Earnings summaries and quarterly performance for Construction Partners.

Executive leadership at Construction Partners.

Fred J. (Jule) Smith, III

President and Chief Executive Officer

Gregory A. Hoffman

Senior Vice President and Chief Financial Officer

J. Ryan Brooks

Senior Vice President and General Counsel

N. Nelson Fleming, IV

Senior Vice President, Strategy and Business Development

Robert G. Baugnon

Senior Vice President, Personnel and Administration

Board of directors at Construction Partners.

Research analysts who have asked questions during Construction Partners earnings calls.

Adam Thalhimer

Thompson, Davis & Company, Inc.

8 questions for ROAD

Kathryn Thompson

Thompson Research Group

7 questions for ROAD

Andrew J. Wittmann

Robert W. Baird & Co.

5 questions for ROAD

Michael Feniger

Bank of America

5 questions for ROAD

Tyler Brown

Raymond James Financial, Inc.

4 questions for ROAD

Brent Thielman

D.A. Davidson

2 questions for ROAD

Ethan Trollinger

Raymond James

2 questions for ROAD

John Felicis

DA Davison

2 questions for ROAD

Nandita Nayar

Bank of America Merrill Lynch

2 questions for ROAD

Brian Biros

Stephens Inc.

1 question for ROAD

Gene Ramirez

D.A. Davidson & Co.

1 question for ROAD

Jean Paul Ramirez

D.A. Davidson & Co.

1 question for ROAD

Patrick Brown

Raymond James

1 question for ROAD

Recent press releases and 8-K filings for ROAD.

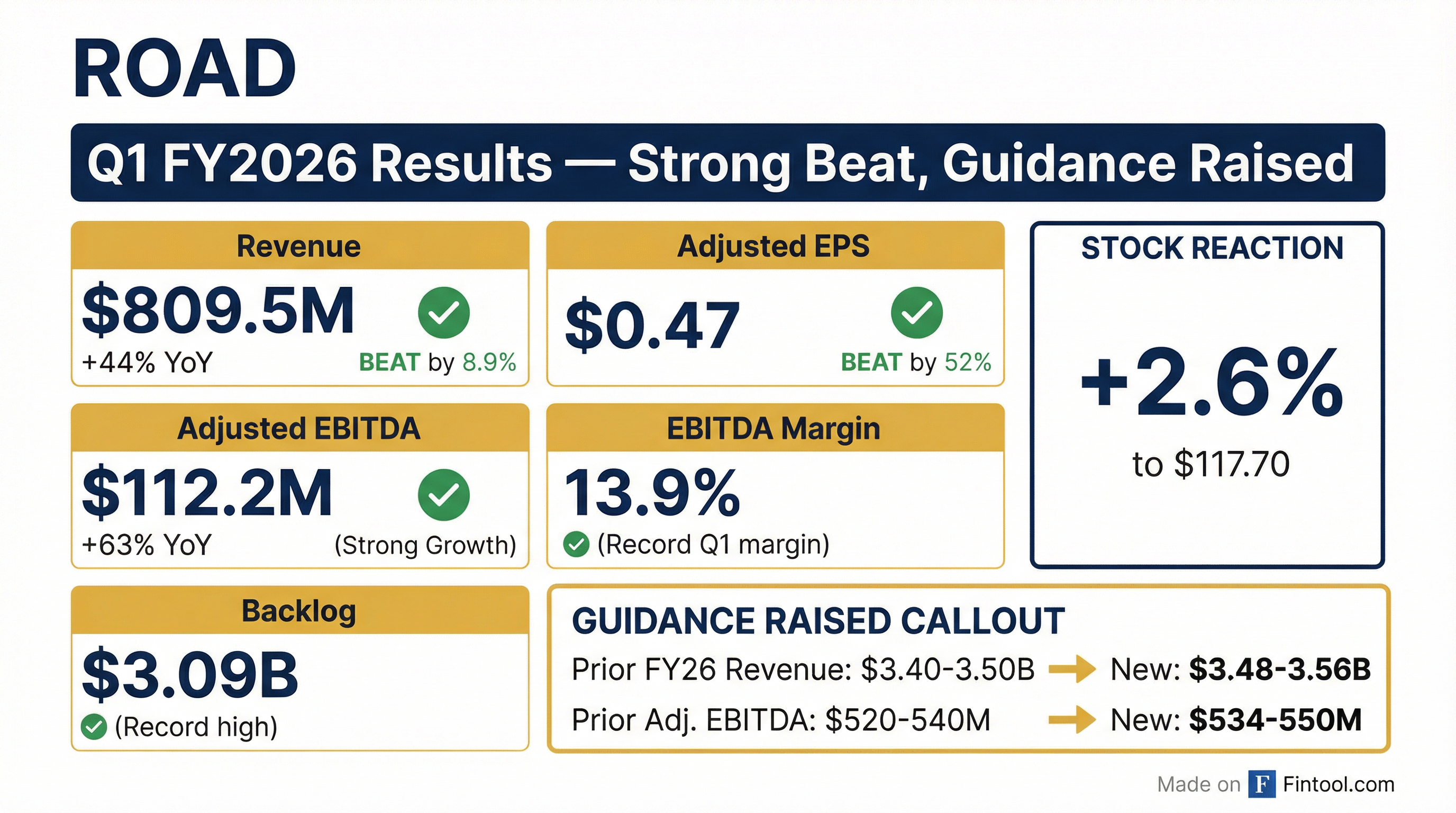

- Construction Partners reported strong Q1 fiscal 2026 results, with revenue increasing 44% to $809.5 million and adjusted EBITDA increasing 63% to $112.2 million, achieving a 13.9% adjusted EBITDA margin, the highest for a first quarter in its history.

- The company raised its fiscal year 2026 outlook, now expecting revenue in the range of $3.48 billion to $3.56 billion and adjusted EBITDA between $534 million and $550 million, with an adjusted EBITDA margin of 15.34% to 15.45%.

- Project backlog stood at $3.09 billion as of December 31, 2025, and the company anticipates a 10%-15% increase in total federal, state, and local contract awards for FY 2026.

- Construction Partners continued its growth strategy with the acquisition of GMJ Paving Company in Houston and aims to reduce its debt to trailing twelve-month EBITDA ratio to approximately 2.5 times by late 2026 from 3.18 times at the end of Q1 2026.

- Construction Partners reported strong Q1 fiscal 2026 results, with revenue increasing 44% to $809.5 million and Adjusted EBITDA rising 63% to $112.2 million, achieving a 13.9% Adjusted EBITDA margin, which is the highest first quarter margin in its history.

- The company raised its full-year fiscal 2026 guidance, now expecting revenue between $3.48 billion and $3.56 billion and Adjusted EBITDA between $534 million and $550 million, with an Adjusted EBITDA margin of 15.34%-15.45%.

- Construction Partners closed the quarter with a project backlog of $3.09 billion as of December 31, 2025, and continues its growth strategy with recent acquisitions, including GMJ Paving Company in Houston in February 2026, and plans for organic growth through new HMA greenfield facilities.

- The company is focused on deleveraging, aiming to reduce its debt to trailing twelve-month EBITDA ratio from 3.18 times to approximately 2.5 times by late 2026, supported by strong cash flow from operations.

- Construction Partners reported a strong start to fiscal 2026, with revenue increasing 44% to $809.5 million and adjusted EBITDA increasing 63% to $112.2 million, achieving a record first-quarter adjusted EBITDA margin of 13.9%.

- The company raised its full-year fiscal 2026 outlook, now expecting revenue in the range of $3.48 billion to $3.56 billion and adjusted EBITDA between $534 million and $550 million, while maintaining an organic growth anticipation of 7%-8%.

- Construction Partners continues its active M&A strategy, recently acquiring GMJ Paving Company in Houston, which is expected to be funded by cash flow from operations, and aims to reduce its debt to trailing twelve-month EBITDA ratio to approximately 2.5 times by late 2026 from the current 3.18 times.

- The company ended the quarter with a project backlog of $3.09 billion at December 31, 2025, and anticipates total federal, state, and local contract awards in FY 2026 to increase approximately 10%-15% over FY 2025, supported by strong demand in the Sun Belt.

- Construction Partners, Inc. reported revenue of $809.5 million for the first quarter of fiscal 2026, marking a 44.1% increase compared to the same quarter last year.

- Net income for Q1 FY26 was $17.2 million, with diluted earnings per share of $0.31, a significant improvement from a net loss of $3.1 million and diluted losses per share of $0.06 in the prior year's quarter.

- Adjusted EBITDA increased 63.1% to $112.2 million in Q1 FY26, achieving an Adjusted EBITDA margin of 13.9%.

- The company ended the quarter with a record project backlog of $3.09 billion at December 31, 2025.

- Construction Partners, Inc. raised its fiscal 2026 outlook for revenue, net income, Adjusted net income, and Adjusted EBITDA.

- Construction Partners reported a strong start to fiscal 2026, with revenue increasing 44.1% to $809.5 million and Adjusted EBITDA growing 63.1% to $112.2 million for the quarter ended December 31, 2025.

- The company achieved diluted earnings per share of $0.31 and Adjusted net income of $26.4 million, marking a 99% increase in Adjusted net income compared to Q1 FY25.

- Project backlog reached a record $3.09 billion at December 31, 2025, and the company completed two strategic acquisitions during the quarter, with another announced in Houston.

- Management raised its fiscal 2026 outlook, now expecting revenue between $3.480 billion and $3.560 billion and Adjusted EBITDA in the range of $534.0 million to $550.0 million.

- Construction Partners, Inc. (CPI) completed the acquisition of GMJ Paving Company, LLC (GMJ), an asphalt paving contractor operating in the Houston, Texas metro area, on February 2, 2026.

- This acquisition adds GMJ's hot-mix asphalt plant in Baytown, east of Houston, which is CPI's twelfth plant in the Houston metro area.

- The acquisition is part of CPI's growth strategy to expand its market share in the Houston metro area, complementing its existing geographic footprint and providing additional throughput opportunity at its nearby liquid asphalt terminal.

- Construction Partners, Inc. (CPI) announced on February 2, 2026, the acquisition of GMJ Paving Company, LLC, an asphalt paving contractor operating in the Houston, Texas metro area.

- This acquisition adds GMJ's hot-mix asphalt plant in Baytown, marking CPI's twelfth plant in the Houston metro area and enhancing its existing geographic footprint and liquid asphalt terminal throughput.

- The acquisition is part of CPI's growth strategy to expand market share in Houston, following previous acquisitions of Durwood Greene Construction Co. in August and Houston-area assets of Vulcan Materials Company in October.

- Construction Partners reported fiscal year 2025 revenue of $2.812 billion, a 54% increase year-over-year, driven by 8.4% organic growth and 45.6% acquisitive growth. Adjusted EBITDA for FY 2025 increased 92% to $423.7 million, achieving a 15% Adjusted EBITDA margin.

- The company ended FY 2025 with a record project backlog of $3 billion and provided fiscal year 2026 guidance projecting revenue between $3.4 billion and $3.5 billion and Adjusted EBITDA of $520 million to $540 million.

- Construction Partners introduced its "Road 2030" strategic plan, aiming to double revenue to over $6 billion by 2030 and expand EBITDA margins to 17% by the end of the period, projecting Adjusted EBITDA to exceed $1 billion by 2030.

- The company continued its M&A strategy with significant acquisitions in FY 2025 and early FY 2026, including expanding into Texas, Oklahoma, Tennessee, and Florida, while targeting a reduction in its debt-to-trailing 12-month EBITDA ratio to approximately 2.5 times by late 2026.

- Construction Partners reported strong fiscal year 2025 results, with revenue increasing 54% to $2.812 billion and Adjusted EBITDA growing 92% to $423.7 million, achieving a 15% Adjusted EBITDA margin.

- The company provided fiscal year 2026 guidance, projecting revenue between $3.4 billion and $3.5 billion and Adjusted EBITDA between $520 million and $540 million, with an Adjusted EBITDA margin of 15.3%-15.4%.

- Strategic acquisitions in fiscal year 2025, including entries into Texas, Oklahoma, and Tennessee, contributed significantly to growth, with further acquisitions completed in October 2025.

- Construction Partners ended fiscal year 2025 with a record project backlog of $3 billion and aims to reduce its debt-to-trailing 12-month EBITDA ratio to approximately 2.5 times by late 2026.

- The company unveiled its "Road 2030" strategic plan, targeting to double revenue to over $6 billion by 2030 and expand EBITDA margins to 17% by the end of the plan period.

- Construction Partners reported a 54% increase in total revenue to $2.812 billion and a 92% increase in Adjusted EBITDA to $423.7 million for fiscal year 2025, achieving a record EBITDA margin of 15%.

- The company completed five acquisitions in fiscal year 2025, entering Texas, Oklahoma, and Tennessee, and continued strategic expansion in October 2025 with acquisitions in Florida and Houston, significantly growing its market share.

- Construction Partners introduced its "Road 2030" strategic plan, targeting to double the company to over $6 billion in revenue and achieve a 17% EBITDA margin by 2030, with Adjusted EBITDA projected to exceed $1 billion.

- For fiscal year 2026, the company provided guidance including revenue in the range of $3.4 billion-$3.5 billion and Adjusted EBITDA between $520 million-$540 million, with an Adjusted EBITDA margin of 15.3%-15.4%.

- The company ended FY 2025 with a record project backlog of $3 billion and aims to reduce its debt-to-trailing 12-month EBITDA ratio from 3.1 times to approximately 2.5 times by late 2026.

Quarterly earnings call transcripts for Construction Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more