Earnings summaries and quarterly performance for Trilogy Metals.

Executive leadership at Trilogy Metals.

Board of directors at Trilogy Metals.

Research analysts covering Trilogy Metals.

Recent press releases and 8-K filings for TMQ.

Trilogy Metals Reports Fiscal 2025 Year-End Results and Highlights U.S. Federal Support

TMQ

Earnings

New Projects/Investments

Guidance Update

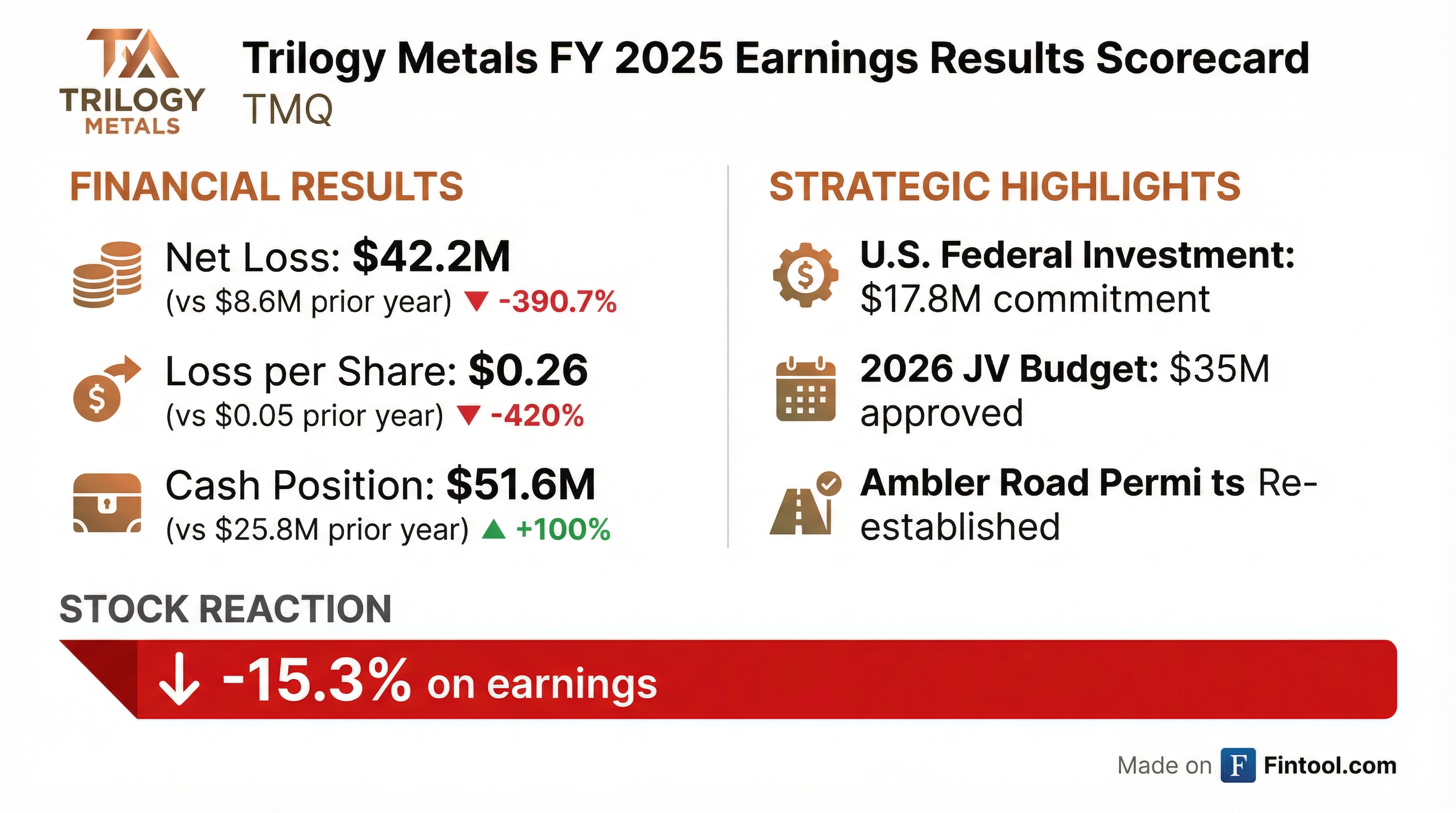

- Trilogy Metals reported a strong cash balance of $51.6 million as of November 30, 2025, and a net loss of $42.2 million (or $0.26 basic and diluted loss per common share) for fiscal 2025.

- The company secured a $17.8 million strategic investment commitment from the U.S. federal government for the Upper Kobuk Mineral Projects (UKMP), underscoring their strategic importance to domestic critical mineral supply chains.

- The Ambler Metals joint venture approved a $35 million budget for 2026 to advance permitting and development, targeting mine permit submissions in 2026, potentially leveraging federal expedited programs such as FAST-41.

- The Alaska Industrial Development and Export Authority (AIDEA) executed Right-of-Way permits for the Ambler Access Project (Ambler Road), formally re-establishing federal authorizations, with the U.S. government committed to facilitating its financing.

Feb 17, 2026, 3:34 PM

Trilogy Metals Reports Fiscal 2025 Results and U.S. Federal Support

TMQ

Earnings

New Projects/Investments

Guidance Update

- Trilogy Metals reported its financial results for the year ended November 30, 2025, with a net loss of $42.2 million (or $0.26 basic and diluted loss per common share) and a strong cash balance of $51.6 million.

- The company secured a $17.8 million strategic investment commitment from the U.S. federal government, which resulted in a $22.585 million loss on derivative carried at fair market value for the year.

- An approved $35 million budget for 2026 for the Ambler Metals joint venture will focus on advancing the Upper Kobuk Mineral Projects, with mine permit submissions targeted for 2026.

Feb 17, 2026, 11:30 AM

Trilogy Metals Strengthens Advisory and Leadership Teams

TMQ

Management Change

New Projects/Investments

Hiring

- Trilogy Metals Inc. is expanding its advisory and leadership teams following a US federal investment announced on October 6, 2025, to advance the Upper Kobuk Mineral Projects (UKMP) in Alaska.

- Egizio Bianchini has been engaged as Strategic Advisor, bringing over 40 years of experience in metals and mining financial services.

- The company also appointed Olav Langelaar as Vice President, Corporate Development; Matthew Keevil as Vice President, Investor Relations and Business Development; and Kimberly Lim as Director, Corporate Communications.

- These strategic additions are intended to strengthen oversight of the Ambler Metals joint venture (50/50 with South32) and accelerate mine permitting and project activity at the UKMP.

Jan 20, 2026, 4:40 PM

Trilogy Metals Expands Advisory and Leadership Teams Following US Federal Investment

TMQ

Management Change

New Projects/Investments

Hiring

- Trilogy Metals is expanding its advisory and leadership teams to strengthen oversight of its Ambler Metals joint venture and accelerate project activity, following a US federal government investment in the Upper Kobuk Mineral Projects (UKMP).

- Egizio Bianchini has been engaged as Strategic Advisor, bringing over 40 years of experience in metals and mining financial services.

- The company also appointed Olav Langelaar as Vice President, Corporate Development, Matthew Keevil as Vice President, Investor Relations and Business Development, and Kimberly Lim as Director, Corporate Communications.

- These appointments are intended to advance the corporate development pipeline, deepen stakeholder engagement, and deliver long-term value for shareholders and communities.

Jan 20, 2026, 11:30 AM

Trilogy Metals Announces 2026 Program and Budget for Ambler Metals and Corporate Operations

TMQ

New Projects/Investments

Guidance Update

- Trilogy Metals Inc. announced its 2026 program and budget for Ambler Metals and its corporate budget on December 17, 2025.

- Ambler Metals LLC, a joint venture, approved a $35 million budget for the Upper Kobuk Mineral Projects (UKMP) in 2026, primarily focused on initiating the mine permitting process for the Arctic Project.

- Trilogy Metals' 2026 corporate budget is approximately $5 million.

- The company reported a cash position of over $50 million and expects an additional $35.6 million from a US federal government strategic investment in early 2026, following $25 million in gross proceeds from common share sales in October 2025.

Dec 17, 2025, 2:42 PM

Trilogy Metals Announces 2026 Budgets and Project Advancement Plans

TMQ

New Projects/Investments

Guidance Update

- Trilogy Metals announced a 2026 program and budget for Ambler Metals LLC totaling approximately $35 million for the advancement of the Upper Kobuk Mineral Projects (UKMP), alongside its own 2026 corporate budget of approximately $5 million.

- Ambler Metals plans to initiate the mine permitting process for the Arctic Project in 2026, with exploration activities focusing on geotechnical and condemnation drilling to support mine design and infrastructure.

- Trilogy Metals reported a cash position of over $50 million and generated approximately $25 million in gross proceeds from an at-the-market program in October 2025 by selling 3,513,495 common shares at an average price of $7.12 per share.

- Additional funding of approximately $35.6 million is expected for Ambler Metals from a strategic investment by the US federal government, anticipated to close in early 2026.

Dec 17, 2025, 11:30 AM

Trilogy Metals Establishes $200 Million At-The-Market Equity Program

TMQ

New Projects/Investments

- Trilogy Metals Inc. has entered into an at-the-market (ATM) equity distribution agreement to potentially raise up to US$200,000,000 through the sale of common shares.

- The program, effective November 7, 2025, allows the company to sell shares at its discretion at prevailing market prices through agents including Cantor Fitzgerald & Co. and BMO Capital Markets Corp..

- The net proceeds from any sales are anticipated to be used for the continued development of the Upper Kobuk Mineral Projects (UKMP) in Alaska and for general corporate purposes.

- The agreement will terminate upon the earlier of October 31, 2028, or when the aggregate gross sales proceeds reach US$200,000,000.

Nov 7, 2025, 11:49 PM

Trilogy Metals provides update on Ambler Access Project permits

TMQ

New Projects/Investments

- Trilogy Metals Inc. announced that the Alaska Industrial Development and Export Authority (AIDEA) has executed federal Right-of-Way permits for the Ambler Access Project (AAP) in Alaska.

- These permits formally re-establish the federal authorizations for the proposed 211-mile industrial-use-only road, restoring a 50-year right-of-way across federally managed lands.

- The re-issuance of permits follows a Presidential decision on October 6, 2025, and enables AIDEA to proceed with road planning activities for next year.

- The Ambler Access Road is crucial for advancing exploration and development at the Ambler Mining District, which contains significant copper-dominant polymetallic deposits.

Oct 24, 2025, 12:41 PM

Trilogy Metals Provides Update on Ambler Access Project Permits

TMQ

New Projects/Investments

- Trilogy Metals announced that the Alaska Industrial Development and Export Authority (AIDEA) has executed Right-of-Way permits for the Ambler Access Project (AAP).

- These permits formally re-establish the federal authorizations required for the 211-mile, industrial-use-only road.

- The permits restore the 50-year right-of-way across federally managed lands, following an October 6, 2025 Presidential decision.

- With the permits in effect, AIDEA plans to proceed with road planning activities, including updating detailed engineering plans, programs, and budgets for next year.

Oct 24, 2025, 10:30 AM

Trilogy Metals: President Trump Grants Permits for Ambler Access Project

TMQ

New Projects/Investments

Guidance Update

- On October 6, 2025, President Trump issued a decision granting permits for the Ambler Access Project (Ambler Road), reversing the Biden Administration's June 2024 decision to terminate the previously issued right-of-way grant.

- The Ambler Road is a proposed 211-mile industrial-use-only road intended to enable the advancement of exploration and development at the Ambler Mining District in Northwest Alaska, which includes Trilogy Metals' Arctic and Bornite deposits.

- This decision is considered a "landmark decision" for Trilogy Metals and for domestic critical mineral development in the United States, supporting secure, domestic supply chains for vital minerals such as copper, cobalt, zinc, and lead.

- Trilogy Metals anticipates providing an update on advancing engineering, baseline environmental work, and community engagement prior to the end of the year.

Oct 6, 2025, 11:54 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more