Earnings summaries and quarterly performance for UNION BANKSHARES.

Executive leadership at UNION BANKSHARES.

David Silverman

President and Chief Executive Officer

Jonathan Gould

Executive Vice President, Senior Commercial Loan Officer

Karyn Hale

Vice President, Treasurer, and Chief Financial Officer

Patricia Hogan

Executive Vice President, Senior Risk Officer

Stephen Kendall

Executive Vice President, Senior Residential and Consumer Loan Officer

Vincent Schoenig

Executive Vice President, Senior Information Technology and Operations Officer

Board of directors at UNION BANKSHARES.

Research analysts who have asked questions during UNION BANKSHARES earnings calls.

Austin Nicholas

Stephens Inc.

1 question for UNB

Bryce Rowe

B. Riley Securities

1 question for UNB

Catherine Mealor

Keefe, Bruyette & Woods

1 question for UNB

David West

Davenport & Company

1 question for UNB

Laurie Hunsicker

Seaport Research Partners

1 question for UNB

William Wallace

Raymond James

1 question for UNB

Recent press releases and 8-K filings for UNB.

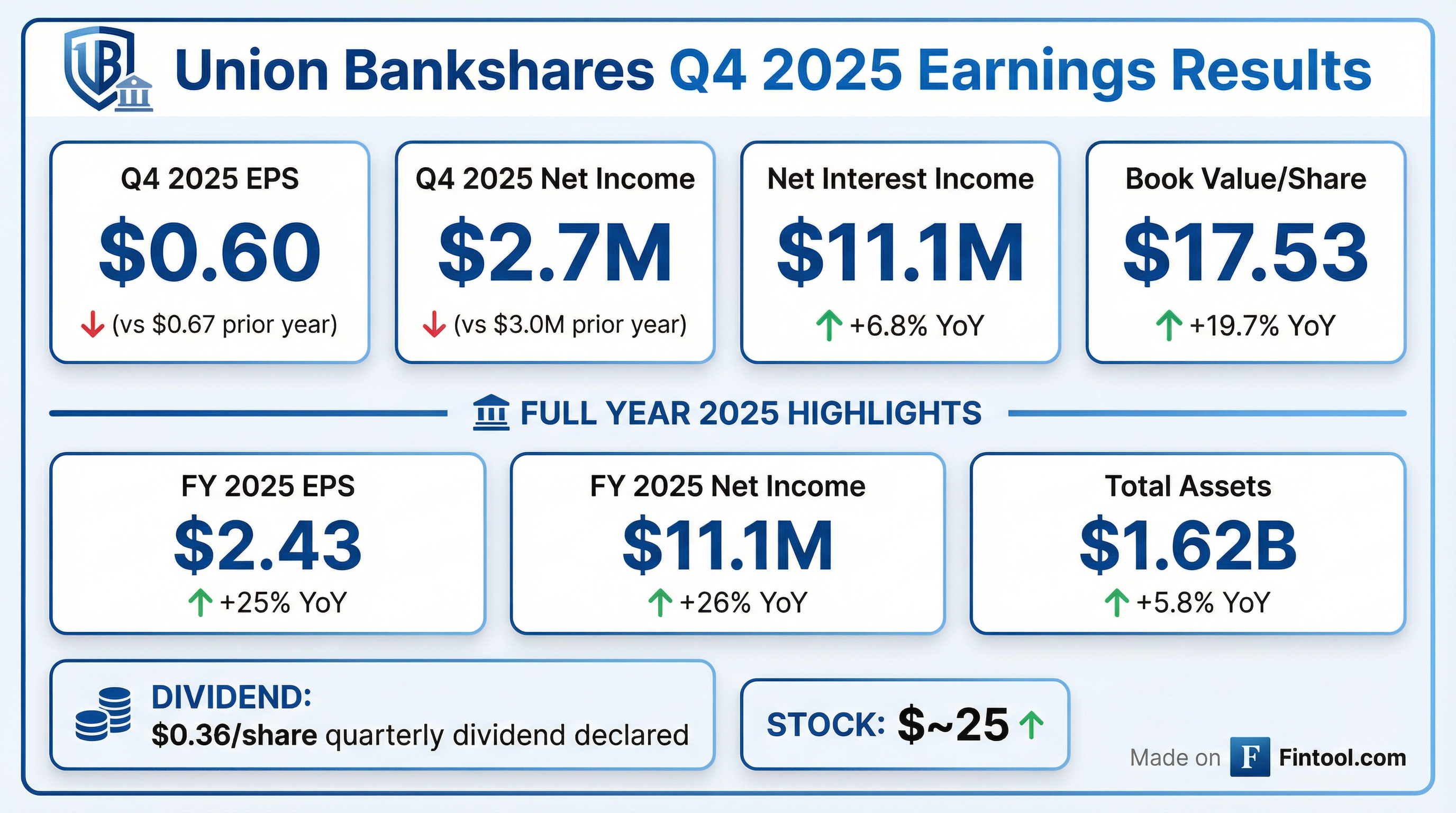

- For the full year 2025, Union Bankshares delivered consolidated net income of $11.1 million, or $2.43 per share, an increase from $8.8 million, or $1.94 per share, in 2024.

- Fourth quarter 2025 net income was $2.7 million, compared to $3.0 million in the same period of 2024, reflecting higher noninterest expenses partially offset by stronger net interest income and noninterest income.

- Total assets ended the year at $1.62 billion, up 5.8% from $1.52 billion in 2024, and book value per share increased 19.7% to $17.53 from $14.65.

- The Board declared a quarterly cash dividend of $0.36 per share.

- Union Bankshares reported consolidated net income for 2025 rose 26.5% to $11.1 million ($2.43 per share), helped by higher net interest income and stronger mortgage banking gains. Fourth-quarter net income declined to $2.7 million ($0.60 per share).

- The board declared a regular quarterly cash dividend of $0.36 per share, payable February 5, 2026, to shareholders of record January 31, 2026.

- Total assets grew 5.8% to $1.62 billion, with investment securities rising 30.1% to $328.3 million as of December 31, 2025.

- Book value per share climbed nearly 20%, and the allowance for credit losses on loans increased 9.5% year-over-year to $8.4 million as of December 31, 2025.

- Consolidated net income for Q4 2025 was $2.7 million, or $0.60 per share, compared to $3.0 million, or $0.67 per share, for the same period in 2024.

- For the full year ended December 31, 2025, consolidated net income was $11.1 million, or $2.43 per share, an increase from $8.8 million, or $1.94 per share, in 2024.

- Total assets grew 5.8% to $1.62 billion as of December 31, 2025, from $1.52 billion as of December 31, 2024, and book value per share increased 19.7% to $17.53.

- The Board of Directors declared a quarterly cash dividend of $0.36 per share.

- Union Bankshares (UNB) reported consolidated net income of $2.7 million, or $0.60 per share, for the three months ended December 31, 2025, and $11.1 million, or $2.43 per share, for the full year ended December 31, 2025.

- Total assets reached $1.62 billion as of December 31, 2025, representing a 5.8% growth from $1.52 billion as of December 31, 2024, primarily driven by increases in securities and loan portfolios.

- Book value per share strengthened by 19.7% to $17.53 as of December 31, 2025, compared to $14.65 as of December 31, 2024.

- The Board of Directors declared a regular quarterly cash dividend of $0.36 per share, payable February 5, 2026.

- Union Bankshares, Inc. reported consolidated net income of $3.4 million for the third quarter ended September 30, 2025, a significant increase from $1.3 million in the same period last year. Earnings Per Share (EPS) for Q3 2025 was $0.75, compared to $0.29 for Q3 2024.

- For the nine months ended September 30, 2025, net income reached $8.3 million (up from $5.8 million in 2024) and EPS was $1.83 (up from $1.27).

- The company's financial position strengthened, with total assets growing to $1.57 billion as of September 30, 2025, an increase from $1.52 billion a year ago. Loans increased 5.1% to $1.18 billion, and total deposits reached $1.19 billion.

- Net interest income for Q3 2025 was $11.2 million, an 18.3% increase from the previous year, driven by a strengthening net interest margin.

- The Board of Directors declared a cash dividend of $0.36 per share, payable on November 6, 2025. Book value per share rose 6.1% to $16.95 as of September 30, 2025.

- Consolidated net income for the third quarter of 2025 was $3.4 million, a substantial increase from $1.3 million for the same period in 2024.

- Net interest income for Q3 2025 rose 18.3% to $11.2 million compared to $9.4 million in Q3 2024.

- The Board of Directors declared a quarterly cash dividend of $0.36 per share, payable on November 6, 2025.

- Total assets increased to $1.57 billion as of September 30, 2025, from $1.52 billion a year prior, with loans growing 5.1% to $1.18 billion.

- Book value per share strengthened by 6.1% to $16.95 as of September 30, 2025.

- Union Bankshares reported consolidated net income of $3.4 million for the three months ended September 30, 2025, an increase from $1.3 million for the same period in 2024.

- Total assets grew to $1.57 billion as of September 30, 2025, up from $1.52 billion a year prior, driven by a 5.1% increase in loans to $1.18 billion.

- Book value per share strengthened by 6.1% to $16.95 as of September 30, 2025, compared to $15.98 as of September 30, 2024.

- The Board of Directors declared a regular quarterly cash dividend of $0.36 per share, payable November 6, 2025.

Quarterly earnings call transcripts for UNION BANKSHARES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more