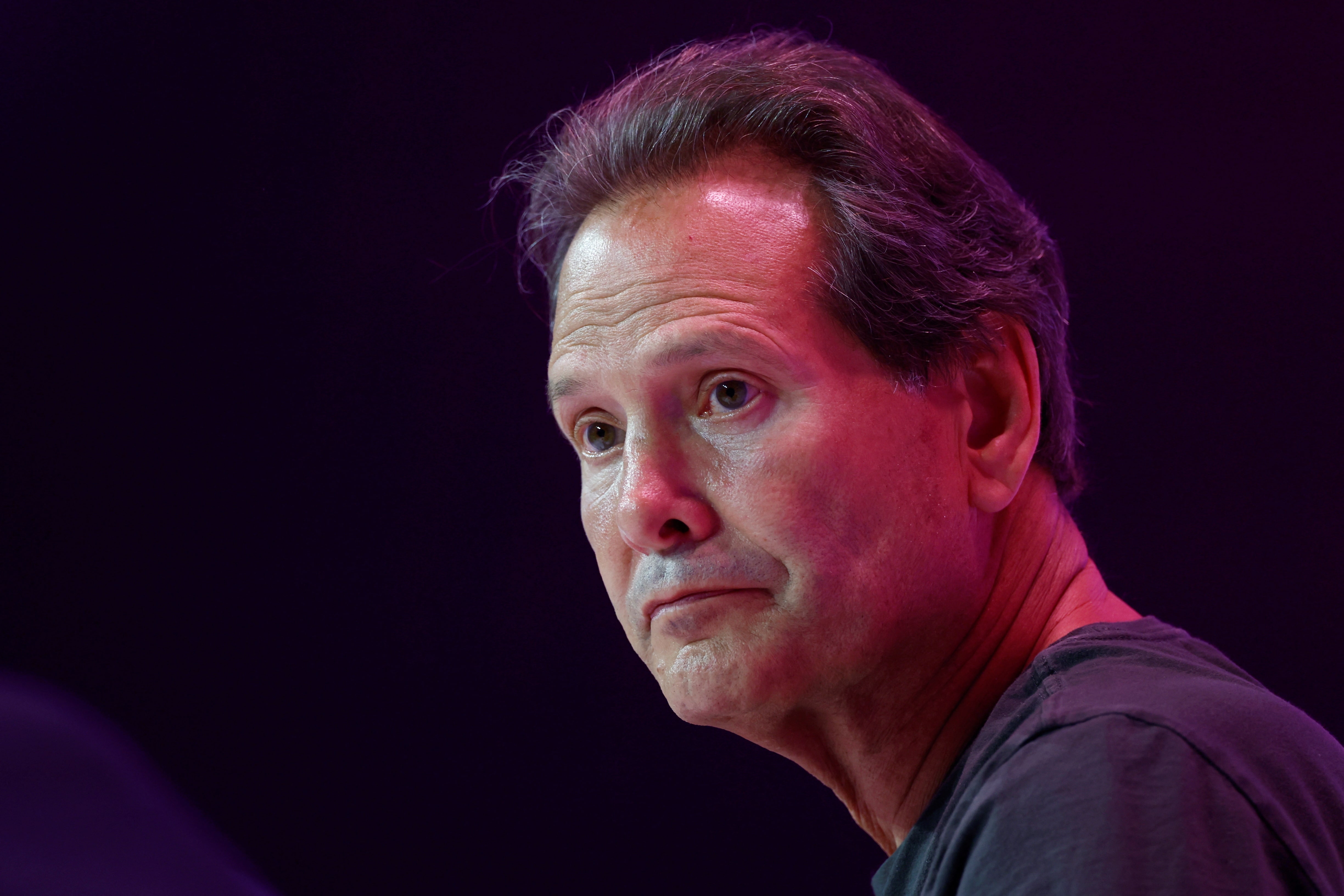

Daniel Schulman

About Daniel Schulman

Daniel Schulman, age 67, is an independent Director of Verizon (VZ) since 2018 and currently serves as Lead Director (effective December 5, 2024) and Chair of the Human Resources Committee overseeing executive compensation, succession, and human capital matters . He is the former President and CEO of PayPal (2015–2023) with prior leadership roles at American Express, Sprint Nextel (Prepaid), Virgin Mobile USA (founding CEO), Priceline, and AT&T, bringing deep experience in technology, cybersecurity/data stewardship, and strategic scaling of consumer platforms . Under the 2024 incentive framework approved by the Human Resources Committee, Verizon’s Short‑Term Plan paid out at 103% on company performance, while the 2022–2024 PSU cycle paid 0% on all three metrics with a −25% TSR modifier vs. S&P 100, signaling payout sensitivity to results; Say‑on‑Pay support in 2024 was ~91% .

Past Roles

| Organization | Role | Years | Strategic impact |

|---|---|---|---|

| PayPal Holdings, Inc. | President and Chief Executive Officer | 2015–2023 | Led global fintech platform reaching ~430M active accounts and significant revenue growth focus . |

| American Express Company | Group President, Enterprise Group | 2010–2014 | Expanded global mobile and online payments capabilities . |

| Sprint Nextel Corporation | President, Prepaid Group | 2009–2010 | Led prepaid wireless initiatives . |

| Virgin Mobile USA, Inc. | Founding CEO | 2001–2009 | Built a scaled prepaid cellphone business . |

| Priceline Group, Inc. | President and CEO | Not disclosed | Drove rapid revenue growth (from ~$20M to nearly $1B over two years) . |

| AT&T, Inc. | Executive roles incl. President, Consumer Markets Division | Not disclosed | Telecommunications operating leadership . |

External Roles

| Organization | Role | Years |

|---|---|---|

| Lazard, Inc. | Director | Since Feb 2024 . |

| Cisco Systems, Inc. | Director | Since 2023 . |

| PayPal Holdings, Inc. | Director (former) | 2015–2023 . |

Fixed Compensation

- Non‑employee director fee structure (2024): $125,000 annual cash retainer; $30,000 additional annual cash for Human Resources Committee Chair; $75,000 additional annual cash for Lead Director; annual equity grant of share equivalents valued at $210,000 (deferred) .

- Schulman’s 2024 director compensation: Fees earned $155,000; Stock awards $210,000; Total $365,000; he became Lead Director on Dec 5, 2024 (Lead Director additional retainer noted in policy) .

| Component | Amount ($) | Notes |

|---|---|---|

| Annual cash retainer | 125,000 | Standard non‑employee director cash retainer . |

| HR Committee Chair fee | 30,000 | Additional to cash retainer . |

| Lead Director fee | 75,000 | Additional to cash retainer; Schulman became Lead Director Dec 5, 2024 . |

| Annual equity grant (share equivalents) | 210,000 | Granted as deferred share equivalents, invested in hypothetical VZ stock fund . |

| 2024 Director Compensation (Schulman) | Amount ($) |

|---|---|

| Fees earned or paid in cash | 155,000 |

| Stock awards (grant‑date fair value) | 210,000 |

| Total | 365,000 |

Performance Compensation

- Role and governance: As Human Resources Committee Chair, Schulman helps oversee incentive design, target setting, and clawback application; Committee uses an independent consultant (Semler Brossy), assessed as independent and conflict‑free .

- Say‑on‑Pay: 2024 approval ~91% of votes cast, indicating strong shareholder support for program design .

2024 Short‑Term Incentive Plan (Corporate metrics)

| Metric | Weighting | Target | Actual/Result | Payout impact |

|---|---|---|---|---|

| Wireless service revenue | Financial measures weighted equally (across 3 financial metrics) | $78.3B–$79.4B | $79.1B | Contributed to overall 103% payout . |

| Adjusted operating income | Financial measures weighted equally | $30.7B–$32.2B | $31.7B | Contributed to overall 103% payout . |

| Cash flow from operations | Financial measures weighted equally | $34.5B–$36.5B | $35.6B (adjusted per policy) | Contributed to overall 103% payout . |

| Workforce diversity (% U.S. workforce women/minorities) | Responsible business metrics (weight unchanged vs. prior year) | 59.2% | 59.2% (below target) | Below‑target contribution . |

| Diverse supplier spend | Responsible business metrics | $5.0B | $5.7B (above target) | Above‑target contribution . |

| Carbon intensity reduction | Responsible business metrics | 16.0% | 18.7% (above target) | Above‑target contribution . |

| Total STIP payout | — | — | 103% corporate payout factor | 103% . |

Notes: Committee adjusted CFFO for Vertical Bridge tower transaction and voluntary separation payments, and adjusted workforce diversity for the voluntary separation program per plan methodology .

Long‑Term Incentive Plan Design (2024 grants)

| Element | Design | Measurement/Term | Vesting |

|---|---|---|---|

| PSUs | 3 equally weighted metrics: cumulative adjusted EPS, cumulative free cash flow, cumulative wireless service revenue | 3‑year cumulative performance; TSR modifier ±25% vs. S&P 100 | Cliff vest at 3 years based on performance (0–200% with TSR cap/floor) . |

| RSUs | Time‑based | 3‑year term | Vest ratably over 3 years . |

Realized Outcomes (most recent completed PSU cycle, 2022–2024)

| PSU Metric (2022–2024) | Threshold/Target/Max (summary) | Actual | Vesting % |

|---|---|---|---|

| Cumulative adjusted EPS | Target $16.92 (100%); max ≥$18.09 (200%) | $14.48 | 0% . |

| Cumulative free cash flow | Target $63.6B (100%); max >$68.6B (200%) | $51.2B (adjusted per policy) | 0% . |

| Cumulative service and other revenue | Target $348.1B (100%); max ≥$355.2B (200%) | $330.8B | 0% . |

| TSR modifier vs. S&P 100 | ±25% | Rank 82nd | −25% applied . |

Equity Ownership & Alignment

| Item | Detail |

|---|---|

| Total director share equivalents held (12/31/2024) | 33,445 share equivalents credited to Schulman’s deferred account . |

| Form of equity | All director equity granted as share equivalents credited to the Executive Deferral Plan and invested in a hypothetical Verizon stock fund; paid in cash lump sum the year after Board departure . |

| Director ownership guideline | Directors must hold stock equal to 5× the cash component of annual Board retainer . |

| Hedging/Pledging | Anti‑hedging policy prohibits Directors and executives who receive equity‑based awards from hedging Verizon stock; no specific pledging policy disclosed; Insider trading policy prohibits trading while in possession of MNPI . |

Implications for selling pressure: Director awards are deferred into cash-settled share equivalents payable after board service, reducing near‑term open‑market selling pressure vs. standard RSU grants .

Employment Terms

- Status: Non‑employee Director; no executive employment agreement with Verizon; company notes no employment contracts for named executive officers and robust governance for directors .

- Independence: Board determined Schulman is independent under NYSE/Nasdaq and Company standards; also meets heightened independence for HR Committee .

- Lead Director responsibilities: Approves agendas/materials with the Chair, leads executive sessions (including CEO evaluation/compensation), oversees CEO succession with HR Committee, and serves as primary Board contact for shareholders .

- Board meetings and attendance: Board held nine meetings in 2024; no incumbent Director attended fewer than 75% of aggregate Board/committee meetings .

- Board time commitment policy: Non‑executive directors may serve on no more than four public company boards; audit committee members on no more than two other public company audit committees; all Directors in compliance .

Board Governance (service history and committees)

- Board service: Independent Director since 2018; Lead Director since Dec 5, 2024 .

- Committee roles: Chair, Human Resources Committee; HR Committee responsibilities include compensation design/approvals, succession and human capital oversight; 2024 members included Schulman (Chair), Bertolini, Narasimhan, Otis, Slater .

- Dual-role mitigation: Verizon combines CEO and Chair roles; independent Lead Director (Schulman) provides checks/balances, runs executive sessions, and represents independent directors in shareholder engagement .

Director Compensation (structure and 2024 actuals)

| Item | Schulman 2024 | Program features |

|---|---|---|

| Cash fees | $155,000 | Base $125,000 plus $30,000 HR Chair fee; Lead Director additional retainer $75,000 per policy (Schulman appointed Dec 5, 2024) . |

| Equity grant (DSUs) | $210,000 | Deferred share equivalents; invest in hypothetical stock fund; paid in cash after departure . |

| Total | $365,000 | No meeting fees; chairs of Audit/HR receive $30,000; Finance/CG&P chairs $20,000; Lead Director +$75,000 . |

| Matching gifts | Eligible for Verizon Foundation matching gifts per program limits |

Compensation Committee Analysis (governance levers)

- Independent advisor: Semler Brossy retained solely by the Committee; no company work; independence confirmed; participates in meetings and benchmarking at ~50th percentile target opportunity .

- Peer group (2024 benchmarking): Large Dow constituents (≥$50B revenue) plus AT&T, Charter, Comcast, T‑Mobile, and large-cap tech platforms (Alphabet, Amazon, Meta, Netflix), aligning with scale and network-levered peers .

- Best practices: Robust clawbacks (including mandatory recovery per listing rules), anti‑hedging, no tax gross‑ups, double‑trigger CIC for LTI, and strict stock ownership guidelines .

- Shareholder support: Say‑on‑Pay approved ~91% in 2024; ongoing director/investor engagement noted .

Performance & Track Record Highlights

- Technology/fintech scaling: Led PayPal with focus on innovation and values, reaching ~430M active accounts; drove rapid scale at Priceline; long cybersecurity oversight tenure at Symantec (including six years as independent chair) supporting risk governance expertise .

- Incentive outcomes at Verizon under HR Committee oversight: 2024 STIP paid 103% on corporate metrics; 2022–2024 PSU cycle paid 0% on all three metrics with −25% TSR modifier vs. S&P 100, indicating strong pay‑for‑performance alignment when targets are not met .

Other Governance, Policies, and Risks

- Related‑party transactions: None required to be disclosed for 2024 .

- Insider trading policy: Prohibits trading while in possession of MNPI; additional trading restrictions apply to directors and certain employees .

- Responsible business: HR metrics embedded in STIP (workforce diversity, diverse supplier spend, carbon intensity reduction) reflect long‑standing responsible business incentives .

Investment Implications

- Pay-for-performance oversight appears stringent: 0% PSU vesting across 2022–2024 metrics with a negative TSR modifier highlights lower realized pay when long‑term goals are missed; near‑target 2024 STIP suggests balanced annual rigor; Say‑on‑Pay support at ~91% reinforces investor alignment .

- Low structural selling pressure: Director equity is deferred into cash-settled share equivalents and paid after board service, which dampens near‑term insider selling dynamics; Schulman held 33,445 share equivalents as of 12/31/2024 under this program .

- Governance mitigants to dual CEO/Chair structure: Schulman’s Lead Director remit (agenda control, executive sessions, shareholder engagement, CEO evaluation/succession) provides independent counterbalance to combined roles .

- Risk controls and shareholder‑friendly features (clawbacks, anti‑hedging, no tax gross‑ups, double‑trigger CIC) reduce governance risk and potential headline events from pay practices .

- Workload/time‑commitment policy and independence affirmations reduce oversight risk; Schulman’s additional board roles (Cisco, Lazard) are within stated limits and Board confirms compliance .