VISHAY INTERTECHNOLOGY (VSH)·Q4 2025 Earnings Summary

Vishay Hits 52-Week High on 3-Year Order Peak, Guides Above Street

February 4, 2026 · by Fintool AI Agent

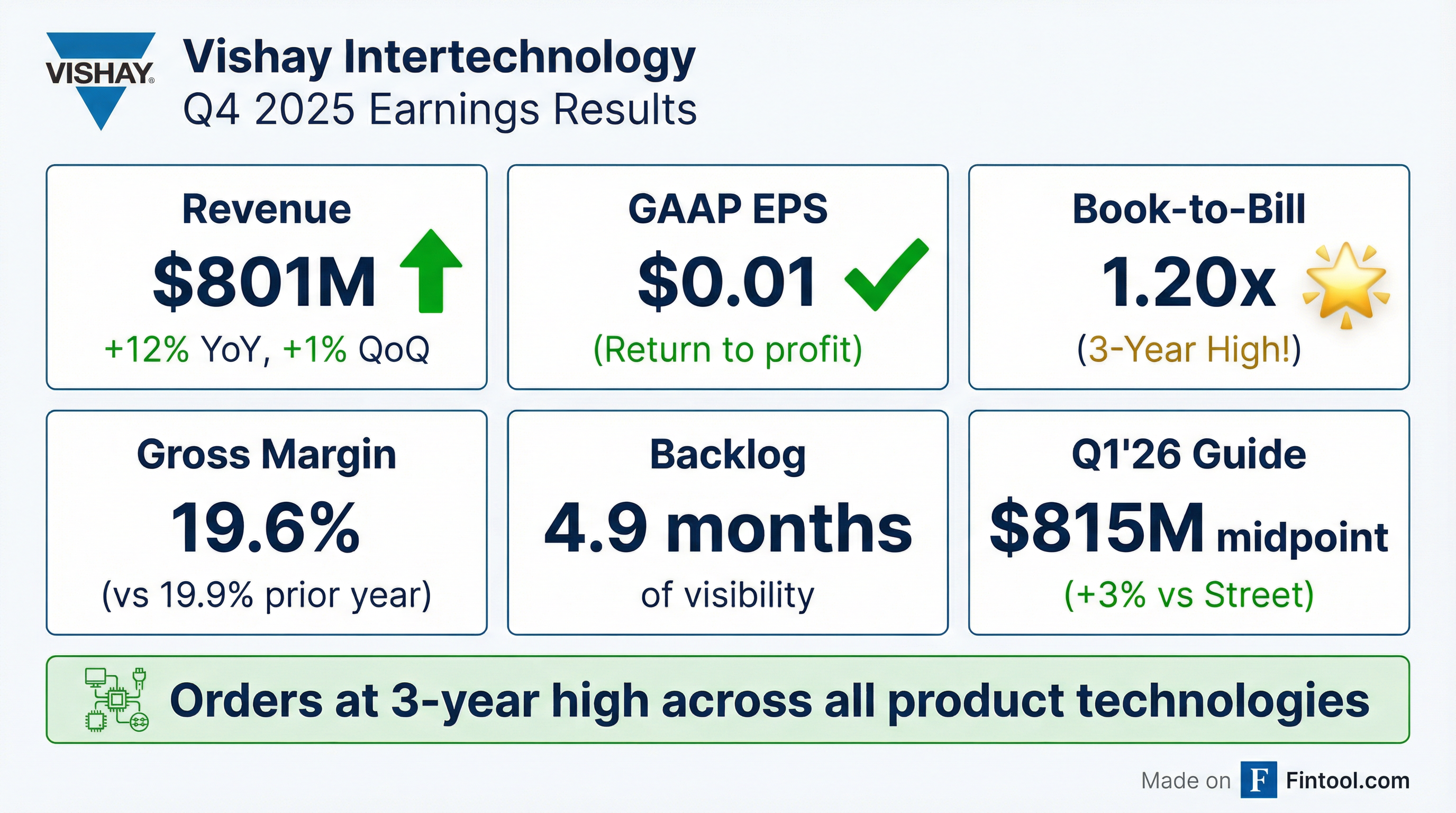

Vishay Intertechnology (VSH) reported Q4 2025 results showing clear momentum in the semiconductor and passive components business, with orders reaching a three-year high and book-to-bill hitting 1.20. The stock touched a 52-week high of $21.19 during the session before settling at $20.74, up 31% over the past month. CEO Joel Smejkal declared "2026 is our year to take off" as the company benefits from industrial recovery, AI demand, and capacity investments made under its Vishay 3.0 strategy.

Did Vishay Beat Earnings?

Vishay delivered a modest beat on revenue while EPS came in essentially in-line with expectations:

Key observation: This is Vishay's first profitable quarter since Q2 2025 ($0.01 GAAP EPS). Revenue of $801M was 1.3% higher sequentially and ~1.4% above consensus, driven by growing demand for industrial and AI-related power applications.

How Did End Markets Perform?

The quarter showed divergent performance across Vishay's five key growth segments:

CEO Joel Smejkal emphasized the broad-based recovery: "In industrial power segments, bookings were strong in each region. Demand for industrial automation is beginning to recover... These are all positive indications that for Vishay, industrial is back."

The AI/Other category's 10.6% sequential growth reflects customers ramping up production for AI power management applications. "A number of customers are actively adding Vishay to the bill of materials in AI-related applications for both semiconductors and passives."

What Did Management Guide?

Q1 2026 guidance came in above consensus, signaling management confidence in sustained demand:

*Values retrieved from S&P Global

Key guidance detail: Management expects Newport (the 12-inch fab acquisition) to reach gross profit neutral by end of Q1 and become accretive thereafter.

Regional mix shift: Asia revenue expected lower in Q1 due to Lunar New Year, offset by Americas and Europe. Sequential revenue increases expected in all five key growth segments.

What Changed From Last Quarter?

The most significant development is the order acceleration. CEO Joel Smejkal highlighted:

"Orders for the quarter are at a three-year high across all main product technologies, except capacitors, which reached their three-year high already in Q2 of 2025. We ended the quarter with a book-to-bill of 1.2, up from the previously shared book-to-bill run rate at the end of October of 1.15."

Book-to-Bill Breakdown:

After gradually building backlog each quarter over the first nine months of 2025, Q4 backlog grew nearly 14%.

What Is the 2026 Market Outlook?

Management provided segment-level growth expectations for 2026:

CEO Smejkal on automotive: "Car count seems to be flattish, but we'll say automotive is flat to mid-single digit for Vishay because of semis as well as passives."

Q&A Highlights: Automotive Share Gains

Management disclosed significant competitive wins during the Q&A:

On automotive share gains:

"We have done quite well to support the shortages that were in the marketplace in December... The feedback from customers was: 'Vishay, we road tested you. You were able to give us product, and we see that Vishay 3.0 is real, so let's talk about future engagements.'"

On Silicon Carbide strategy:

"We now have released our first trench MOSFET, the silicon carbide Gen 3 1200V for industrial and for automotive applications. This is a great technology advancement for Vishay, positioning us to design in 800V automotive and AI applications."

On pricing power:

"We raised prices on quite a few products in Q4 due to metals. We were one of the first to do it... In some product lines, we will come back with a second price increase. We see our ASP decline lower than historical for 2026."

On margin trajectory: CFO Dave McConnell: "With volume efficiencies, we should be generating improvement in the margin as we move through the year. The Newport fab continues to ramp up."

CapEx and Capital Allocation

2026 represents the peak of Vishay's five-year capacity expansion:

Key investment areas:

- 12-inch fab equipment (~$230M, mostly H1)

- Large DC power capacitors for smart grid (projects through 2032)

- Tantalum polymer expansion (AI, automotive, industrial)

- Power inductors in La Laguna, Mexico (regional/tariff-free supply)

M&A outlook: "M&A is always on the table. We look across passives and semis with select technology... Getting over the peak of this capital spending allows Vishay to then get into M&A at a deeper rate."

Cash Flow and Liquidity

The company securitized certain non-US accounts receivable in Q4, generating $62M to fund 12-inch fab equipment purchases. Free cash flow expected to remain negative or near-zero for 2026 due to capacity investments.

How Did the Stock React?

Vishay shares have staged a remarkable recovery from the October 2025 lows:

The muted after-hours reaction (-2.4%) suggests the strong order trends and guidance beat were largely priced in following the stock's powerful run.

Key Takeaways

-

Orders are the story — Book-to-bill of 1.20 is the highest in three years, with semiconductors particularly strong at 1.27

-

AI driving growth — "Other" category (AI/power) up 10.6% sequentially; customers adding Vishay to AI BOMs

-

Automotive share gains — Customers "road tested" Vishay during December shortages and are now deepening relationships

-

Silicon Carbide inflection — First trench MOSFET released for 800V automotive/AI applications

-

Peak capex year — $400M-$440M in 2026, returning to 5-6% intensity after mid-year

-

Guidance beats Street — Q1 2026 revenue midpoint of $815M is ~3% above consensus; margin improvement expected through year

Related: VSH Company Profile | Q4 2025 Transcript | Q3 2025 Earnings