% month-over-month, with fee-based accounts at $1.06 trillion (+18% YoY, +2% MoM).

- Financial assets under management rose to $286.4 billion, up 14% year-over-year and 2% MoM.

- Bank loans, net were $53.8 billion (+13% YoY), and clients’ cash sweep and Enhanced Savings Program balances were $55.0 billion, down 5% sequentially and 4% YoY.

- Raymond James finished fiscal 2025 with $1.7 trillion in client assets under management and $30 billion in net new assets in 4Q.

- CEO Paul Shoukry emphasized reinforcing the firm’s values via “The Power of Personal” and committing $1 billion annually to technology to support financial professionals.

- The Private Client Group delivered a record recruiting year, adding advisors with over $400 million of prior production, up 21% year-over-year.

- The bank saw 13% loan growth in 4Q, driven by securities-based lending, while client cash sweep balances stabilized at approximately 3% of AUM.

- Capital deployment prioritizes organic growth, strategic M&A (e.g., Clark Capital with $40 billion AUM), dividends targeting 20–30% of earnings, and $400 million quarterly buybacks.

- Raymond James reiterated its long-term focus on reinforcing culture and client-first values, launching the “Power of Personal” proposition to differentiate its advisor platform and client relationships.

- The Private Client Group ended FY 2025 with $30 billion of net new assets and executed a record recruiting year, adding advisors with over $400 million in prior-year production (up 21% YoY).

- Capital deployment priorities remain: organic growth (including advisor recruiting), M&A, dividends targeted at 20–30% of earnings, and share buybacks (~$400 million per quarter) when excess capital permits.

- Optimistic about its M&A advisory pipeline recovering after a soft Q1 and focusing on expanding sector coverage, while the banking division expects continued loan growth, led by securities-based lending.

- Manages approximately $1.7 trillion in client assets and reported over $30 billion in net new assets in 2025, capping a strong year-end performance.

- Unveiled “The Power of Personal” value proposition, emphasizing culture and client-first values while investing more than $1 billion annually in technology to support advisors and clients.

- Delivered a record recruiting year by adding advisors with over $400 million of prior production, a 21% increase year-over-year, focusing on long-term fit rather than highest upfront payouts.

- Banking unit achieved 13% loan growth in Q4, driven by expansion in securities-based lending, and expects SBL and residential mortgages to lead earning-asset growth with continued strong credit quality.

- Maintains top-tier capital ratios with $2.1 billion of excess liquidity; capital deployment priorities are organic growth, strategic M&A, then dividends (20–30% payout ratio), and share buybacks (~$400 million per quarter).

- Rio2 acquired a 99.1% interest in the Condestable mine in Peru from Southern Peaks under a December 8, 2025 SPA, subject to final TSX approval.

- The acquisition was funded by an 86.1 million subscription receipt financing at C$2.22 per unit, raising C$191.1 million, all of which converted into common shares on closing.

- As part of the closing, Rio2 issued US$55 million secured and US$10 million mezzanine promissory notes to Southern Peaks, both with six-year terms.

- Rio2 targets approximately 27,000 tonnes of copper equivalent annual production at Condestable and expects a six-month integration period.

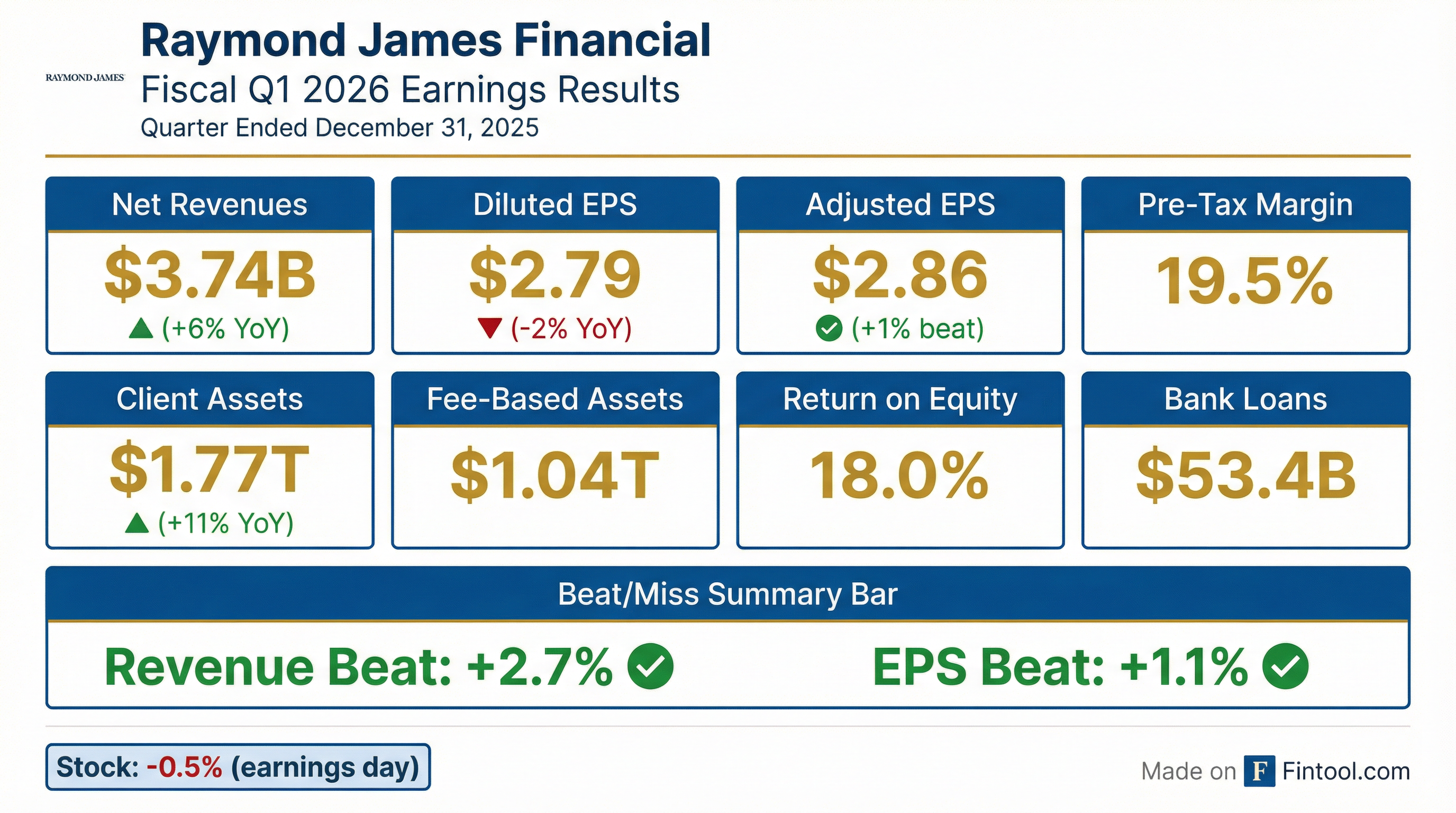

- Raymond James reported record fiscal first-quarter net revenues of $3.7 billion.

- The Private Client Group delivered $2.77 billion in revenue with ~$31 billion of net new assets.

- Acquired Clark Capital Management, adding $46 billion of discretionary and nondiscretionary assets, boosting asset-management scale.

- Reported net income was $562 million ($2.79 per share), down from $599 million ($2.86 per share) year over year; adjusted EPS was $2.80.

- Capital markets revenue declined 21% to $380 million, and management anticipates modest net interest income declines next quarter.

- Reported record net revenues of $3.7 billion, net income of $562 million, and diluted EPS of $2.79 (adjusted EPS of $2.86) in Q1 2026.

- Private Client Group net revenues were $2.77 billion with pre-tax income of $439 million; Capital Markets net revenues were $380 million (pre-tax income $9 million); Asset Management net revenues were $326 million (pre-tax income $143 million); Bank net revenues were $487 million (pre-tax income $173 million).

- Private Client Group fee-based assets reached $1.04 trillion, up 19% year-over-year, driven by market appreciation and net inflows.

- Bank loans ended the quarter at a record $53.4 billion (up 13% YoY), and the firm maintained a Tier 1 leverage ratio of 12.7%, with $2.4 billion of excess capital capacity.

- Returned $511 million of capital to shareholders in Q1, including $400 million of share repurchases, and plans to target $400–500 million of buybacks per quarter.

- Record Q1 net revenues of $3.70 B and net income of $562 M, diluted EPS $2.79 (adjusted EPS $2.86), with a 19.5% pre-tax margin (20% adjusted) and annualized ROE 18% (adjusted ROTE 21.4%).

- 8% annualized net new asset growth, with $31 B recruited in Q1 and $69 B over the past 12 months across all platforms, driven by strong financial advisor recruiting and retention.

- Private Client Group delivered $2.77 B net revenues and $439 M pre-tax income; fee-based assets under administration reached $1.04 T, up 19% YoY.

- Bank segment loans hit a record $53.4 B (28% YoY growth), net interest margin of 2.81%, led by 10% QoQ growth in securities-based lending.

- Capital deployment included $400 M share repurchases at an average price of $162, announced acquisitions of GreensLedge and Clark Capital, and a 12.7% Tier 1 leverage ratio.

- Record Q1 net revenues of $3.7 billion, net income $562 million, EPS $2.79 (adjusted EPS $2.86), with pre-tax margin 19.5% (20% adjusted).

- Private Client Group net revenues $2.77 billion (pre-tax income $439 million); Capital Markets net revenues $380 million (pre-tax income $9 million); Asset Management net revenues $326 million (pre-tax income $143 million); Bank net revenues $487 million (pre-tax income $173 million).

- Strong advisor recruiting: 8% annualized net new asset growth this quarter; $31 billion net new assets (second-best quarter); trailing-12-month recruited client assets over $63 billion.

- Capital deployment and expansion: repurchased $400 million of common stock; redeemed $81 million of Series B preferred; announced acquisitions of GreensLedge and Clark Capital (combined ~$46 billion AUM); Tier 1 leverage ratio 12.7%.

- Fiscal Q2 asset management and administrative fees expected to rise 1% quarter-over-quarter, despite two fewer billing days.

Quarterly earnings call transcripts for RAYMOND JAMES FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more