Earnings summaries and quarterly performance for STAR GROUP.

Research analysts who have asked questions during STAR GROUP earnings calls.

Recent press releases and 8-K filings for SGU.

Star Group Reports Strong Q1 2026 Results Driven by Colder Temperatures and Acquisitions

SGU

Earnings

Revenue Acceleration/Inflection

M&A

- Star Group's Adjusted EBITDA increased by $16.5 million or 32% year-over-year to $68 million for the first quarter of fiscal 2026, with net income rising by $3 million to $36 million.

- This strong performance was primarily driven by temperatures that were 19% colder than the prior year and 6% colder than normal, along with benefits from recent acquisitions.

- Home heating oil and propane volume rose by 14% to approximately 94 million gallons, contributing to a 19% increase in product gross profit to $179 million.

- The company recorded a $5 million charge related to its weather hedge program and experienced an $11 million increase in delivery, branch, and G&A expenses.

- Cold weather conditions have continued into the second quarter, with January finishing 2% colder than last year and 9% colder than normal.

1 day ago

Star Group Reports Strong Q1 2026 Results Driven by Colder Temperatures

SGU

Earnings

Revenue Acceleration/Inflection

M&A

- Star Group (SGU) reported a 32% year-over-year increase in Adjusted EBITDA to $68 million and a $3 million increase in net income to $36 million for the first quarter of fiscal 2026.

- This strong performance was primarily driven by temperatures 19% colder than the prior year and 6% colder than normal, leading to a 14% rise in home heating oil and propane volume to approximately 94 million gallons.

- Product gross profit grew by $29 million or 19% to approximately $179 million, attributed to increased volume and higher per-gallon margins, despite a $5 million charge from weather hedge contracts.

- Management noted that cold weather conditions have continued into the second quarter, with January being 2% colder than last year and 9% colder than normal.

1 day ago

Star Group Reports Strong Q1 2026 Results Driven by Colder Temperatures and Acquisitions

SGU

Earnings

Revenue Acceleration/Inflection

M&A

- Star Group reported a 32% year-over-year increase in adjusted EBITDA to $68 million and a $3 million increase in net income to $36 million for Q1 fiscal 2026.

- Home heating oil and propane volume rose by 14% to approximately 94 million gallons, contributing to a 19% increase in product gross profit to approximately $179 million.

- This strong performance was primarily driven by temperatures 19% colder than the prior year and 6% colder than normal, along with contributions from recent acquisitions, though partially offset by a $5 million charge from the weather hedge program.

- Management noted that colder weather has persisted into January of the second quarter, which was 2% colder than last year and 9% colder than normal.

1 day ago

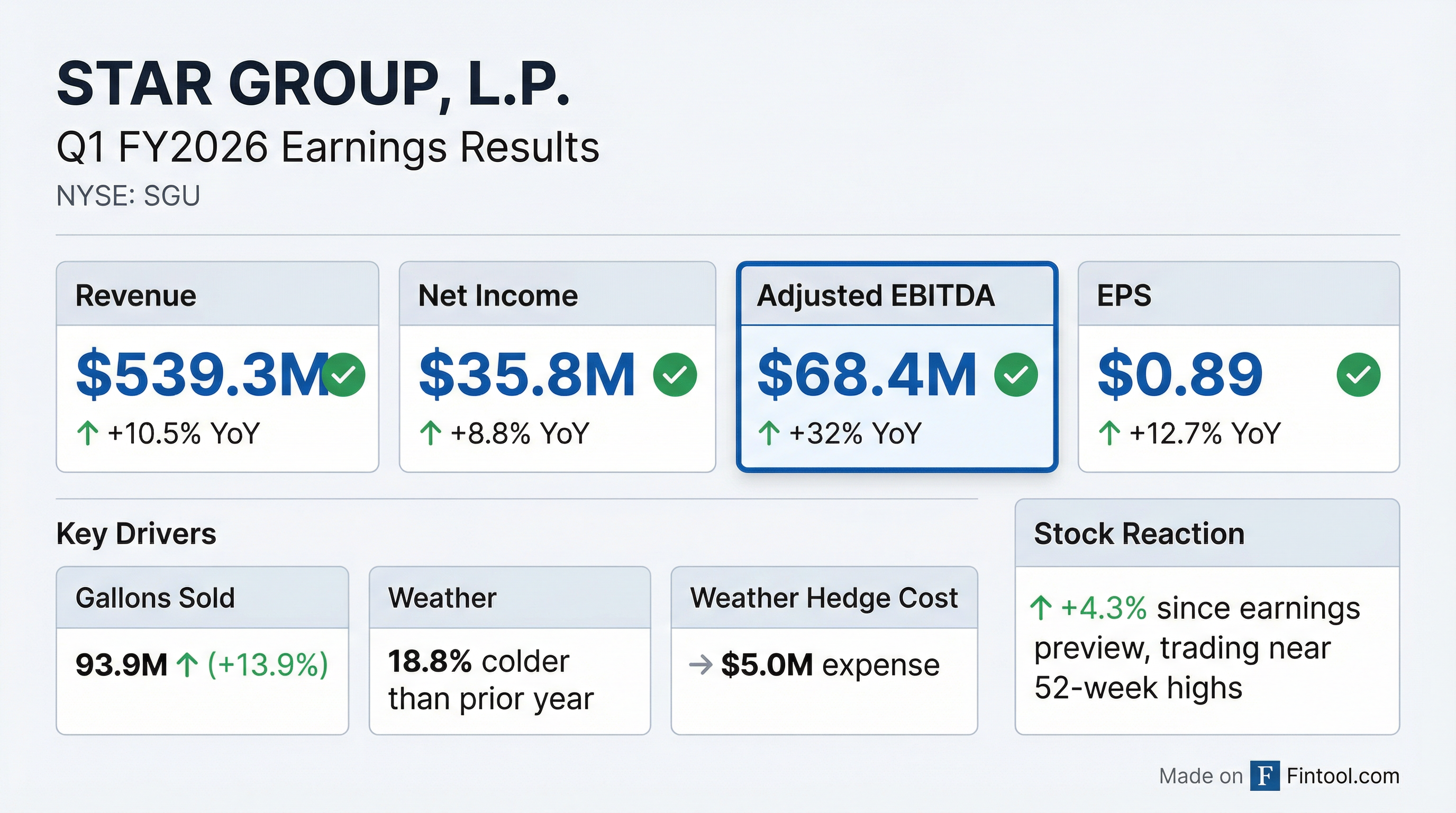

Star Group, L.P. Reports Strong Fiscal 2026 First Quarter Results

SGU

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Star Group, L.P. reported a 10.5% increase in total revenue to $539.3 million for the fiscal 2026 first quarter, ended December 31, 2025, compared to $488.1 million in the prior-year period.

- Net income rose by $2.9 million to $35.8 million in the quarter.

- Adjusted EBITDA increased by 32% year-over-year to $68.4 million in Q1 fiscal 2026, up from $51.9 million in the first quarter of fiscal 2025.

- This performance was primarily driven by 13.9% higher product volumes (93.9 million gallons), recent acquisitions, and 18.8% colder temperatures compared to the prior year, partially offset by a $5.0 million expense from weather hedge contracts.

2 days ago

Star Group, L.P. Reports Strong Fiscal 2026 First Quarter Results

SGU

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Star Group, L.P. reported a 10.5 percent increase in total revenue to $539.3 million for the fiscal 2026 first quarter, compared to the prior-year period.

- Net income for the quarter rose by $2.9 million to $35.8 million, and Adjusted EBITDA increased to $68.4 million from $51.9 million in the first quarter of fiscal 2025.

- The company's performance was driven by a 13.9 percent increase in the volume of home heating oil and propane sold, reaching 93.9 million gallons, benefiting from acquisitions and 18.8 percent colder temperatures compared to the prior year.

2 days ago

Star Group Reports Fiscal 2025 Fourth Quarter and Full Year Results

SGU

Earnings

M&A

Share Buyback

- Star Group (SGU) reported a 12% year-over-year increase in heating oil and propane volume for fiscal year 2025, reaching 283 million gallons, driven by colder temperatures and recent acquisitions.

- For fiscal year 2025, Adjusted EBITDA rose by $24.8 million, or 22.2%, to $136.4 million, and net income was $73.5 million, an increase of $38.2 million from the prior year.

- The company completed four acquisitions in fiscal 2025, adding nearly 12 million gallons of annual volume, and invested $81 million in acquisitions, $16 million in unit repurchases, and paid $26 million in distributions.

- While net customer attrition rose modestly, internal customer satisfaction indicators and loss rates improved, though new customer additions were impacted by a lower level of overall real estate activity.

Dec 9, 2025, 4:00 PM

Star Group Announces Fiscal Year 2025 Results

SGU

Earnings

M&A

Share Buyback

- Star Group reported a 12% year-over-year increase in heating oil and propane volume for fiscal year 2025, reaching 283 million gallons, driven by colder temperatures and recent acquisitions.

- For fiscal year 2025, Adjusted EBITDA rose by $24.8 million, or 22.2%, to $136.4 million, with net income reaching $73.5 million, an increase of $38.2 million over the prior year.

- The company completed four acquisitions in fiscal 2025, adding nearly 12 million gallons of heating oil and propane volume annually, and invested $81 million in acquisitions, $16 million in unit repurchases, and paid $26 million in distributions.

- While net customer attrition modestly increased, the company noted improving loss rates and internal customer satisfaction, with challenges in new customer additions attributed to lower real estate activity and less disruptive weather.

Dec 9, 2025, 4:00 PM

Star Group Reports Strong Fiscal Year 2025 Performance Driven by Volume Growth and Acquisitions

SGU

Earnings

M&A

Share Buyback

- Star Group reported a strong Fiscal Year 2025, with home heating oil and propane volume increasing 12% to 283 million gallons and net income reaching $73.5 million, up $38.2 million year-over-year.

- Adjusted EBITDA for FY 2025 rose by $24.8 million to $136.4 million, with contributions from both base business growth and acquisitions.

- The company invested approximately $81 million in acquisitions and completed four transactions in Fiscal Year 2025, adding nearly 12 million gallons of volume annually, while also repurchasing $16 million in units.

- For Q4 2025, home heating oil and propane volume increased 8% to 20 million gallons, but the company recorded a net loss of $28.7 million and an Adjusted EBITDA loss of $33 million.

- Despite improving customer loss rates, net customer attrition rose modestly in FY 2025, primarily due to lower real estate activity and warmer-than-normal temperatures impacting new customer additions.

Dec 9, 2025, 4:00 PM

Star Group, L.P. Reports Fiscal 2025 Full Year and Fourth Quarter Results

SGU

Earnings

Revenue Acceleration/Inflection

M&A

- Star Group, L.P. reported a modest 1.0% rise in total revenue to $1.8 billion for fiscal year 2025, driven by higher volumes sold and increased sales of installations and services.

- For fiscal year 2025, net income increased by $38.3 million to $73.5 million, primarily due to a favorable change in the fair value of derivative instruments and higher Adjusted EBITDA.

- Adjusted EBITDA for fiscal 2025 increased by 22.2% to $136.4 million, with contributions from both the base business and recent acquisitions.

- In the fourth quarter of fiscal 2025, total revenue increased by 3.1% to $247.7 million, and the net loss declined by $6.4 million to $28.7 million.

Dec 9, 2025, 12:23 AM

Star Group, L.P. Reports Fiscal 2025 Full Year and Fourth Quarter Results

SGU

Earnings

M&A

- For the fiscal year ended September 30, 2025, Star Group, L.P. reported a modest 1.0 percent rise in total revenue to $1.8 billion and a significant increase in net income by $38.3 million to $73.5 million.

- Adjusted EBITDA for fiscal 2025 increased by $24.8 million, or 22.2 percent, to $136.4 million, primarily driven by higher home heating oil and propane per gallon margins, increased volume from acquisitions and colder temperatures, and improved service and installation profitability.

- The volume of home heating oil and propane sold during fiscal 2025 increased by 29.2 million gallons, or 11.5 percent, to 282.6 million gallons, largely due to additional volume from acquisitions and colder temperatures.

- In the fourth quarter of fiscal 2025, total revenue increased 3.1 percent to $247.7 million, and the net loss declined by $6.4 million to $28.7 million.

Dec 9, 2025, 12:22 AM

Quarterly earnings call transcripts for STAR GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more