Earnings summaries and quarterly performance for UNIFI.

Executive leadership at UNIFI.

Edmund Ingle

Detailed

Chief Executive Officer

CEO

AE

A.J. Eaker

Detailed

Executive Vice President, Chief Financial Officer, and Treasurer

AC

Albert Carey

Detailed

Executive Chairman

BM

Brian Moore

Detailed

Executive Vice President and President of UMI

HN

Hongjun Ning

Detailed

Executive Vice President, President of Unifi Textiles (Suzhou) Co. Ltd., and President of Unifi Asia Pacific

Board of directors at UNIFI.

Research analysts who have asked questions during UNIFI earnings calls.

Recent press releases and 8-K filings for UFI.

Unifi Reports Q2 2026 Results and Operational Improvements

UFI

Earnings

Guidance Update

Revenue Acceleration/Inflection

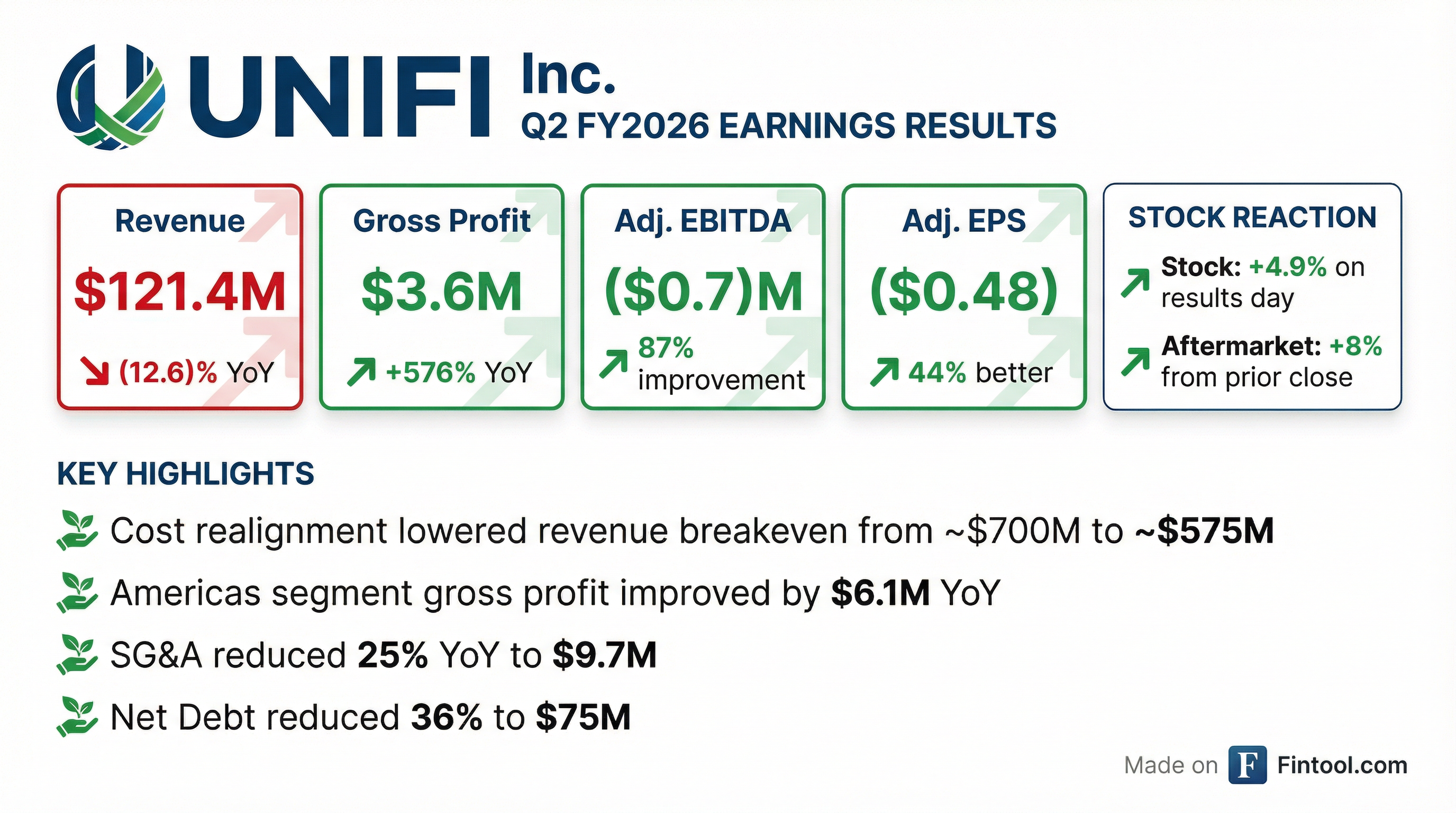

- Unifi reported Q2 2026 net sales were down 12.5% year-over-year, with a consolidated gross profit of $3.6 million (3% gross margin) and an adjusted EBITDA loss of $0.7 million, representing a $5.1 million improvement compared to the prior year period.

- The company has significantly improved its cost structure, reducing annual revenue break-even points by approximately $125 million to $575 million. This was achieved through initiatives including the closing of the Madison facility, a 25% reduction in North America headcount, and a 25% improvement in SG&A to $9.7 million.

- Unifi generated $13.3 million in year-to-date free cash flow and reduced net debt to $75 million by the end of December.

- Management is cautiously optimistic about future revenue growth, citing improved order trends in January and February, post-holiday restocking, and increased demand from Central America due to new reciprocal tariff deals. They anticipate full benefits of cost reduction initiatives in Q3.

3 days ago

UNIFI, Inc. Reports Q2 FY2026 Earnings with Improved Profitability and Reduced Debt

UFI

Earnings

Guidance Update

Demand Weakening

- UNIFI, Inc. reported Q2 FY2026 consolidated revenue of $121.4 million, representing a 12.6% decrease year-over-year, but demonstrated significant profitability improvements.

- Gross profit surged by 576.2% to $3.6 million and Adjusted EBITDA improved by 87% to ($0.7) million in Q2 FY2026, primarily driven by cost-saving initiatives and a 25% reduction in SG&A expenses.

- Strategic repositioning efforts have successfully lowered the revenue breakeven point from approximately $700 million to $575 million.

- The company significantly improved its financial position year-to-date, with Free Cash Flow reaching $13.3 million (up from ($19.9) million in the prior year) and Net Debt decreasing by 35.5% to $75 million.

- Management anticipates full benefits from cost reduction actions and improved working capital turns post-Q2 FY2026, expecting a stronger path to positive operating cash flows and revenue improvement in calendar 2026.

3 days ago

Unifi Reports Q2 2026 Results, Highlights Cost Savings and Improved Demand

UFI

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Unifi reported Q2 FY2026 net sales decreased 12.5% year-over-year, with a consolidated gross profit of $3.6 million (3% gross margin) and an adjusted EBITDA loss of $0.7 million, representing a $5.1 million improvement from the prior year.

- The company significantly improved its financial position, generating $13.3 million in year-to-date free cash flow and reducing net debt to $75 million by December.

- Strategic cost-saving initiatives, including manufacturing footprint consolidation, have reduced the annual revenue break-even point by approximately $125 million to $575 million, with $4 million in SG&A savings expected in fiscal year 2026.

- Management is cautiously optimistic about future demand, noting improved order trends in January and February across all segments due to post-holiday restocking, increased Central America demand, and new tariff agreements. The company anticipates revenue improvement through calendar year 2026.

3 days ago

Unifi Reports Q2 Fiscal 2026 Results with Improved Profit Margins and Reduced Debt

UFI

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Unifi reported Q2 Fiscal 2026 results with net sales down 12.5% year-over-year, but gross profit increased to $3.6 million from $0.5 million in the prior year, and adjusted EBITDA improved by $5.1 million to a loss of $0.7 million.

- The company significantly improved its financial position, with year-to-date free cash flow reaching $13.3 million and net debt reduced to $75 million at the end of December.

- Operational restructuring, including the closing of the Madison facility and headcount reduction, has led to a $125 million to $575 million reduction in annual revenue break-even points.

- Management noted improved order trends in January and February, driven by post-holiday restocking, increased Central America demand, and recent reciprocal tariff deals with El Salvador and Guatemala, expressing optimism for sales improvement in the second half of fiscal 2026.

3 days ago

UNIFI Announces Second Quarter Fiscal 2026 Results

UFI

Earnings

Demand Weakening

Guidance Update

- For the second fiscal quarter ended December 28, 2025, UNIFI reported net sales of $121.4 million, a 12.6% decrease from the prior year, primarily due to trade and tariff-related uncertainty and demand volatility.

- Despite lower sales, gross profit significantly increased to $3.6 million from $0.5 million in the second quarter of fiscal 2025, and SG&A expenses decreased by 25% to $9.7 million. The net loss improved to $9.7 million (or $0.53 per diluted share) from $11.4 million (or $0.62 per share), and Adjusted EBITDA improved to $(0.7) million from $(5.8) million.

- Strategic initiatives, including cost and footprint reductions, have reduced the annual revenue breakeven point from ~$700 million to ~$575 million.

- Cash provided by operating activities was $25.3 million during Q2 FY2026, and Net Debt decreased to $75.2 million at December 28, 2025, from $85.3 million at June 29, 2025. Management expects to generate positive operating cash flow in future quarters, with early Q3 showing signs of improving customer engagements, though Q3 operating cash flows are anticipated to be lower than Q2 due to increased working capital for expected sales growth.

3 days ago

UNIFI Announces Second Quarter Fiscal 2026 Results

UFI

Earnings

Demand Weakening

Layoffs

- UNIFI reported net sales of $121.4 million for the second quarter of fiscal 2026, a 12.6% decrease from the prior year, primarily due to trade and tariff-related uncertainty and demand volatility.

- The company's net loss was $9.7 million, or $0.53 per diluted share, for the second quarter of fiscal 2026, an improvement from a net loss of $11.4 million in the second quarter of fiscal 2025. Adjusted EBITDA improved to $(0.7) million from $(5.8) million in the same period last year.

- Gross profit increased to $3.6 million (3.0% gross margin) from $0.5 million (0.4% gross margin) in the second quarter of fiscal 2025, driven by multi-year cost alignment efforts.

- Cash provided by operating activities was $25.3 million during the second quarter of fiscal 2026, and Net Debt decreased to $75.2 million at December 28, 2025, from $85.3 million at June 29, 2025.

- In October 2025, UNIFI implemented additional cost savings initiatives, including reducing variable manufacturing costs and eliminating many salaried positions in the U.S..

3 days ago

Ufi Ventures and Tyton Partners Release Q3+ 2025 VocTech Market Report

UFI

New Projects/Investments

M&A

- Ufi Ventures and Tyton Partners released their Q3+ 2025 VocTech Market Report on November 13, 2025, which explores trends in vocational learning and workforce development across the UK, Europe, and North America.

- The report highlights a major White Paper published by the UK government, providing a clear direction for vocational training and workforce upskilling in England and for university funding across the UK, which is considered an encouraging basis for investment decisions.

- Key market trends include intense US government announcements, growing concerns about an "AI bubble", and significant investments and deals despite low deal volumes.

- Notable acquisitions include Sana Labs' sale to Workday, a rare European unicorn exit, and PeopleCert's acquisition of the commercial businesses of City and Guilds.

Nov 13, 2025, 6:00 AM

Unifi Reports Q1 FY 2026 Results Amidst Tariff Headwinds, Implements Cost Restructuring

UFI

Earnings

Demand Weakening

Layoffs

- Unifi reported Q1 FY 2026 consolidated net sales of $135.7 million, an 8% year-over-year decrease, with a gross profit of $3.4 million and a 2.5% gross margin.

- The challenging quarter was primarily due to tariff and trade uncertainties leading to softer ordering patterns, particularly impacting sales in Asia and Central America.

- The company implemented a cost restructuring program after Q1, including headcount reductions and operating cost adjustments, expecting $5 million in annual SG&A savings and $5 million per quarter in manufacturing cost savings for the remainder of fiscal 2026.

- Management anticipates a return to normal ordering patterns and revenue momentum starting in calendar 2026, driven by reduced customer inventories post-holiday season and growth in beyond apparel initiatives (military, carpet, packaging, resin sales).

Nov 5, 2025, 1:30 PM

UNIFI, INC. Reports Q1 FY26 Financial Results with Revenue Decline and Negative Adjusted EPS

UFI

Earnings

Guidance Update

Product Launch

- UNIFI, INC. reported Q1 FY26 consolidated revenue of $135.7 million, a 7.9% decrease year-over-year, alongside an Adjusted EPS of ($0.56) and Adjusted EBITDA of ($2.5) million.

- The decline in net sales and gross profit was primarily attributed to weak demand in the Asia Segment and pricing pressures in the Brazil Segment.

- The company introduced new products, ThermaLoop Insulation and REPREVE TAKETACK, both derived from 100% Textile Waste, during Q1 FY26.

- Management expects improved free cash flow for the rest of fiscal 2026 from cost reductions and working capital improvements, with revenue anticipated to improve in calendar 2026 as global trade conditions become clearer.

- As of Q1 FY26, Net Debt was $100 million and Free Cash Flow was ($11) million.

Nov 5, 2025, 1:30 PM

UNIFI, Inc. Announces First Quarter Fiscal 2026 Results

UFI

Earnings

Profit Warning

Demand Weakening

- UNIFI, Inc. reported net sales of $135.7 million for Q1 Fiscal 2026, a 7.9% decrease from the prior year, primarily due to trade and tariff-related uncertainty and demand volatility.

- The company posted a gross profit of $3.4 million (2.5% margin) and a net loss of $11.4 million (or $0.62 per diluted share), alongside an Adjusted EBITDA of $(2.5) million for Q1 Fiscal 2026, significantly lower than the prior year.

- In response to these financial pressures, UNIFI launched an additional restructuring program in October 2025 and anticipates improved operating cash flows in the second quarter of fiscal 2026.

Nov 4, 2025, 9:25 PM

Quarterly earnings call transcripts for UNIFI.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more