Earnings summaries and quarterly performance for UNION PACIFIC.

Executive leadership at UNION PACIFIC.

Jim Vena

Chief Executive Officer

Eric Gehringer

Executive Vice President, Operations

Carrie Powers

Vice President, Controller and Chief Accounting Officer

Craig Richardson

Executive Vice President, Chief Legal Officer and Corporate Secretary

Jennifer Hamann

Executive Vice President and Chief Financial Officer

Kenny Rocker

Executive Vice President, Marketing and Sales

Board of directors at UNION PACIFIC.

Christopher Williams

Director

David Dillon

Director

Deborah Hopkins

Director

Doyle Simons

Director

Jane Lute

Director

John Tien

Director

John Wiehoff

Director

Michael McCarthy

Chairman of the Board

Sheri Edison

Director

Teresa Finley

Director

Research analysts who have asked questions during UNION PACIFIC earnings calls.

Brandon Oglenski

Barclays

6 questions for UNP

Brian Ossenbeck

JPMorgan Chase & Co.

6 questions for UNP

David Vernon

Sanford C. Bernstein & Co., LLC

6 questions for UNP

Jonathan Chappell

Evercore ISI

6 questions for UNP

Ken Hoexter

BofA Securities

6 questions for UNP

Scott Group

Wolfe Research

6 questions for UNP

Walter Spracklin

RBC Capital Markets

5 questions for UNP

Ariel Rosa

Citigroup

4 questions for UNP

Christian Wetherbee

Wells Fargo

4 questions for UNP

Daniel Imbro

Stephens Inc.

4 questions for UNP

Stephanie Moore

Jefferies

4 questions for UNP

Tom Wadewitz

UBS Group

4 questions for UNP

Elliot Alper

TD Cowen

3 questions for UNP

Jason Seidl

TD Cowen

3 questions for UNP

Jeffrey Kauffman

Vertical Research Partners

3 questions for UNP

Jordan Alliger

Goldman Sachs

3 questions for UNP

Andre Kelleners

Goldman Sachs

2 questions for UNP

Ari Rosa

Citigroup Inc.

2 questions for UNP

Bascome Majors

Susquehanna Financial Group

2 questions for UNP

Chris Wetherbee

Wells Fargo & Company

2 questions for UNP

Richa Harnain

Deutsche Bank

2 questions for UNP

Thomas Wadewitz

UBS

2 questions for UNP

Andrzej Tomczyk

Goldman Sachs

1 question for UNP

Benjamin Nolan

Stifel

1 question for UNP

Christyne McGarvey

Morgan Stanley

1 question for UNP

Fadi Chamoun

BMO Capital Markets

1 question for UNP

Jairam Nathan

Daiwa Capital Markets

1 question for UNP

Joe Hafling

Jefferies

1 question for UNP

Joseph Lawrence Hafling

Jefferies

1 question for UNP

Madison

Morgan Stanley

1 question for UNP

Megan Onferrica

Deutsche Bank

1 question for UNP

Oliver Holmes

Redburn Atlantic

1 question for UNP

Ravi Shanker

Morgan Stanley

1 question for UNP

Recent press releases and 8-K filings for UNP.

- Union Pacific will refile its STB application for the Norfolk Southern merger by April 30, pursuing a mid-next-year closing and following additional information requests from the regulator.

- The company has eliminated ~$750 million in proposed concessions after traffic studies confirmed that 75% of expected growth will come from highway-to-rail conversion, equating to 2 million trucks removed from U.S. roads.

- Post-refiling, the STB will allow formal responses, potential hearings, and could shorten its review period from 90 to 45 days given prior familiarity with the application.

- Operations have rebounded from January weather: the network is running at 230–240 car-miles/day with sub-20 hour dwell, leading to a 2% QTD carload decline but year-over-year gains in February driven by grain, coal, plastics, and domestic intermodal demand.

- Excess cash will be deployed after M&A and capital investments, with shareholder returns prioritized via dividends and buybacks.

- Union Pacific will refile its STB merger application by April 30, 2026, remaining on track to close mid-next year.

- Proposed merger offers a seamless end-to-end network designed to remove 24–48 hours of handling, enhance competition, and shift 2 million truckloads off highways (75% from roads).

- Management removed an initial $750 million in anticipated customer concessions after detailed traffic origin-destination analysis deemed them unnecessary.

- Network operations rebounded from January weather to 230–240 car miles/day with sub-20 day dwell; February carloads are up YoY, led by grain, coal, petrochemicals, and domestic intermodal.

- Excess cash will be returned to shareholders through dividends and share repurchases after necessary capital investments.

- Merger application to be refiled by April 30, with STB review to follow; deal closure still targeted for mid/early 2027.

- Merger delivers end-to-end service, cutting car transit times by 24–48 hours, offering customer cost savings, environmental benefits (70% lower GHG vs trucks), and lifetime job guarantees for union employees.

- Removed $750 million of proposed pricing concessions after analysis showed 75% of growth will come from highway-to-rail conversions, making concessions unnecessary.

- Operations running at 230–240 car-miles/day with dwell times sub-20 hours; Q1 carloads down 2% but February volumes are up y/y, driven by bulk (grain, coal, plastics) and domestic intermodal growth; management plans to return excess cash to shareholders after M&A.

- Union Pacific and Wabtec agreed to a US$1.2 billion program to modernize AC4400 locomotives, the largest single locomotive modernization in rail industry history.

- Upgrades include the FDL Advantage engine, LOCOTROL Expanded Architecture and new Modular Control Architecture for next-generation data, diagnostics and software capabilities.

- The program is expected to reduce fuel consumption by over 5%, boost tractive effort by about 14% and improve reliability by roughly 80%, extending fleet life.

- Production will occur at Wabtec’s U.S. facilities, with deliveries starting in 2027, and the agreement was signed in Q4 2025.

- This is Wabtec’s fourth major modernization order from Union Pacific since 2018, bringing total modernized units to over 1,700 across UP’s fleet.

- Union Pacific and Wabtec signed a $1.2 billion agreement to modernize AC4400 locomotives—the largest locomotive-modernization investment in rail industry history.

- The upgrades are expected to deliver >5% fuel savings, a 14% increase in tractive effort, and an 80% improvement in reliability, enhancing operational efficiency and service reliability.

- Signed in Q4 2025, the deal builds on a prior 2022 order (due for completion in 2026) and will result in over 1,700 modernized locomotives, with deliveries beginning in 2027 from Wabtec’s U.S. facilities.

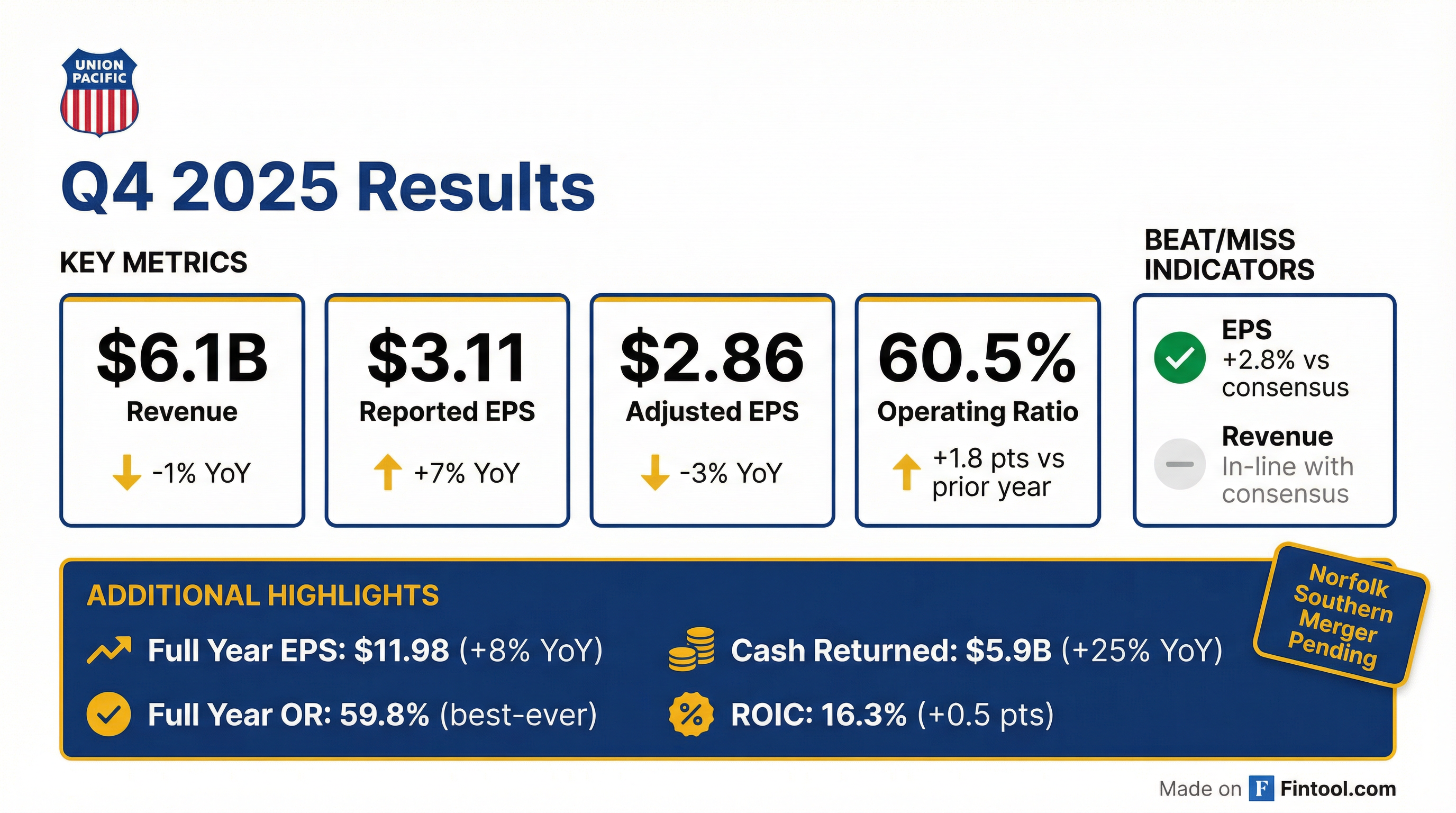

- Q4 operating revenue was $6.085 billion, with operating income of $2.401 billion (down 5% YoY) and net income of $1.848 billion (up 5% YoY); diluted EPS rose 7% to $3.11.

- Reported Q4 operating ratio deteriorated to 60.5% (versus 58.7% in Q4 2024); adjusted operating ratio was 60.0%.

- For full year 2025, operating income reached $9.8 billion, operating ratio improved to 59.8%, and EPS was $11.98.

- 2026 outlook calls for mid-single-digit EPS growth, further operating ratio improvement, and a $3.3 billion capital plan.

- Union Pacific delivered 2025 full-year net income of $7.1 billion (+6%), EPS of $11.98 (+8%), and freight revenue ex-fuel up 3%; full-year adjusted operating ratio improved to 59.3%.

- In Q4, operating revenue was $6.1 billion (-1%), freight revenue $5.8 billion (-1% on 4% lower volume), adjusted EPS $2.86, and adjusted operating ratio 60%.

- Full-year cash from operations totaled $9.3 billion; returned $5.9 billion to shareholders (+25%) via dividends and buybacks; year-end adjusted debt/EBITDA was 2.7×.

- 2026 outlook calls for mid-single-digit EPS growth, with price dollars exceeding ~4% inflation, $3.3 billion CapEx, and an expected improvement in operating ratio.

- Merger with Norfolk Southern remains on track for H1 2027 despite an STB request for additional information.

- Q4 2025 operating revenue of $6.1 B (–1% YoY), operating income of $2.4 B (–5%), EPS of $3.11 (record; adjusted EPS $2.86) and an adjusted operating ratio of 60%. Full-year cash from operations was $9.3 B, with $5.9 B returned to shareholders (up 25%) through dividends and buybacks.

- 2026 guidance anticipates mid-single-digit EPS growth, an improved operating ratio versus 2025 and $3.3 B in capital expenditures; price dollars are expected to exceed ~4% inflation despite volume and cost headwinds.

- Merger with Norfolk Southern remains on track for H1 2027 close; the STB has requested further detail, with a response expected in March, and the transaction is projected to drive $2 B in net revenue synergies.

- Continued operational excellence delivered record safety, service, fluidity and productivity metrics, with workforce levels down 5% and freight revenue performance supported by pricing and mix gains amid lower volumes.

- Full-year 2025 net income of $7.1 billion (+6%) and EPS of $11.98 (+8%), with freight revenue ex-fuel up 3%; adjusted operating ratio improved 60 bps to 59.3%

- Q4 2025 operating revenue of $6.1 billion (–1%), freight revenue down 1% on 4% lower volume, other revenue of $326 million (–2%); net income reached a record $1.8 billion and EPS was $3.11; adjusted EPS $2.86 and adjusted OR 60%

- Initial 2026 guidance calls for mid-single-digit EPS growth, operating ratio improvement versus 2025, and $3.3 billion of capital expenditures

- Merger with Norfolk Southern remains on track for first half of 2027 closing; STB requested additional information with no expected material delay

- Q4 diluted EPS of $3.11 and adjusted EPS of $2.86; Q4 operating ratio of 60.5% (adjusted 60.0%)

- Full year diluted EPS of $11.98 and adjusted EPS of $11.66; full year operating ratio of 59.8% (adjusted 59.3%)

- Q4 operating revenue of $6.1 billion, down 1%; full year operating revenue of $24.5 billion, up 1%

- Q4 net income of $1.8 billion and full year net income of $7.1 billion, a 6% year-over-year increase

- Full year return on invested capital of 16.3%

Fintool News

In-depth analysis and coverage of UNION PACIFIC.

Union Pacific and Wabtec Ink $1.2 Billion Locomotive Deal — Largest Modernization Program in Rail History

STB Rejects $85 Billion Union Pacific-Norfolk Southern Merger Application as 'Incomplete'

Union Pacific and Norfolk Southern File $85 Billion Merger to Create America's First Transcontinental Railroad

Quarterly earnings call transcripts for UNION PACIFIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more