Earnings summaries and quarterly performance for CHARTER COMMUNICATIONS, INC. /MO/.

Executive leadership at CHARTER COMMUNICATIONS, INC. /MO/.

Chris Winfrey

President and Chief Executive Officer

Adam Ray

Executive Vice President, Chief Commercial Officer

Jamal Haughton

Executive Vice President, General Counsel and Corporate Secretary

Jessica Fischer

Chief Financial Officer

Kevin Howard

Executive Vice President, Chief Accounting Officer and Controller

Richard DiGeronimo

President, Product and Technology

Board of directors at CHARTER COMMUNICATIONS, INC. /MO/.

Balan Nair

Director

Carolyn Slaski

Director

David Merritt

Director

David Wargo

Director

Eric Zinterhofer

Non-Executive Chairman of the Board

John Markley

Director

Kim Goodman

Director

Lance Conn

Director

Martin Patterson

Director

Mauricio Ramos

Director

Michael Newhouse

Director

Steven Miron

Director

Research analysts who have asked questions during CHARTER COMMUNICATIONS, INC. /MO/ earnings calls.

Benjamin Swinburne

Morgan Stanley

5 questions for CHTR

Craig Moffett

MoffettNathanson

5 questions for CHTR

Jessica Reif Ehrlich

Bank of America Securities

4 questions for CHTR

Steven Cahall

Wells Fargo & Company

4 questions for CHTR

John Hodulik

UBS Group AG

3 questions for CHTR

Jonathan Chaplin

New Street Research

3 questions for CHTR

Bryan Kraft

Deutsche Bank AG

2 questions for CHTR

Frank Louthan

Raymond James

2 questions for CHTR

Kutgun Maral

Evercore ISI

2 questions for CHTR

Michael Ng

Goldman Sachs

2 questions for CHTR

Michael Rollins

Citigroup

2 questions for CHTR

Sebastiano Petti

JPMorgan Chase & Co.

2 questions for CHTR

Vikash Harlalka

New Street Research

2 questions for CHTR

James Schneider

Goldman Sachs

1 question for CHTR

Jim Schneider

Goldman Sachs

1 question for CHTR

Peter Supino

Wolfe Research

1 question for CHTR

Recent press releases and 8-K filings for CHTR.

- The group secured its first-ever global credit ratings, with Moody’s assigning a B1 rating and Fitch reaffirming its long-term issuer rating alongside the debut international bond issuance.

- This achievement makes Telekom Srbija the first West Balkan–based company to access the international debt market and obtain ratings from both agencies, signaling heightened investor confidence in the region.

- Fitch highlighted the group’s robust cash flow profile, strong market position, and disciplined financial strategy, while Moody’s noted its established operational performance and strategic importance in Southeastern Europe.

- Charter Communications named Nick Jeffery, current Frontier Communications President & CEO, as its Chief Operating Officer effective September 1, 2026, reporting to CEO Chris Winfrey and overseeing Marketing & Sales, Field Operations and Customer Operations across its 41-state footprint.

- Jeffery led Frontier (2021–2026) through a post-bankruptcy turnaround to sustained revenue growth, fiber network expansion and a 60-point Net Promoter Score improvement.

- Before Frontier, he served as CEO of Vodafone UK from 2016, executing a multi-year turnaround that restored mobile and broadband revenue, EBITDA, cash flow growth and NPS market leadership.

- Under his employment agreement, Jeffery will receive an annual base salary of $1.5 million, a target bonus equal to 225% of base pay, and initial equity awards valued at $20 million in options and $0.5 million in RSUs.

- Charter appoints Nick Jeffery as Chief Operating Officer, effective September 1, 2026.

- Jeffery will oversee Marketing and Sales, Field Operations, and Customer Operations across Spectrum’s 41-state footprint.

- He has served as President and CEO of Frontier Communications since 2021, leading its post-bankruptcy turnaround, fiber network expansion, and a 60-point NPS improvement.

- Previously, as CEO of Vodafone UK from 2016, he executed a multi-year turnaround restoring mobile and broadband revenue and EBITDA growth.

- Charter’s Spectrum Internet and Spectrum Mobile bundle offers new customers $1,000 in guaranteed savings in their first year when switching from AT&T, T-Mobile or Verizon and subscribing to at least two Unlimited mobile lines and Spectrum Internet Advantage or higher; if savings fall short, Spectrum credits the difference over the year.

- Customers lock in a two-year price guarantee of $30/month per product (Fiber-Powered Premier Internet and each Unlimited Mobile line), taxes and fees included.

- Spectrum aims to drive broadband and mobile growth through this risk-free switch, leveraging its Fiber Broadband Network spanning over one million miles and claiming the fastest converged Internet and wireless speeds coast to coast.

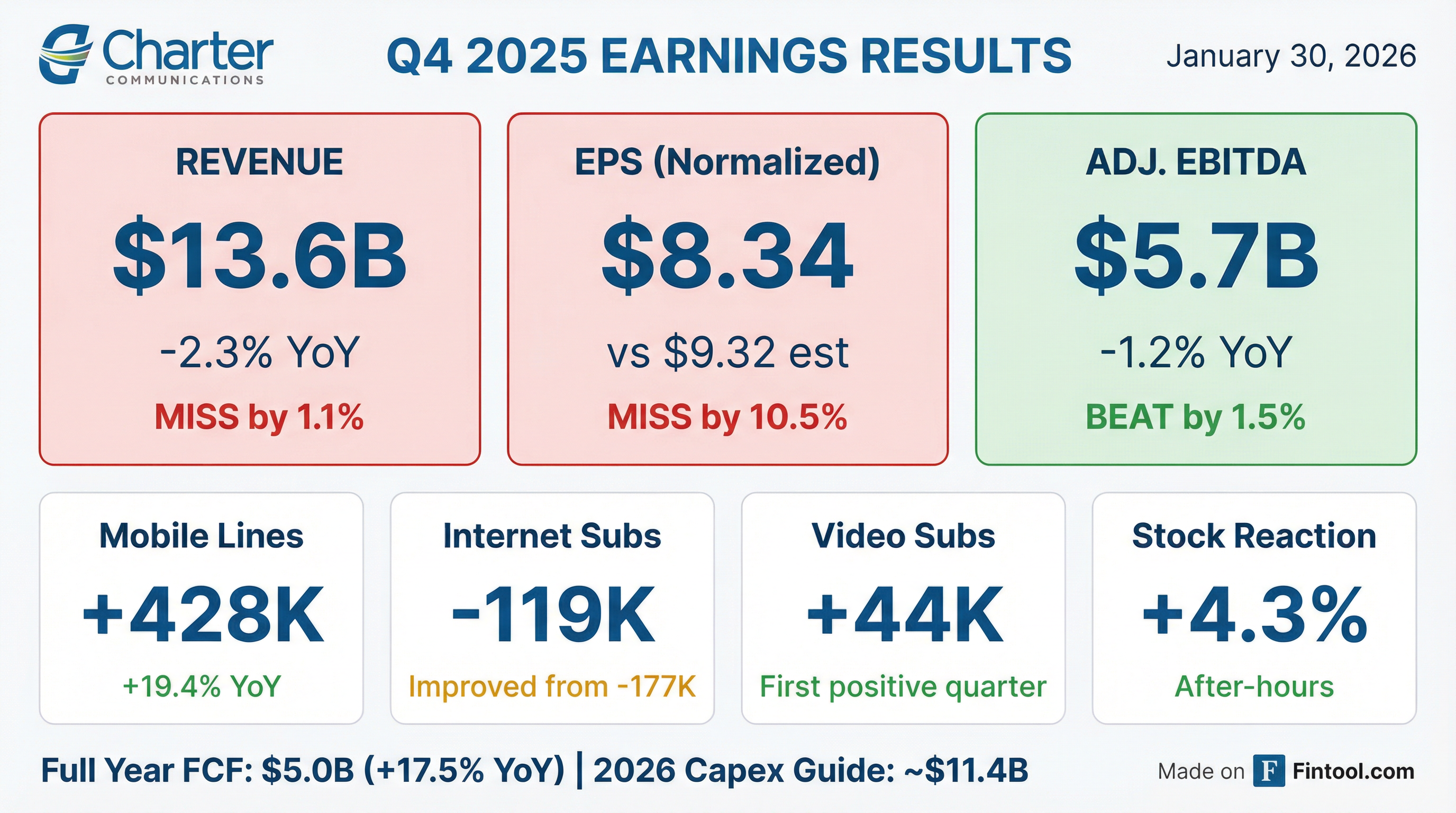

- Charter’s Q4 consolidated revenue declined 2.3% YoY (–0.4% ex-advertising); Adjusted EBITDA fell 1.2% in Q4, while FY 2025 EBITDA grew 0.6%.

- Q4 CapEx totaled $3.3 B; FY 2025 CapEx reached $11.66 B; Q4 free cash flow was $773 M; guidance for 2026 CapEx of $11.4 B and cash taxes of $500 M–$800 M.

- Added nearly 2 M mobile lines (19% growth), delivered Q4 video net adds, and saw improved internet churn and sales amid strong competition.

- Ended Q4 with net debt/EBITDA of 4.15x (4.21x pro forma); repurchased 2.9 M shares for $760 M; targeting post-Cox leverage of 3.5x–3.75x within three years.

- Charter posted 4Q25 revenue of $13.6 B, down 2.3% Y/Y; residential revenue was $10.4 B (−2.4%), commercial revenue $1.8 B (+0.3%).

- Adjusted EBITDA in 4Q25 was $5.7 B, a 1.2% decline Y/Y; LTM Adjusted EBITDA rose 0.6% to $22.7 B.

- Capex totaled $3.3 B in 4Q25, lifting FY25 capex to $11.7 B; 4Q25 free cash flow was $773 M, with LTM FCF of $5.0 B.

- Total debt edged up to $94.6 B in 4Q25, with net leverage at 4.21× on a pro forma basis for the Liberty Broadband transaction.

- Q4 lost 119k internet customers, added 428k mobile lines and 44k video subscriptions, contributing to full-year 0.5% revenue decline and 0.5% EBITDA growth.

- Q4 consolidated revenue dropped 2.3% YoY; excluding advertising and app allocation, revenue was down 0.4%.

- 2026 outlook targets slight EBITDA growth, $11.4 billion in CapEx (vs. $11.66 billion in 2025), with run-rate CapEx under $8 billion by 2028.

- Q4 free cash flow of $773 million, repurchased $760 million of shares, net debt/EBITDA at 4.15x, and plans to reach 3.5–3.75x leverage within three years post-Cox.

- Pending regulatory approval of the Cox merger to expand Spectrum’s footprint to 70 million households and enhance cross-sell of connectivity services.

- Q4 2025 consolidated revenue down 2.3%, adjusted EBITDA down 1.2%, full-year revenue down 0.5% and EBITDA up 0.6% YoY

- In Q4, net customer adds included loss of 119,000 internet customers, addition of 428,000 mobile lines, growth of 44,000 video customers and 46,000 net subsidized rural additions

- Capital expenditures: $3.3 B in Q4 and $11.66 B in 2025; expects $11.4 B in 2026 and a decline to below $8 B by 2028

- Free cash flow of $773 M in Q4; repurchased 2.9 M shares for $760 M; ended the quarter with $95 B debt and 4.15x net leverage

- 2026 guidance: slight EBITDA growth excluding transaction costs, $11.4 B capex, and a post-Cox target leverage of 3.5–3.75x within three years

- Charter’s Q4 revenue fell to $13.6 billion, down about 2–2.3% year-over-year, with full-year revenue roughly flat.

- The company added ~2 million mobile lines (19% growth), claiming the title of fastest-growing U.S. mobile provider, and saw Spectrum TV sign-ups rise via bundled streaming apps.

- Broadband remained under pressure, with a loss of 119,000 internet customers, though residential connectivity revenue grew 2.3% and internet revenue rose 0.7% to $5.9 billion.

- Advertising revenue plunged 25.8%, driven almost entirely by reduced political ad spending, offsetting modest gains elsewhere.

- Q4 net income declined to $1.332 billion (basic EPS $10.47; diluted EPS $10.34, up 2.4% year-over-year but slightly below estimates).

- Q4 revenue of $13.6 billion (–2.3% y-o-y) and net income of $1.3 billion; full-year 2025 revenue $54.8 billion (–0.6%) with net income $5.0 billion; Q4 Adjusted EBITDA $5.7 billion, FY 2025 $22.7 billion

- Customer trends: Internet customers down by 119,000 to 29.7 million, mobile lines up by 428,000 to 11.8 million, video customers up by 44,000 to 12.6 million, voice customers down to 6.0 million

- Capital deployment: Q4 capex $3.3 billion, FY 2025 capex $11.7 billion (incl. $3.9 billion of line extensions); free cash flow of $5.0 billion (vs. $4.3 billion prior year); share repurchases of 17.1 million shares for $5.4 billion

- FY 2026 outlook: expects capex of $11.4 billion and will prioritize product utility, value and service to drive customer, EBITDA and cash‐flow growth

Quarterly earnings call transcripts for CHARTER COMMUNICATIONS, INC. /MO/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more