SOUTHSIDE BANCSHARES (SBSI)·Q4 2025 Earnings Summary

Southside Bancshares Posts Q4 EPS of $0.70 as NIM Climbs to 2.98%

January 29, 2026 · by Fintool AI Agent

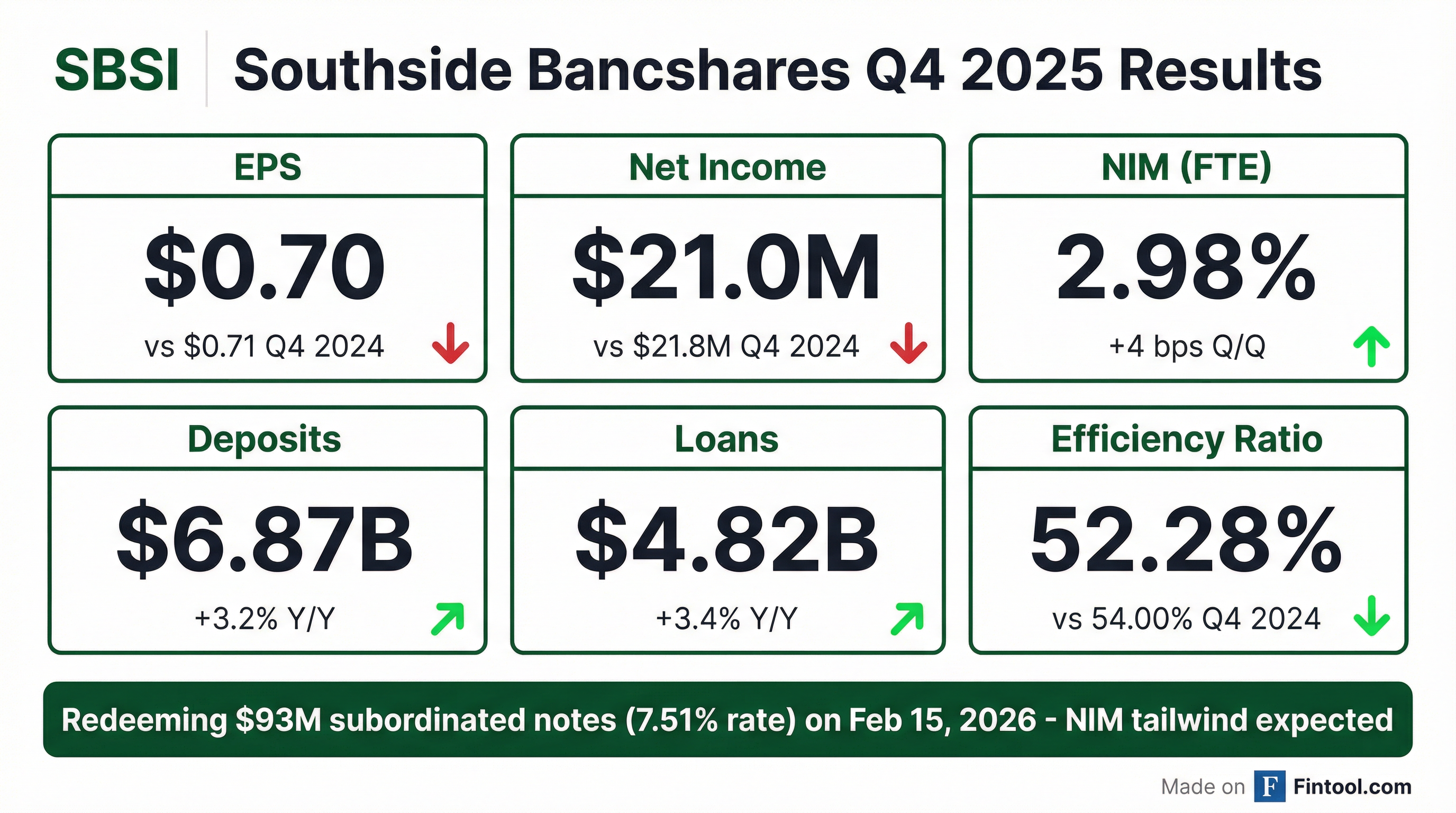

Southside Bancshares (NYSE: SBSI) reported Q4 2025 earnings per diluted share of $0.70, down 1.4% from $0.71 in the year-ago quarter, as the Tyler, Texas-based bank continued restructuring its securities portfolio while delivering net interest margin expansion.

The company's tax-equivalent net interest margin rose to 2.98%, up 4 basis points from Q3 2025 and 15 basis points from Q4 2024, driven by lower funding costs. Management signaled further NIM improvement ahead with the planned February 2026 redemption of $93 million in high-cost subordinated notes.

Did Southside Bancshares Beat Earnings?

Q4 2025 results came in roughly in-line with expectations:

Net income declined modestly year-over-year primarily due to a $7.3 million net loss on the sale of available-for-sale (AFS) securities recorded during the quarter, partially offset by higher net interest income and lower provision for credit losses.

What's the Securities Portfolio Strategy?

CEO Keith Donahoe highlighted the ongoing portfolio restructuring initiative:

"During the fourth quarter, we continued the restructure of a portion of our available for sale securities portfolio by selling approximately $82 million of lower yielding long duration municipal securities with a combined taxable equivalent yield of approximately 2.59% at a loss of $7.3 million. All the sales occurred at the end of October. The proceeds from the sale of these securities were reinvested primarily in U.S. Agency mortgage-backed securities."

This strategy has been a recurring theme throughout 2025, with total AFS securities losses reaching $32.3 million for the full year. While painful in the short term, management is repositioning the portfolio for higher yields and better interest rate sensitivity.

What Changed From Last Quarter?

Key sequential changes (Q4 vs Q3 2025):

The stark improvement from Q3 2025 reflects the absence of Q3's $24.4 million AFS securities loss, which had crushed that quarter's results.

Loan growth was solid, with total loans up $52.7 million quarter-over-quarter driven by construction loans (+$29.0M), commercial real estate (+$24.1M), and commercial loans (+$14.8M).

How Is the Stock Performing?

SBSI shares were trading at $32.28 as of January 29, 2026, down 0.2% on the day following the earnings release. The stock is up 24.9% from its 52-week low of $25.85 and trading near its 52-week high of $33.96.*

*Values retrieved from S&P Global

What Did Management Guide?

Management provided specific 2026 guidance across several categories:

NIM Tailwind from Debt Redemption:

"On February 15, 2026, we will redeem our $93 million subordinated notes due 2030 which bear interest at a rate of 7.51%. We expect the redemption to have a positive impact on our net interest margin in the first quarter."

CFO Julie Shamburger noted the sub-debt repriced in mid-Q4 and will be eliminated mid-Q1, so the benefit won't fully materialize until Q2 2026.

2026 Expense Guidance:

Key Technology Initiatives: CEO Keith Donoho outlined two major software investments driving the expense increase:

- Core Banking Migration — Moving from on-premise to OutLink (off-premise hosting), expected to create efficiencies for growth and M&A integration

- Data Platform Build — Building out enterprise data capabilities to unlock insights from multiple systems

What's the M&A Strategy?

Management confirmed M&A remains core to the growth strategy, with particular focus on Texas metros:

"We're not going to acquire just to acquire. We're gonna be strategic, if it's filling out a geography for us... We've got, as an example, only a loan production office in Dallas. If we can find the right target in Dallas, that would be a good expansion."

Target Criteria:

- Asset size generally below $1.5B, but open to larger deals that "spring over" the $10B threshold

- Geographic focus: Dallas, Houston, Austin, Fort Worth

- New Woodlands retail location opening in next 60 days

Texas Disruption Opportunity: Donoho highlighted recent Texas bank M&A activity (including a Houston deal announced the day prior) as creating opportunities:

"We're seeing opportunity both from a people side as well as customer side. We've been working on a couple of C&I opportunities in the Metroplex that are being disrupted because of the acquisitions we're seeing."

What's the Loan Pipeline Outlook?

The loan pipeline showed healthy momentum after a mid-quarter dip:

"Our loan pipeline dipped to $1.5 billion mid-quarter, but rebounded after the first of the year to just over $2 billion today."

Pipeline Composition:

Donoho expects production to exceed 2025 levels but cautioned that elevated payoffs from construction project completions create headwinds.

Full Year 2025 Results

The full year 2025 results were significantly impacted by securities portfolio restructuring:

Excluding the $32.3 million loss on AFS securities sales (vs. $2.5 million in 2024), underlying operating performance remained solid with net interest income growing 2.3% and efficiency ratio improving.

Asset Quality Update

Credit quality remained stable with nonperforming assets at 0.45% of total assets, though elevated from 0.04% a year ago:

The increase in NPAs was primarily due to a $27.5 million commercial real estate loan that was restructured in Q1 2025 to allow for an extended lease-up period. Provision for credit losses declined to $0.6 million in Q4 2025 from $1.6 million in Q4 2024.

NPA Resolution Update: CEO Donoho expressed optimism on the $27.5M multifamily NPA:

"Despite this loan not paying off in the fourth quarter, we remain optimistic that the borrower will finalize their refinance within the next two weeks."

Q4 also saw a $2.4M addition to NPAs from a small residential condo project loan.

Capital Return

Southside continued returning capital to shareholders through both dividends and buybacks:

Dividend: Declared Q4 2025 cash dividend of $0.36 per share, paid December 4, 2025. Annualized dividend of $1.44 per share represents a 4.5% yield at current prices.

Share Repurchases: Repurchased 369,804 shares during Q4 at an average price of $28.84, with approximately 0.8 million shares remaining under the authorization.

Capital Ratios

Capital levels remain well above regulatory requirements:

Q&A Highlights

On Margin Outlook (Michael Rose, RJ): CFO Shamburger clarified that the sub-debt benefit will be muted in Q1 2026 since it repriced mid-Q4 and gets redeemed mid-Q1: "Strictly with respect to the $93 million, it's gonna have about the same impact in the first quarter as it did in the fourth. But when those sources of funding are replaced in the second quarter, we'll certainly see some improvement."

On Expense Investments (Woody Lay, KBW): CFO Shamburger noted FTEs are down 6% since December 2023 despite growth, highlighting efficiency gains. The 7% expense increase won't fully hit in Q1: "The $39.5 million that I've forecasted for the first quarter doesn't reflect a full 7%, as these are not all day one increases."

On Fee Income (Brett Rabatin, Hovde): Trust income is the primary driver of the $1.5M fee income budget increase, with the team expanding to North Texas/Fort Worth from its East Texas and Southeast Texas base.

On Securities Portfolio (Brett Rabatin, Hovde): CEO Donoho indicated the restructuring is "in a holding pattern" with rates not currently conducive to additional moves, though they continue to evaluate opportunities daily.

On $10B Threshold (Jordan Ghent, Stephens): Donoho prefers deals below $1.5B in assets but would consider a larger transaction that can "spring us over" $10B in a significant way. Two-step approach: "If we can get one done that gets us close, then that helps us get to the point that we can spring over 10 with a second transaction."

Key Takeaways

-

NIM expansion continues — Tax-equivalent NIM of 2.98% marked the fourth consecutive quarter of improvement, with the Feb 2026 debt redemption providing additional tailwind.

-

Securities pain largely behind — The $82M Q4 restructuring was smaller than Q3's $190M+ transaction, suggesting the heaviest lifting may be complete.

-

Solid loan growth — Loans up 3.4% YoY and 1.1% QoQ, led by construction and commercial real estate.

-

Efficiency improving — Tax-equivalent efficiency ratio of 52.28% was the best quarter of 2025 and improved 172 bps from Q4 2024.

-

Liquidity strong — Available contingent liquidity of $2.78 billion as of year-end.

-

Pipeline rebounding — Loan pipeline recovered from $1.5B mid-quarter dip to over $2B, with management expecting production to exceed 2025 levels.

-

M&A active — Management pursuing opportunistic acquisitions in Dallas, Houston, and Austin while also benefiting from Texas M&A disruption attracting customers and talent.

-

NPA resolution imminent — The $27.5M multifamily NPA that's been on the books since Q1 2025 expected to refinance "within the next two weeks."