Earnings summaries and quarterly performance for Meta Platforms.

Executive leadership at Meta Platforms.

Board of directors at Meta Platforms.

Andrew Houston

Director

Charles Songhurst

Director

Dana White

Director

Dina Powell McCormick

Director

Hock Tan

Director

John Arnold

Director

John Elkann

Director

Marc Andreessen

Director

Nancy Killefer

Director

Patrick Collison

Director

Peggy Alford

Director

Robert Kimmitt

Lead Independent Director

Tony Xu

Director

Tracey Travis

Director

Research analysts who have asked questions during Meta Platforms earnings calls.

Brian Nowak

Morgan Stanley

10 questions for META

Eric Sheridan

Goldman Sachs

10 questions for META

Justin Post

Bank of America Corporation

10 questions for META

Mark Shmulik

Bernstein

9 questions for META

Douglas Anmuth

JPMorgan Chase & Co.

8 questions for META

Ronald Josey

Citigroup Inc.

7 questions for META

Ross Sandler

Barclays

7 questions for META

Youssef Squali

Truist Securities

7 questions for META

Mark Mahaney

Evercore ISI

6 questions for META

Kenneth Gawrelski

Wells Fargo & Company

5 questions for META

Doug Anmuth

J.P. Morgan

2 questions for META

Ken Gawrelski

Wells Fargo

2 questions for META

Ron Josey

Citi

2 questions for META

Recent press releases and 8-K filings for META.

- U.S. data center electricity demand is projected to grow from 176 TWh to 580 TWh by 2028, with AI-driven consumption outpacing grid capacity in several regions.

- Spot uranium prices jumped 25% in January 2026, topping $100/lb before easing to $89/lb amid institutional buying.

- Oklo and Meta Platforms will co-develop a 1.2 GW nuclear campus in Pike County, Ohio, to power Meta’s data centers—including its AI supercluster—with pre-construction starting in 2026, phase 1 online by 2030, and full build-out by 2034.

- U.S. domestic uranium concentrate production fell 44% in Q3 2025 to about 330,000 lbs, while over 95% of utility purchases remain imported, intensifying supply concerns.

- Virtuix’s Omni One 360-degree treadmill will be compatible with Meta Quest headsets and games, expanding access to millions of active XR users.

- The partnership integrates Virtuix into Meta’s certified ecosystem, broadening its consumer reach within the world’s largest XR user base.

- Virtuix reported 138% year-over-year revenue growth for the six months ended September 30, 2025, with manufacturing capacity of 3,000 units/month (~$100 million annual revenue potential).

- The company began trading on Nasdaq under ticker VTIX on January 27, 2026.

- Pershing Square built a 10% position in Meta Platforms, investing about $2 billion, initiated in late November and recorded at end-2025.

- Since the position began, Meta’s shares have risen roughly 11% in 2025 and 3% year-to-date in 2026.

- The firm argues Meta’s share price understates long-term upside from AI-driven content recommendations, personalized advertising and new user engagement via digital assistants and wearables.

- The investment aligns with Pershing Square’s concentrated style, alongside new stakes in Amazon and Hertz and exits from Hilton, Chipotle and Nike.

- Meta has broken ground on a $10 billion, 1 gigawatt data center campus in Indiana’s LEAP Research and Innovation District, covering 1,500 acres with 13 buildings; first phase expected late 2027 or early 2028.

- Designed for AI compute and core services, the campus targets LEED Gold certification, features closed-loop liquid cooling, and will match 100% of its energy use with clean power.

- The project includes $120 million in public-works investments, workforce programs, and $1 million annually for resident energy assistance, creating about 4,000 construction and 300 permanent jobs.

- Incentives include a 10-year, 50% real-property tax abatement, personal-property abatements, and community impact payments; it’s Meta’s 27th US data center.

- EssilorLuxottica sold 7 million AI smartglasses in 2025, tripling shipments versus the roughly 2 million sold in 2023–24 combined.

- Wearables helped lift group revenue to €28.5 billion, an 11% increase (18% adjusted) year-over-year.

- Adjusted operating margin declined to 16.0% from 16.7%, driven by lower-margin smartglasses and U.S. import tariffs.

- Partners are discussing scaling production toward at least 20 million units, and Meta has extended the long-term collaboration.

- CEO Francesco Milleri affirmed the group’s capacity to manage the surge in smartglasses demand.

- The European Commission has sent Meta a statement of objections, preliminarily finding that an October change to WhatsApp Business Solution Terms bars third-party AI assistants and breaches EU antitrust rules, and may impose interim measures to preserve competitor access.

- Regulators note that since Jan. 15, only Meta AI has been available on WhatsApp, cutting off competitors such as ChatGPT; Italy reached similar conclusions and a Brazil probe was suspended.

- In India, the Supreme Court adjourned Meta and WhatsApp’s appeals against a ₹213.14 crore Competition Commission of India penalty over the 2021 “take-it-or-leave-it” privacy policy to Feb. 23, sharply criticizing the data-sharing practice and adding the Ministry of Electronics and Information Technology as a party.

- On Nov. 4, 2025, the National Company Law Appellate Tribunal set aside part of the CCI order banning data-sharing for advertising purposes but retained the ₹213.14 crore penalty and clarified its application to non-WhatsApp data uses.

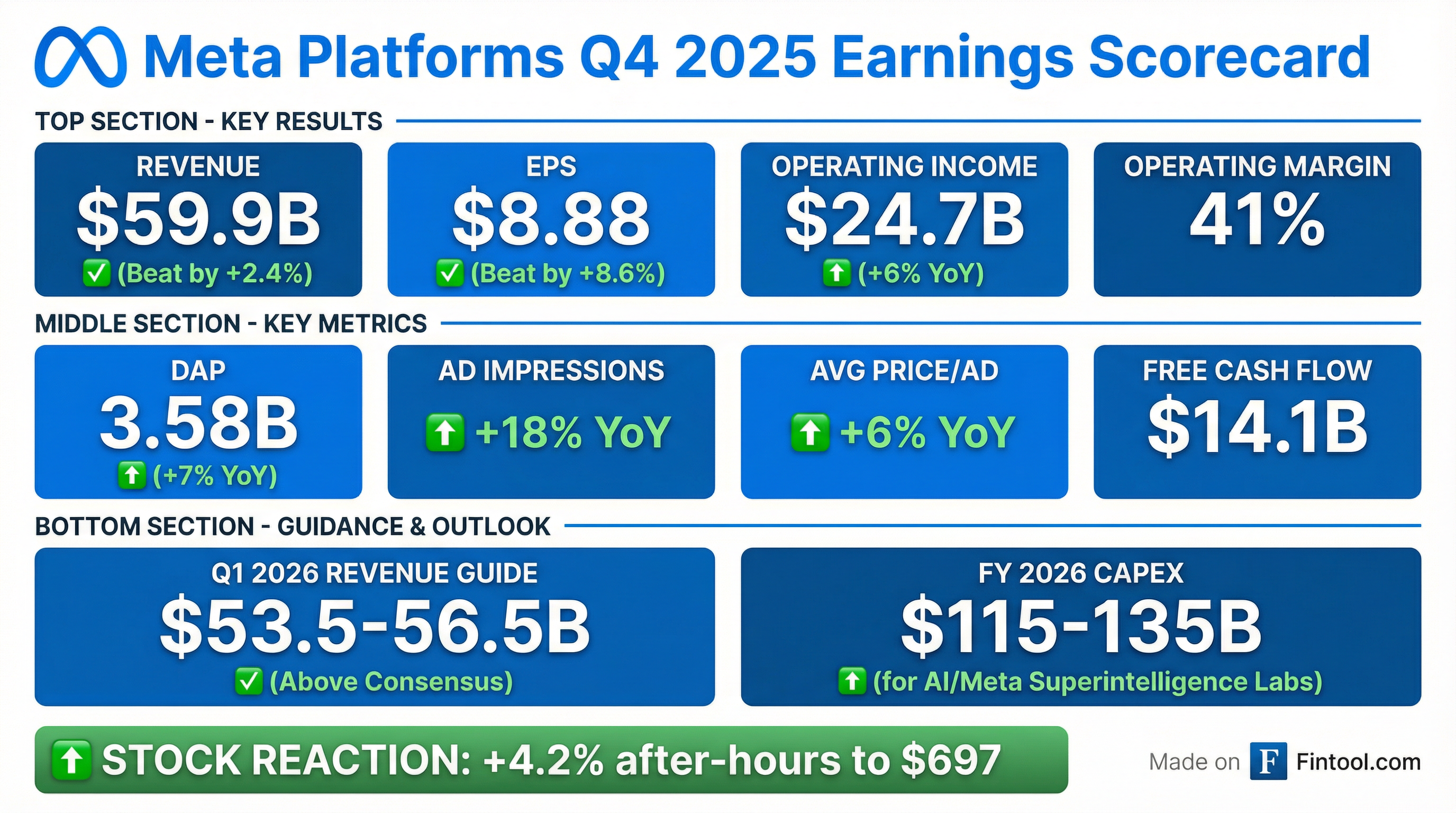

- 3.5 billion people used at least one Meta app daily in Q4 2025, including 2 billion daily actives on both Facebook and WhatsApp; strong holiday demand and AI-driven gains powered record performance.

- Q1 2026 total revenue is guided to $53.5 billion–$56.5 billion, full-year 2026 expenses to $162 billion–$169 billion, CapEx to $115 billion–$135 billion, and operating income above 2025 levels.

- Q4 2025 ad improvements: 3.5% lift in Facebook ad clicks, >1% gain in Instagram conversions, 3% boost from a new runtime model, 12% higher ads quality; WhatsApp paid messaging reached a $2 billion run rate and US click-to-message ads grew >50% YoY.

- Ongoing heavy investment in AI and infrastructure via MetaCompute and Meta Superintelligence Labs (MSL), with Reality Labs losses expected to remain at 2025 levels.

- Meta reported Q4 2025 total revenue of $59.9 billion with an operating margin of 41%.

- Net income was $22.8 billion, driving diluted EPS of $8.88.

- Free cash flow reached $14.1 billion in the quarter, up from $13.2 billion in Q4 2024.

- Family Daily Active People rose to 3.58 billion and average revenue per person was $16.56 in Q4 2025.

- Q4 total revenue was $59.9 billion, up 24% year-over-year; Family of Apps revenue reached $58.9 billion (+25%), while Reality Labs revenue declined 12% to $955 million.

- Operating income in Q4 was $24.7 billion (41% margin); net income was $22.8 billion or $8.88 per share.

- Meta highlighted a major AI acceleration, including record engagement gains from recommendation and generative media tools, the tripling of AI glasses sales, and expansion of Meta AI to over 200 markets.

- 2026 outlook: Q1 revenue guidance of $53.5 billion–$56.5 billion, full-year expenses of $162 billion–$169 billion, and CapEx of $115 billion–$135 billion, with operating income expected above 2025 levels.

- Meta forecasts Q1 2026 revenue of $53.5–56.5 billion, with a 4% FX tailwind year-over-year

- Full-year 2026 expenses expected at $162–169 billion, driven by infrastructure and talent; capital expenditures at $115–135 billion

- Operating income in 2026 projected to exceed 2025 levels, with a full-year tax rate of 13–16%

- Reality Labs losses in 2026 expected to match 2025 (peak year) amid heavy investment in AI infrastructure, including Meta Compute

Fintool News

In-depth analysis and coverage of Meta Platforms.

Meta's Stablecoin Redemption: Zuckerberg Takes Another Shot at Crypto Payments—This Time at Arm's Length

Zuckerberg Takes the Stand in 'Big Tobacco' Trial for Social Media

Meta and Nvidia Ink Multibillion-Dollar Deal for 'Millions' of AI Chips

Meta Commits to $135 Billion AI Bet, Shattering CapEx Records as Q4 Earnings Soar

Meta Commits $6 Billion to Corning for AI Data Center Fiber

Meta Bets on Subscriptions: Premium Tiers Coming to Instagram, Facebook, and WhatsApp

Quarterly earnings call transcripts for Meta Platforms.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more