RXO (RXO)·Q4 2025 Earnings Summary

RXO Misses Q4 as Brokerage Margins Collapse, Stock Falls 11%

February 6, 2026 · by Fintool AI Agent

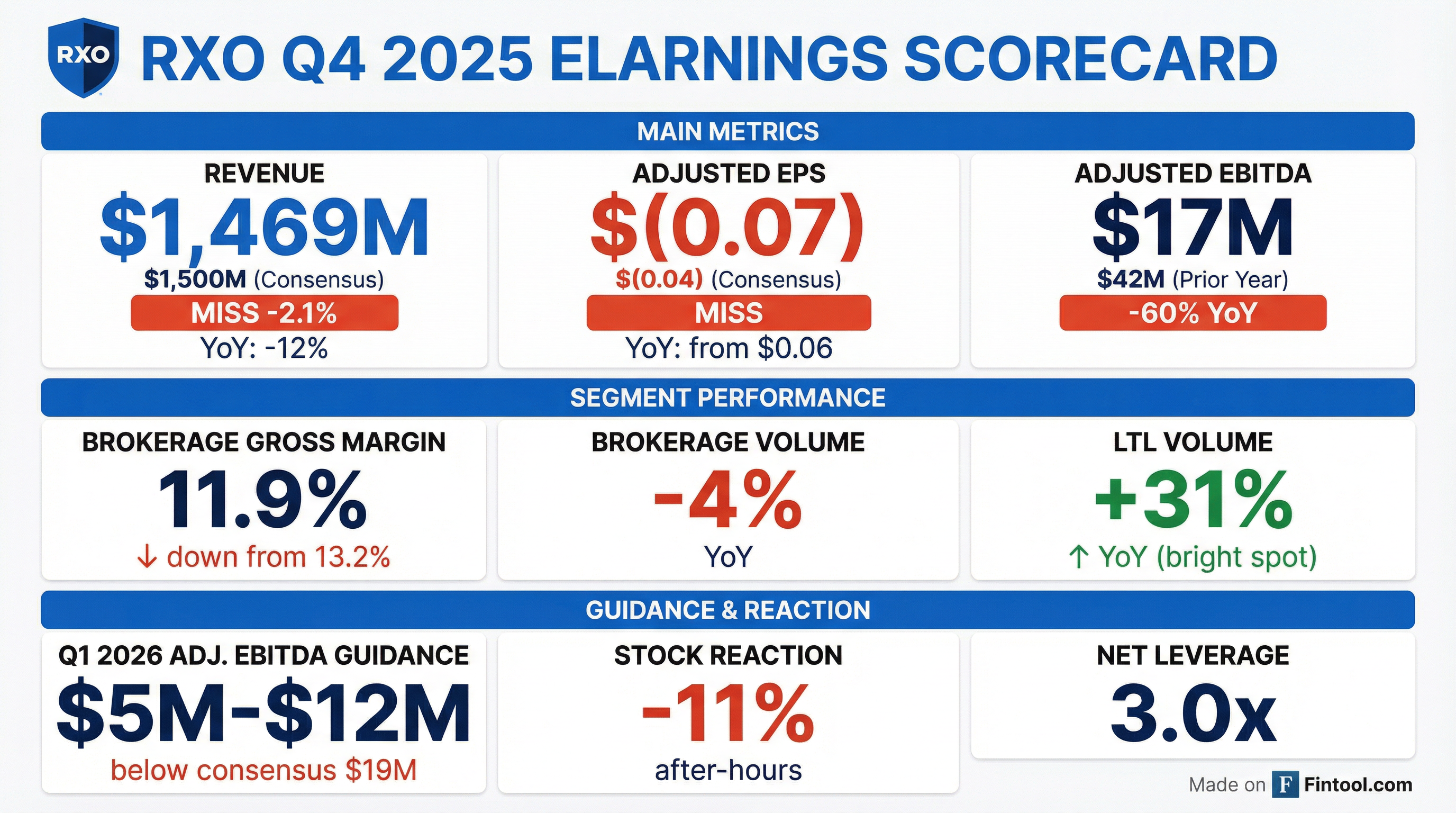

RXO reported a difficult fourth quarter as the freight broker's margins were crushed by a rapidly tightening supply-side environment. Revenue of $1.47 billion missed consensus by 2%, while adjusted EPS of $(0.07) significantly underperformed the $(0.04) expected, sending shares down 11% in after-hours trading to $14.80.

The quarter's story was margin compression. Brokerage TL gross margin fell to 11.9%—down from 13.5% last quarter and 13.2% a year ago—as carrier costs rose faster than RXO could pass through to customers. Management called out a "significant" tightening in December, with industry linehaul rates surging approximately 15% month-over-month.

Did RXO Beat Earnings?

No. RXO missed on both top and bottom lines:

*Values retrieved from S&P Global

The misses were driven by severe margin compression in the core brokerage business, not volume weakness. Management emphasized that costs on the buy-side (carrier rates) increased sharply while the sell-side (customer pricing) remained constrained by weak freight demand.

What Changed From Last Quarter?

The margin squeeze intensified dramatically in Q4:

*Values retrieved from S&P Global

The deterioration accelerated at quarter-end. Management specifically called out December as the inflection point when supply-side tightening reached "highest levels for 2025."

What Did Management Guide?

RXO's Q1 2026 outlook is weak and below consensus:

*Values retrieved from S&P Global

FY 2026 modeling assumptions included:

- CapEx: $50M - $55M

- Depreciation: $65M - $75M

- Amortization of intangibles: $40M - $45M

- Net interest expense: $32M - $36M

- Cash taxes: $6M - $8M

- Fully diluted shares: ~170M

The guidance implies management expects margin pressure to persist through at least Q1, with the midpoint of EBITDA guidance ($8.5M) representing a 53% decline from Q4's already weak $17M result.

How Did the Stock React?

RXO shares fell sharply after hours:

The stock had been trading up 17% over the prior month heading into earnings, suggesting the market had priced in some recovery hope. The guidance miss likely triggered the sell-off.

Segment Performance

Brokerage (72% of revenue)

The core business faced a perfect storm of compressed margins:

LTL (less-than-truckload) was the bright spot with 31% volume growth and 26% of total brokerage volume. However, this couldn't offset the margin squeeze in the larger TL business.

Complementary Services (28% of revenue)

Highlights:

- Managed Transportation awarded >$200M of freight under management

- Last Mile stop growth of 3% year-over-year

Key Management Commentary

Management framed the quarter as a cyclical squeeze rather than structural problem:

On the margin squeeze: "In December, rates increased by about 15% month-over-month, much faster than our contractual sale rates. At the same time, demand remained soft with not enough spot loads to offset the rise in purchased transportation costs."

On capacity exits: "The capacity reductions in the industry represent one of the largest structural changes to truckload supply since deregulation and should set the market up for a sharper inflection when demand recovers."

On gross profit per load: "Our truckload gross profit per load in the month of December was about 30% below our five-year average, excluding COVID highs."

On earnings power: "For every dollar that gross margin per load improves, it's well north of $1 million in EBITDA annualized. So when you think about the earnings power during a recovery, it's extremely strong."

On AI investments: "Our vision is that RXO will lead the next decade in freight by arming expert people with the best-in-class intelligence to solve problems before they happen, delivering a level of speed and flexibility that makes the old way of thinking unimaginable."

On the sales pipeline: "Our late-stage brokerage sales pipeline for new business grew more than 50% year-over-year... These wins will result in increased synergy loads to RXO's other lines of business."

Q&A Highlights

On the 50% pipeline increase (Ravi Shanker, Morgan Stanley): Drew Wilkerson explained the pipeline growth reflects the team's shift from integration mode to growth mode: "Last year was a big year for us in terms of the integration of Coyote into the organization. It's the largest acquisition that has ever happened in the brokerage space. This is all about us returning to what we do." The pipeline includes both existing long-tenured customers (largest customers have been with RXO for >15 years on average) and "big new names." Contract bids are typically implemented in Q2, which is why management expects to resume truckload volume outperformance by mid-year.

On pricing (Ravi Shanker, Morgan Stanley): Management expects contractual rates to increase "low to mid-single digits" while spot rates should be "significantly more than that."

On why spot volumes haven't surged despite tender rejections >10% (Scott Group, Wolfe Research): Drew Wilkerson noted spot volume has actually increased: "When you look from the third quarter to the fourth quarter, you saw an increase in spot loads... You saw that increase continue into January, but it has not been enough to offset the compression of what we've seen on the contractual side." Tender rejections exceeded 13% this week—"a level not seen since early 2022."

On free cash flow expectations (Scott Group, Wolfe Research): CFO Jamie Harris confirmed confidence in positive free cash flow for 2026: "If you just apply, let's just say, $25 million EBITDA as a proxy, that ends up being in the 45% range of a free cash flow conversion. And we'd have a positive free cash flow."

On weather impact (Stephanie Moore, Jefferies): The Southeast and Southwest experienced two major snow/ice storms back-to-back in January. Management quantified the impact at approximately $2 million of negative EBITDA through January, affecting both brokerage and last-mile operations.

On comparison to C.H. Robinson's outperformance (Ken Hoexter, Bank of America): Drew Wilkerson acknowledged the competitor's strong execution: "We've got to acknowledge that the peer you're referencing, C.H. Robinson, is executing well." RXO's focus in 2025 was integration: "We thought that we would stabilize the volume decline faster than what we did. But as you start to look at what happened in Q3 and Q4, we actually outperformed the truckload market on a sequential basis."

On Q2 visibility (Tom Wadewitz, UBS): Management has "high confidence in improving loads from Q1 to Q2." On gross margin, it depends on where tender rejections settle and how contract pricing catches up, but there's "certainly a strong opportunity" if spot loads pick up.

On Coyote synergies (Bruce Chan team, Stifel): CFO Jamie Harris confirmed total synergies of approximately $70 million ($60M OpEx, $10M CapEx). A majority flowed through in 2025, with an incremental ~$10 million of P&L benefit expected in 2026 vs 2025. The CapEx synergies are reflected in the 2026 CapEx guide of $50-55M.

Technology and AI Investments

Despite margin pressure, RXO continued investing over $100 million annually in technology across four pillars:

Volume:

- New proprietary AI spot quote agent

- Rolled out Agentic AI capacity sourcing to attract qualified carriers to RXO platform

- 24% increase in digital bids per carrier with new AI-based load recommendation in RXO Connect

Margin:

- Expanded pricing tooling with increased automation

- Launched contract pricing model view for enhanced decision-making

- Improvements to pricing engine continue

Productivity:

- Productivity up 19% year-over-year; almost 40% on a two-year stack

- Brokerage headcount declined by mid-teens percentage year-over-year

- Decoupling volume growth from headcount growth for strong incremental contribution margins

Service:

- Automated thousands of tracking updates via Agentic AI tooling

- Enhanced theft prevention processes across thousands of loads in high-risk cargo areas by deploying Agentic AI

- Delivered generative AI assistant to support customer sales and operations

Capital Structure and Liquidity

RXO secured a new asset-based lending facility, replacing its existing revolver:

Leverage moved higher as profitability declined, though the new ABL provides "more flexibility through all market cycles."

Cash Flow and Capital Allocation

Management highlighted "disciplined strategic capital deployment and favorable working capital" driving improved FCF conversion. Long-term conversion target remains 40-60% across market cycles.

Capital allocation priorities:

- Internal investments with strong historical ROIC

- Share repurchases ($125M program)

- Opportunistic M&A complementary to strategy

Risks and Concerns

Near-term headwinds:

- Margin compression may persist if capacity exits continue outpacing demand recovery. Tender rejections exceeded 13% this week—highest since early 2022.

- Guidance implies Q1 could be the trough with EBITDA potentially below $10M

- Leverage at 3.0x could constrain flexibility if conditions worsen

Regulatory-driven supply tightening:

- English language proficiency violation rates have climbed back to pre-2016 levels (~3%), with out-of-service enforcement rate spiking to >30% from <5%

- Non-domiciled CDL restrictions continue to drive capacity exits

- This represents "one of the largest structural changes to truckload supply since deregulation"

Structural concerns:

- Dependence on third-party carriers creates margin volatility

- Contract/spot mix (72%/28%) limits ability to capture pricing upside

- Contractual book of business prevents passing through cost increases quickly

Forward Catalysts

Potential upside drivers:

- Demand recovery would allow pricing catch-up to carrier cost increases. "Any significant improvement in demand could set up for a sharp inflection."

- LTL volume momentum (+31% YoY) represents fourth consecutive quarter of double-digit growth

-

$200M Managed Transportation awards not yet fully ramped, with "very robust pipeline of opportunities"

- Late-stage brokerage pipeline increased >50% YoY with high-quality enterprise accounts—management expects to resume truckload volume outperformance "as early as the middle of this year"

- Productivity up 19% YoY (40% two-year stack) creating operating leverage for the recovery

- ISM manufacturing activity expanded most since 2022 in January, a "key leading indicator for the U.S. economy and the transportation industry"

Management's EBITDA recovery math:

- GPL currently ~30% below 5-year average (ex-COVID)

- Every $1 of GPL improvement = "well north of $1 million in EBITDA annualized"

- Incremental brokerage margins can be as high as 80% flow-through to EBITDA

Margin defense initiatives underway:

- Expanding alternative sources of capacity like private fleets to reduce buy rate volatility

- Working closely with customers to optimize volume, service, and price during bid season

- Developing "creative ways to leverage our hub network within last-mile to provide customers with customized middle-mile solutions"

Key dates to watch:

- Q1 2026 earnings (early May 2026)

- Mid-year 2026: Expected return to truckload volume outperformance

- Freight demand inflection signals

Historical Earnings Performance

*Values retrieved from S&P Global