Earnings summaries and quarterly performance for CEMEX SAB DE CV.

Research analysts who have asked questions during CEMEX SAB DE CV earnings calls.

Wilfredo Jorel Guilloty

Goldman Sachs

8 questions for CX

Adrian Huerta

JPMorgan Chase & Co.

7 questions for CX

Alejandra Obregon

Morgan Stanley

7 questions for CX

Anne Milne

Bank of America Merrill Lynch

7 questions for CX

Gordon Lee

BTG Pactual

7 questions for CX

Francisco Suarez

Scotiabank

6 questions for CX

Yassine Touahri

On Field Investment Research

6 questions for CX

Paul Roger

BNP Paribas

5 questions for CX

Benjamin Theurer

Barclays Corporate & Investment Bank

4 questions for CX

Carlos Peyrelongue

Bank of America

4 questions for CX

Adam Thalhimer

Thompson, Davis & Company, Inc.

3 questions for CX

Ben Theurer

Barclays

3 questions for CX

Marcelo Furlan

Itau

3 questions for CX

Anna Schumacher

BNP Paribas

2 questions for CX

Arnaud Pinatel

Onfield

2 questions for CX

Daniel Rojas

Bank of America Corporation

2 questions for CX

Alberto Valerio

UBS Group AG

1 question for CX

Alejandra Obregón Martínez

Morgan Stanley

1 question for CX

Anne Jean Milne

BofA Securities

1 question for CX

Benjamine Theurer

Barclays

1 question for CX

Daniel Sasson

Itaú BBA

1 question for CX

José Itzamna Espitia Hernández

BBVA México

1 question for CX

Recent press releases and 8-K filings for CX.

- CEMEX is committed to returning 40%-50% of free cash flow to shareholders by 2030 through progressive dividends and share buybacks, having already announced a 40% increase in dividends and completed $99.9 million in share buybacks at an average price of $12.70. The company anticipates generating $2.5 billion in free cash flow in 2026 and 2027.

- The target for structural savings from Project Cutting Edge has been increased to $400 million, with $200 million from global overhead reduction already secured. Additionally, business reviews have identified incremental opportunities for $80 million-$120 million in EBITDA and $100 million-$150 million in free cash flow.

- CEMEX is reorienting its growth strategy to materially reduce strategic CapEx, instead allocating 40%-50% of cash to bolt-on acquisitions, primarily in U.S. aggregates and adjacent synergetic businesses. This includes the recently announced acquisition of Omega, a stucco producer with $110 million in revenue and $23 million in EBITDA (before synergies), acquired at a multiple below 7x after synergies. The company also expects at least $1 billion in divestitures to be recycled into U.S. bolt-ons.

- For the second half of 2025, CEMEX reported an 8% growth in top line, 17% in EBITDA, and 25% in EBITA, with a 160 basis point expansion in EBITDA margin. The company is committed to achieving 10% EBITDA growth annually over the 2025-2027 sprint and aims to increase ROIC by almost 200 basis points.

- CEMEX is undergoing a strategic transformation focused on putting investors at the center, targeting $3.7 billion EBITDA by 2027 (10% CAGR from 2025) and 47% free cash flow conversion from operations by the end of 2027. This growth is largely driven by self-help measures (55%).

- The company is committed to maintaining an investment-grade credit rating and plans to distribute 40%-50% of free cash flow to shareholders by 2030 through progressive dividends and share buybacks. CEMEX has already initiated $100 million in share buybacks and proposed a 40% increase in dividends.

- CEMEX announced the acquisition of Omega, a stucco producer with $110 million revenue and $23 million EBITDA before synergies, with an acquisition multiple below 7x after synergies. The company also expects at least $1 billion in divestitures during the current sprint, with proceeds recycled into bolt-on acquisitions, primarily in US aggregates and adjacent businesses.

- CapEx and interest expenses are projected to reduce by $500 million in 2026 compared to 2024, with $327 million from CapEx and $160 million from interest.

- CEMEX has introduced a new three-year sprint (2025-2027) with key financial targets for 2027, including $3.7 billion in EBITDA (a 10% compounded annual growth rate from 2025), a 14% EBIT CAGR, a 170 basis point expansion in ROIC, and at least 47% free cash flow conversion from operations.

- The company is committed to robust shareholder returns, announcing a 40% increase in dividends (subject to shareholder meeting approval in March) and initiating a $500 million share buyback program, with $99.9 million already purchased as of yesterday at an average price of $12.70. CEMEX aims to return 40%-50% of its free cash flow to shareholders by 2030.

- The strategic focus includes a new capital allocation framework prioritizing risk-adjusted shareholder returns and maintaining an investment-grade credit rating. 55% of the targeted growth relies on self-help measures, and the company expects at least $1 billion of divestitures during the sprint, with proceeds recycled into U.S. bolt-on acquisitions.

- In the second half of 2025, CEMEX achieved 8% top-line growth, 17% EBITDA growth, and 25% EBITA growth, with a 160 basis point expansion in EBITDA margin. The company also projects a $500 million reduction in CapEx and interest expenses in 2026 compared to 2024.

- CEMEX reported Net Sales of $16.1 billion, EBITDA of $3.1 billion, and EBIT of $1.8 billion for 2025, and targets $17.8 billion in Sales, $3.7 billion in EBITDA, and $2.3 billion in EBIT by 2027, with EBITDA and EBIT growing at 10% and 14% CAGRs respectively.

- The company's "Project Cutting Edge" is expected to deliver $400 million in recurrent EBITDA savings by 2027, and it is transitioning its investment strategy to bolt-on M&A, including the acquisition of Omega.

- CEMEX is implementing a new capital allocation framework, targeting 40-50% of Free Cash Flow for shareholder return, which includes a 40% growth in dividend in 2026 and an intent to repurchase up to $500 million in shares over the next 3 years.

- The company aims to reduce its Total Net Financial Leverage from 2.26x in 2025 to 1.5x-2.0x and expand its ROIC spread by 170 bps by 2027, with Free Cash Flow from Operations conversion rate targeted at 47% by 2027.

- CEMEX is leading European decarbonization efforts, with 507 gross CO2 emissions per ton of cement in 2025, which is 19% ahead of the Cement Europe 2030 Target, and expects its carbon allowances to cover emissions through 2029.

- Cemex, S.A.B. de C.V. (CX) announced an agreement to acquire Omega Products International, a leading stucco manufacturer in the western U.S..

- Omega Products International generates approximately US$23 million in EBITDA per year.

- The acquisition is expected to strengthen Cemex's position in the U.S. broader mortars market and is anticipated to close during the first quarter of 2026.

- Cemex has reached an agreement to acquire Omega Products International, a leading stucco manufacturer in the western United States.

- Omega generates approximately US$23 million in EBITDA per year.

- This acquisition strengthens Cemex's position in the U.S. broader mortars market and aligns with its U.S. growth strategy.

- The transaction is expected to close during the first quarter of 2026.

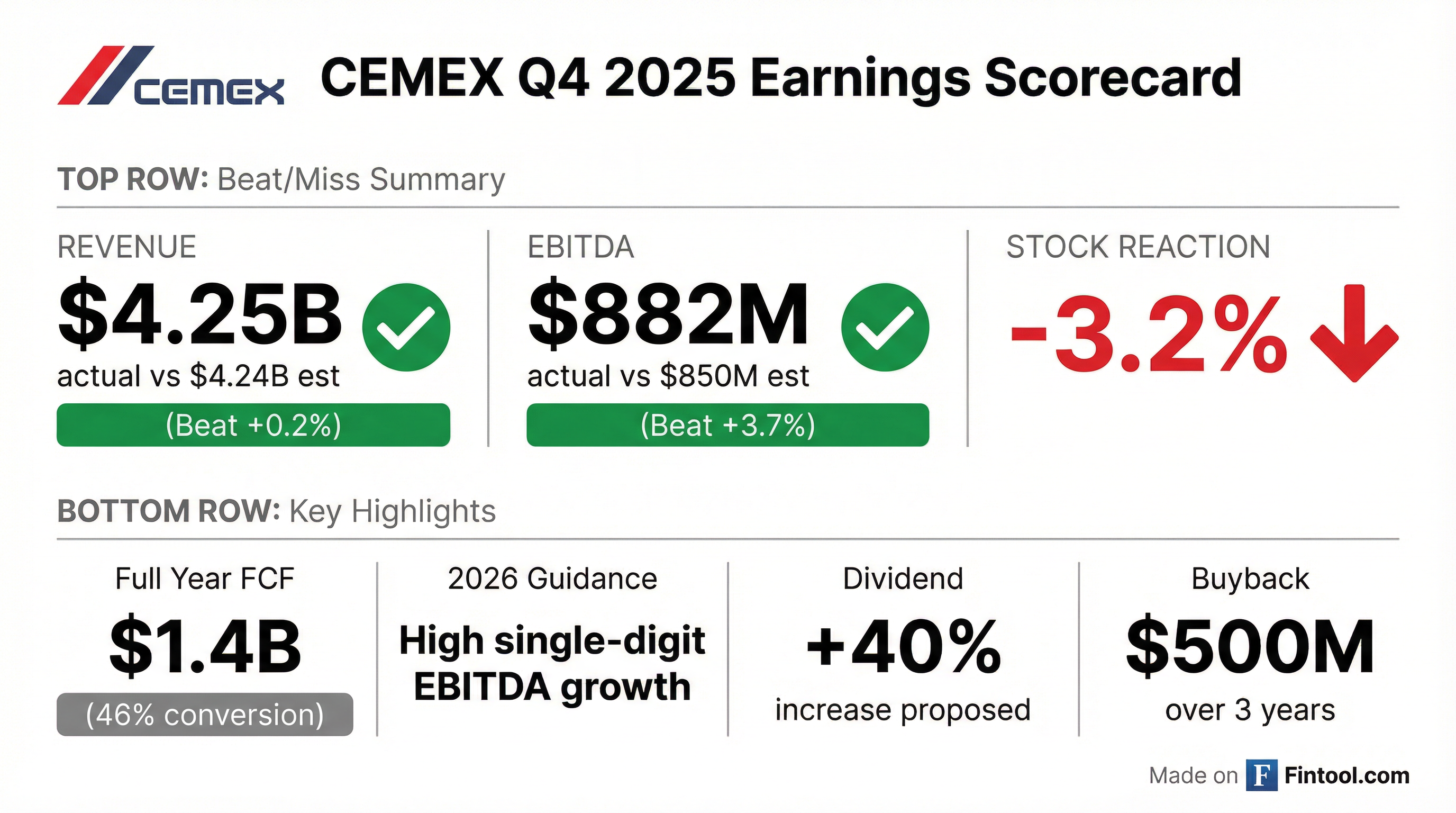

- CEMEX reported $1.4 billion in free cash flow from operations for full year 2025, achieving a 46% conversion rate (adjusted for one-off items) and fully realizing its $200 million EBITDA recurring savings target from Project Cutting Edge.

- For 2026, the company guides for high single-digit EBITDA growth, anticipating $165 million in incremental savings from Project Cutting Edge and $80 million in incremental EBITDA from completed growth portfolio projects.

- The board plans to propose an annual cash dividend close to 40% higher than 2025 and will activate a share buyback program of up to $500 million over the next three years, subject to shareholder approval.

- In Q4 2025, Mexico's EBITDA increased by 20% like-for-like with a 5 percentage point margin expansion, the U.S. posted record Q4 EBITDA, and EMEA achieved record EBITDA and EBITDA margin for full year 2025.

- CEMEX reported $1.4 billion in free cash flow from operations in 2025, with a 46% conversion rate, and an adjusted net income of $1.5 billion, a 41% increase year-over-year.

- The company fully achieved its $200 million EBITDA recurring savings target for 2025 under Project Cutting Edge and expanded the program to target $400 million in recurring savings by 2027.

- For 2026, CEMEX anticipates high single-digit rate growth in EBITDA, driven by a more favorable demand environment, $165 million in incremental Project Cutting Edge savings, and $80 million from completed growth projects.

- The board will propose an annual cash dividend of $180 million, representing an almost 40% increase over the prior year, and plans to activate a share buyback program of up to $500 million over the next three years, subject to shareholder approval.

- CEMEX reported $1.4 billion in adjusted free cash flow from operations in 2025, achieving a 46% conversion rate, and an adjusted net income of $1.5 billion, representing a 41% increase.

- The company fully realized $200 million in EBITDA recurring savings from Project Cutting Edge in 2025 and anticipates high single-digit EBITDA growth for 2026, supported by an additional $125 million in savings and an expected more favorable demand environment.

- To enhance shareholder returns, CEMEX's board will propose an annual cash dividend close to 40% higher than 2025, totaling $180 million, and plans to activate a buyback program for up to $500 million in shares over the next three years.

- CEMEX continued its portfolio rebalancing by divesting most operations in Panama and investing in targeted businesses in the U.S., while aiming to reach and maintain a net total financial leverage target of 1.5-2 times.

- Sales for the fourth quarter of 2025 increased by 11% to $4,179,704 thousand, while full-year 2025 sales remained flat at $16,131,879 thousand.

- Operating EBITDA for Q4 2025 grew by 16% to $781,034 thousand, and for the full year 2025, it increased by 1% to $3,080,073 thousand.

- CEMEX reported a controlling interest net loss of $(355,518) thousand or $(0.25) per ADS in Q4 2025, contrasting with a net income of $48,309 thousand or $0.03 per ADS in Q4 2024. However, full-year 2025 controlling interest net income increased by 2% to $960,158 thousand, or $0.66 per ADS.

- Consolidated cement volume in Q4 2025 increased by 4% to 13,361 thousand metric tons, while ready-mix volume decreased by 3% to 10,715 thousand cubic meters, and aggregates volume increased by 2% to 33,847 thousand metric tons.

Quarterly earnings call transcripts for CEMEX SAB DE CV.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more