Earnings summaries and quarterly performance for SILICON LABORATORIES.

Executive leadership at SILICON LABORATORIES.

Board of directors at SILICON LABORATORIES.

Research analysts who have asked questions during SILICON LABORATORIES earnings calls.

Cody Grant Acree

The Benchmark Company

4 questions for SLAB

Christopher Rolland

Susquehanna Financial Group

3 questions for SLAB

Peter Peng

Evercore ISI

3 questions for SLAB

Quinn Bolton

Needham & Company, LLC

3 questions for SLAB

Thomas O’Malley

Barclays Capital

3 questions for SLAB

Tore Svanberg

Stifel Financial Corp.

3 questions for SLAB

Srinivas Pajjuri

Raymond James & Associates, Inc.

2 questions for SLAB

Joseph Moore

Morgan Stanley

1 question for SLAB

Nicolas Doyle

Needham & Company, LLC

1 question for SLAB

Recent press releases and 8-K filings for SLAB.

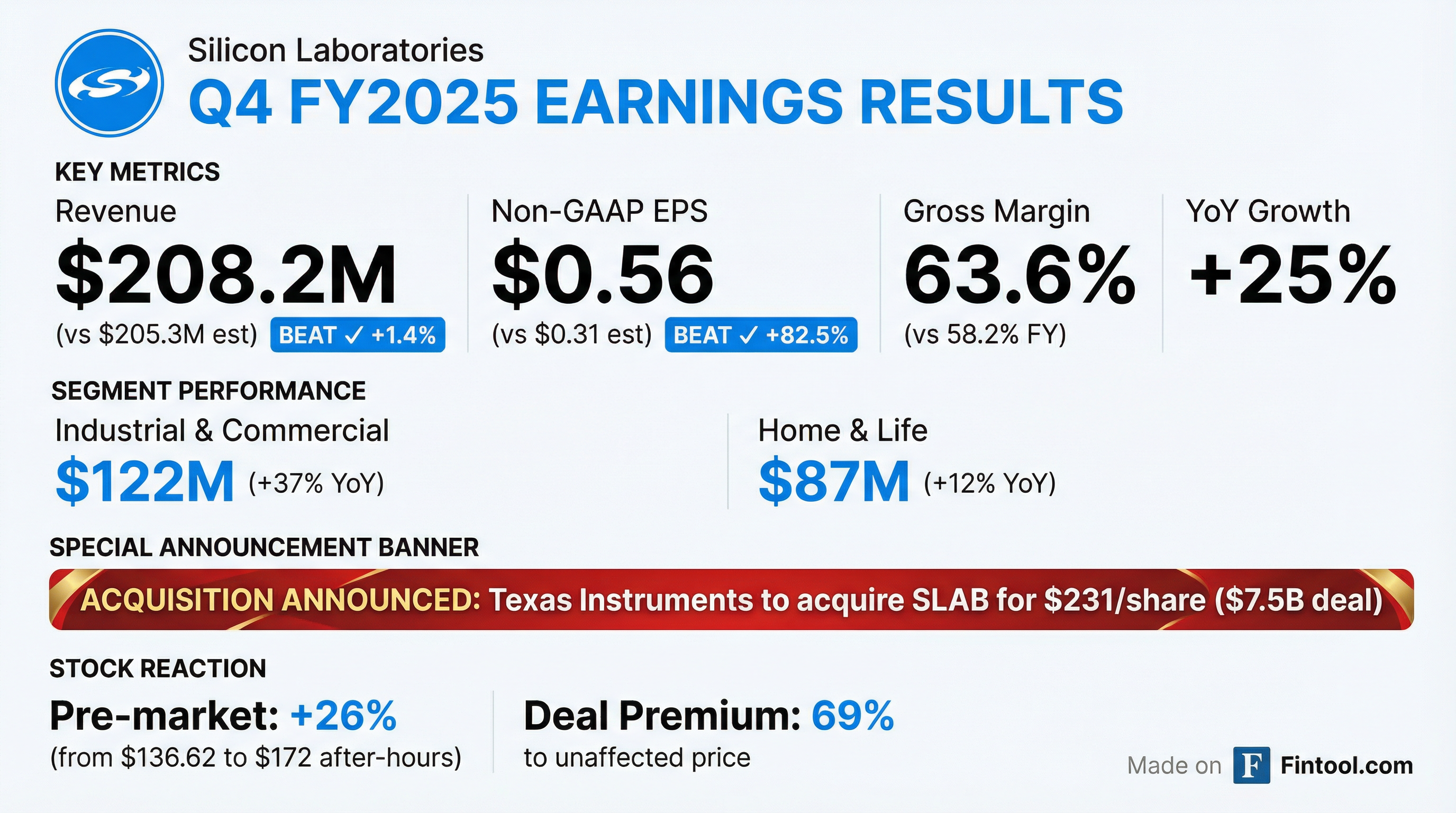

- Silicon Labs reported full year 2025 revenue of $785 million, a 34% increase year-over-year, with non-GAAP diluted earnings per share of $0.92.

- For the fourth quarter of 2025, revenue was $208 million, up 25% year-over-year, and non-GAAP diluted earnings per share was $0.56.

- Due to a separately announced pending acquisition by Texas Instruments, Silicon Labs has cancelled its scheduled earnings call and suspended providing forward-looking guidance.

- Texas Instruments (TXN) has signed a definitive agreement to acquire Silicon Labs (SLAB) for $231.00 per share in an all-cash transaction, representing a total enterprise value of approximately $7.5 billion.

- The Agreement and Plan of Merger was entered into on February 4, 2026, with the transaction expected to close in the first half of 2027, pending regulatory and Silicon Labs stockholder approvals.

- The acquisition is anticipated to generate approximately $450 million in annual manufacturing and operational synergies within three years post-close.

- Silicon Labs achieved full year 2025 revenue of $785 million, an increase of 34% year-over-year, with non-GAAP diluted earnings per share of $0.92.

- In the fourth quarter of 2025, revenue grew 25% year-over-year to $208 million, and non-GAAP diluted earnings per share were $0.56.

- Due to a separately announced pending acquisition by Texas Instruments, Silicon Labs has canceled its earnings call and suspended providing forward-looking guidance.

- Texas Instruments is reportedly in advanced talks to acquire Silicon Laboratories for approximately $7 billion.

- Following the news, Silicon Labs shares surged roughly 28–32% in after-hours trading, while Texas Instruments' stock dipped about 1%.

- The potential acquisition would integrate Silicon Labs' strength in wireless chips and IoT connectivity to expand TI’s capabilities in these markets.

- This potential deal is part of a broader trend of semiconductor industry consolidation but faces risks including the possibility of talks collapsing and potential regulatory review.

- Silicon Labs is strategically focused on AI at the edge, anticipating a multi-year growth journey beyond data centers, and is not primarily focused on data centers.

- The company's next-generation Series 3 devices are designed for edge AI, featuring up to 100 times the processing capability of Series 2 and advanced security, with the first device already shipping in high volume and expected to command higher Average Selling Prices (ASPs).

- Significant growth drivers include Continuous Glucose Monitors (CGM), projected to reach 10% of revenue in 2025 from near zero in 2024, and Electronic Shelf Labels (ESL), where the company's solutions offer seven-year battery life on a coin cell battery.

- Smart metering also represents a major growth opportunity, notably a 250 million unit deployment in India that commenced in mid-2024 and is still ramping up.

- Silicon Labs targets long-term gross margins of 56%-58%, with recent performance in the high 50s to low 60s due to its industrial focus, and aims to sustain a 20% compounding annual growth rate, building on its historical 15%-18%.

- Silicon Labs is focused on the "far edge physical AI" opportunity, with its new Series 3 devices designed to support this trend by offering up to 100x the processing capability of Series 2 and enhanced security features. The first Series 3 device began shipping in high volume in Q1 or Q2 2025.

- The company anticipates significant growth from Continuous Glucose Monitors (CGM), projecting this application to contribute 10% of total revenue "pretty soon over the next couple of quarters" (from a near-zero base in 2024), and reported that its medical segment grew 60% year-on-year in 2025.

- Growth in the Industrial & Commercial segment is driven by the broad deployment of Electronic Shelf Labels (ESL) and smart metering, including a 250 million unit deployment in India that started in mid-2024 and is still ramping.

- Silicon Labs maintains a long-term gross margin target of 56%-58%, with expectations for 2025 and 2026 to be in the high 50s to low 60s, attributed to its industrial-focused business model.

- Management believes the company can sustain a 20% compounding annual growth rate, building on its historical 15%-18% over the past 10-15 years, and expects to deploy excess cash flow primarily through share buybacks.

- Silicon Labs is focused on edge AI, with its new Series 3 devices offering up to 100 times the processing capability of Series 2 and expected to bring higher Average Selling Prices (ASPs). The first Series 3 device is already shipping in high volume.

- The Home and Life segment is experiencing rapid growth, particularly from Continuous Glucose Monitors (CGM), which are projected to contribute approximately 10% of revenue over the next couple of quarters, up from approximately zero in 2024. Medical revenue grew 60% year-on-year in 2025.

- Significant growth opportunities exist in the Industrial and Commercial segment through Electronic Shelf Labels (ESL) and Smart Metering. ESL deployments are expanding with retailers, and smart metering is seeing a worldwide push, notably with a 250 million unit deployment in India that began in mid-2024 and is still ramping up.

- The company maintains a strong financial profile with long-term gross margin targets of 56%-58%, with near-term expectations for 2025 and 2026 in the high 50s to low 60s, driven by its industrial focus and distribution channel performance.

- Silicon Labs has a history of 15%-18% compounding annual growth rate over the past 10-15 years and aims to sustain 20% growth, anchored by the increasing demand for connected devices requiring wireless radios and MCUs.

- Silicon Labs reported Q3 2025 revenue of $206 million, a 24% increase year-over-year, with a non-GAAP gross margin of 58% and non-GAAP EPS of $0.32.

- For Q4 2025, the company anticipates revenue between $200 million and $215 million and non-GAAP EPS of $0.40 to $0.70. Non-GAAP gross margin is projected at 62% to 64%, including a 200 basis point one-time benefit.

- Full-year 2025 revenue growth is expected to be 34% compared to 2024.

- Key growth drivers include strong performance in industrial and commercial segments, smart metering, and medical applications, with Continuous Glucose Monitors (CGM) projected to reach 10% of revenue by the first half of 2026. Asset tracking is also identified as a significant future growth opportunity.

- Operational developments include an expanded partnership with GlobalFoundries for U.S. manufacturing of Series 2 wireless SoCs and the launch of new AI-powered development tools, Studio 6 and Simplicity AI SDK, to streamline IoT development. Customer inventory levels are now at their lowest point since tracking began.

- Silicon Labs reported Q3 2025 revenue of $206 million, an increase from $193 million in Q2 2025.

- For Q3 2025, Non-GAAP gross margin improved to 58.0% from 56.3% in Q2 2025, and Non-GAAP earnings per share increased to $0.32 from $0.11 in Q2 2025.

- The company provided a Q4 2025 outlook with revenue projected between $200-$215 million and Non-GAAP earnings per share between $0.40-$0.70.

- As of Q3 2025, Silicon Labs reported $439 million in Cash, Cash Equivalents & Short-Term Investments and no total debt.

- The company forecasts 15-25% revenue growth, driven by a 10-15% CAGR in the IoT market and an additional 5-10% incremental CAGR specific to Silicon Labs.

- Silicon Labs reported revenue of $206 million for the third quarter ended October 4, 2025, reflecting sequential and year-over-year growth.

- For Q3 2026, the company achieved non-GAAP diluted earnings per share of $0.32.

- Silicon Labs expects fourth-quarter revenue (Q4 2026) to be between $200 million to $215 million, with non-GAAP diluted earnings per share projected between $0.40 to $0.70.

- The company announced an expanded strategic partnership with Global Foundries (GF) to advance energy-efficient wireless technologies and scale U.S.-based semiconductor manufacturing.

Quarterly earnings call transcripts for SILICON LABORATORIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more