Earnings summaries and quarterly performance for Vulcan Materials.

Executive leadership at Vulcan Materials.

Board of directors at Vulcan Materials.

Cynthia L. Hostetler

Director

David P. Steiner

Director

George A. Willis

Director

James T. Prokopanko

Director

Kathleen L. Quirk

Director

Lee J. Styslinger, III

Director

Lydia H. Kennard

Director

Melissa H. Anderson

Director

O. B. Grayson Hall, Jr.

Independent Lead Director

Richard T. O’Brien

Director

Thomas A. Fanning

Director

Research analysts who have asked questions during Vulcan Materials earnings calls.

Garik Shmois

Loop Capital Markets

7 questions for VMC

Kathryn Thompson

Thompson Research Group

7 questions for VMC

Michael Dudas

Vertical Research Partners

7 questions for VMC

Trey Grooms

Stephens Inc.

7 questions for VMC

Angel Castillo Malpica

Morgan Stanley

5 questions for VMC

David Macgregor

Longbow Research

5 questions for VMC

Keith Hughes

Truist Financial Corporation

5 questions for VMC

Steven Fisher

UBS

5 questions for VMC

Timna Tanners

Wolfe Research

5 questions for VMC

Ivan Yi

Wolfe Research, LLC

4 questions for VMC

Tyler Brown

Raymond James Financial, Inc.

4 questions for VMC

Adam Thalhimer

Thompson, Davis & Company, Inc.

3 questions for VMC

Andrew Maser

Stifel Financial Corp.

3 questions for VMC

Asher Sohnen

Citigroup Inc.

3 questions for VMC

Jerry Revich

Goldman Sachs Group Inc.

3 questions for VMC

Michael Feniger

Bank of America

3 questions for VMC

Philip Ng

Jefferies

3 questions for VMC

Angel Castillo

Morgan Stanley & Co. LLC

2 questions for VMC

Anthony Pettinari

Citigroup Inc.

2 questions for VMC

Asher Sohnen

Citigroup

2 questions for VMC

Brian Brophy

Stifel Financial Corp

2 questions for VMC

Jesse Barone

Jefferies Financial Group Inc.

2 questions for VMC

Michael Dahl

RBC Capital Markets

2 questions for VMC

Adam Falheimer

Thompson Davis

1 question for VMC

Adrian Huerta

JPMorgan Chase & Co.

1 question for VMC

Brent Thielman

D.A. Davidson

1 question for VMC

Jean Veliz

D.A. Davidson Companies

1 question for VMC

Joe Nolan

Longbow Research

1 question for VMC

Patrick Brown

Raymond James

1 question for VMC

Recent press releases and 8-K filings for VMC.

- FY 2025 total revenues of $7,941 M, up 7% year-over-year.

- FY 2025 Adjusted EBITDA of $2,324 M, up 13%, with margin expanding to 29.3% (+160 bps).

- Aggregates segment: volume +3%, mix-adjusted pricing +6%, delivering cash gross profit per ton of $11.33 (+7%).

- Operating cash flow of $1.8 B, up 29%; capital returned via $438 M in share repurchases and $260 M in dividends.

- 2026 outlook: aggregates volume growth of 1–3%, pricing up 4–6%, and Adjusted EBITDA of $2.4–2.6 B.

- In 2025, Adjusted EBITDA of $2.3 billion represented a 13% increase and margin expansion of 160 bps to 29.3%.

- Aggregate shipments reached 227 million tons (+3%), with cash gross profit per ton of $11.33, hitting target levels despite same-store volume softness.

- The company generated over $1.8 billion of operating cash flow (+29%) and free cash flow up 40% after $678 million of CapEx, returning $260 million in dividends and $438 million in share repurchases; net debt/EBITDA ended at 1.8x.

- 2026 guidance forecasts aggregate volume growth of 1–3%, price increases of 4–6%, low-single-digit cost inflation, and Adjusted EBITDA of $2.4–2.6 billion, with CapEx of $750–800 million.

- Adjusted EBITDA of $2.3 billion in FY 2025, up 13% year-over-year, with margin expansion of 160 bps to 29.3%

- Aggregates shipments of 227 million tons, +3% (driven by acquisitions; same-store volumes slightly below prior year), and cash gross profit per ton up 7% to $11.33

- Generated $1.8 billion in operating cash flow (+29%), returned $260 million via dividends and $438 million through share repurchases; net debt/EBITDA at 1.8× after $2 billion of note issuance and $550 million commercial paper repayment

- 2026 outlook: Adjusted EBITDA of $2.4–2.6 billion; aggregates shipments growth of 1–3%, selling prices +4–6%, unit costs up low single-digit; CapEx of $750–800 million

- Vulcan delivered $2.3 billion Adjusted EBITDA in 2025, a 13% increase over prior year, with margin expansion to 29.3%, operating cash flow of over $1.8 billion, and 227 million tons of aggregate shipments (+3%).

- Achieved $11.33 cash gross profit per ton in aggregates, driving >40% free cash flow growth after $678 million of CapEx, reducing leverage to 1.8× net debt/EBITDA, and returning $698 million to shareholders via $260 million of dividends and $438 million of share repurchases.

- 2026 guidance calls for aggregate shipments to grow 1–3%, freight-adjusted ASP up 4–6%, unit cash costs up low single-digits, resulting in high single-digit growth in cash gross profit per ton and $2.4–2.6 billion of Adjusted EBITDA; CapEx of $750–800 million.

- Demand outlook underpinned by continued public infrastructure spending (IIJA tail, highway starts +24% in Vulcan markets), a robust data center pipeline (>150 million sq ft under construction), and modest private non-residential growth, while single-family housing activity remains subdued.

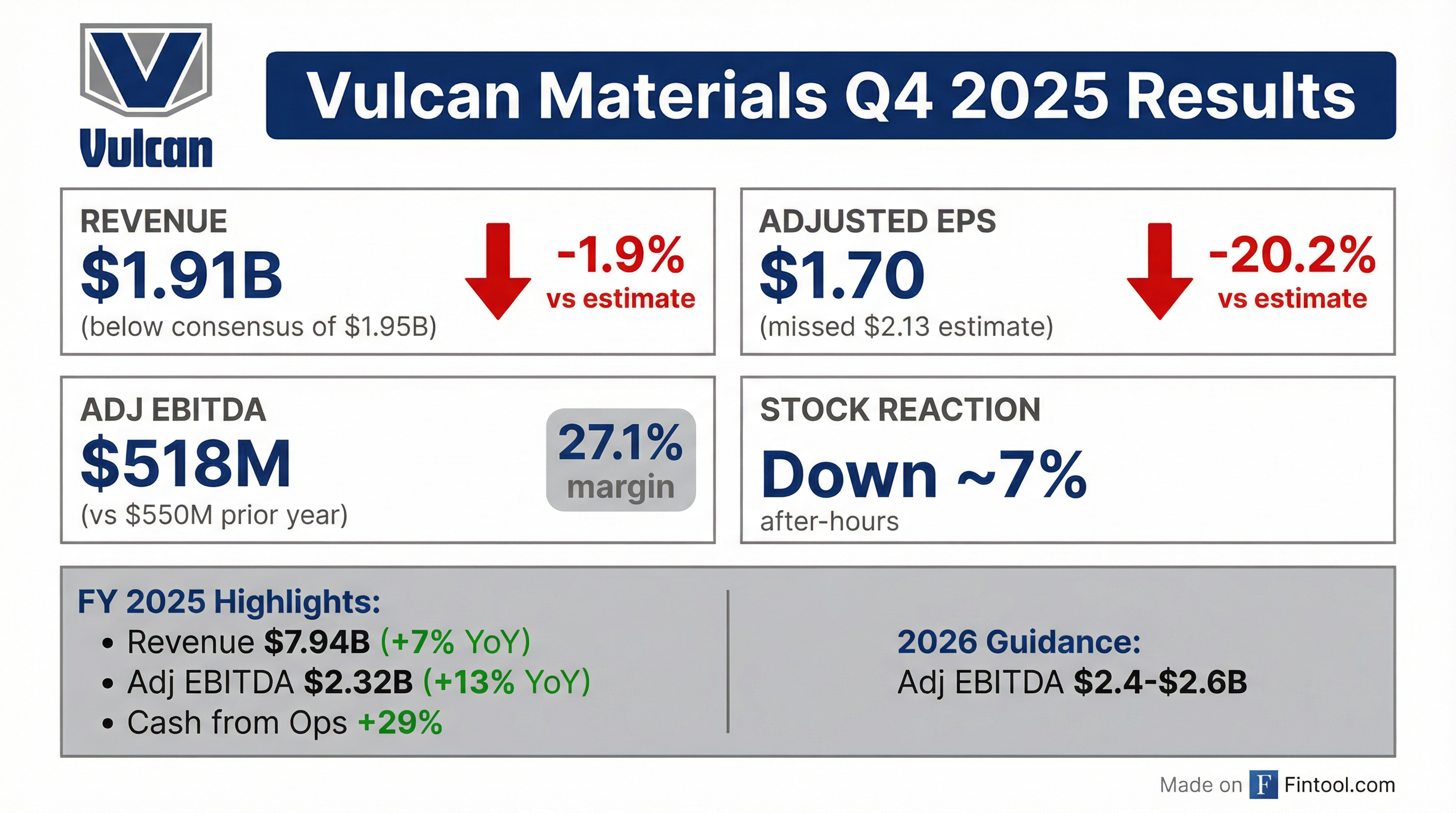

- Vulcan saw FY 2025 revenues of $7.94 billion (+7%) and Q4 revenues of $1.91 billion.

- Adjusted EBITDA grew 13% to $2.324 billion, with margin expansion to 29.3% in 2025 from 27.7% in 2024.

- Operating cash flow rose 29% to $1.8 billion, capital expenditures were $703 million, and $698 million was returned to shareholders via $438 million of buybacks and $260 million of dividends.

- Net debt/Adjusted EBITDA was 1.8× at year-end and total debt/EBITDA was 1.9×, reflecting strong leverage metrics.

- 2026 outlook: $2.4 billion to $2.6 billion of Adjusted EBITDA, with aggregates shipments up 1–3% and price growth of 4–6%.

- Total revenues of $1.913 billion in Q4 (+3% YoY) and $7.941 billion for FY 2025 (+7% YoY).

- Adjusted EBITDA of $518 million in Q4 (27.1% margin) and $2.324 billion for FY 2025 (29.3% margin), with net earnings of $252 million in Q4 and $1.077 billion for the year.

- Operating cash flow rose 29% to $1.8 billion; full-year capital expenditures were $703 million, with $438 million returned via share repurchases and $260 million in dividends.

- Aggregates shipments of 55.1 million tons in Q4 (+2% YoY) and 226.8 million tons for FY 2025 (+3% YoY), delivering full-year cash gross profit per ton of $11.33 (+7% YoY).

- 2026 outlook: expects Adjusted EBITDA of $2.4–$2.6 billion, shipments up 1–3%, price improvement of 4–6%, SAG expense of $580–$590 million and capex of $750–$800 million.

- The Board declared a $0.52 per share quarterly cash dividend, payable March 23, 2026, to shareholders of record on March 9, 2026.

- This represents a 6% increase from the prior dividend of $0.49 and marks the ninth consecutive year of dividend hikes.

- Vulcan Materials, a member of the S&P 500, is the nation’s largest producer of construction aggregates, including crushed stone, sand and gravel.

- Vulcan Materials shares surged to an all-time high of $313.37, reflecting robust pricing discipline and sustained demand for aggregates.

- The rally coincides with converging megatrends—AI data-center buildouts, infrastructure spending, reshoring and energy transition—driving accelerated materials demand.

- Q4 2025 earnings will be released before market open, with the conference call scheduled for February 17, 2026.

- Vulcan Materials reported Q3 adjusted EPS of $2.84, revenue of $2.29 billion, and net income of $374.9 million.

- Aggregates shipments rose about 12% to 64.7 million tons, with aggregates revenue of $1.79 billion and gross profit of $612.1 million.

- Freight-adjusted average sales price climbed to $22.01 /ton, lifting freight-adjusted revenues 15.9% to $1.42 billion, and expanding gross margin by 250 bps to 34.2%.

- Management reiterated 2025 adjusted EBITDA guidance of $2.35–$2.45 billion and now anticipates mid-single-digit shipment growth.

- Management cited strength in public construction and expects an improving private nonresidential outlook into 2026.

- Q3 2025 revenues of $2.29 billion (+14%), aggregates cash gross profit per ton of $11.84 (+9%), adjusted EBITDA of $735 million (+27%) and margin expansions to 34.2% and 32.1%, respectively.

- Year-to-date through Q3, generated $1.71 billion of operating cash flow, maintained a 1.9× Debt/TTM EBITDA ratio, invested $655 million in maintenance and growth, deployed $2.07 billion on strategic acquisitions, and returned $294 million to shareholders.

- 2025 guidance raised to $2.35 – 2.45 billion of adjusted EBITDA (≈17% growth at midpoint), with full-year aggregates shipments expected to grow ~3%.

- Preliminary 2026 outlook projects modest volume growth, mid-single-digit pricing gains, cost benefits from operational execution, and continued improvement in aggregates cash gross profit per ton.

Quarterly earnings call transcripts for Vulcan Materials.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more