Earnings summaries and quarterly performance for VISHAY INTERTECHNOLOGY.

Executive leadership at VISHAY INTERTECHNOLOGY.

Joel Smejkal

Chief Executive Officer and President

Marc Zandman

Executive Chairman of the Board and Chief Business Development Officer

David McConnell

Executive Vice President and Chief Financial Officer

David Tomlinson

Senior Vice President – Chief Accounting Officer

Michael O'Sullivan

Executive Vice President – Chief Administrative and Legal Officer

Peter Henrici

Executive Vice President – Corporate Development and Corporate Secretary

Roy Shoshani

Executive Vice President – Chief Operating Officer - Semiconductors and Chief Technical Officer

Board of directors at VISHAY INTERTECHNOLOGY.

Research analysts who have asked questions during VISHAY INTERTECHNOLOGY earnings calls.

Peter Peng

Evercore ISI

7 questions for VSH

Ruplu Bhattacharya

Bank of America

5 questions for VSH

Ripple Boruwa

Bank of America

2 questions for VSH

Ruplu Bhattacharjee

Bank of America Corporation

1 question for VSH

Shawn Holland

D.A. Davidson & Co.

1 question for VSH

Shawny Mitwali

D.A. Davidson & Co.

1 question for VSH

Recent press releases and 8-K filings for VSH.

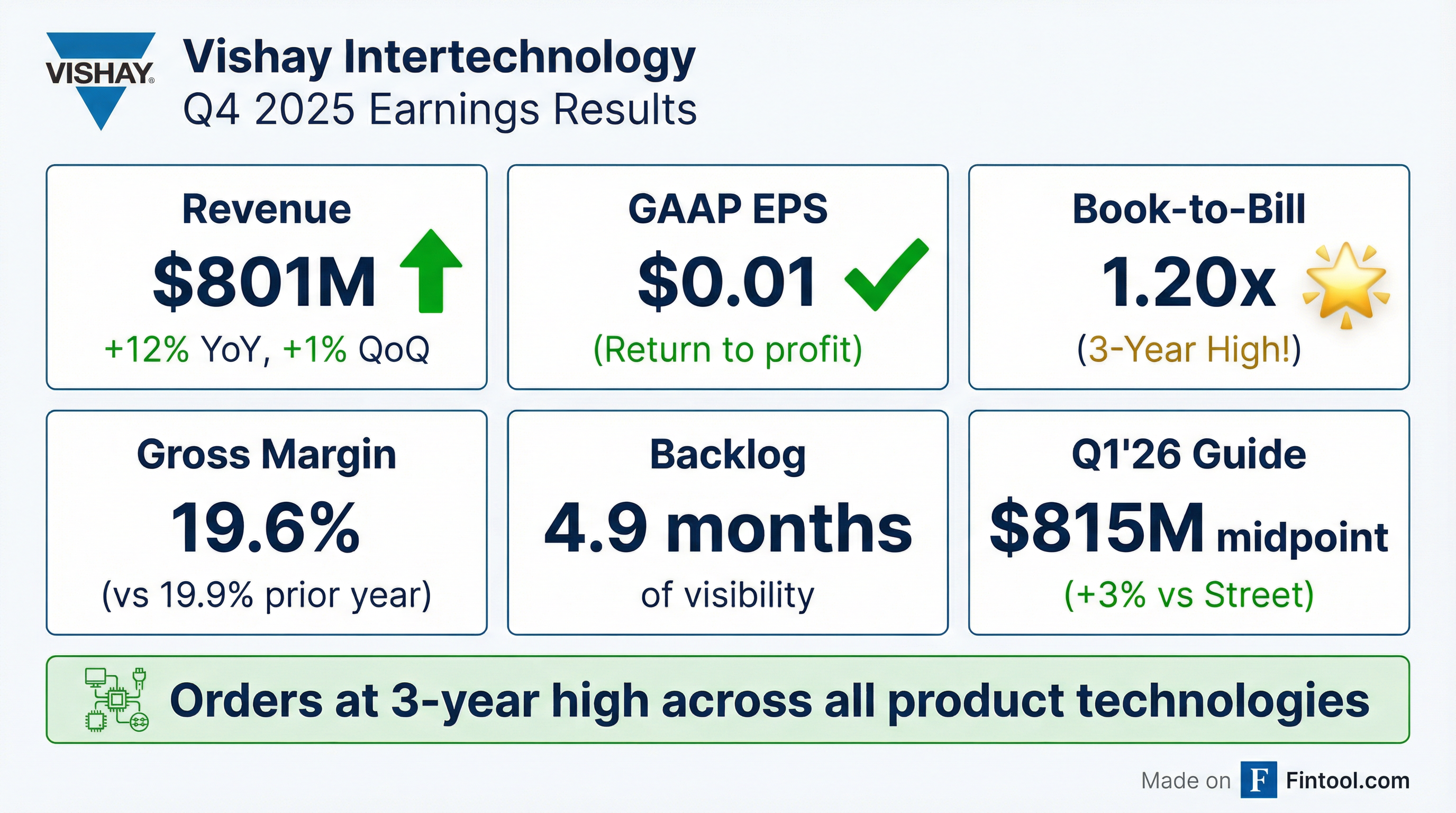

- Vishay Intertechnology reported Q4 2025 revenues of $800.9 million, diluted EPS of $0.01, and a gross margin of 19.6%.

- The company maintained a strong book-to-bill ratio of 1.20 and a backlog of 4.9 months at quarter-end.

- For Q1 2026, Vishay provided revenue guidance of $800 million to $830 million and a gross margin outlook of 19.9% +/- 50 bps.

- Vishay returned capital to shareholders with $0.10 cash dividends per share and $15 million in stock repurchases during Q4 2025.

- Asia was a key growth region in Q4 2025, with revenue mix up 21% year-over-year, driven by strong automotive and AI demand.

- Vishay Intertechnology reported Q4 2025 revenue of $801 million, a 1.3% sequential increase driven by broad-based business in industrial power and AI-related power applications, and GAAP earnings per share of $0.01.

- The company achieved a book-to-bill ratio of 1.2 in Q4 2025, with a quarter-end backlog of $1.3 billion or 4.9 months.

- For Q1 2026, revenue is expected to be between $800 million and $830 million, with a gross margin guidance of 19.9% ±50 basis points.

- Vishay plans CapEx between $400 million and $440 million for 2026, primarily for 12-inch fab investments, and anticipates negative free cash flow for the year while maintaining its dividend.

- Vishay Intertechnology reported Q4 2025 revenue of $801 million, a 1.3% sequential increase and 12% increase year-over-year, with GAAP earnings per share of $0.01.

- The company ended Q4 2025 with a strong book-to-bill ratio of 1.2 and a backlog of $1.3 billion, representing 4.9 months.

- For Q1 2026, revenue is guided between $800 million and $830 million, with a gross margin expected at 19.9% ±50 basis points.

- Vishay plans FY 2026 capital expenditures between $400 million and $440 million, primarily for its 12-inch fab, and anticipates negative free cash flow for the year due to these investments.

- The company is seeing strong, broad-based order growth across all regions, channels, and technologies, driven by demand in automotive, industrial power, aerospace defense, AI computing, and healthcare, and expects to outperform the market's mid to high single-digit growth.

- Vishay Intertechnology reported Q4 2025 revenue of $801 million and GAAP earnings per share of $0.01.

- The company achieved a book-to-bill ratio of 1.2 and ended Q4 2025 with a backlog of $1.3 billion.

- For Q1 2026, revenue is guided to be between $800 million and $830 million, with a gross margin of 19.9% ±50 basis points.

- Vishay expects negative free cash flow for the full year 2026 due to planned capital expenditures of $400 million to $440 million for capacity expansion, with a focus on outperforming market growth.

- Vishay Intertechnology reported fourth quarter 2025 revenues of $800.9 million and GAAP EPS of $0.01.

- The company achieved a gross margin of 19.6% in Q4 2025.

- Book-to-bill for Q4 2025 was 1.20, with backlog at 4.9 months at quarter-end, reflecting growing demand for industrial and AI-related power applications.

- For the first quarter of 2026, management expects revenues in the range of $800 million to $830 million and a gross profit margin of 19.9% +/- 50 basis points.

- Vishay Intertechnology reported Q4 2025 revenues of $800.9 million and GAAP EPS of $0.01.

- The company achieved a book-to-bill ratio of 1.20 in Q4 2025, with semiconductors at 1.27 and passive components at 1.13, and ended the quarter with a backlog of 4.9 months.

- For the full fiscal year 2025, net revenues were $3,069.0 million and diluted EPS was ($0.07).

- Management expects 1Q 2026 revenues between $800 million and $830 million and a gross profit margin of 19.9% +/- 50 basis points.

- CEO Joel Smejkal highlighted that Q4 revenue was 1.3% higher than Q3, reflecting growing demand for industrial and AI-related power applications, with orders reaching a three-year high.

- Vishay Intertechnology reported Q3 2025 revenue of $791 million, a 4% sequential increase, with a gross margin of 19.5% and adjusted earnings per share of $0.04.

- The company's book-to-bill ratio for Q3 was 0.97, but the October run rate improved to 1.15, driven by orders in automotive, smart grid infrastructure, aerospace defense, and AI-related power requirements.

- For Q4 2025, revenue is expected to be $790 million +/- $20 million, with a gross margin of 19.5% +/- 50 basis points, which includes an anticipated 150-175 basis point drag from the Newport facility.

- Vishay expects negative free cash flow for 2025 due to $300-$350 million in capacity expansion investments but plans to maintain its dividend.

- Management aligns with 2026 consensus estimates of 7% year-on-year revenue growth and 23.6% gross margin, supported by market segments and the expectation that the Newport facility will be margin neutral by the end of Q1 2026.

- Vishay Intertechnology reported Q3 2025 revenue of $791 million, a 4% sequential increase, and adjusted earnings per share of $0.04.

- For Q4 2025, revenue is guided to be $790 million ± $20 million, with gross margin expected at 19.5% ± 50 basis points. The Newport facility is projected to be margin neutral by the end of Q1 2026, which would raise gross margin by 1.5%.

- The October book-to-bill run rate was 1.15, and management anticipates mid-to-high single-digit revenue growth in 2026 driven by automotive, industrial, aerospace defense, AI, and smart grid infrastructure, aligning with consensus estimates of 7% year-on-year revenue growth.

- Year-to-date capital expenditures for 2025 totaled $179 million, with full-year CapEx expected between $300 million-$350 million for capacity expansion. The company plans to maintain its dividend but is not currently repurchasing shares due to U.S. liquidity.

- Vishay Intertechnology reported Q3 2025 revenue of $791 million, representing a 4% sequential increase, and adjusted earnings per share of $0.04.

- For Q4 2025, the company expects revenues to be $790 million plus or minus $20 million and gross margin to be in the range of 19.5% plus or minus 50 basis points.

- The book-to-bill ratio for Q3 2025 was 0.97, with the October run rate improving to 1.15.

- Key market segments such as automotive, industrial, medical, and AI-related computing showed revenue growth in Q3, with Asia achieving the greatest growth.

- The company continues significant capacity investments, with $179 million invested year-to-date and an expected $300-$350 million for the full year 2025, primarily for expansion projects. Elevated metal prices negatively impacted gross margin, and the Newport facility is expected to be margin neutral by the end of Q1 2026.

- Vishay Intertechnology reported Q3 2025 revenues of $790.6 million and a GAAP loss per share of $(0.06), with Adjusted EPS of $0.04.

- The company's Q3 2025 gross margin was 19.5% and the book-to-bill ratio was 0.97, indicating a slight decline in new orders relative to shipments.

- For Q4 2025, management expects revenues in the range of $790 million +/- $20 million and a gross profit margin of 19.5% +/- 50 basis points.

Quarterly earnings call transcripts for VISHAY INTERTECHNOLOGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more