Earnings summaries and quarterly performance for SOUTHSIDE BANCSHARES.

Executive leadership at SOUTHSIDE BANCSHARES.

Lee Gibson

Chief Executive Officer

Anne Martinez

Chief Risk Officer

April Pinkley

Chief Accounting Officer

Curtis Burchard

Chief Lending Officer

Jared Green

Regional President, East Texas

Julie Shamburger

Chief Financial Officer

Keith Donahoe

President

Mitchell Craddock

Chief Operations Officer

Sherri Anthony

Chief Banking Officer

Suni Davis

Chief Treasury Officer

T. L. Arnold, Jr.

Chief Credit Officer

Board of directors at SOUTHSIDE BANCSHARES.

Alton Frailey

Director

H. J. Shands, III

Vice Chair

Jeb Jones

Director

John Garrett

Chair of the Board

Kirk Calhoun

Director

Lawrence Anderson

Director

Michael Bosworth

Director

Patricia Callan

Director

Preston Smith

Director

Raymond McKinney

Director

S. Elaine Anderson

Director

Shannon Dacus

Director

Research analysts who have asked questions during SOUTHSIDE BANCSHARES earnings calls.

Michael Rose

Raymond James Financial, Inc.

6 questions for SBSI

Jordan Ghent

Stephens Inc.

5 questions for SBSI

Wood Lay

Keefe, Bruyette & Woods

5 questions for SBSI

Brett Rabatin

Hovde Group, LLC

4 questions for SBSI

Matt Olney

Stephens Inc.

4 questions for SBSI

Anya Pelshaw

Hovde Group

2 questions for SBSI

Timothy Mitchell

Raymond James

2 questions for SBSI

Woody Lay

Keefe, Bruyette & Woods (KBW)

2 questions for SBSI

Recent press releases and 8-K filings for SBSI.

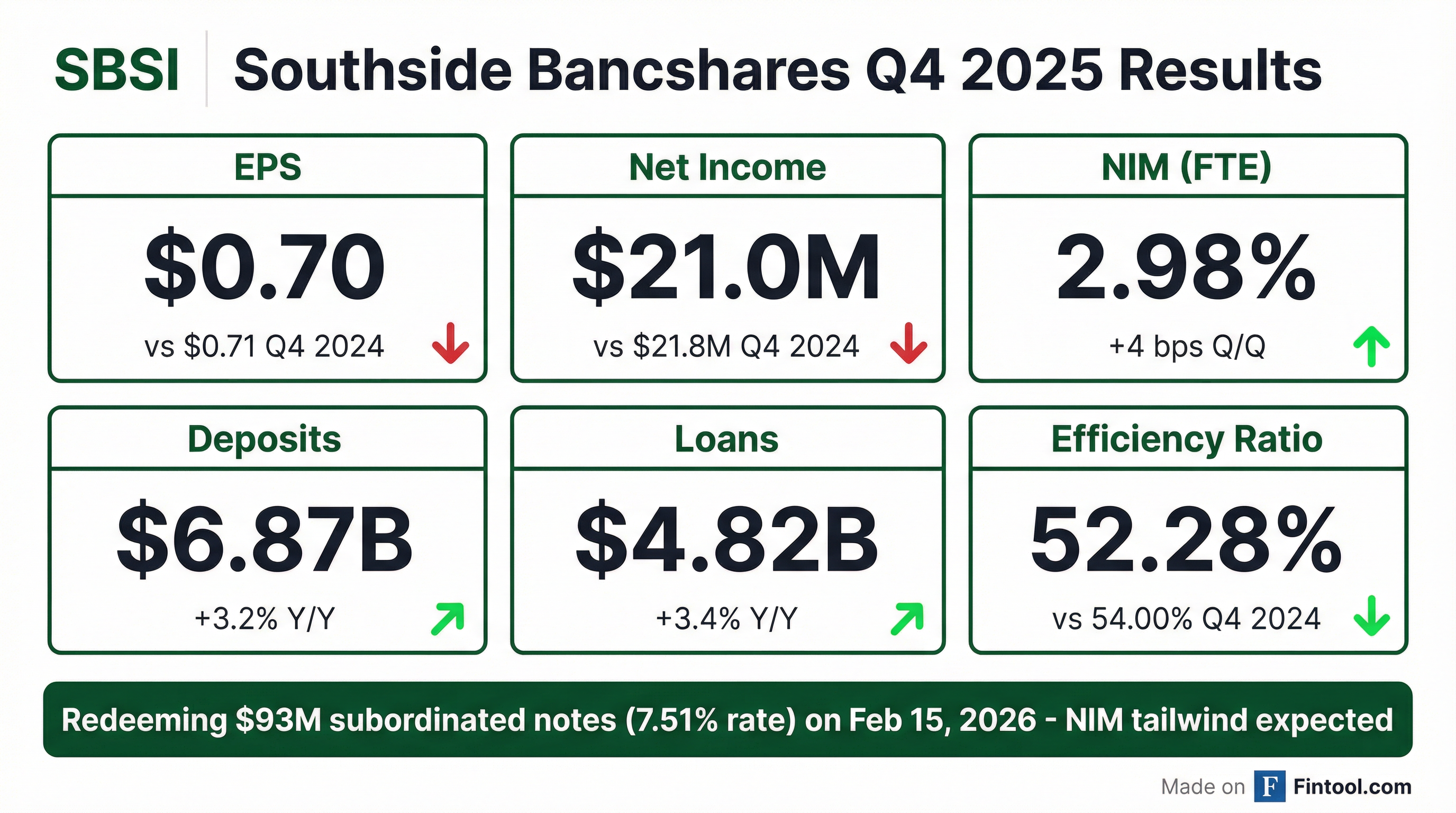

- Southside Bancshares Inc. reported Q4 2025 net income of $21 million and diluted earnings per share of $0.70, a significant increase from the prior quarter, while full-year 2025 net income was $69.2 million and diluted EPS was $2.29, a decrease from 2024 primarily due to AFS securities portfolio restructuring.

- The company continued its securities portfolio restructuring in Q4 2025, selling approximately $82 million of lower-yielding municipal securities at a $7.3 million net loss and reinvesting proceeds into higher-yielding agency MBS, contributing to a net interest margin expansion to 2.98%.

- Loans increased by 1.1% linked-quarter to $4.18 billion as of December 31, 2025, with non-performing assets remaining low at 0.45% of total assets.

- Management anticipates a 7% increase in non-interest expense for 2026, driven by salary and employment benefits, software initiatives (including moving the core system to OutLink and building a data platform), and a one-time $800,000 charge related to subordinated debt redemption.

- The company purchased 369,804 shares at an average price of $28.84 during Q4 2025 and plans to continue opportunistic share buybacks, while also pursuing strategic M&A opportunities, particularly targets below $2 billion or those that could significantly exceed the $10 billion asset threshold.

- Southside Bankshares Inc. reported net income of $21 million and diluted earnings per share of $0.70 for Q4 2025, marking significant linked-quarter increases. The net interest margin expanded to 2.98%.

- The company continued its securities portfolio restructuring, selling approximately $82 million of lower-yielding municipal securities at a $7.3 million net loss and reinvesting in higher-yielding agency MBS to enhance future net interest income.

- SBSI plans to redeem $93 million of subordinated notes on February 15, 2026, anticipating additional net interest margin expansion, with a one-time charge of approximately $800,000 expected in Q1 2026.

- For 2026, the company projects a 7% increase in non-interest expense, primarily due to salary and employment benefits, and software initiatives such as moving its core to OutLink and building a data platform.

- SBSI purchased 369,804 shares of its common stock in Q4 2025 and remains open to strategic M&A opportunities to expand its footprint and potentially cross the $10 billion asset threshold.

- Southside Bankshares Inc. reported net income of $21 million and diluted earnings per share of $0.70 for Q4 2025, with full-year 2025 net income at $69.2 million and diluted EPS at $2.29.

- The company continued its securities portfolio restructuring in Q4 2025, selling approximately $82 million of lower-yielding municipal securities at a $7.3 million net loss and reinvesting proceeds into higher-yielding agency MBS.

- Net interest margin expanded to 2.98% in Q4 2025, and further expansion is anticipated from the redemption of $93 million of subordinated debt on February 15, 2026.

- Loans increased by $52.7 million to $4.18 billion in Q4 2025, and the loan pipeline rebounded to over $2 billion after the year-end.

- For 2026, the company anticipates a 7% increase in non-interest expense over 2025 actuals, including a $800,000 one-time charge for debt redemption, and expects a $1.5 million increase in fee income.

- For the fourth quarter ended December 31, 2025, Southside Bancshares, Inc. reported net income of $21.0 million and earnings per diluted common share of $0.70. For the full year 2025, net income was $69.2 million and earnings per diluted common share were $2.29.

- The tax-equivalent net interest margin for Q4 2025 increased four basis points linked quarter to 2.98% , and for the full year 2025, it increased to 2.93% from 2.88% in 2024.

- Nonperforming assets at December 31, 2025, were $38.2 million, or 0.45% of total assets, a significant increase from $3.6 million, or 0.04% of total assets, at December 31, 2024.

- During Q4 2025, the company repurchased 369,804 shares of common stock at an average price of $28.84 per share. The company also recorded a $7.3 million net loss on the sale of available-for-sale securities in Q4 2025, contributing to a $32.3 million net loss for the full year 2025 from such sales.

- Southside Bancshares, Inc. reported net income of $21.0 million and earnings per diluted common share of $0.70 for the fourth quarter ended December 31, 2025. For the full year 2025, net income was $69.2 million and diluted EPS was $2.29.

- The company's tax-equivalent net interest margin increased four basis points linked quarter to 2.98% for Q4 2025. Southside Bancshares, Inc. plans to redeem $93 million in subordinated notes on February 15, 2026, which is expected to positively impact net interest margin in the first quarter.

- As of December 31, 2025, total assets were $8.51 billion, total loans increased $52.7 million linked quarter to $4.82 billion, and deposits were $6.87 billion.

- Nonperforming assets remained low at 0.45% of total assets, totaling $38.2 million at December 31, 2025.

- During the fourth quarter of 2025, the company repurchased 369,804 shares of its common stock at an average price of $28.84 per share.

- Southside Bancshares Inc. reported net income of $4.9 million and diluted earnings per share of $0.16 for Q3 2025, representing a decrease of 77.5% and $0.56/share respectively, primarily due to a $24.4 million net loss from the repositioning of its available-for-sale securities portfolio.

- The company repositioned its securities portfolio by selling approximately $325 million of lower-yielding, longer-duration securities, booking a $24.4 million net loss with an estimated payback of less than four years, and issued $150 million of 7% subordinated notes in mid-August.

- Loans increased by $163.4 million or 3.5% linked quarter to $4.77 billion as of September 30, 2025, with new loan production totaling approximately $500 million in Q3, and the loan pipeline rebounded to $1.8 billion. Deposits also increased by $329.6 million or 5% linked quarter.

- CEO Lee Gibson announced his retirement at year-end, with President Keith Donahoe succeeding him. Additionally, the board approved an additional 1 million shares for repurchase, bringing the total available to approximately 1.1 million.

- Southside Bancshares Inc. reported Q3 2025 net income of $4.9 million and diluted earnings per share of $0.16, a decrease primarily due to a $24.4 million net loss from the repositioning of its available-for-sale (AFS) securities portfolio.

- The company strategically repositioned its AFS securities portfolio by selling approximately $325 million of lower-yielding securities, with proceeds partially funding loan growth and reinvested in higher-yielding assets, expecting a payback of the loss in less than four years. Additionally, $150 million of 7% fixed to floating rate subordinated notes were issued in mid-August 2025.

- Loans increased by $163.4 million or 3.5% linked quarter to $4.77 billion as of September 30, 2025, driven by approximately $500 million in new loan production during Q3, and the loan pipeline rebounded to $1.8 billion.

- The board approved an additional 1 million shares authorization for repurchase on October 16, 2025, bringing the total available to approximately 1.1 million shares. Furthermore, CEO Lee Gibson announced his retirement at year-end, with President Keith Donahoe assuming the CEO role.

- Southside Bancshares Inc. (SBSI) reported net income of $4,900,000 and diluted earnings per share of $0.16 for Q3 2025, largely impacted by a $24,400,000 net loss from the strategic repositioning of its available-for-sale securities portfolio. This repositioning involved selling approximately $325,000,000 of lower-yielding securities and reinvesting in higher-yielding assets, with an estimated payback of the loss in less than four years.

- Loans increased by $163,400,000 (3.5%) to $4,770,000,000 as of September 30, 2025, with the loan pipeline rebounding to $1,800,000,000. The company also issued $150,000,000 of 7% fixed-to-floating rate subordinated debt in mid-August.

- The company repurchased 26,692 shares of common stock during Q3 2025 at an average price of $30.24, and its Board approved an additional 1,000,000 shares authorization for repurchase on October 16, 2025.

- CEO Lee Gibson announced his retirement at the end of the year, with Keith Donahoe succeeding him.

- Southside Bancshares Inc. reported net income of $4.9 million and diluted earnings per share of $0.16 for Q3 2025, primarily impacted by a $24.4 million net loss from the sale of approximately $325 million in lower-yielding securities.

- The company's loan portfolio increased by $163.4 million (3.5%) linked quarter, reaching $4.77 billion as of September 30, 2025, with a strong loan pipeline of $1.8 billion.

- Deposits grew by $329.6 million (5%) linked quarter, and $150 million of 7% subordinated notes were issued in mid-August 2025.

- Net interest income rose by $1.45 million (2.7%) linked quarter, although the net interest margin slightly decreased to 2.94%. Management anticipates a slight increase in net interest margin for Q4 2025.

- The Board authorized an additional 1 million shares for repurchase on October 16, 2025, and CEO Lee Gibson announced his retirement at year-end, with Keith Donahoe succeeding him.

- Southside Bancshares, Inc. reported net income of $4.9 million and diluted earnings per common share of $0.16 for the three months ended September 30, 2025, a decrease of 76.1% and 76.5%, respectively, compared to the same period in 2024.

- The significant decrease in net income was primarily due to a $24.4 million net loss on the sale of available-for-sale (AFS) securities during the third quarter of 2025.

- Net interest income increased to $55.7 million for the three months ended September 30, 2025, a 0.5% increase compared to the same period in 2024.

- As of September 30, 2025, total loans increased by $163.4 million (3.5%) linked quarter to $4.77 billion, and deposits increased by $329.6 million (5.0%) linked quarter to $6.96 billion.

- During the third quarter ended September 30, 2025, the company repurchased 26,692 shares of common stock at an average price of $30.24 per share and issued $150.0 million of subordinated debt in August.

Quarterly earnings call transcripts for SOUTHSIDE BANCSHARES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more