Earnings summaries and quarterly performance for Toll Brothers.

Executive leadership at Toll Brothers.

Douglas C. Yearley, Jr.

Chairman and Chief Executive Officer

Kevin J. Coen

Secretary

Martin P. Connor

Senior Vice President and Chief Financial Officer

Michael J. Grubb

Senior Vice President, Chief Accounting Officer

Robert Parahus

President and Chief Operating Officer

Board of directors at Toll Brothers.

Christine N. Garvey

Director

Derek T. Kan

Director

John A. McLean

Director

Judith A. Reinsdorf

Director

Karen H. Grimes

Director

Katherine M. Sandstrom

Director

Paul E. Shapiro

Director

Scott D. Stowell

Lead Independent Director

Stephen F. East

Director

Wendell E. Pritchett

Director

Research analysts who have asked questions during Toll Brothers earnings calls.

John Lovallo

UBS Group AG

8 questions for TOL

Alan Ratner

Zelman & Associates

7 questions for TOL

Michael Rehaut

JPMorgan Chase & Co.

7 questions for TOL

Stephen Kim

Evercore ISI

6 questions for TOL

Alex Barron

Housing Research Center

5 questions for TOL

Sam Reid

Wells Fargo

4 questions for TOL

Trevor Allinson

Wolfe Research, LLC

4 questions for TOL

Chris Dendrinos

RBC Capital Markets

2 questions for TOL

James McCanless

Citizens

2 questions for TOL

Michael Dahl

RBC Capital Markets

2 questions for TOL

Paul Przybylski

Wolfe Research, LLC

2 questions for TOL

Rafe Jadrosich

Bank of America

2 questions for TOL

Randa Shaw

Evercore ISI

2 questions for TOL

Ryan Gilbert

Stifel

2 questions for TOL

Steven Mia

RBC Capital Markets

2 questions for TOL

Trevor Allison

Wolfe Research LLC

2 questions for TOL

Victoria Piskarev

Bank of America

2 questions for TOL

Buck Horne

Raymond James Financial, Inc.

1 question for TOL

Christopher Kalata

RBC Capital Markets

1 question for TOL

Ivy Lynne Zelman

Zelman & Associates

1 question for TOL

Mike Dahl

RBC Capital Markets

1 question for TOL

Richard Reid

Wells Fargo & Company

1 question for TOL

Susan Maklari

Goldman Sachs Group Inc.

1 question for TOL

Susan McLarney

Goldman Sachs

1 question for TOL

Recent press releases and 8-K filings for TOL.

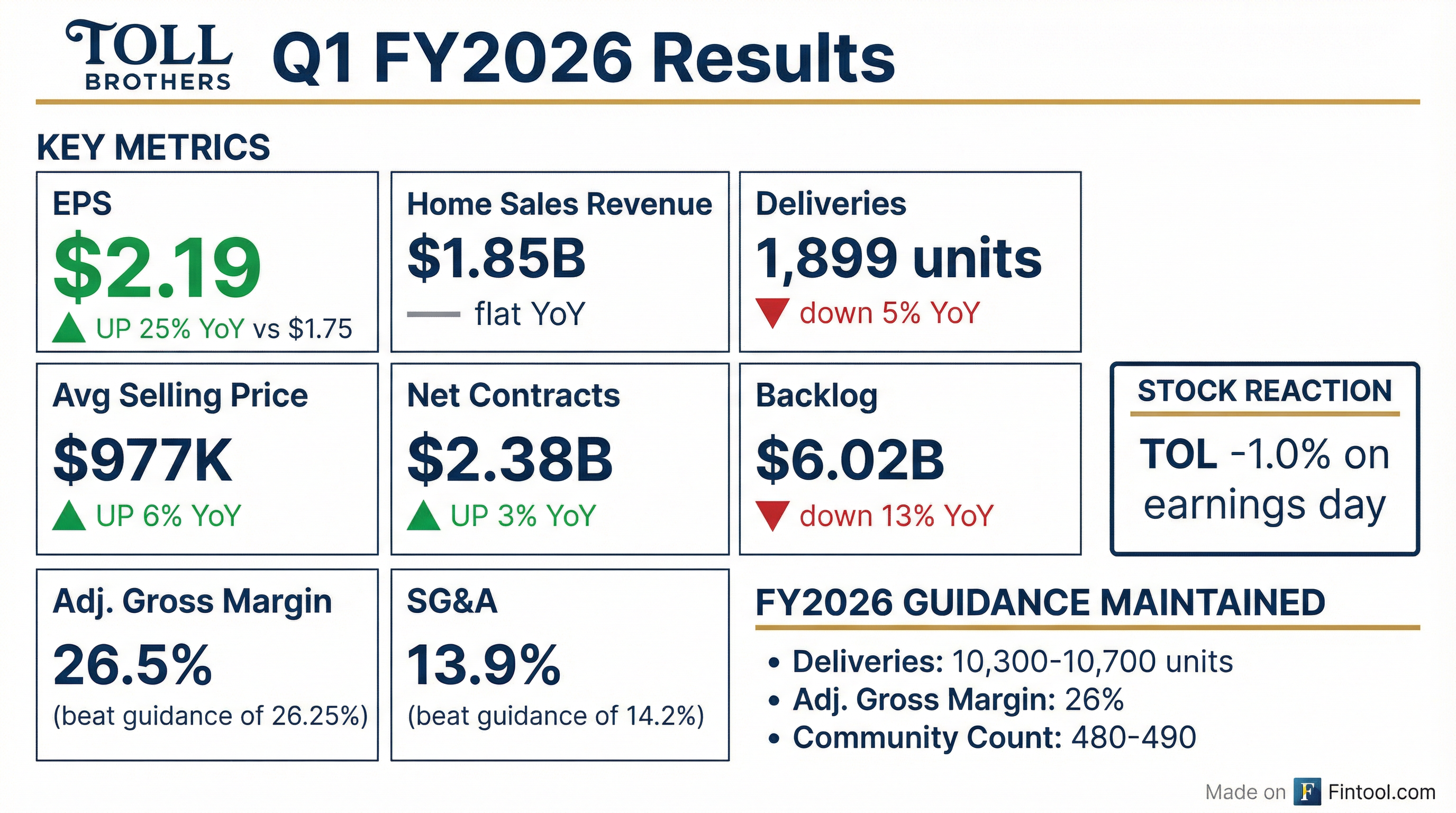

- Toll Brothers reported Q1 2026 homebuilding revenue of $1.85 billion and diluted earnings per share of $2.19, a 25% increase compared to the prior year's Q1.

- The company signed 2,303 net contracts totaling $2.4 billion in Q1 2026, with the average sales price reaching $1,033,000.

- Toll Brothers maintained its full fiscal year 2026 guidance, projecting 10,300-10,700 home deliveries at an average price of $970,000-$990,000, and an adjusted gross margin of 26.0%.

- Douglas Yearley will transition to Executive Chairman, and Karl Mistry will assume the role of CEO on March 30.

- The company ended Q1 2026 with strong liquidity of $3.4 billion and a net debt to capital ratio of 14.2%.

- Toll Brothers reported strong Q1 2026 results, with diluted EPS increasing 25% to $2.19 and homebuilding revenue reaching $1.85 billion, exceeding guidance. The company also signed 2,303 net contracts for $2.4 billion, with the average sales price increasing to $1,033,000.

- The company maintained its full fiscal year 2026 guidance for deliveries between 10,300 and 10,700 homes and an adjusted gross margin of 26.0%. Incentives remained flat at 8% of sales price for the third consecutive quarter.

- Doug Yearley will transition to Executive Chairman on March 30, with Karl Mistry taking over as CEO. Additionally, the company substantially completed the sale of approximately half of its apartment living portfolio for $330 million and plans to fully exit the multifamily development business.

- For Q1 FY 2026, Toll Brothers reported home sales revenue of $1,854,985 thousand and diluted earnings per share of $2.19.

- The company's adjusted gross margin as a percentage of revenue for Q1 FY 2026 was 26.5%.

- As of February 5, 2026, Toll Brothers maintained total liquidity of $3.40 billion, including $1.20 billion in cash & equivalents.

- Toll Brothers has a history of consistent share repurchases, approximately 53% since 2016, and pays an annual dividend of $1.00, which has increased for five consecutive years.

- The total backlog for Q1 2026 stood at 5,051 units , and the company's Net Debt to EBITDA ratio was 0.7.

- Toll Brothers reported strong Q1 2026 results, with $1.85 billion in home building revenue and $2.19 per diluted share, a 25% increase compared to the prior year's first quarter.

- The company signed 2,303 net contracts for $2.4 billion, with the average sales price increasing to $1,033,000.

- Guidance for fiscal year 2026 was maintained, projecting 10,300 to 10,700 home deliveries at an average price of $970,000 to $990,000, and an adjusted gross margin of 26.0%.

- Douglas Yearley will transition to Executive Chairman, and Karl Mistry will become CEO on March 30.

- The company ended Q1 2026 with a healthy balance sheet, including $3.4 billion of liquidity and a net debt to capital ratio of 14.2%, and targets $650 million in common stock repurchases for the full year.

- Toll Brothers reported net income of $210.9 million and diluted earnings per share of $2.19 for the first quarter of fiscal year 2026, marking a 25% increase in diluted EPS compared to the first quarter of fiscal year 2025.

- Home sales revenues for Q1 FY 2026 were $1.85 billion, with net signed contract value increasing to $2.38 billion. The company's backlog value stood at $6.02 billion at quarter-end.

- The company provided guidance for the second quarter and full fiscal year 2026, projecting 10,300 to 10,700 unit deliveries for the full year at an average delivered price of $970,000 to $990,000.

- Toll Brothers ended Q1 FY 2026 with $1.20 billion in cash and cash equivalents and a net debt-to-capital ratio of 14.2%. The company also repurchased $50.5 million of its shares and substantially completed the sale of approximately half of its Apartment Living portfolio for $330 million in net cash proceeds.

- Toll Brothers reported fiscal Q1 EPS of $2.19 and revenue of $2.15 billion, marking a roughly 15% year-over-year increase in revenue.

- The company signed 2,303 net contracts worth approximately $2.4 billion and delivered 1,899 homes.

- Adjusted gross margin was 26.5% and SG&A expense was 13.9% of homebuilding revenues, both modestly exceeding guidance.

- Backlog stood at $6.02 billion, representing a roughly 13% year-over-year decrease.

- Toll Brothers reported net income of $210.9 million and diluted earnings per share of $2.19 for the first quarter ended January 31, 2026, an increase from $177.7 million and $1.75 per diluted share in the prior year's first quarter.

- Home sales revenues increased slightly to $1.85 billion from $1.84 billion, and net signed contract value grew to $2.38 billion from $2.31 billion compared to the first quarter of FY 2025.

- The company's backlog value decreased to $6.02 billion at the end of the first quarter of FY 2026, down from $6.94 billion at the end of the first quarter of FY 2025.

- Toll Brothers improved its financial leverage, with the net debt-to-capital ratio decreasing to 14.2% at January 31, 2026, from 21.1% at January 31, 2025.

- The company repurchased approximately 0.3 million shares for $50.5 million and substantially completed the sale of approximately half of its Apartment Living portfolio for net cash proceeds of approximately $330 million, with plans to exit the multi-family development business.

- On February 5, 2026, Toll Brothers, Inc. (TOL) amended its senior unsecured revolving credit agreement, increasing the total available amount from $2.35 billion to $2.375 billion and extending its maturity date from February 7, 2030 to February 5, 2031.

- The company also amended its senior unsecured term loan credit agreement on the same date, extending the maturity date for $548,437,500 of loans from February 7, 2030 to February 5, 2031, while $101,562,500 of loans retain the original February 7, 2030 maturity.

- Both amended credit agreements eliminated the ten basis points SOFR Credit Spread Adjustment.

- ING Capital LLC joined as a new lender for the revolving credit agreement, while Capital One, National Association, First-Citizens Bank & Trust Company, and Zions Bancorporation, N.A. exited as lenders.

- Toll Brothers reported strong fiscal year 2025 results, with $10.8 billion in home sales revenues, $13.49 per diluted share in earnings, and an adjusted gross margin of 27.3%.

- In Q4 2025, the company generated $3.4 billion in home sales revenue and $4.58 per diluted share in earnings, which was modestly below guidance due to the delayed closing of the sale of its apartment living business. The sale to Kennedy Wilson, valued at $380 million, is expected to complete by the end of Q1 2026, marking an exit from the multifamily business.

- For fiscal year 2026, Toll Brothers projects new home deliveries between 10,300 and 10,700 homes at an average price of $970,000 to $990,000, with an adjusted gross margin of approximately 26.0%. This guidance is described as conservative, not assuming any market improvement.

- The company returned approximately $750 million to stockholders in fiscal 2025 through share repurchases and dividends and has budgeted $650 million for share repurchases in fiscal 2026.

- Toll Brothers reported strong fiscal year 2025 results, with $10.8 billion in home sales revenues from 11,292 homes delivered and $13.49 per diluted share in earnings.

- In Q4 2025, the company generated $3.4 billion in home sales revenue and $4.58 per diluted share in earnings, which was modestly below guidance primarily due to the delayed closing of the apartment living business sale.

- For fiscal year 2026, Toll Brothers projects new home deliveries between 10,300 and 10,700 homes at an average price of $970,000 to $990,000, with an adjusted gross margin of approximately 26.0%.

- The company plans to fully exit its multifamily business, with a significant portion of its apartment living business being sold to Kennedy Wilson for $380 million, expected to close by the end of Q1 2026.

- Toll Brothers returned approximately $750 million to stockholders in fiscal 2025 through share repurchases and dividends, and has budgeted $650 million for share repurchases in fiscal 2026.

Quarterly earnings call transcripts for Toll Brothers.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more