Earnings summaries and quarterly performance for TWENTY-FIRST CENTURY FOX, INC..

Executive leadership at TWENTY-FIRST CENTURY FOX, INC..

Board of directors at TWENTY-FIRST CENTURY FOX, INC..

Research analysts who have asked questions during TWENTY-FIRST CENTURY FOX, INC. earnings calls.

Benjamin Swinburne

Morgan Stanley

4 questions for FOXA

John Hodulik

UBS Group AG

4 questions for FOXA

Michael Ng

Goldman Sachs

4 questions for FOXA

Michael Morris

Guggenheim Partners

3 questions for FOXA

Robert Fishman

MoffettNathanson

3 questions for FOXA

Jessica Reif Cohen

Bank of America Merrill Lynch

2 questions for FOXA

Jessica Reif Ehrlich

Bank of America Securities

2 questions for FOXA

Steven Cahall

Wells Fargo & Company

1 question for FOXA

Recent press releases and 8-K filings for FOXA.

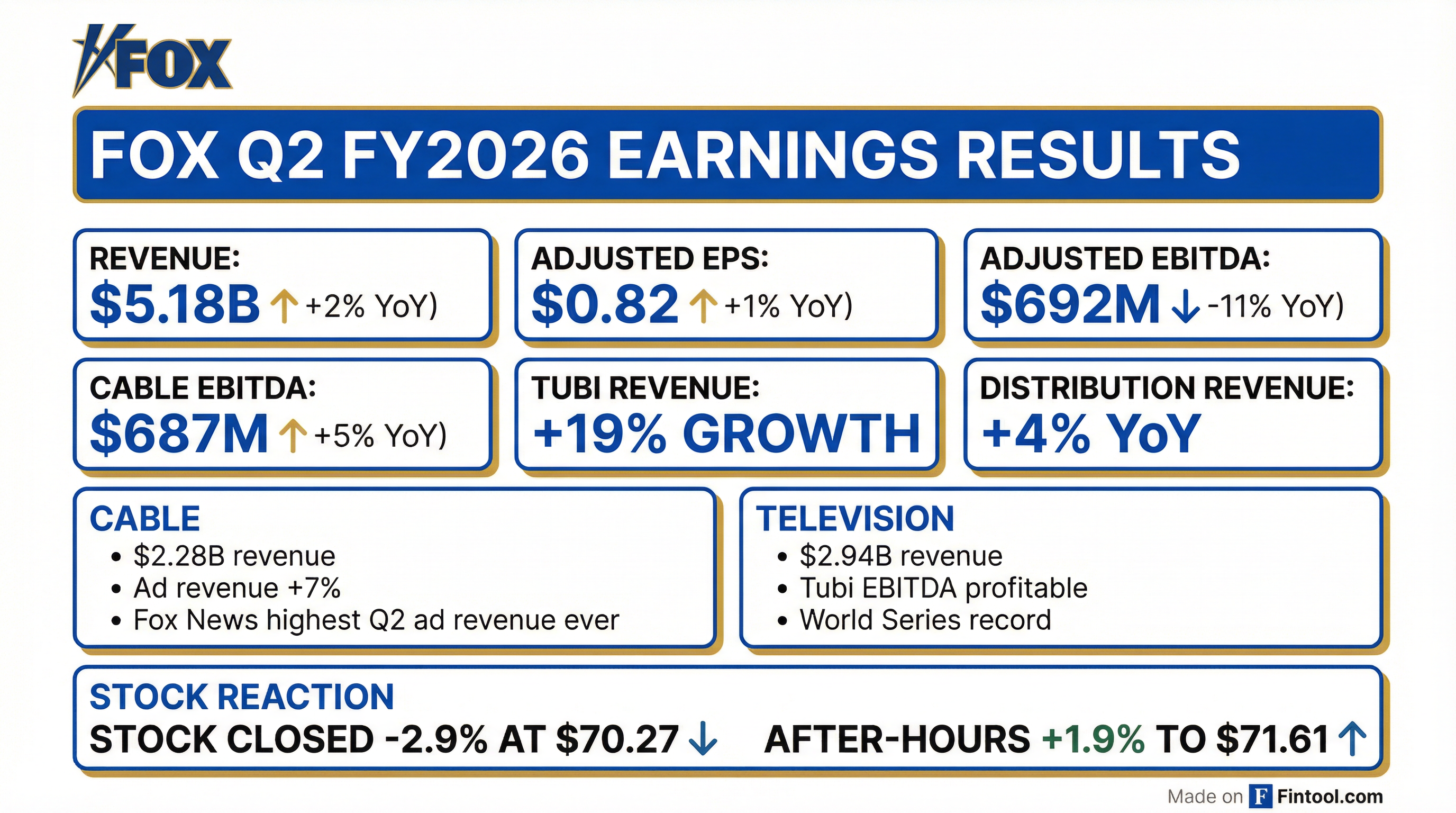

- Fox delivered $5.18 billion in fiscal Q2 revenue, up about 2% year-over-year, driven by higher advertising and distribution receipts.

- Cable network programming revenue rose to roughly $2.28 billion, boosted by Fox News’s robust ratings, pricing gains in news and sports, and added MLB postseason inventory.

- Streaming platform Tubi achieved record quarterly revenue and logged consecutive quarters of EBITDA profitability, underpinning the company’s digital growth and increased viewership.

- The company repurchased about $1.8 billion of stock year-to-date (cumulative buybacks since 2019 total $8.4 billion), even as net income declined to $247 million for the quarter.

- Fox Corporation posted Q2 FY2026 revenues of $5.18 billion (up 2% YoY), net income of $247 million, and adjusted EBITDA of $692 million for the quarter ended December 31, 2025.

- Advertising revenues increased 1%, driven by higher sports and news pricing, digital growth via Tubi AVOD, and additional MLB postseason games, partially offset by lower political advertising and ratings.

- Cable Network Programming segment revenues rose 5% to $2.28 billion with segment EBITDA increasing 5% to $687 million.

- The company declared a $0.28 per share dividend payable March 25, 2026, and repurchased approximately $750 million of Class A and $800 million of Class B shares during the quarter, with $3.6 billion remaining authorization.

- Fox River Resources has successfully produced purified phosphoric acid (PPA) from its Martison phosphate project, confirming technical feasibility for LFP battery supply chain applications.

- Testwork by JESA Technologies LLC identified all necessary unit operations to upgrade merchant grade acid to PPA, validating the suitability of Martison concentrate for PPA production.

- The company plans a dedicated PPA facility integrated within its phosphate fertilizer complex to recover byproducts rich in P₂O₅ and supply PPA to LFP battery manufacturers.

- Production milestone underscores Fox River’s strategy to support domestic phosphate fertilizer supply for Canadian farmers and the growing LFP battery market, with backing from the Ontario Ministry of Energy and Mines.

- Revenue rose 5% year-over-year to $3.74 billion, while net income declined to $599 million from $827 million.

- Advertising revenue increased 6%, driven by cable networks, news division, NFL programming, and the Tubi streaming service, which became profitable faster than expected.

- Fox News remained the most-watched cable network in prime time and total day, attracting 350 new national advertisers, and achieved its highest ad revenue quarter in history.

- The company announced a $1.5 billion share buyback program, underscoring confidence in its financial outlook.

- Fox delivered quarterly revenues of $3.74 billion (+5% YoY), net income of $609 million (vs. $832 million a year ago) and adjusted EBITDA of $1.07 billion (+2% YoY).

- Revenue growth was driven by a 3% increase in distribution revenues, 6% growth in advertising (led by Tubi AVOD, stronger news and sports pricing) and a 12% rise in content and other revenues.

- Cable Network Programming segment revenues rose 4% to $1.66 billion with segment EBITDA up 7% to $800 million; Television segment revenues increased 5% to $2.05 billion with segment EBITDA up 7% to $399 million.

- Announced a $1.5 billion accelerated share repurchase beginning October 31, 2025, completed $250 million of Class A repurchases this quarter and has $5.15 billion of authorization remaining.

- Madhive, the Fox-backed local media operating system, made a strategic equity investment in AI-powered data collaboration firm Precise.AI to advance data-driven local advertising.

- Jim Wilson, founder of Premion and Madhive President since 2024, will become CEO of Madhive, while current Madhive CEO Spencer Potts will lead Precise.AI as CEO.

- The partnership will integrate Precise.AI’s privacy-first infrastructure to deliver real-time campaign insights, comprehensive multi-touch attribution, and cryptographically verified data provenance.

- Fox Corp and Disney’s ESPN will introduce a $39.99/month bundled streaming service, Fox One + ESPN Unlimited, on October 2, 2025, combining sports, news, and entertainment content.

- ESPN Unlimited standalone is priced at $29.99/month or $299.99/year, while Fox One costs $19.99/month, making the bundle a cost-effective alternative.

- The bundle offers Fox’s full linear portfolio (Fox News, FS1, Big Ten Network, Fox Deportes, Fox Local Stations) alongside ESPN’s coverage of the NFL, NBA, MLB, NHL, college sports, NASCAR, UFC, and the FIFA World Cup.

- This collaboration follows the cancellation of the Warner Bros. Discovery-led Venu Sports joint venture and is designed to challenge traditional pay-TV packages by leveraging bundled sports rights.

- Launch date and pricing: Fox One debuts on August 21 at $19.99/month or $199.99/year for standalone subscribers.

- Comprehensive content: The service consolidates Fox News Channel, Fox Business, Fox Sports, FS1, FS2, Fox Deportes, Big Ten Network, Fox Local Stations, Fox Network, plus Fox Nation and B1G+ into one platform.

- Target audience and access: Aimed at cord-cutters and cord-nevers seeking live NFL, MLB, college football, and news; existing pay-TV subscribers receive free access.

- Strategic positioning: Priced to complement traditional pay-TV bundles with modest subscriber expectations and limited investment, alongside Fox Nation and ad-supported Tubi.

- NASCAR’s current $7.7 billion seven-year media deal blends broadcast (Fox, NBC, CW), cable (FS1, USA, Turner) and streaming (Amazon Prime, Max) to meet viewers where they are and attract younger audiences.

- Amazon Prime’s coverage of marquee races like the Coke 600 averaged 2.7 million viewers per minute—more than 50% above early forecasts—and drove a 6-year drop in average viewer age.

- NASCAR operates four international series in Canada, Mexico, Brazil and Europe aimed at driver, fan and owner development to expand its global footprint.

- The sport permits private equity minority stakes in team charters, with investors such as Harris Blitzer, Avenue Capital and Knighthead Capital boosting team competitiveness and sponsorship.

- NASCAR is defending an antitrust lawsuit by 23XI Racing (Michael Jordan, Denny Hamlin), highlighting a 73% revenue increase offered to teams under its latest contract, with trial or settlement pending.

- Fox Corporation acquired Caliente TV in Mexico to broaden its sports content footprint across Latin America, launching a new Pay TV channel and SVOD service to complement its free, ad-supported Tubi platform.

- Carlos Martinez was appointed Executive Vice President and Managing Director for Latin America to oversee the transition and expansion, with the initiative expected to create over 350 jobs.

- The acquisition boosts Fox’s sports rights portfolio, adding major leagues such as Liga MX (men’s and women’s), UEFA Champions League, Premier League, and motorsports, and underpins plans to produce and distribute more than 3,000 hours of original sports content.

- Fox is set to launch its new Fox One subscription streaming service ahead of the fall American football season, and the announcement drove Fox’s stock to close at $50.22 (+1.19%) on Nasdaq.

Fintool News

In-depth analysis and coverage of TWENTY-FIRST CENTURY FOX, INC..

Quarterly earnings call transcripts for TWENTY-FIRST CENTURY FOX, INC..

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more