Earnings summaries and quarterly performance for Venu Holding.

Executive leadership at Venu Holding.

Board of directors at Venu Holding.

Research analysts who have asked questions during Venu Holding earnings calls.

Recent press releases and 8-K filings for VENU.

Venu Holding Corporation Reports Preliminary Q4 and Full-Year 2025 Results and Announces Public Offering

VENU

Earnings

New Projects/Investments

Guidance Update

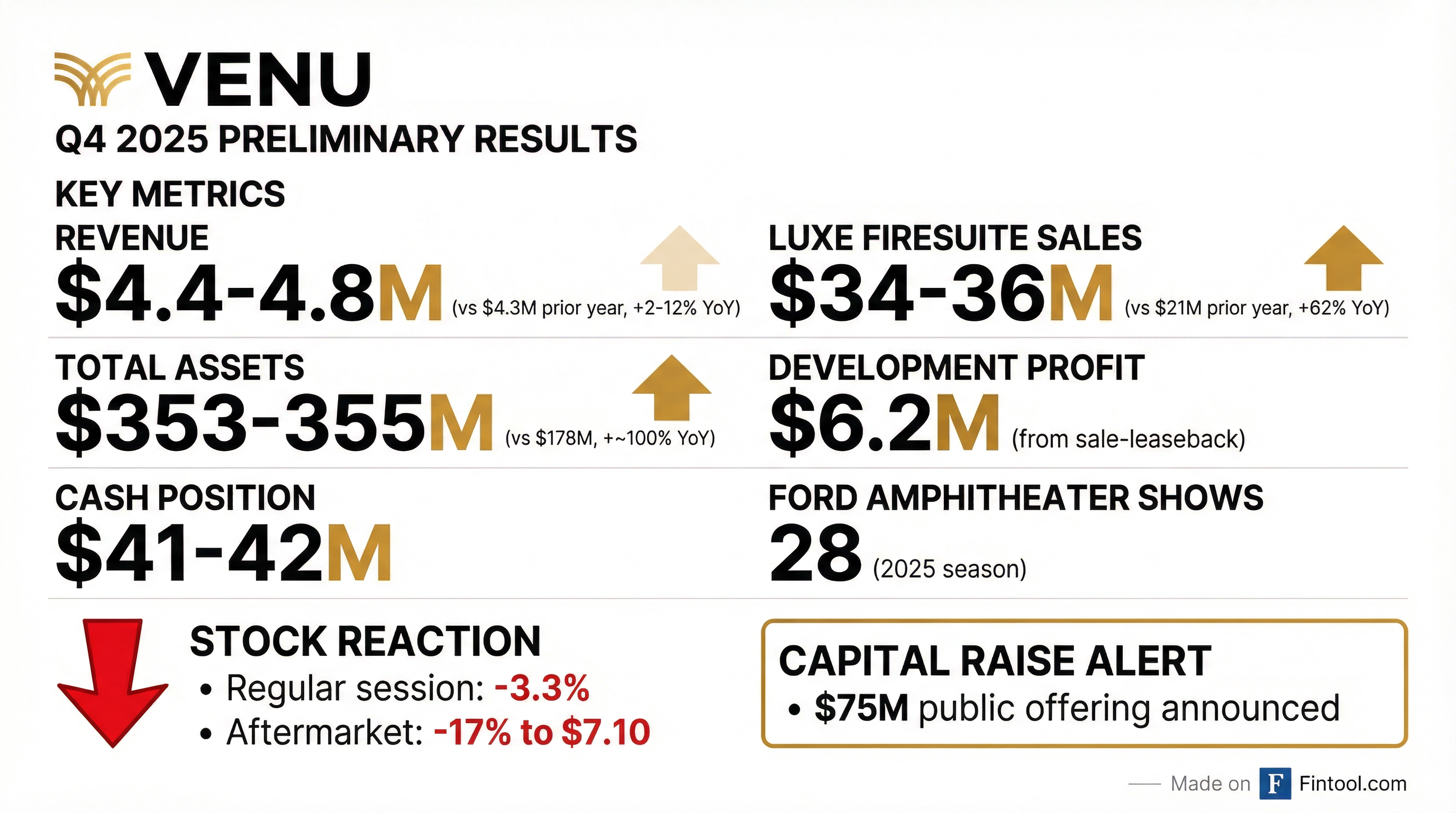

- Venu Holding Corporation reported preliminary Q4 2025 total revenues estimated between $4.4 million to $4.8 million and full-year 2025 total revenues estimated between $17.8 million to $18.7 million.

- The company's total assets grew by 98%-100% year-over-year to an estimated $352.8 million to $355.4 million as of December 31, 2025.

- Luxe FireSuite and Aikman Club sales for the full year 2025 increased by 62% to an estimated $125.3 million to $126.8 million.

- The company announced a registered underwritten public offering of $75,000,000 of common stock to fund development costs for new venues and for working capital.

- Venu recognized its first development profit of $6.2 million in Q4 2025 and its CEO expects the company to become operationally profitable by the end of 2026.

Jan 27, 2026, 10:25 PM

Venu Holding Corporation Amends Aramark Agreement, Secures Additional Equity Investment

VENU

New Projects/Investments

Convertible Preferred Issuance

- Venu Holding Corporation (VENU) and Aramark Sports and Entertainment Services, LLC entered into a First Amendment to their Binding Letter of Intent on January 5, 2026.

- This amendment expands Aramark's exclusive service provision to two additional amphitheaters to be constructed in El Paso, TX and the greater Houston, TX area.

- In connection with the amendment, Aramark committed an additional $10,005,000 equity investment in Venu Holding Corporation.

- This investment involves the purchase of 667 additional shares of Series B 4% Cumulative Convertible Preferred Stock, with $4,995,000 due by January 20, 2026, and $5,010,000 on October 15, 2026.

- To facilitate this, the company filed an amendment to increase the designated Series B Preferred Stock from 675 shares to 1,342 shares.

Jan 9, 2026, 8:39 PM

Venu Holding Corp Enters Operator Agreement with Live Nation

VENU

New Projects/Investments

- Venu Holding Corporation (VENU) entered into an Operator Agreement with Live Nation Worldwide, Inc. on December 10, 2025, for the amphitheater being developed by VENU in McKinney, Texas, named The Sunset McKinney.

- Under the agreement, Live Nation will lease the premises and serve as the exclusive booking agency for all events, with an initial five-year term and options for extension.

- The financial terms include a revenue-sharing arrangement where Live Nation will pay VENU a percentage of net profits, a fixed per-ticket rent payment, and VENU will retain all sponsorship and naming rights.

- The effectiveness of the agreement is subject to certain conditions precedent, and the expected delivery date for the premises is on or before March 15, 2027.

Dec 12, 2025, 12:00 PM

VENU Holding Corporation Reports Q3 2025 Financial Results and Strategic Progress

VENU

Earnings

New Projects/Investments

Convertible Preferred Issuance

- VENU Holding Corporation's total assets increased to $314.8 million as of September 30, 2025, marking a 76% increase from year-end 2024, with property and equipment growing to $250.2 million. The company reported a net loss of $(9.3) million for the third quarter of 2025, compared to $(4.5) million in the third quarter of 2024.

- The company's "net revenue," defined as profit after its split with AEG Presents Rocky Mountains and including naming rights agreements, increased by approximately 24% year-over-year to $1,999,169 for the three months ended September 30, 2025.

- VENU expanded its national footprint and strategic alliances, forming a partnership with Primary Wave Music and welcoming globally recognized artists Niall Horan and Dierks Bentley as shareholders and advisory council members.

- Key real estate milestones include an independent appraisal valuing the Colorado Springs campus at $186 million, a 46% increase over cost, and the completion of a sale-leaseback on its primary parking structure, which generated $6.2 million in development profit. The company also announced the groundbreaking for the new 12,500-seat Sunset Amphitheater in El Paso, supporting its goal of 40 total locations by 2030.

Nov 17, 2025, 2:00 PM

VENU Holding Corporation Reports Strong Q3 2025 Financials and Details Development Pipeline

VENU

Earnings

New Projects/Investments

Convertible Preferred Issuance

- VENU Holding Corporation develops live entertainment venues through public-private partnerships, utilizing an innovative financing model where 40% of funding comes from municipalities, 40% from the pre-sale of fractional ownerships, and 20% from the sale-leaseback of real estate.

- For the nine months ended September 30, 2025, VENU reported net revenue of $2,768,463, representing a 72% increase year-over-year compared to the same period in 2024.

- As of September 30, 2025, total assets increased by 76% to $314.8 million from $178.4 million at December 31, 2024, and Luxe FireSuite and Aikman Club sales reached $91.1 million, up 58% from September 30, 2024.

- VENU has a robust development pipeline, including amphitheaters in McKinney, TX, Tulsa, OK, and El Paso, TX, which are currently under construction or in design, with estimated deliveries ranging from Q3/Q4 2026 to 2027.

Nov 13, 2025, 11:00 PM

Venu Holding Corporation Completes Sale-Leaseback Transaction

VENU

M&A

New Projects/Investments

- Venu Holding Corporation, through its wholly-owned subsidiary Notes Live Real Estate, LLC, completed a sale-leaseback transaction on November 5, 2025, involving an approximately 5.5-acre parcel of property used as the primary parking structure for its Ford Amphitheater.

- The property was sold to Belmont Manor Apartments, LLC, an entity wholly owned by a significant shareholder of Venu, for a purchase price of $14,000,000.00.

- The purchase price was paid with $7,600,000.00 in cash and $6,400,000.00 in Venu common stock, which the company intends to retire into treasury.

- As part of the transaction, Venu's subsidiary will lease the property back with an initial annual base rent of $1,050,000, and retains an option to repurchase the property for $17,500,000.00 at any time during the three-year period following the closing date.

Nov 10, 2025, 10:00 PM

Venu Holding Corporation Launches Artist 280 Travel Services

VENU

Product Launch

New Projects/Investments

- Venu Holding Corporation (VENU) launched its "Artist 280" travel services on October 17, 2025, to provide first-class private air and travel services to music artists performing at its venues.

- This initiative is expected to generate significant cost efficiencies by replacing third-party travel providers, with over 200 annual shows anticipated from initial amphitheaters by 2027.

- Artist 280, a wholly-owned subsidiary, will operate an owned aircraft (partially funded by a PNC Bank loan in September 2025) through an FAA-certified air carrier.

Oct 17, 2025, 8:15 PM

Venu Holding Corporation Completes $34.5 Million Public Offering

VENU

New Projects/Investments

- Venu Holding Corporation priced an underwritten public offering of 2,500,000 shares of common stock at $12.00 per share, generating $30 million in gross proceeds.

- The company also granted the underwriters a 45-day option to purchase up to an additional 375,000 shares to cover over-allotments.

- The offering closed on August 28, 2025, with the full exercise of the over-allotment option, resulting in a total of 2,875,000 shares sold for gross proceeds of $34,500,000.

- The net proceeds to the company, approximately $32.0 million, will be used to fund development costs for the Sunset McKinney and Sunset Broken Arrow, and for working capital and other general corporate purposes.

Aug 28, 2025, 9:20 PM

Quarterly earnings call transcripts for Venu Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more