Earnings summaries and quarterly performance for FIRST FINANCIAL CORP /IN/.

Executive leadership at FIRST FINANCIAL CORP /IN/.

Board of directors at FIRST FINANCIAL CORP /IN/.

GL

Gregory L. Gibson

Detailed

Director

JO

James O. McDonald

Detailed

Director

MJ

Mark J. Blade

Detailed

Director

MA

Michael A. Carty

Detailed

Director

NL

Norman L. Lowery

Detailed

Chairman of the Board

PJ

Paul J. Pierson

Detailed

Director

RJ

Richard J. Shagley

Detailed

Director

RK

Ronald K. Rich

Detailed

Lead Independent Director

SM

Susan M. Jensen

Detailed

Director

TC

Thomas C. Martin

Detailed

Director

TT

Thomas T. Dinkel

Detailed

Director

TJ

Tina J. Maher

Detailed

Director

WC

W. Curtis Brighton

Detailed

Director

WJ

William J. Voges

Detailed

Director

WR

William R. Krieble

Detailed

Director

Research analysts covering FIRST FINANCIAL CORP /IN/.

Recent press releases and 8-K filings for THFF.

First Financial Corporation Announces Strong Q4 and Full-Year 2025 Results

THFF

Earnings

Revenue Acceleration/Inflection

M&A

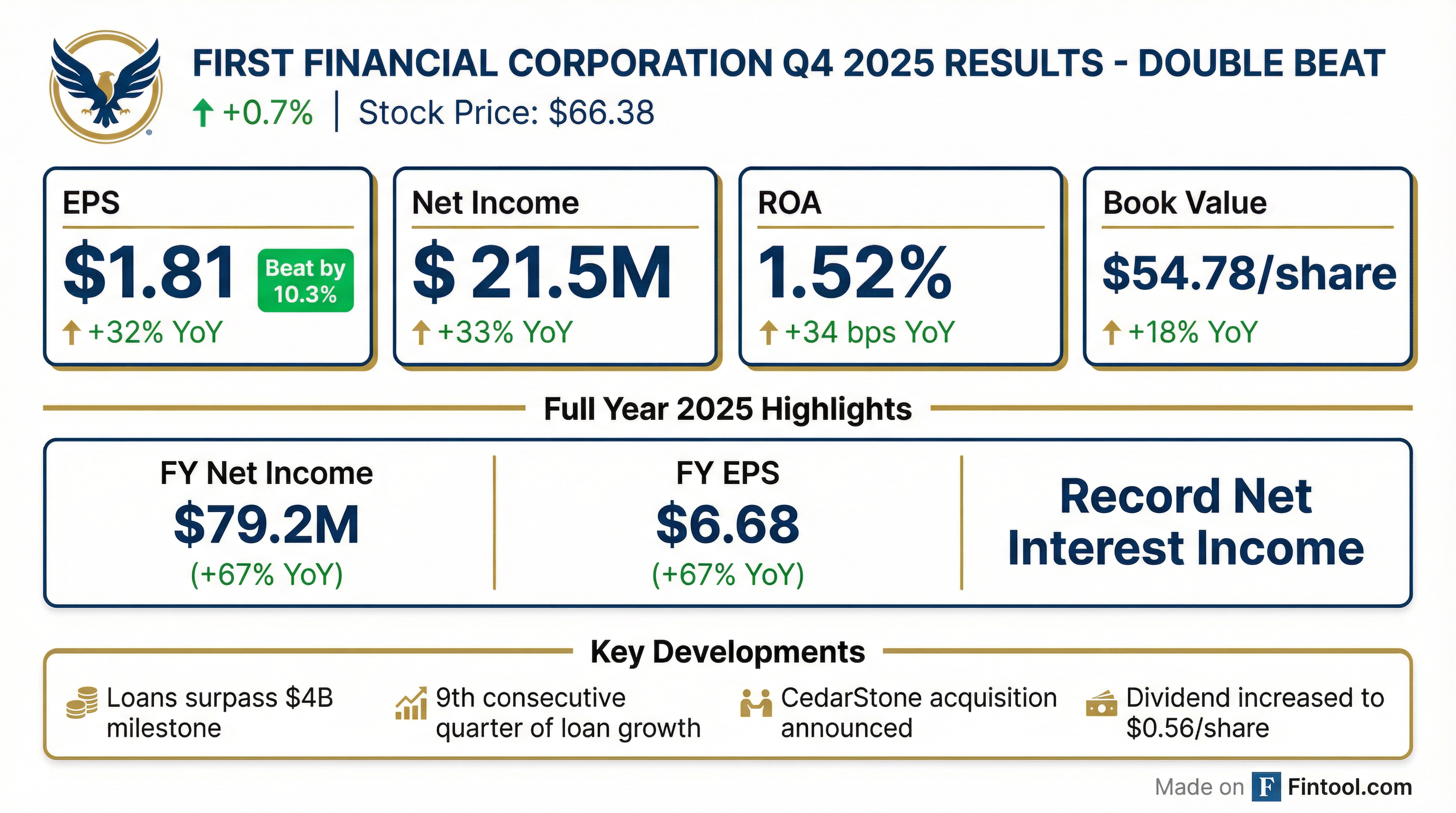

- For the fourth quarter of 2025, First Financial Corporation reported net income of $21.5 million and diluted net income per common share of $1.81.

- The company achieved record net income of $79.2 million and diluted net income per common share of $6.68 for the full year 2025.

- Total loans outstanding reached $4.06 billion as of December 31, 2025, marking the first time loans surpassed $4 billion and representing a 5.69% increase from December 31, 2024.

- Net interest income for the fourth quarter of 2025 was a record $60.6 million, an increase of 22.2% compared to the same period in 2024.

4 days ago

First Financial Corporation Reports Strong Q4 and Full Year 2025 Results

THFF

Earnings

M&A

Dividends

- First Financial Corporation reported net income of $21.5 million and diluted net income per common share of $1.81 for Q4 2025, and $79.2 million and $6.68 respectively for the full year 2025, marking significant increases over 2024.

- The company achieved its ninth consecutive quarter of loan growth, with total loans outstanding reaching $4.06 billion as of December 31, 2025, an increase of 5.69% year-over-year and surpassing $4 billion for the first time.

- Net interest income reached a record $60.6 million for Q4 2025, a 22.2% increase from Q4 2024, and the net interest margin improved to 4.66% from 3.94%.

- The efficiency ratio improved to 58.17% for Q4 2025, down from 62.98% in the same period of 2024.

- The Corporation declared a $0.56 quarterly dividend and announced a pending acquisition of CedarStone Financial on November 6, 2025.

4 days ago

First Financial Corporation Reports Full-Year 2025 Financial Highlights and Announces Janney CEO Forum Participation

THFF

Earnings

Share Buyback

- First Financial Corporation reported diluted Earnings Per Share of $6.68 and Net Income of $79.208 million for the full year ended December 31, 2025. As of the same date, Total Assets were $5,756.508 million, with a Net Interest Margin of 4.29%, and Tangible Book Value per share was $45.05.

- The company maintained strong asset quality as of December 31, 2025, with Non-Performing Loans at 0.360% of total loans and Reserves / Loans at 1.18% for Q4 2025, out of a total loan portfolio of $4,055.304 million.

- First Financial Corporation announced that its President and CEO, CFO, and Chief Credit Officer will participate in the 2026 Janney CEO Forum on February 4-5, 2026.

8 days ago

First Financial Corporation to Acquire CedarStone Financial for $25 Million

THFF

M&A

New Projects/Investments

- First Financial Corporation (THFF) has entered into a definitive agreement to acquire CedarStone Financial, Inc. for an aggregate value of $25.0 million, with a cash consideration of $19.12 per share.

- The transaction is expected to close in Q1 2026 and will result in First Financial having total combined consolidated assets of approximately $6.1 billion.

- Anticipated financial impacts for First Financial include 6.6% EPS accretion in 2026 and 8.0% EPS accretion in 2027, with a -3.0% TBV dilution at close and a ~2.2 year TBV earnback.

- CedarStone Financial, with approximately $358 million in assets and 3 bank branches in Tennessee, will expand First Financial's presence in the Nashville market.

Nov 6, 2025, 1:32 PM

First Financial Corporation reports Q3 2025 financial results

THFF

Earnings

Revenue Acceleration/Inflection

- First Financial Corporation reported net income of $20.8 million, or $1.75 diluted net income per common share, for Q3 2025, a significant increase from $8.7 million, or $0.74 per share, in Q3 2024.

- The company achieved a record net interest income of $54.6 million for Q3 2025, up from $47.2 million in Q3 2024, with the net interest margin rising to 4.25% from 3.78%.

- Total loans outstanding grew by 6.79% year-over-year to $3.97 billion as of September 30, 2025, from $3.72 billion as of September 30, 2024.

- The efficiency ratio improved to 56.63% for Q3 2025, compared to 64.43% for the same period in 2024.

- Nonperforming loans increased to $19.3 million as of September 30, 2025, representing 0.49% of total loans and leases, compared to $14.1 million, or 0.38%, a year prior. However, the provision for credit losses decreased to $2.0 million in Q3 2025 from $9.4 million in Q3 2024.

Oct 28, 2025, 2:01 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more