Earnings summaries and quarterly performance for BIO-TECHNE.

Executive leadership at BIO-TECHNE.

Kim Kelderman

President and Chief Executive Officer

James Hippel

Executive Vice President – Finance and Chief Financial Officer

Matthew McManus

President – Diagnostics and Spatial Biology

Shane Bohnen

Senior Vice President – General Counsel and Corporate Secretary

William Geist

President – Protein Sciences

Board of directors at BIO-TECHNE.

Research analysts who have asked questions during BIO-TECHNE earnings calls.

Puneet Souda

Leerink Partners

6 questions for TECH

Patrick Donnelly

Citi

5 questions for TECH

Dan Arias

Stifel Financial Corp.

3 questions for TECH

Daniel Leonard

Stifel Financial Corp.

3 questions for TECH

Dan Leonard

UBS Group AG

3 questions for TECH

Matthew Larew

William Blair & Company

3 questions for TECH

Matt Larew

William Blair & Co.

3 questions for TECH

Sung Ji Nam

Scotiabank

3 questions for TECH

Brandon Couillard

Wells Fargo

2 questions for TECH

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

2 questions for TECH

Daniel Markowitz

Evercore ISI

2 questions for TECH

Mac Etoch

Stephens Inc.

2 questions for TECH

Brandon Couillard

Wells Fargo & Company

1 question for TECH

Catherine Schulte

Baird

1 question for TECH

Conor Noel McNamara

RBC Capital Markets

1 question for TECH

Hannah Hefley

Stephens

1 question for TECH

Jacob Johnson

Stephens Inc.

1 question for TECH

Justin Bowers

Deutsche Bank AG

1 question for TECH

Kyle Boucher

TD Cowen

1 question for TECH

Paul Knight

KeyBanc Capital Markets

1 question for TECH

Steven Etoch

Stephens Inc.

1 question for TECH

Thomas Peterson

Robert W. Baird & Co. Incorporated

1 question for TECH

Tom DeBourcy

Nephron Research LLC

1 question for TECH

Recent press releases and 8-K filings for TECH.

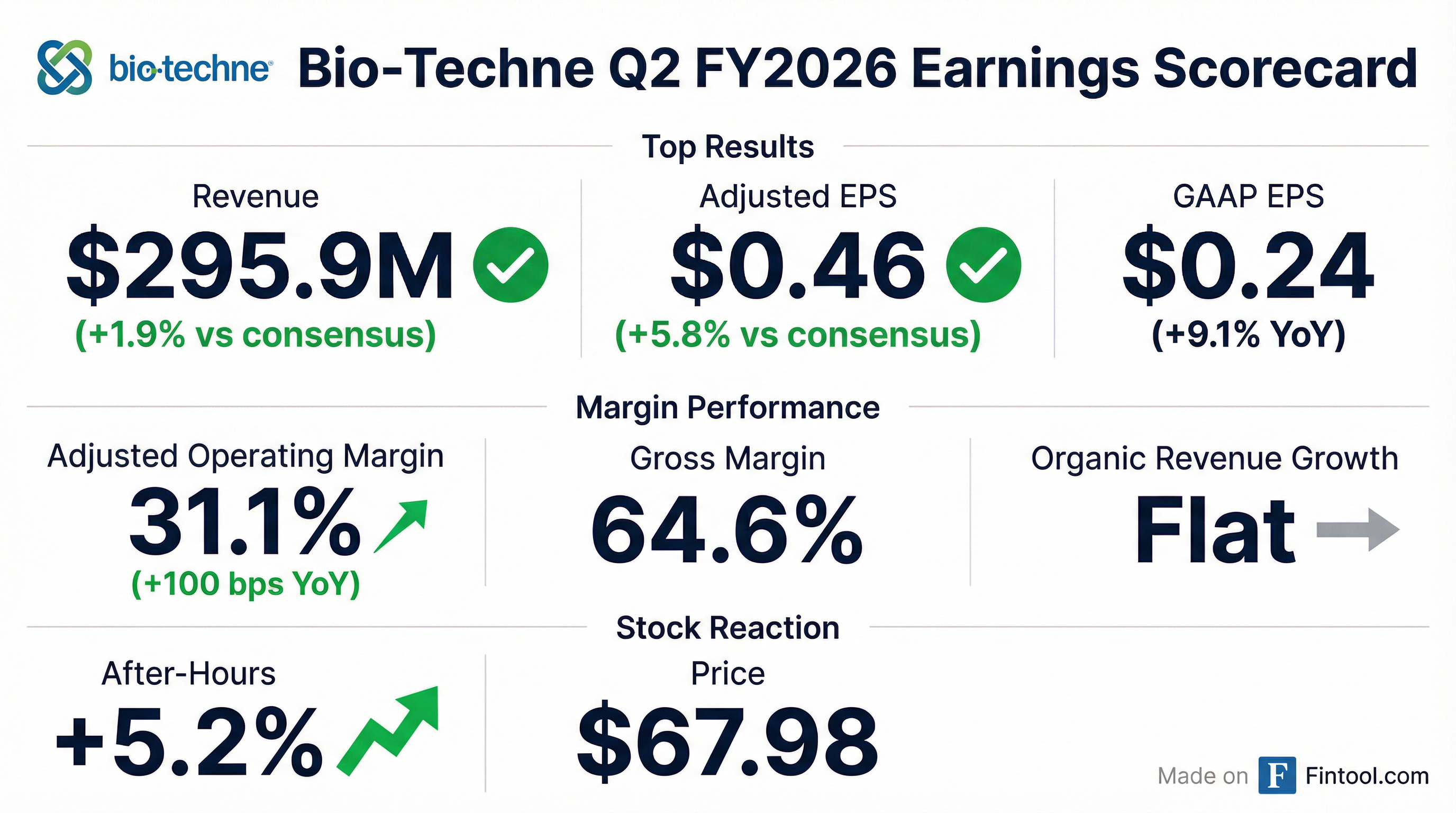

- Total revenue was $295.9 M, flat year-over-year; adjusted EPS was $0.46, up 10% YoY; adjusted operating margin expanded to 31.1%, +100 bps YoY.

- Protein Sciences sales of $215.1 M (+2% reported, –1% organic; +4% ex-cell therapy timing impacts); Diagnostics & Spatial Biology sales of $81.2 M (–4% reported, +3% organic) with segment margin improving to 10.4% from 3.9% YoY.

- Geographically, North America revenue declined upper single digits, Europe was flat, China grew mid-single digits for the third consecutive quarter, and APAC ex-China rose almost 20%.

- Q3 organic growth is expected to mirror Q2 when excluding cell therapy and OEM timing headwinds, with underlying mid-single-digit growth; full-year operating margin expansion of 100 bps remains on track.

- Strategic growth verticals (cell therapy, proteomic instruments, spatial biology, diagnostics) now represent 47% of revenue (vs. 32% in FY2020) with an upper-teens CAGR; M&A remains a priority, including the pending Wilson Wolf acquisition (20% stake, closing by end of 2027).

- Revenue flat at $295.9 M, with reported and organic growth flat YoY; excluding FDA Fast Track cell therapy timing headwinds, organic growth was 4%.

- Adjusted EPS of $0.46 (up 10% YoY) and adjusted operating margin of 31.1% (up 100 bps).

- Generated $82.4 M in operating cash flow, invested $5.9 M in capex, ending with $172.9 M cash and a leverage ratio below 1× EBITDA.

- Segment highlights: Protein Sciences revenue rose 2% to $215.1 M; Diagnostics & Spatial Biology sales were $81.2 M (–4% reported, +3% organic), with segment margin improving to 10.4%.

- Q3 outlook: organic growth expected to be consistent with Q2, with underlying mid-single-digit growth excluding cell therapy and OEM timing headwinds.

- Bio-Techne reported total Q2 revenue of $295.9 million, flat y/y, with 4% organic growth excluding timing impacts from two large cell therapy customers.

- Adjusted operating margin widened 100 bps y/y to 31.1%, driven by productivity and cost management; adjusted EPS increased 10% to $0.46.

- Large pharma revenues rose low double digits; emerging biotech declined mid-single digits; U.S. academic end market down low single digits; China sales grew mid-single digits, APAC excluding China up ~20%.

- Protein Sciences segment organic sales fell 1% (reported +2%), but grew 4% excluding cell therapy timing; Diagnostics & Spatial Biology segment achieved 3% organic growth after divestiture impacts.

- Q3 organic growth is expected to remain in line with Q2, with underlying (ex-cell therapy/OEM headwinds) growth of mid-single digits; full-year operating margin expansion of 100 bps reiterated.

- Revenue was flat year-over-year at $295.9 million in Q2 FY2026.

- GAAP EPS of $0.24 rose from $0.22 a year ago; adjusted EPS improved to $0.46 from $0.42.

- Adjusted operating margin expanded by 100 bps to 31.1%, while GAAP operating margin increased to 18.4% from 16.0% in Q2 FY2025.

- By segment, Protein Sciences net sales grew 2% to $215.1 million, and Diagnostics & Spatial Biology revenue declined 4% to $81.2 million (organic +3%).

- Revenue for Q2 FY2026 was $295.9 million, flat year-over-year.

- GAAP EPS of $0.24 versus $0.22 prior year; adjusted EPS of $0.46 versus $0.42.

- Adjusted operating margin improved to 31.1%, up 100 bps year-over-year.

- Protein Sciences revenue increased 2% to $215.1 million; Diagnostics & Spatial Biology revenue decreased 4% to $81.2 million.

- Bio-Techne reported $1.2 billion in revenue for 2025, with 81% consumables, 9% instruments, 7% services, and 2% royalties, operating in two segments: protein sciences and diagnostics & spatial biology.

- The company targets three high-growth verticals: cell therapies in a $2 billion TAM growing ~20% annually, proteomic applications in a $4 billion addressable market, and spatial biology in a $5 billion market, contributing to a $27 billion total addressable market.

- Innovation priorities include AI-designed proteins and the ProPak cytokine delivery system for cell therapy, the Simple Western Leo and ultra-sensitive Ella cartridges for proteomics, and expanded multi-omic capabilities via RNAscope and COMET.

- Financially, Bio-Techne has achieved a 10% revenue CAGR over five years, delivered 5% organic growth in fiscal 2025 with 9% operating margin, and targets 35–40% operating margins going forward.

- M&A remains strategic: the company holds 20% of Wilson Wolf with plans to acquire the remainder by end of 2027, reinforcing its position in cell therapy bioreactors.

- Bio-Techne reported $1.2 billion in 2025 revenue, driven by 81% consumables with a segment mix of 73% protein sciences and 27% diagnostics & spatial biology. The company delivered a 10% five-year CAGR, 5% organic growth in fiscal 2025, and targets 35–40% operating margins.

- The firm addresses a combined $27 billion total addressable market across three growth verticals—discovery, advanced therapeutics manufacturing, and precision diagnostics—and leverages a differentiated portfolio in cell therapies, proteomic analytics, and spatial biology.

- Bio-Techne reaffirmed low single-digit revenue growth guidance for fiscal 2026, assuming an “air pocket” due to delayed orders from fast-track cell therapy customers and gradual market recovery.

- Upcoming and recent product innovations include AI-designed proteins and ProPak cytokine delivery for cell therapies; the Simple Western Leo and ultra-sensitive Ella immunoassays for proteomic analysis; and enhanced RNAscope proximity assays alongside the COMET multi-omic spatial platform.

- The company holds a 20% stake in Wilson Wolf and plans to acquire the remaining interest by end of calendar 2027, integrating the G-Rex disposable bioreactor into its cell therapy solutions.

- Bio-Techne reported $1.2 billion in 2025 revenue, comprised of 81% consumables, 9% instruments, 7% services and 2% royalties, with 12% of consumables tied to installed instruments.

- Revenues split 73% to Protein Sciences and 27% to Diagnostics & Spatial Biology, the latter down slightly after the Exosome Diagnostics divestiture.

- The company is targeting three high-growth applications: cell therapies (addressable market of $2 billion, ~20% CAGR) , proteomic analytical instruments ($4 billion TAM) , and spatial biology ($5 billion market).

- Over the past five years, Bio-Techne delivered a 10% revenue CAGR and in FY 2025 achieved 5% organic growth with a 9% operating margin, underpinned by productivity and strategic investment.

- FY2025 revenue exceeded $1.2 billion, driven by Protein Sciences (73 %) and Diagnostics & Spatial Biology (27 %).

- Adjusted operating income reached $384 million in 2025, up from $246 million in 2020.

- Company addresses a $27 billion total addressable market, including $14 billion in discovery, $5 billion in advanced therapeutics, and $8 billion in precision diagnostics.

- Focused on three strategic growth vectors: cell-based systems & therapies, high-value proteomic applications, and spatial multiomic interrogation.

- Bio-Techne leverages a 50-year core reagents business with four high-growth verticals: cell therapy, proteomics, spatial biology, and molecular diagnostics.

- Q1 FY2026 highlights include double-digit growth in large pharma, China back to growth, spatial biology bookings up double digits, and margins of 29.9% versus a 20% forecast, offset by a near-term “air pocket” in cell therapy after two customers received FDA Fast Track approvals.

- Biopharma represents 50% of revenue with large pharma (30% of revenue) growing double digits and biotech pressured by mid-teens funding declines but showing improvement; academic research (20% of revenue) faces US budget uncertainty with funding shifting toward neurology, oncology, and weight management.

- Full-year FY2026 guidance expects single-digit growth as headwinds in biotech and academic markets persist, with management targeting a return to double-digit growth in a normalized environment and anticipating easier comps in the back half of the year.

Quarterly earnings call transcripts for BIO-TECHNE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more