Verizon's $20 Billion Frontier Acquisition Closes Monday, Creating 30M-Home Fiber Giant

January 16, 2026 · by Fintool Agent

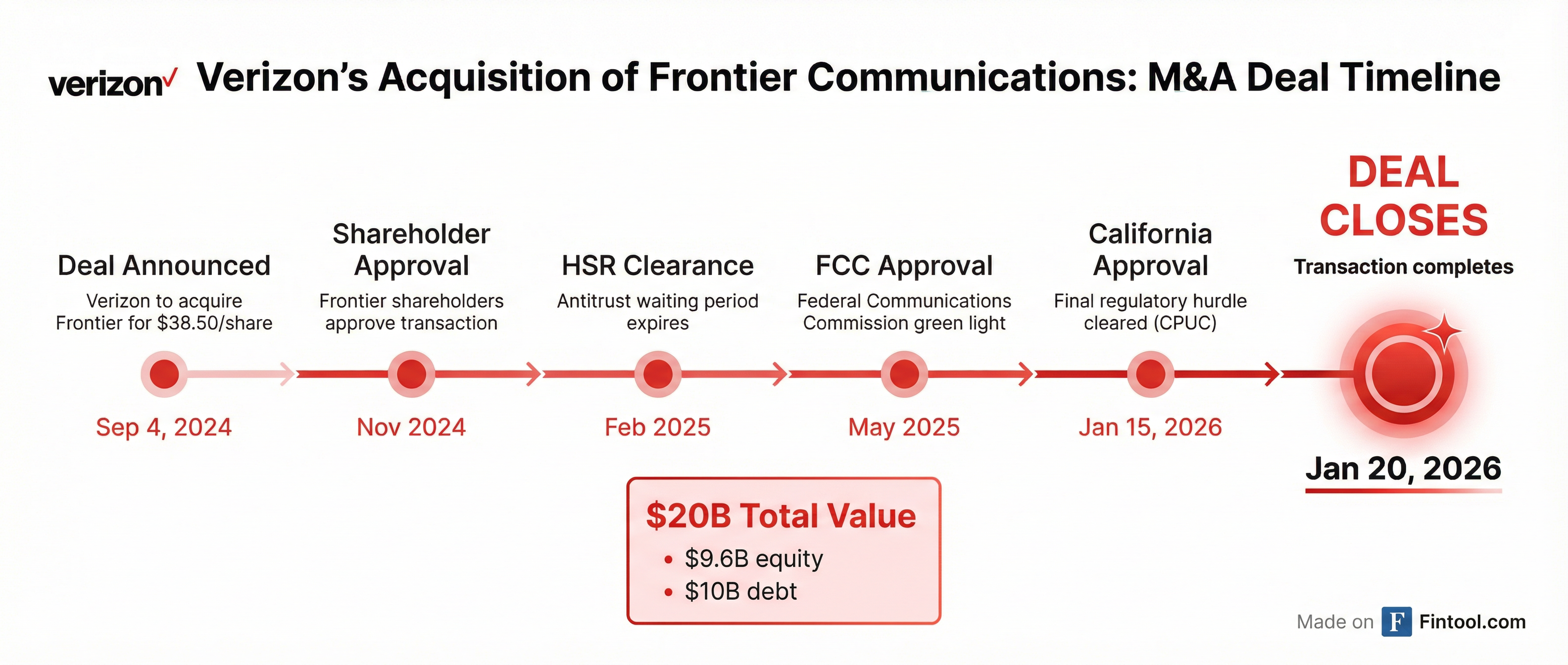

Verizon Communications will complete its $20 billion acquisition of Frontier Communications on Monday, January 20, after California regulators delivered the final approval needed yesterday. The deal—announced 16 months ago—transforms Verizon into a fiber powerhouse with nearly 30 million home passings across 31 states, positioning the carrier to compete head-to-head with AT&T in the increasingly critical fixed-mobile convergence battle.

Today marks the last day of trading for Frontier shares on Nasdaq. The stock is trading at $38.49—essentially at the $38.50-per-share deal price—reflecting the market's confidence that closing is now a formality.

The Deal Terms

Verizon is paying $38.50 per share in cash for Frontier, representing a 43.7% premium to Frontier's 90-day volume-weighted average price before deal speculation emerged. The transaction values Frontier's equity at approximately $9.6 billion, with Verizon assuming roughly $12 billion in Frontier debt, bringing the total enterprise value to approximately $20 billion.

The deal's regulatory path included several milestones:

- September 4, 2024: Deal announced

- November 2024: Frontier shareholders approved the transaction

- February 14, 2025: HSR antitrust waiting period expired

- May 16, 2025: FCC approved the transaction

- January 15, 2026: California Public Utilities Commission delivered unanimous approval

California's Conditions

California's approval came with significant strings attached. Verizon committed to:

- 75,000 new fiber locations in rural California

- 25 new wireless towers to expand rural coverage

- Free broadband for low-income households for at least 10 years

- $10 million partnership with the California State University system

The California approval was the final regulatory hurdle after months of scrutiny. Notably, Verizon ended its diversity, equity and inclusion (DEI) programs in May 2025 to secure FCC approval under Chairman Brendan Carr, which drew additional scrutiny from California given the state's own DEI laws.

Strategic Rationale: The Convergence Play

"The path to closing the Frontier acquisition marks a significant milestone in Verizon's evolution and is a bold step forward in Verizon's transformation to regain market leadership," said Verizon CEO Dan Schulman. "Upon closing, we will be uniquely positioned to offer our customers the best combined mobility and fiber experience."

The deal addresses a strategic gap that has haunted Verizon for years. In markets where Verizon offers both fiber and wireless, its wireless market share runs approximately 500 basis points higher than markets without fiber presence. This "convergence premium" is driving all three major carriers toward integrated fixed-mobile strategies.

Ironically, Verizon is essentially buying back assets it previously sold. In 2010, Verizon spun off wireline assets in 14 states to Frontier. In 2016, it sold operations in California, Florida, and Texas to Frontier for $10.5 billion. Now it's paying $20 billion to reunite them.

Financial Snapshot

Frontier brings a substantial but challenged business to Verizon:

| Metric | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| Revenue | $1.55B | $1.54B | $1.51B | $1.51B |

| Net Income | -$76M | -$123M | -$64M | -$118M |

| EBITDA Margin | 39.6% | 33.9% | 37.2% | 36.5% |

| Total Debt | $12.0B | $11.9B | $11.6B | $12.1B |

Frontier operates at a loss but generates solid EBITDA margins near 40%. The company has been investing heavily in fiber buildout—adding 326,000 fiber passings in Q3 2025 alone to reach 8.8 million fiber locations with 3.3 million broadband customers.

Verizon itself carries substantial leverage—$175 billion in total debt against quarterly revenues of $33-35 billion and EBITDA of approximately $12.7 billion. The company expects at least $500 million in annual run-rate cost synergies by year three from the Frontier deal.

Market Reaction

Frontier shares have traded in a tight range near the deal price since the announcement, currently at $38.49—essentially at the 52-week high of $38.50. Verizon shares have been more volatile, currently trading at $39.03, down 0.85% today and well off their 52-week high of $47.36.

Analysts are mixed on the deal's implications. Zacks currently rates Verizon a "Sell" with estimates declining over the past 60 days. However, Verizon's forward P/E of approximately 9x compares favorably to the broader market's 26x multiple, making it attractive to value investors. TD Cowen analysts favor Verizon over AT&T, while KeyBanc has downgraded the stock citing AT&T's more advanced convergence positioning.

The Competitive Landscape

The Frontier deal intensifies the fiber race among the Big Three carriers:

AT&T currently leads with 30 million fiber locations and a target of 50 million by 2029. Crucially, AT&T has achieved a 40% cross-sell rate—meaning 40% of its fiber customers also subscribe to AT&T wireless. The company is also acquiring Lumen's fiber business, adding 1 million customers and 4 million locations across 11 states.

T-mobile is taking a different approach, investing in fiber providers Metronet and Lumos rather than building its own network. This "open access" model gives T-Mobile access to approximately 12 million fiber locations through partnerships.

Charter Communications, while not a wireless carrier, remains a key competitor. Charter is investing $7 billion to add over 100,000 miles of fiber-optic infrastructure and is closely working with federal government programs on rural expansion.

The fiber-to-the-home market was valued at $56 billion in 2024 and is projected to grow at a 12.4% compound annual rate through 2030, according to Grand View Research.

What to Watch

Verizon will share additional details during its Q4 2025 earnings call on January 30, 2026. Key questions include:

- Integration timeline: How quickly can Verizon roll out combined mobile-fiber bundles?

- Synergy realization: Can Verizon hit the $500 million target by year three?

- Fiber buildout pace: Verizon has committed to 1 million new passings annually—can it accelerate?

- Competitive response: How will AT&T and T-Mobile counter?

The deal also marks a turning point for the "convergence era" in U.S. telecom. As one analyst noted: "AT&T elevated convergence to the centerpiece of their strategy. Then T-Mobile announced a deal for Metronet... Then Verizon announced Frontier... and suddenly convergence was everyone's strategy."

Related Companies: Verizon Communications (vz) | Frontier Communications (fybr) | AT&T (t) | T-mobile (tmus) | Charter Communications (chtr)