Earnings summaries and quarterly performance for RXO.

Executive leadership at RXO.

Board of directors at RXO.

Research analysts who have asked questions during RXO earnings calls.

Ken Hoexter

BofA Securities

7 questions for RXO

Scott Group

Wolfe Research

6 questions for RXO

Stephanie Moore

Jefferies

5 questions for RXO

Christian Wetherbee

Wells Fargo

4 questions for RXO

Jordan Alliger

Goldman Sachs

4 questions for RXO

Ravi Shanker

Morgan Stanley

4 questions for RXO

Tom Wadewitz

UBS Group

4 questions for RXO

Brian Ossenbeck

JPMorgan Chase & Co.

3 questions for RXO

David Zazula

Barclays

3 questions for RXO

Scott Schneeberger

Oppenheimer & Co. Inc.

3 questions for RXO

Ariel Rosa

Citigroup

2 questions for RXO

Ari Rosa

Citigroup Inc.

2 questions for RXO

Brandon Oglenski

Barclays

2 questions for RXO

Daniel Imbro

Stephens Inc.

2 questions for RXO

Jason Seidl

TD Cowen

2 questions for RXO

J. Bruce Chan

Stifel

2 questions for RXO

Jeffrey Kauffman

Vertical Research Partners

2 questions for RXO

Matt Milask

Stifel

2 questions for RXO

Ravi Shankar

Morgan Stanley

2 questions for RXO

David Hicks

Raymond James

1 question for RXO

Joe Hoffman

Jefferies

1 question for RXO

Joseph Lawrence Hafling

Jefferies

1 question for RXO

Lucas Cervera

Truist Securities

1 question for RXO

Lucas de Servera

Truist Financial Corporation

1 question for RXO

Lucas Severa

Truist Securities

1 question for RXO

Thomas Wadewitz

UBS

1 question for RXO

Recent press releases and 8-K filings for RXO.

- On February 20, 2026, RXO, Inc. closed an offering of $400,000,000 in aggregate principal amount of its 6.375% Senior Notes due 2031.

- These Notes are senior unsecured obligations maturing on May 15, 2031, with semi-annual interest payments beginning November 15, 2026.

- The company has optional redemption rights starting May 15, 2028, with redemption prices ranging from 103.188% to 100.000% of the principal amount depending on the redemption year.

- Concurrently, RXO, Inc. completed the redemption of all its outstanding 7.500% Notes due 2027 at a price of 101.875% of the principal amount, utilizing proceeds from the new Notes offering.

- The freight market is experiencing soft demand, being in a freight recession for three and a half years, while the supply side is tightening due to new regulations, evidenced by tender rejections more than doubling to 14% in mid-February.

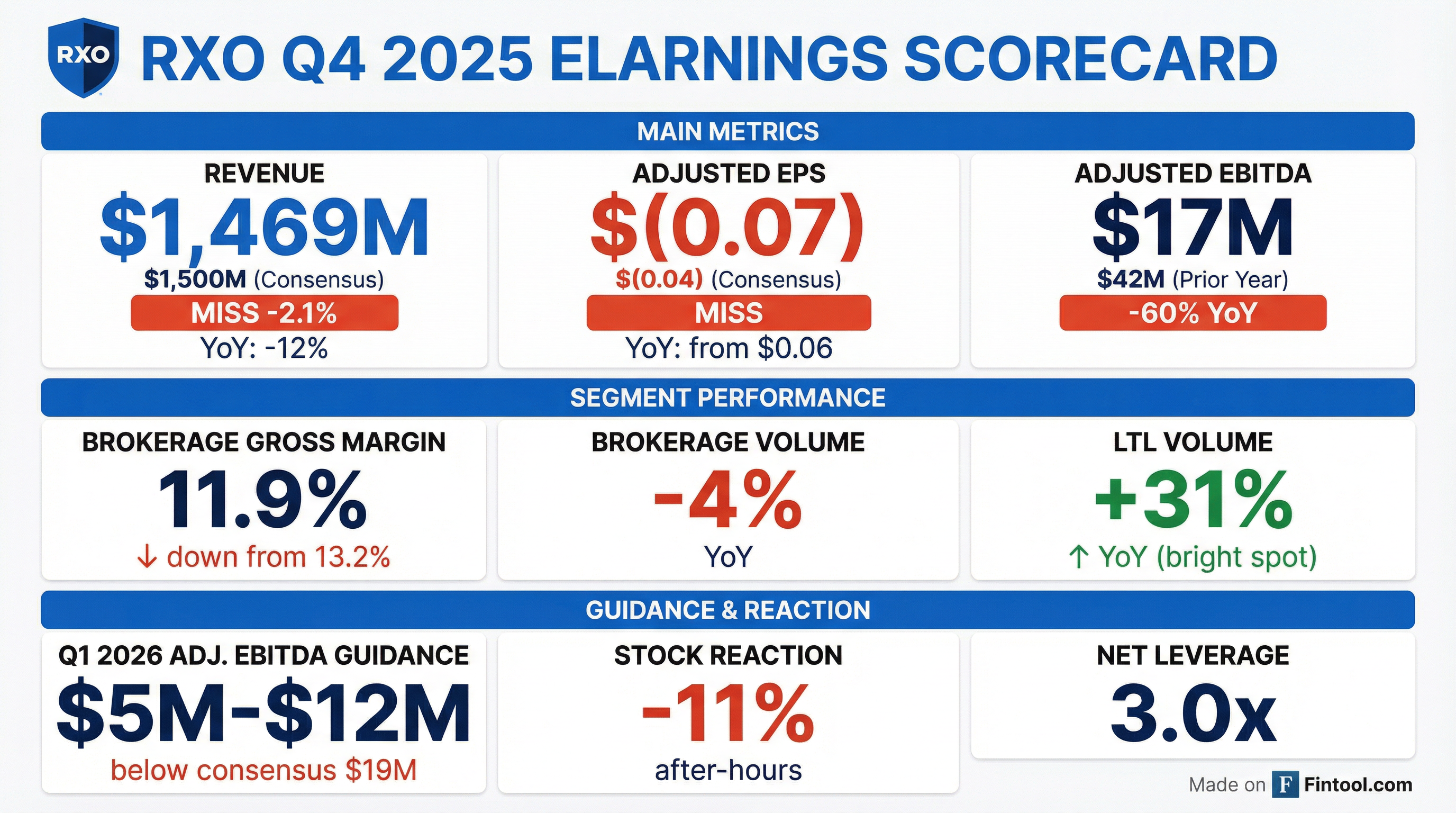

- RXO projects Q1 2026 volume to be down 5%-10% year-over-year and anticipates Adjusted EBITDA in the range of $5 million-$12 million, primarily due to a squeeze on brokerage gross margins caused by a 15% increase in industry-wide spot rates from November to December.

- Despite current pressures, RXO's late-stage sales pipeline in brokerage is up more than 50% year-over-year, and the company aims for at least 5%-6% EBITDA margins mid-cycle, supported by $155 million in cost reductions over the last three years post-spin from XPO.

- The company expects significant free cash flow generation, with cash outflows of approximately $30 million for interest expense and $50 million for CapEx, targeting a free cash flow conversion of 40%-60%.

- RXO projects Q1 2026 adjusted EBITDA in the range of $5 million-$12 million and anticipates a 5%-10% year-over-year decline in overall volume, attributing this to persistent tight market conditions and squeezed brokerage gross margins.

- Despite current market pressures, RXO is in growth mode, with its late-stage sales pipeline in brokerage up more than 50% year-over-year, and expects to resume outperformance versus the broader market as early as mid-2026, supported by the materially complete Coyote integration and over $155 million in cost reductions.

- The company aims for at least 5%-6% EBITDA margins in a mid-cycle environment and highlights strong free cash flow generation potential, having achieved 43% adjusted free cash flow in 2025.

- RXO recently refinanced its notes and secured a new ABL facility, positioning it for 2026 and beyond.

- RXO anticipates Q1 Adjusted EBITDA between $5 million and $12 million, attributing this to persistent tight market conditions from late Q4 2025, which saw brokerage gross margins squeezed by a 15% increase in spot rates from November to December.

- The company is in growth mode, with its pipeline up more than 50% year-on-year, primarily in full truckload, and expects to resume outperformance against the broader market from Q2 2026 onwards.

- RXO recently replaced its unsecured revolver with a new secured ABL facility, increasing availability to $450 million (almost 2x the prior amount), eliminating maintenance covenants, and saving approximately 35 basis points in interest expense.

- The company has achieved over $155 million in cost reductions and views the $400 billion market opportunity, coupled with its position as the number 3 player and materially completed Coyote integration, as setting it up for growth in 2026 and beyond.

- RXO forecasts Q1 adjusted EBITDA between $5 million and $12 million, attributing this to a significant 15% month-on-month increase in industry-wide buy rates from November to December, which is impacting brokerage gross margins.

- The company expects Q1 volumes to decrease by 5%-10% year-over-year, with truckload volumes projected to be down low double digits, while LTL volumes are anticipated to be up approximately 5% year-over-year.

- RXO aims to resume truckload outperformance against the market by mid-2026, bolstered by a late-stage brokerage sales pipeline that has grown over 50% year-over-year.

- The integration of Coyote is substantially complete, with $60 million in operating expense synergies fully realized for 2026, and an additional $30 million in operating expenses expected to be fully realized in 2026.

- Management characterizes the market as "extremely fragile," citing 14% tender rejections in mid-February due to capacity removal, and anticipates 2026 contract rates to increase by low- to mid-single digits year-over-year.

- RXO provided a Q1 adjusted EBITDA outlook of $5 million-$12 million and anticipates Q1 volumes to be down 5%-10% year-over-year. This is attributed to a significant market squeeze, with industry-wide buy rates increasing 15% month-on-month from November to December, impacting brokerage gross margins.

- The integration of Coyote is materially complete, with $70 million in total synergies realized and an additional $30 million in operating expense synergies expected to be fully realized in 2026.

- The company's late-stage brokerage sales pipeline is up more than 50% year-over-year, and RXO expects to resume truckload outperformance versus the market as early as the middle of the year.

- Capital expenditure for last year was $57 million, below the guided range, and is projected to further decrease to $50 million-$55 million this year, with a through-cycle expectation of $50 million.

- RXO projects Q1 2026 adjusted EBITDA between $5 million and $12 million and anticipates overall volumes to decrease by 5%-10% year-over-year, though LTL volumes are expected to rise by approximately 5% year-over-year.

- The company's late-stage brokerage sales pipeline has increased by over 50% year-over-year, leading to expectations of resuming truckload outperformance against the broader market by as early as mid-2026.

- The Coyote integration is largely complete, with $60 million in operating expense synergies fully realized for 2026, and an additional $30 million in operating expense opportunities expected to be fully realized in 2026.

- RXO notes a "fragile" supply-demand balance, with industry-wide buy rates increasing 15% month-on-month from November to December and tender rejections reaching 14% as of February 18, 2026, despite muted demand.

- Capital expenditures for 2025 were $57 million, below the guided range, and are projected to be $50 million-$55 million for 2026, with a through-cycle expectation of $50 million.

- RXO, Inc. announced the pricing of its offering of $400 million aggregate principal amount of 6.375% Senior Notes due 2031.

- The notes were priced at an issue price of 100.00%.

- The company intends to use the net proceeds primarily to repurchase or redeem all of its outstanding 7.500% Notes due 2027, as well as for related fees and general corporate purposes.

- Trucking supply is tightening due to regulatory changes, with tender rejections reaching double digits even before recent weather impacts, compared to mid-single digits a few months prior.

- RXO observes early signs of demand recovery, including encouraging news from home building and an ISM new orders component hitting 57 (highest since 2022). Automotive volumes, a headwind in 2025, are expected to no longer be a year-on-year headwind in 2026.

- The company is making transformational investments in AI, which have already led to a 19% increase in productivity (loads per person per day) over the last 12 months and are expected to drive significant incremental margins by decoupling volume growth from headcount growth.

- RXO has implemented over $155 million in cost reductions over the past three years, with the full run-rate impact expected in 2026, and is strategically growing its LTL business (aiming for 50-60% of volume from current 30%) and managed transportation, with a pipeline of over $1.5 billion.

- Regulatory changes are significantly impacting trucking supply, causing tender rejections to rise from mid-single digits to double digits, with an estimated 20-25% of the market potentially at risk due to new regulations.

- The integration of Coyote saw an initial volume pullback, but 99 of the top 100 customers have been retained, and volume is now returning following intentional pricing adjustments.

- RXO is making transformational investments in AI to enhance profitability, reporting a 19% increase in productivity (loads per person per day) over the last 12 months and aiming for 80% incremental margins in brokerage by decoupling volume growth from headcount.

- The company is targeting growth in its LTL business (from 30% to 50-60% of overall volume) and managed transportation, which has a pipeline exceeding $1.5 billion, while also realizing the full $155 million in cost reductions in 2026.

Quarterly earnings call transcripts for RXO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more