Earnings summaries and quarterly performance for SoFi Technologies.

Executive leadership at SoFi Technologies.

Anthony Noto

Chief Executive Officer

Arun Pinto

Chief Risk Officer

Christopher Lapointe

Chief Financial Officer

Eric Schuppenhauer

Executive Vice President, Group Business Unit Leader, Borrow

Jeremy Rishel

Chief Technology Officer

Kelli Keough

Executive Vice President, Group Business Unit Leader, Spend Invest Protect and Save

Stephen Simcock

General Counsel

Board of directors at SoFi Technologies.

Clara Liang

Director

Dana Green

Director

Gary Meltzer

Director

John Hele

Director

Magdalena Yeşil

Director

Ruzwana Bashir

Director

Steven Freiberg

Vice Chairman of the Board

Tom Hutton

Chairman of the Board

William Borden

Director

Research analysts who have asked questions during SoFi Technologies earnings calls.

Dan Dolev

Mizuho Financial Group

7 questions for SOFI

Kyle Peterson

Needham & Company

7 questions for SOFI

Andrew Jeffrey

William Blair & Company

6 questions for SOFI

Peter Christiansen

Citigroup Inc.

5 questions for SOFI

John Hecht

Jefferies

4 questions for SOFI

Kyle Joseph

Jefferies

4 questions for SOFI

Moshe Orenbuch

TD Cowen

4 questions for SOFI

Reggie Smith

JPMorgan Chase & Co.

4 questions for SOFI

Devin Ryan

Citizens JMP

3 questions for SOFI

Jeffrey Adelson

Morgan Stanley

3 questions for SOFI

Terry Ma

Barclays

3 questions for SOFI

John Heck

Jefferies

2 questions for SOFI

Mihir Bhatia

Bank of America

2 questions for SOFI

Reginald Smith

JPMorgan Chase & Co.

2 questions for SOFI

Jill Glaser Shea

UBS

1 question for SOFI

Jill Shea

UBS Group

1 question for SOFI

Noah Katz

JPMorgan Chase & Co.

1 question for SOFI

William Nance

The Goldman Sachs Group, Inc.

1 question for SOFI

Recent press releases and 8-K filings for SOFI.

- SoFi announced monthly distributions for its SoFi Enhanced Yield ETF (THTA).

- The distribution per share is $0.1536, resulting in a distribution rate of 12.00%.

- The 30-Day SEC Yield for THTA is 3.11% as of January 31, 2026.

- The ex-date and record date for this distribution are February 12, 2026, with the payment date set for February 13, 2026.

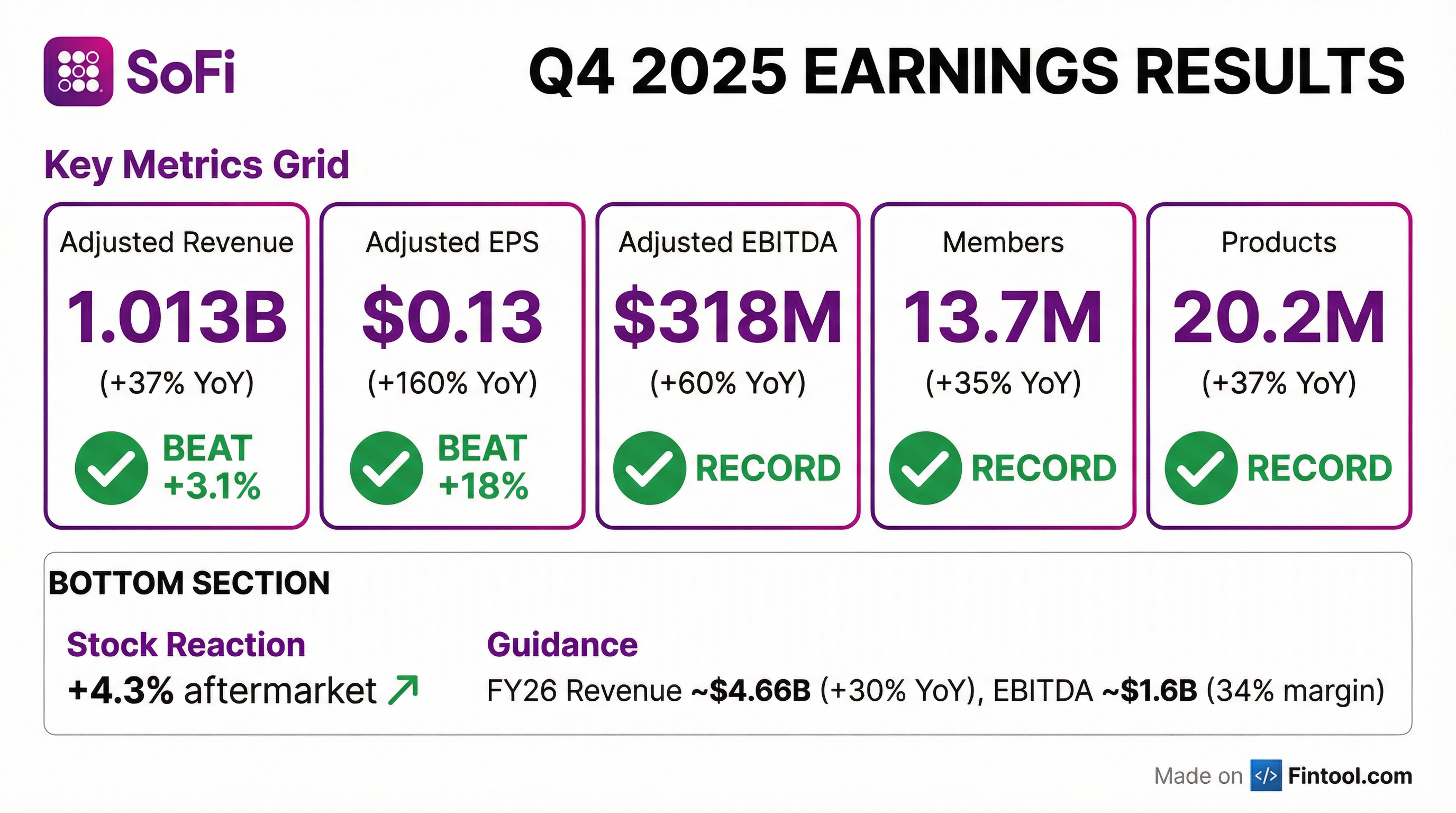

- SoFi reported record Q4 2025 adjusted net revenue of over $1 billion, marking its first billion-dollar quarter and a 37% year-over-year increase, with adjusted EBITDA reaching $318 million, up 60% year-over-year. For the full year 2025, adjusted net revenue was $3.6 billion (up 38%) and adjusted EBITDA was $1.1 billion (up 58%), the first time surpassing $1 billion in EBITDA.

- The company achieved substantial growth, adding a record 1 million new members in Q4, bringing the total to 13.7 million members (up 35% year-over-year), and a record 1.6 million new products, totaling over 20 million products (up 37% year-over-year).

- SoFi significantly expanded its product ecosystem by launching SoFi Pay for international payments, SoFi Crypto for direct investment from FDIC-insured accounts, SoFi USD as the first stablecoin issued by a national bank, and the SoFi Smart Card.

- For full-year 2026, SoFi expects adjusted net revenue of approximately $4.655 billion (30% year-over-year growth) and adjusted EPS of approximately $0.60 per share. The company also projects compounded annual adjusted net revenue growth of at least 30% and adjusted EPS growth of 38%-42% from 2025 to 2028.

- SoFi reported record adjusted net revenue of $1.013 billion in Q4 2025, marking its first billion-dollar quarter, and $3.6 billion for the full year 2025. Adjusted EBITDA reached $318 million in Q4 and $1.1 billion for the full year.

- The company achieved $0.13 earnings per share in Q4 2025 and $0.39 for the full year, marking its ninth consecutive profitable quarter.

- For 2026, SoFi expects adjusted net revenue of approximately $4.655 billion and adjusted EPS of approximately $0.60 per share. Long-term, it projects compounded annual adjusted net revenue growth of at least 30% and EPS growth of 38%-42% from 2025 to 2028.

- SoFi added a record 1 million new members in Q4 2025, increasing total members to 13.7 million, and launched new crypto products including SoFi Pay, SoFi Crypto, and the SoFi USD stablecoin.

- The company strengthened its balance sheet with $3.2 billion in new capital in 2025, increasing tangible book value per share to $7.01, and reported total deposits of $37.5 billion.

- SoFi reported record financial results for Q4 2025 and the full year 2025, with Q4 adjusted net revenue exceeding $1 billion (up 37% year-over-year) and full-year adjusted net revenue reaching $3.6 billion (up 38% year-over-year). Adjusted EBITDA for Q4 was $318 million (up 60% year-over-year) and $1.1 billion for the full year (up 58% year-over-year).

- The company achieved significant growth in its member base, adding a record 1 million new members in Q4 2025 for a total of 13.7 million (up 35% year-over-year), and a record 1.6 million new products, totaling over 20 million (up 37% year-over-year).

- SoFi launched several new offerings, including SoFi Pay, SoFi Crypto, its own stablecoin SoFi USD, and the SoFi Smart Card, while also strengthening its balance sheet with $3.2 billion in new capital, increasing tangible book value per share to $7.01.

- For fiscal year 2026, SoFi expects adjusted net revenue of approximately $4.655 billion (approximately 30% year-over-year growth) and adjusted EBITDA of approximately $1.6 billion (approximately 34% margin).

- SoFi Technologies reported record GAAP net revenue of $1.0 billion for the fourth quarter of 2025, a 40% increase year-over-year, with net income of $173.5 million and diluted earnings per share of $0.13.

- The company achieved record member growth, adding 1.0 million new members in Q4 2025, resulting in a 35% year-over-year increase to 13.7 million members.

- Total originations reached a record of $10.5 billion in Q4 2025, up 46% year-over-year, driven by strong performance across all lending segments.

- Management provided 2026 guidance, expecting full-year adjusted net revenue of approximately $4.655 billion and adjusted EPS of approximately 60 cents per share.

- SoFi announced monthly distributions for its SoFi Enhanced Yield ETF (THTA).

- The distribution as of January 14, 2026, is $0.1520 per share, with a 12.00% distribution rate, an ex-date of January 16, 2026, and a payment date of January 20, 2026.

- The THTA ETF, which had an inception date of November 15, 2023, seeks current income by combining U.S. government securities with a "credit spread" option strategy.

- SoFi Technologies has launched SoFiUSD, a fully reserved U.S. dollar stablecoin issued by SoFi Bank, N.A., described as the first national bank–issued stablecoin on a public, permissionless blockchain.

- The SoFiUSD token is backed 1:1 by cash reserves held at the Federal Reserve for immediate redemption and debuted on Ethereum.

- Initially, SoFiUSD will be used for internal settlement and is positioned as infrastructure for banks, fintechs, and enterprise partners, with broader availability to SoFi members planned in the coming months.

- The initial mint of SoFiUSD began with a $10,000 issuance on launch day, and SoFi is in advanced discussions with several institutions for its adoption.

- SoFi Technologies, Inc. announced the launch of SoFiUSD, a fully reserved U.S. dollar stablecoin issued by SoFi Bank, N.A..

- SoFi is the first national bank to issue a stablecoin on a public, permissionless blockchain, aiming to serve as a stablecoin infrastructure provider for banks, fintechs, and enterprise partners.

- SoFiUSD is fully reserved 1:1 by cash for immediate redemption and is issued by an OCC-regulated insured depository institution, providing regulatory strength and reserve transparency.

- The stablecoin will enable faster and more efficient money movement with near-instant settlement, and will also be available to SoFi members for uses such as international remittance and everyday consumer point-of-sale purchases.

- SoFi Technologies, Inc. announced an underwritten public offering of $1.5 billion of its common stock on December 4, 2025.

- The offering consists of 54,545,454 shares priced at $27.50 per share, for total gross proceeds of approximately $1.5 billion.

- SoFi has granted the underwriters a 30-day option to purchase up to an additional 8,181,818 shares of common stock.

- The company intends to use the net proceeds for general corporate purposes, including enhancing its capital position, increasing optionality, and funding incremental growth and business opportunities.

- The offering is expected to close on December 8, 2025.

- SoFi Technologies raised its full-year 2025 guidance, projecting over 3.5 million new members and $3.54 billion in Adjusted Net Revenue, reflecting approximately 36% growth.

- Significant growth is attributed to the financial services business, with interchange and brokerage fees up 70% year-to-date, and the loan platform business, which has grown 4x year-to-date. The company's revenue mix has shifted, with 40% of total revenue now fee-based, up from a typical 25%.

- The loan platform business achieved $3.4 billion in originations on behalf of others last quarter, reaching a $13 billion run rate and generating $660 million in annualized revenue. Management expects Q4 LPB originations to increase relative to Q3.

- SoFi is actively investing in product innovation, including the relaunch of SoFi Crypto, the introduction of SoFi Pay for global remittance, and the upcoming SoFi Stablecoin, supported by its strong capital levels of approximately 20%.

Quarterly earnings call transcripts for SoFi Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more