Earnings summaries and quarterly performance for SLR Investment.

Executive leadership at SLR Investment.

Board of directors at SLR Investment.

Research analysts who have asked questions during SLR Investment earnings calls.

Erik Zwick

Lucid Capital Markets

5 questions for SLRC

Melissa Wedel

JPMorgan Chase & Co.

4 questions for SLRC

Helly Sheff

Raymond James

2 questions for SLRC

Rick Shane

JPMorgan Chase & Co.

2 questions for SLRC

Bryce Rowe

B. Riley Securities

1 question for SLRC

Casey Alexander

Compass Point Research & Trading, LLC

1 question for SLRC

Heli Sheth

Raymond James

1 question for SLRC

Paul Johnson

Keefe, Bruyette & Woods

1 question for SLRC

Sean-Paul Adams

Not Provided in Transcript

1 question for SLRC

Recent press releases and 8-K filings for SLRC.

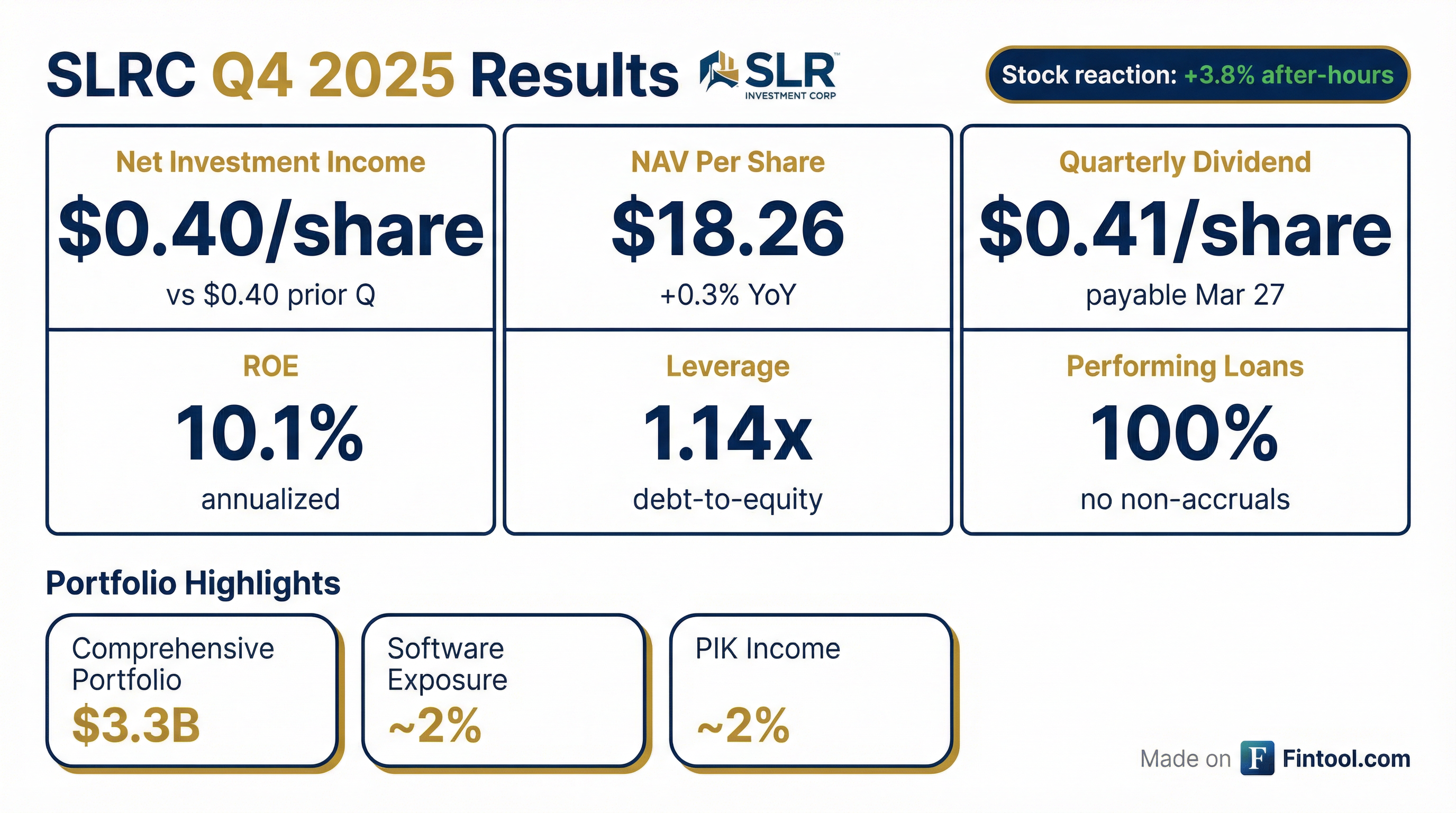

- SLR Investment Corp. (SLRC) reported net investment income of $0.40 per share and net income of $0.46 per share for Q4 2025. For the full year 2025, net income was $1.70 per share, representing a 9.3% return on average equity. The net asset value per share stood at $18.26 as of December 31, 2025.

- The comprehensive investment portfolio grew to $3.3 billion at year-end 2025, with $1.84 billion in originations for the full year. This growth was primarily driven by commercial finance strategies, particularly asset-based lending.

- The portfolio continues its strategic shift, with 95% in first lien senior secured loans and 100% performing with zero non-accruals as of December 31, 2025. Software industry exposure remains low at approximately 2%.

- SLRC declared a Q1 2026 quarterly base distribution of $0.41 per share. The company ended 2025 with a net debt-to-equity ratio of 1.14 times and over $850 million of available capital, with management indicating a willingness to increase leverage up to 1.25x in 2026 for attractive opportunities.

- SLR Investment Corp. (SLRC) reported Net Investment Income of $0.40 per share and Net Income of $0.46 per share for Q4 2025, with a Net Asset Value per share of $18.26 as of December 31, 2025. For the full year 2025, net income was $1.70 per share, representing a 9.3% return on average equity.

- The company originated $462 million in new investments during Q4 2025, leading to a year-end comprehensive portfolio of $3.3 billion and 7.2% annual growth. Full year originations totaled $1.84 billion.

- SLRC continued its strategic shift, with over 83% of its portfolio in senior secured, specialty finance loans as of December 31, 2025, and a low 2% exposure to the software industry. The portfolio is 100% performing with no non-accruals.

- The weighted average yield on the portfolio was 11.6% at year-end, down from 12.2% in Q3, primarily due to a decline in base rates. The board declared a Q1 2026 quarterly base distribution of $0.41 per share.

- SLRC reported net investment income of $0.40 per share and net income of $0.46 per share for the fourth quarter of 2025, with net assets of value per share at $18.26 as of December 31, 2025.

- For the full year 2025, the company generated net income of $1.70 per share, representing a 9.3% return on average equity, and achieved 7.2% annual growth in its comprehensive portfolio, reaching $3.3 billion.

- The company continued its strategic shift towards asset-based lending, with over 83% of portfolio investments in senior secured, specialty finance loans as of December 31, 2025, and a direct industry exposure to software of approximately 2%.

- The board declared a Q1 2026 quarterly base distribution of $0.41 per share, payable on March 27, 2026.

- SLR Investment Corp. reported Net Investment Income of $0.40 per share for the fourth quarter of 2025 and $1.59 per share for the full year 2025.

- As of December 31, 2025, the Net Asset Value (NAV) was $18.26 per share, showing a modest increase from the prior quarter and prior year.

- The company declared a quarterly distribution of $0.41 per share on February 24, 2026, payable on March 27, 2026.

- The Comprehensive Investment Portfolio demonstrated strong credit quality, with 100% performing investments and no non-accruals as of December 31, 2025.

- Comprehensive Investment Portfolio originations totaled $461.8 million for Q4 2025 and $1,837.2 million for the full year 2025.

- SLR Investment Corp. reported net investment income of $0.40 per share for Q4 2025 and $1.59 per share for the full year ended December 31, 2025.

- The company's Net Asset Value (NAV) was $18.26 per share as of December 31, 2025, an increase from $18.20 per share a year ago.

- A quarterly distribution of $0.41 per share was declared on February 24, 2026, payable on March 27, 2026.

- As of December 31, 2025, the net debt-to-equity ratio was 1.14x, within the target range of 0.9x to 1.25x, and 100% of the portfolio was performing with no investments on non-accrual.

- The Comprehensive Investment Portfolio, valued at $3.3 billion as of December 31, 2025, was 97.8% invested in senior secured loans, with 94.8% being first lien senior secured loans.

- SLR Investment Corp. reported net investment income of $0.40 per share and net income of $0.43 per share for Q3 2025.

- Net asset value per share increased slightly to $18.21 as of September 30, 2025, from $18.19 per share at June 30.

- The company originated $447 million in new investments during Q3 2025, representing a 12.7% increase in year-over-year new originations.

- As of September 30, 83% of the loan portfolio consists of specialty finance investments, with 94.8% of the comprehensive investment portfolio comprised of first lien senior secured loans.

- SLRC issued $125 million in unsecured notes during Q3 2025 and had approximately $1.1 billion of debt outstanding with a net debt-to-equity ratio of 1.13 times at September 30, 2025.

- SLR Investment Corp. reported Net Investment Income of $21.6 million, or $0.40 per share, for the third quarter of 2025.

- The company's Net Asset Value (NAV) increased to $18.21 per share as of September 30, 2025, up from $18.19 per share at June 30, 2025.

- The Board declared a quarterly distribution of $0.41 per share payable on December 26, 2025.

- The Comprehensive Investment Portfolio recorded originations of $447.0 million and repayments of $418.9 million during the quarter ended September 30, 2025. As of September 30, 2025, 98.2% of the portfolio was invested in senior secured loans, with non-accruals at 0.3% of fair value, and a net debt-to-equity ratio of 1.13x.

- SLR Capital Partners announced on October 14, 2025, that Mac Fowle has joined the firm as President of Asset-Based Lending (ABL), a newly created role.

- Fowle, who brings over 20 years of experience in the ABL industry and previously served as Global Head of Asset-Based Lending for J.P. Morgan Commercial Banking, will lead the expansion of SLR's ABL platform.

- This appointment is considered a significant milestone in SLR's growth trajectory, aimed at accelerating the firm's Specialty Finance platform and expanding its offerings to borrowers and sponsors.

Quarterly earnings call transcripts for SLR Investment.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more