Earnings summaries and quarterly performance for Silicon Motion Technology.

Research analysts who have asked questions during Silicon Motion Technology earnings calls.

Craig Ellis

B. Riley Securities

6 questions for SIMO

Also covers: ACLS, AKTS, AMKR +17 more

MH

Mehdi Hosseini

Susquehanna Financial Group

6 questions for SIMO

Also covers: AEIS, ALAB, AMAT +21 more

Matthew Bryson

Wedbush Securities Inc.

5 questions for SIMO

Also covers: AXTI, DBD, TSEM +1 more

GH

Gokul Hariharan

JPMorgan Chase & Co

4 questions for SIMO

Also covers: 3711.TW, ASX, GDS +2 more

SD

Suji Desilva

ROTH MKM

4 questions for SIMO

Also covers: ACMR, AEVA, AKTS +18 more

Neil Young

Needham & Company

2 questions for SIMO

Also covers: MRAM, MTSI, SKYT +2 more

ND

Nick Doyle

Needham & Company

2 questions for SIMO

Also covers: CRNC, MBLY, MTSI +5 more

SD

Sujeeva De Silva

Roth MKM

2 questions for SIMO

Also covers: ACMR, AEVA, ALAB +16 more

ND

Nicolas Doyle

Needham & Company, LLC

1 question for SIMO

Also covers: CRNC, LSCC, MX +9 more

Recent press releases and 8-K filings for SIMO.

Silicon Motion Reports Strong Q4 2025 Results, Projects Record 2026 Revenue

SIMO

Earnings

Guidance Update

New Projects/Investments

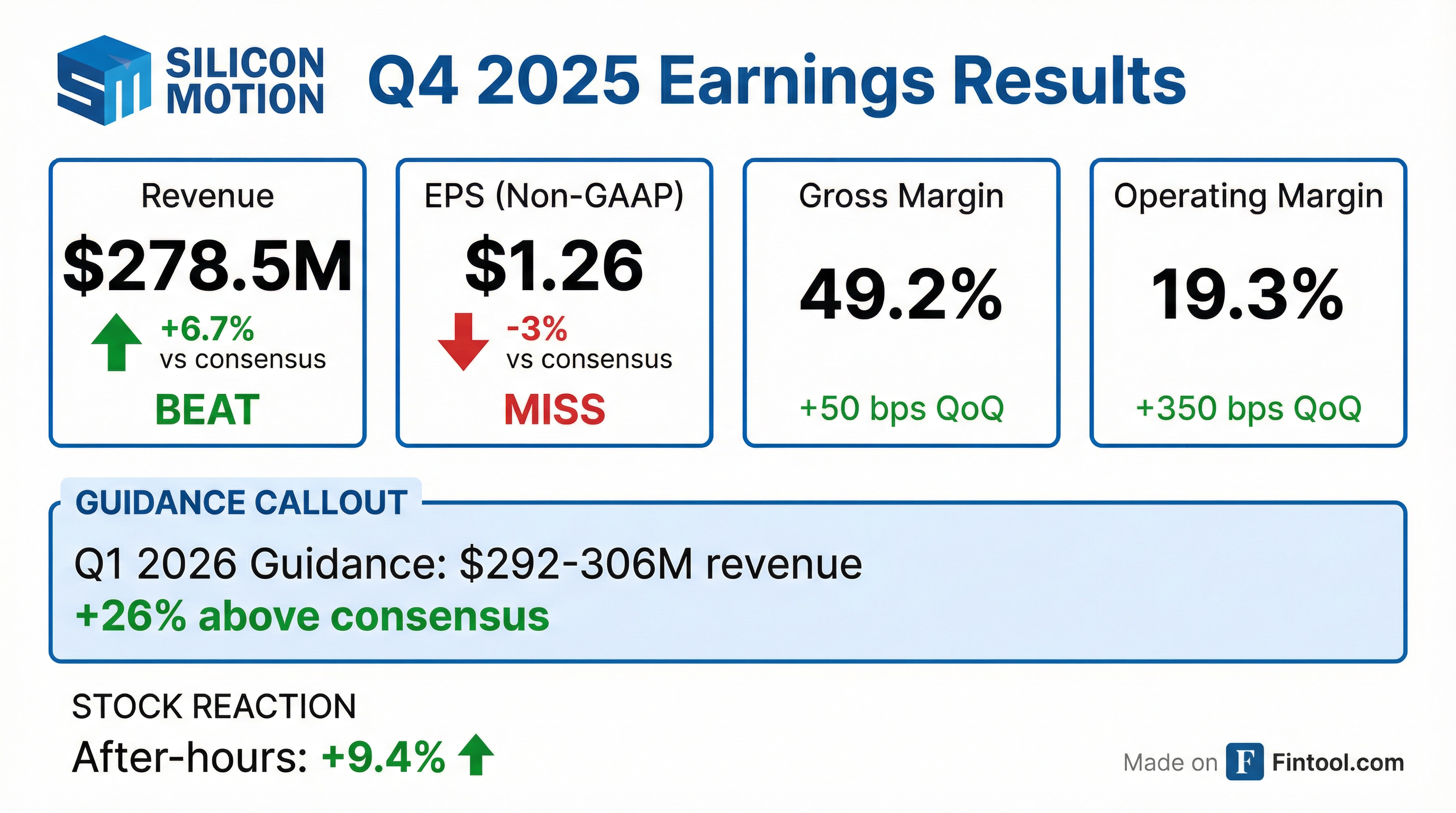

- Silicon Motion reported Q4 2025 revenue of $278.5 million, an increase of 15% sequentially and over 45% year-on-year, exceeding the high end of their guidance, with a gross margin of 49.2% and EPS of $1.26.

- For Q1 2026, revenue is expected to grow 5%-10% sequentially to $292 million-$306 million. The company anticipates 2026 to be a record revenue year with sequential revenue growth each quarter and improved operating margins compared to 2025.

- Despite challenging memory and storage industry dynamics due to NAND and DRAM supply tightness and increasing prices, Silicon Motion expects growth across all major product lines in 2026, including mobile, PC, enterprise SSD, and boot drive solutions. The eMMC and UFS business grew 25% for the full year 2025.

- The company is seeing strong momentum from new product introductions, including PCIe 5 controllers for client SSDs and the ramp-up of MonTitan enterprise SSD controllers and enterprise boot drive solutions, with MonTitan projected to represent 5%-10% of revenue exiting 2026.

Feb 4, 2026, 1:00 PM

Silicon Motion Technology Reports Strong Q4 2025 Results and Projects Record Revenue in 2026

SIMO

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Silicon Motion Technology (SIMO) reported strong Q4 2025 sales of $278.5 million, exceeding guidance, with a gross margin of 49.2% and earnings per ADS of $1.26.

- For Q1 2026, revenue is projected to grow 5%-10% sequentially to $292 million-$306 million, though gross margins are expected to be slightly lower at 46%-47% due to product mix.

- The company anticipates 2026 to be a record revenue year with sequential growth each quarter and improved operating margins compared to 2025, despite higher investments.

- Despite NAND and DRAM supply tightness and increasing prices, SIMO expects growth across all major product lines in 2026, including mobile, PC, enterprise SSD, and boot drive solutions, leveraging strong flash vendor partnerships.

- Growth will be driven by continued strong performance in eMMC and UFS business, market share gains in client SSDs with new PCIe 5 controllers, and the commercial ramp of MonTitan enterprise SSDs in the second half of 2026.

Feb 4, 2026, 1:00 PM

Silicon Motion Reports Q4 and Full Year 2025 Financial Results

SIMO

Earnings

Guidance Update

Dividends

- Silicon Motion reported Non-GAAP revenue of $278.5 million for Q4 2025, marking a 15% increase quarter-over-quarter and 46% year-over-year, with diluted EPS of $1.26.

- For the full year 2025, the company achieved Non-GAAP revenue of $885.6 million, an increase of 10% year-over-year, and diluted EPS of $3.55.

- The company provided Q1 2026 guidance, projecting revenue between $292 million and $306 million, which would represent a 5% to 10% sequential increase.

- Silicon Motion announced an annual cash dividend of $2.00 per American Depositary Share for FY 2025.

- In Q4 2025, SSD controller sales increased 25% to 30% quarter-over-quarter, and the company launched new high-performance PCIe 5.0 SSD controllers.

Feb 4, 2026, 1:00 PM

Silicon Motion Technology reports Q4 2025 results and provides 2026 outlook

SIMO

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Silicon Motion Technology reported Q4 2025 revenue of $278.5 million, a 15% sequential increase and over 45% year-on-year, with a gross margin of 49.2% and earnings per ADS of $1.26.

- For Q1 2026, the company expects revenue between $292 million and $306 million (5%-10% sequential growth), with gross margins of 46%-47% and operating margins of 16%-18%.

- The company anticipates record revenue in 2026 with sequential growth each quarter, driven by strong performance in mobile (eMMC/UFS), client SSDs, and scaling enterprise solutions like MonTitan and boot drives, despite industry-wide NAND and DRAM supply constraints.

- The eMMC and UFS business grew 25% in 2025 and is expected to continue strong growth in 2026, while the enterprise boot drive business is projected to generate approximately $50 million in revenue in 2026.

Feb 4, 2026, 1:00 PM

Silicon Motion Confirms Quarterly Dividend Payment

SIMO

Dividends

- Silicon Motion Technology Corporation confirmed its quarterly cash dividend on February 2, 2026.

- On October 27, 2025, the Board of Directors declared an annual dividend of US$2.00 per ADS, equivalent to US$0.50 per ordinary share, to be paid in four quarterly installments.

- The next quarterly installment of $0.50 per ADS (equivalent to US$0.125 per ordinary share) is scheduled for payment on February 26, 2026, to shareholders of record on February 11, 2026.

Feb 2, 2026, 9:10 PM

Silicon Motion Discusses Market Expansion, Share Gains, and MaxLinear Arbitration

SIMO

New Projects/Investments

Revenue Acceleration/Inflection

Legal Proceedings

- Silicon Motion (SIMO) is guiding to a $1 billion annual revenue run rate for the fourth quarter and is expanding its market presence in automotive, enterprise, industrial, and commercial sectors, including AI-related opportunities.

- The company expects to increase its client SSD market share from 30% to 40% with the ramp of PCIe 5 controllers and its eMMC and UFS market share to over 30%. This growth is partly driven by NAND makers increasingly outsourcing controller development to SIMO.

- SIMO's MonTitan platform for enterprise SSDs, utilizing QLC NAND for AI inference and training, is projected to contribute 5%-10% of total revenue by late 2026 or late 2027. The company also plans a PCIe 6 controller tapeout at 4nm for its enterprise business in 2026.

- Silicon Motion is involved in arbitration regarding the MaxLinear merger termination, seeking the $160 million termination fee plus significant damages, with a decision expected in the second half of 2026.

Jan 13, 2026, 1:00 PM

Silicon Motion Discusses Market Leadership, New Opportunities, and Legal Proceedings

SIMO

New Projects/Investments

Legal Proceedings

Revenue Acceleration/Inflection

- Silicon Motion (SIMO) is the global leader in supplying NAND flash controllers, expanding its footprint into new opportunities such as enterprise, automotive, industrial, commercial, and AI-related applications.

- The company anticipates significant new revenue opportunities from its win with NVIDIA's BlueField 3 DPU, with further scaling expected in BlueField 4 and other switch products, leading to higher volumes and ASPs.

- SIMO's MonTitan platform for enterprise SSDs, leveraging its expertise in QLC NAND, is expected to contribute 5%-10% of total revenue by late 2026 or late 2027.

- NAND makers are increasingly outsourcing controller development to Silicon Motion, allowing SIMO to gain share across multiple products, including an expected increase in PC SSD market share from 30% to 40% with the ramp of PCIe 5 controllers.

- The arbitration process regarding the MaxLinear merger termination is ongoing, with closing arguments scheduled for March and a decision expected in the second half of 2026.

Jan 13, 2026, 1:00 PM

Silicon Motion Discusses Strategic Growth, New Product Investments, and Legal Proceedings

SIMO

New Projects/Investments

Legal Proceedings

Guidance Update

- Silicon Motion is expanding into new opportunities in automotive, enterprise, and industrial, and anticipates scaling beyond a $1 billion annual revenue run rate.

- The company expects to increase its market share in PC SSDs from 30% to 40% and in the eMMC and UFS controller market from 20%-25% to over 30% over the next few years.

- Silicon Motion is making significant investments in new products, including the MonTitan platform for enterprise SSDs, which is targeted to contribute 5%-10% of total revenue by late 2026 or late 2027, and plans to tape out a PCIe 6 controller at 4 nm in 2026.

- The company is involved in an arbitration process regarding the MaxLinear merger termination, seeking $160 million plus fees, interest, and significant damages, with a decision expected in the second half of 2026.

- Silicon Motion aims for long-term operating margins greater than 25%, up from a fourth-quarter guidance of 19%-20%.

Jan 13, 2026, 1:00 PM

Silicon Motion Nears $1 Billion Revenue Run Rate, Details Growth Drivers and NAND Shortage Impact

SIMO

Revenue Acceleration/Inflection

New Projects/Investments

Guidance Update

- Silicon Motion is approaching a $1 billion revenue run rate, driven by its core Client SSD (50%-60% of revenue) and Mobile Controller (30%-40% of revenue) businesses, alongside rapidly growing Ferri Automotive (projected 10% of revenue by 2026) and Enterprise MonTitan (projected 5%-10% of revenue by 2026-2027) segments.

- The company anticipates significant growth from its Enterprise MonTitan PCIe Gen 5 controllers, which are ramping from 2026, and the emerging boot drive business with NVIDIA, offering ASPs scaling up to north of $100 for high-density drives. Gen 6 silicon for enterprise is expected in H2 2026.

- Management forecasts the global NAND supply shortage to continue for at least two years (2026-2027), but Silicon Motion expects minimal impact due to its strong OEM and NAND maker relationships, with over 50% of its business tied to NAND maker projects.

- Silicon Motion aims for long-term operating margins of 25%+ while maintaining gross margins at 48%-50%. The company's capital allocation prioritizes dividends (currently $2 per share), share buybacks, and strategic acquisitions.

Dec 3, 2025, 10:35 PM

Silicon Motion Highlights Growth Drivers and Market Share Gains at UBS Conference

SIMO

Revenue Acceleration/Inflection

New Projects/Investments

Guidance Update

- Silicon Motion is approaching a $1 billion revenue run rate, with Client SSDs contributing 50%-60% of total revenue, mobile controllers 30%-40%, Ferri Automotive projected to reach 10% of revenue by 2026, and Enterprise MonTitan 5%-10% of total revenue by 2026-2027.

- The company's Enterprise MonTitan product line, featuring PCIe Gen5 controllers, has secured two tier-one customer design wins expected to ramp from 2026, with a total of six customers. Additionally, boot drive solutions for NVIDIA's BlueField-3 and BlueField-4 are ramping up, with ASPs potentially scaling to over $100 for higher densities, contributing significant revenue upside.

- CEO Wallace Kou expects the NAND supply shortage to persist for at least two years (2026-2027) due to high demand, but Silicon Motion's business is largely insulated as over 50% is related to NAND maker projects and 70% to OEMs.

- Silicon Motion anticipates its Client SSD market share for PCIe Gen 5 to reach 50% or higher, an increase from its current 30% for Gen 4, driven by multiple design wins.

- CFO Jason Tsai noted that gross margins are within the historical 48%-50% range, and operating margins are currently 19%-20%, with a long-term target of 25%+. The company's capital allocation strategy includes dividends, share buybacks, and strategic acquisitions.

Dec 3, 2025, 10:35 PM

Quarterly earnings call transcripts for Silicon Motion Technology.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more