Earnings summaries and quarterly performance for TRACTOR SUPPLY CO /DE/.

Executive leadership at TRACTOR SUPPLY CO /DE/.

Harry A. Lawton III

President and Chief Executive Officer

J. Seth Estep

Executive Vice President - Chief Merchandising Officer

John P. Ordus

Executive Vice President - Chief Stores Officer

Kurt D. Barton

Executive Vice President - Chief Financial Officer and Treasurer

Robert D. Mills

Executive Vice President - Chief Technology, Digital Commerce, and Strategy Officer

Board of directors at TRACTOR SUPPLY CO /DE/.

Research analysts who have asked questions during TRACTOR SUPPLY CO /DE/ earnings calls.

Michael Lasser

UBS

9 questions for TSCO

Peter Benedict

Robert W. Baird & Co.

9 questions for TSCO

Christopher Horvers

JPMorgan Chase & Co.

8 questions for TSCO

Steven Forbes

Guggenheim Securities, LLC

7 questions for TSCO

David Bellinger

Mizuho Securities USA LLC

6 questions for TSCO

Peter Keith

Piper Sandler & Co.

6 questions for TSCO

Scot Ciccarelli

Truist Securities

6 questions for TSCO

Robert Ohmes

Bank of America

5 questions for TSCO

Steven Zaccone

Citigroup

5 questions for TSCO

Zachary Fadem

Wells Fargo

5 questions for TSCO

Chuck Grom

Gordon Haskett Research Advisors

4 questions for TSCO

Karen Short

Melius Research

4 questions for TSCO

Kate McShane

Goldman Sachs

4 questions for TSCO

Seth Sigman

Cantor Fitzgerald

3 questions for TSCO

Bobby Griffin

Raymond James Financial

2 questions for TSCO

Charles Grom

Gordon Haskett Research Advisors

2 questions for TSCO

Jonathan Matuszewski

Jefferies Financial Group Inc.

2 questions for TSCO

Michael Baker

D.A. Davidson & Co.

2 questions for TSCO

Oliver Wintermantel

Evercore ISI

2 questions for TSCO

Simeon Gutman

Morgan Stanley

2 questions for TSCO

Spencer Hanus

Wolfe Research

2 questions for TSCO

Barath Ratta

JPMorgan Chase & Co.

1 question for TSCO

Charles Cerankosky

Northcoast Research

1 question for TSCO

Chuck Cerankosky

Northcoast Research

1 question for TSCO

Josh Young

Truist Securities

1 question for TSCO

Katharine McShane

Goldman Sachs Group, Inc.

1 question for TSCO

Zach Fadem

Wells Fargo

1 question for TSCO

Recent press releases and 8-K filings for TSCO.

- Tractor Supply Company raised its annualized dividend by $0.04 (4.3%) to $0.96 per share for 2026, declaring a quarterly cash dividend of $0.24 payable March 10, 2026, to shareholders of record February 24, 2026.

- This marks the company’s 17th consecutive year of annual dividend increases.

- The board expanded to 10 members with the appointment of Sonia Syngal as an independent director, bringing over 30 years of leadership experience including CEO roles at Gap Inc. and Old Navy.

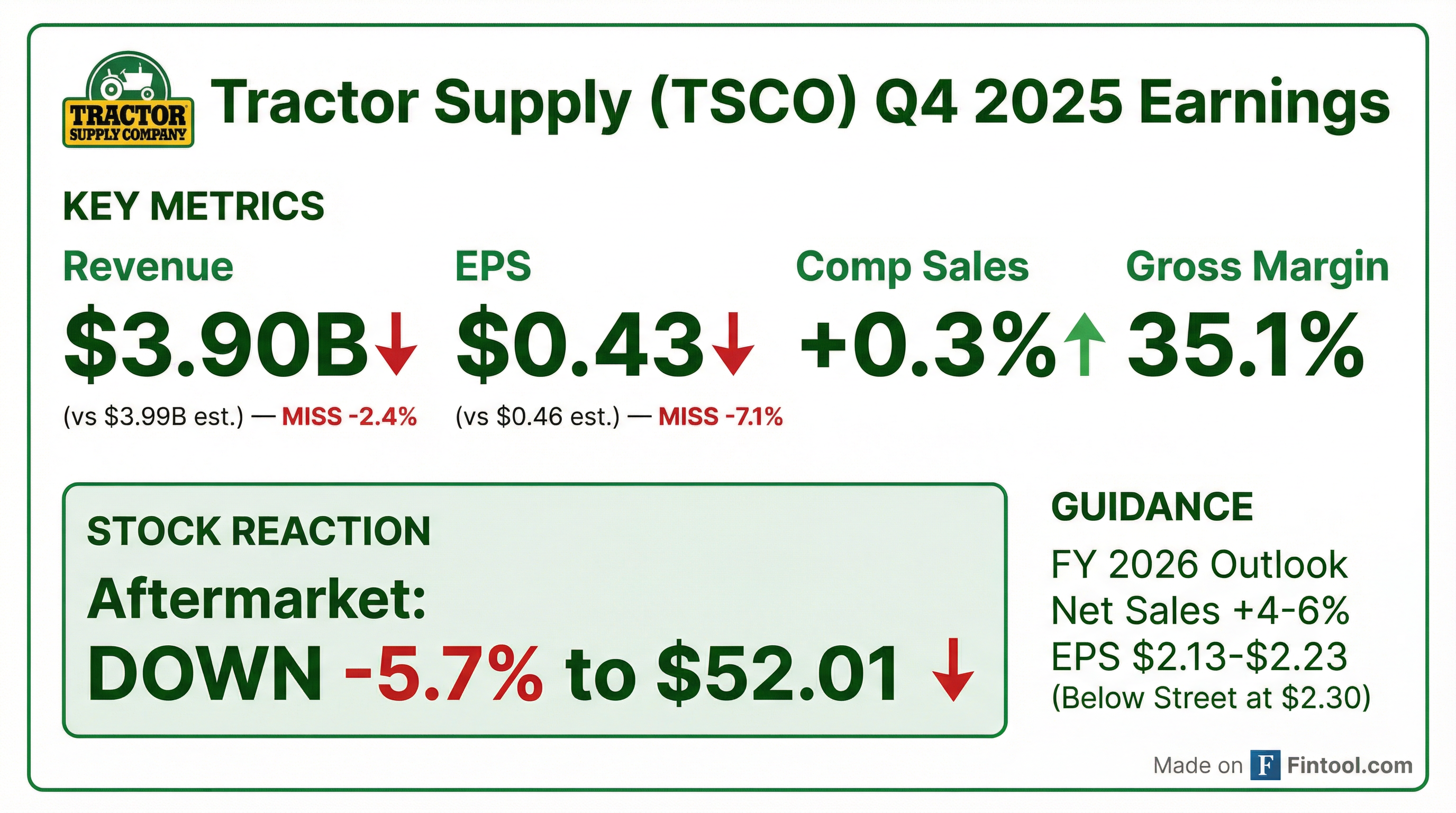

- Net sales were $3.90 billion, up from $3.77 billion in Q4 2024, with comparable store sales of +0.3% in Q4 2025.

- Operating margin declined to 7.6% of net sales, while net income amounted to $227.4 million and diluted EPS was $0.43.

- Gross margin was 35.1% of net sales and SG&A expenses increased to 27.5%, driven by higher promotional and delivery costs as well as planned investments.

- The company opened 99 new Tractor Supply stores and 5 Petsense stores in 2025, and achieved high single-digit digital sales growth.

- For fiscal 2026, Tractor Supply guides to net sales growth of +4% to +6% and diluted EPS of $2.13 to $2.23.

- Net sales rose 3.3% to $3.9 billion in Q4, with comparable store sales up 0.3%; diluted EPS was $0.43.

- For FY 2025, net sales increased 4.3% to $15.5 billion with comparable comps of 1.2%; diluted EPS was $2.06.

- Q4 gross margin contracted by 10 bps amid elevated promotions and tariffs; SG&A increased to 27.5% of sales, and the effective tax rate improved to 19%.

- 2026 outlook: 4–6% total sales growth, 1–3% comp growth, 9.3–9.6% operating margin, EPS of $2.13–$2.23, $675–725 million capex, 100 new stores, and $375–450 million in share repurchases.

- Strategic initiatives include doubling direct-sales specialists to target $50 million in sales and expanding final-mile delivery to ~375 hubs covering 50% of stores.

- Q4 net sales rose 3.3% to $3.9 billion, with comps up 0.3% and diluted EPS of $0.43; digital sales grew high-single digits.

- Full-year 2025 net sales increased 4.3% to $15.5 billion, comps gained 1.2%, and diluted EPS was $2.06; digital business also delivered high-single-digit growth.

- Q4 performance was held back by cycling last year’s storm benefits (≈100 bps headwind), softer big-ticket and holiday categories amid elevated promotions, while consumable and farm/ranch products gained share.

- 2026 outlook: net sales growth of 4–6%, comps 1–3%, operating margin 9.3–9.6%, diluted EPS $2.13–2.23; plans include ~100 new stores, $675–725 million capex, and $375–450 million in share repurchases.

- Q4 2025 net sales rose 3.3% to $3.9 billion, with comparable store sales up 0.3%, diluted EPS of $0.43, and digital sales delivering high single-digit growth.

- FY 2025 net sales increased 4.3% to $15.5 billion, comparable store sales +1.2%, diluted EPS of $2.06, with Neighbors Club contributing over 80% of sales.

- Q4 gross margin declined ~10 bps; SG&A rose ~70 bps to 27.5% of sales; operating income fell 6.5%; effective tax rate improved to 19%.

- The quarter faced a ~100 bp comp headwind from absent storm recovery and high-single-digit declines in big-ticket and emergency response categories.

- 2026 outlook: total sales growth of 4–6%, comps 1–3%, diluted EPS $2.13–$2.23, operating margin 9.3–9.6%, net capex $675–725 million, 100 new stores, and $375–450 million in share repurchases.

- Recorded $3.90 billion in Q4 2025 net sales (+3.3% YOY) and diluted EPS of $0.43 (vs. $0.44 prior year).

- Delivered FY 2025 net sales of $15.52 billion (+4.3% YOY) and diluted EPS of $2.06.

- Comparable store sales rose 0.3% in Q4 and 1.2% for the full year.

- Issued FY 2026 guidance for net sales growth of 4%–6% and diluted EPS of $2.13–$2.23.

- Returned capital of $238.9 million in Q4 via $117.5 million of buybacks and $121.4 million of dividends; FY 2025 total return was $848.5 million.

- In Q4 2025, net sales rose 3.3% to $3.90 billion with comparable-store sales up 0.3%, and diluted EPS was $0.43.

- For FY 2025, net sales increased 4.3% to $15.52 billion with comparable-store sales growth of 1.2%, and diluted EPS was $2.06.

- The company forecasts FY 2026 net-sales growth of 4%–6% and diluted EPS of $2.13–$2.23.

- In Q4 2025, Tractor Supply repurchased 2.2 million shares for $117.5 million and paid $121.4 million in dividends; for FY 2025, it repurchased 6.6 million shares for $360.8 million and paid $487.7 million in dividends.

- Tractor Supply opened its 2,400th store in Aiken, South Carolina, in early January 2026.

- The Aiken launch is one of four grand openings in the first two weeks of 2026, supporting a plan to open 100 new stores by year-end.

- The new store features a 3,000 sq ft Garden Center and complements a nearby location that has served the community since 2004.

- Tractor Supply donated $2,400 to Aiken Equine Rescue as part of the grand opening celebrations.

- The consumer remains healthy and resilient, with positive comparable store transactions, mid-single-digit CUE comps, strong big-ticket gains and stable discretionary categories in H1 2025.

- Tariff-related costs are now flowing into P&L in H2, prompting modest 1–2% price increases with no notable elasticity impact so far.

- Gross margin improved 30 bps in H1 2025; management expects an additional 5–15 bps expansion in H2, moderating headwinds from lapping distribution center benefits, consumable mix and tariffs.

- The company is pursuing four “Life Out Here” growth pillars: Allivet pet pharmacy acquisition integration, B2B direct sales, final-mile delivery rollout and 15% store localization.

- Tractor Supply plans 90+ store openings in 2025 (ramping to 100 in 2026), including 18 Big Lots retrofits, while managing limited cannibalization and exceeding new-store ROI forecasts.

- Tractor Supply grew net sales 4.5% to $4.44 B with comparable store sales up 1.5% (transactions +1%, ticket +0.5%), delivering diluted EPS of $0.81 in Q2 2025.

- Gross margin expanded 31 bps to 36.9%, operating income rose 2.9% to $577.8 M, and net income increased 1.1% to $430 M; inventories ended at $3.1 B to bolster in-stock levels.

- Returned $196 M to shareholders via dividends and buybacks; full-year repurchase guidance lowered to $325–375 M (from $525–600 M) to support inventory and tariff impacts.

- Reconfirmed 2025 outlook: net sales growth 4–8%, comp store sales flat to +4%, operating margin 9.5–9.9%, net income $1.07–1.17 B (EPS $2.00–2.18).

Quarterly earnings call transcripts for TRACTOR SUPPLY CO /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more