Earnings summaries and quarterly performance for WESTERN ALLIANCE BANCORPORATION.

Executive leadership at WESTERN ALLIANCE BANCORPORATION.

Kenneth Vecchione

President and Chief Executive Officer

Barbara Kennedy

Chief Human Resources Officer

Dale Gibbons

Vice Chair and Chief Financial Officer

Emily Nachlas

Chief Risk Officer

Jessica Jarvi

Chief Legal Officer

Lynne Herndon

Chief Credit Officer

Stephen Curley

Chief Banking Officer for National Business Lines

Tim Bruckner

Chief Banking Officer for Regional Banking

Timothy Boothe

Chief Administration Officer

Vishal Idnani

Transitioning Chief Financial Officer

Board of directors at WESTERN ALLIANCE BANCORPORATION.

Anthony Meola

Director

Bruce Beach

Chair of the Board

Bryan Segedi

Director

Christopher Halmy

Director

Donald Snyder

Director

Greta Guggenheim

Director

Howard Gould

Director

Juan Figuereo

Director

Marianne Boyd Johnson

Director

Mary Chris Jammet

Director

Mary Tuuk Kuras

Director

Robert Latta

Director

Research analysts who have asked questions during WESTERN ALLIANCE BANCORPORATION earnings calls.

Anthony Elian

JPMorgan

8 questions for WAL

Bernard Von Gizycki

Deutsche Bank

8 questions for WAL

Ebrahim Poonawala

Bank of America Securities

8 questions for WAL

Matthew Clark

Piper Sandler

8 questions for WAL

Andrew Terrell

Stephens Inc.

7 questions for WAL

Casey Haire

Jefferies

6 questions for WAL

Jared Shaw

Barclays

6 questions for WAL

David Smith

Truist Securities

5 questions for WAL

Gary Tenner

D.A. Davidson & Co.

5 questions for WAL

Jon Arfstrom

RBC Capital Markets

5 questions for WAL

Timur Braziler

Wells Fargo

5 questions for WAL

Chris McGratty

KBW

4 questions for WAL

Christopher McGratty

Keefe, Bruyette & Woods

4 questions for WAL

Janet Lee

TD Cowen

4 questions for WAL

Ben Gerlinger

Citigroup

2 questions for WAL

Benjamin Gerlinger

Citigroup Inc.

2 questions for WAL

David Chiaverini

Wedbush Securities Inc.

2 questions for WAL

Timothy Coffey

Janney Montgomery Scott LLC

2 questions for WAL

Brandon King

Truist Securities

1 question for WAL

Jared David Shaw

Barclays Capital

1 question for WAL

John Rob

Barclays PLC

1 question for WAL

Nicholas Holowko

UBS Group AG

1 question for WAL

Samuel Varga

UBS

1 question for WAL

Recent press releases and 8-K filings for WAL.

- Western Alliance Bancorporation (WAL) will charge off a $126 million loan balance in the current quarter due to a breach of contract by Jefferies, which directed its subsidiary Leucadia Asset Management to cease payments on a loan to Point Bonita Capital.

- WAL has filed a formal complaint in New York Supreme Court against Jefferies, Leucadia Asset Management, and Point Bonita Capital to recover all damages caused by this breach.

- The $126 million charge-off will be substantially offset by approximately $50 million in security sale gains (with $45 million already realized and $5 million expected by the end of March) and approximately $50 million from expense initiatives throughout the year. The remaining $26 million is under active review.

- The company expects to maintain an approximate 11% CET1 ratio after these actions, and the expense reductions are not expected to impair future growth or operational capacity.

- Western Alliance Bancorporation (WAL) announced a $126 million charge-off for a loan to a Point Bonita Capital fund, citing a breach of contract by Jefferies.

- WAL has initiated legal proceedings by filing a formal complaint in New York Supreme Court against Jefferies, Leucadia Asset Management, and Point Bonita to recover all damages.

- The $126 million charge-off will be substantially offset by approximately $50 million in security sale gains and $50 million from expense initiatives throughout the year, with the remaining $26 million under active review.

- Following these actions, WAL expects to maintain an approximate 11% CET1 ratio.

- Western Alliance Bancorporation (WAL) will record a $126 million charge-off in the current quarter after Jefferies directed its subsidiary, Leucadia Asset Management, to cease payments on a loan to a Point Bonita Capital fund.

- WAL has initiated legal proceedings in New York Supreme Court against Jefferies, Leucadia Asset Management, and Point Bonita to hold them accountable and recover damages.

- The bank plans to substantially offset the financial impact through approximately $50 million in security sale gains ($45 million already realized) and $50 million in expense reductions throughout the year, with the remaining $26 million under active review.

- Following these actions, WAL expects to maintain an approximate 11% CET1 ratio.

- The bank's total exposure to similar asset-based lending (ABL) loans to funds will be reduced to approximately $330 million after this write-down.

- Western Alliance Bancorporation (WAL) has filed a Complaint in New York Supreme Court against Jefferies Financial Group, Leucadia Asset Management LLC (LAM), and affiliates, alleging breach of contract and fraud after being informed that $126.4 million owed under a forbearance agreement would not be paid.

- The company is charging-off the entire remaining LAM I loan balance of $126.4 million, which will be matched by a provision of the same amount.

- To mitigate the financial impact, WAL plans to realize $50 million in securities gains (with approximately $45 million already realized quarter-to-date) and implement $50 million in expense savings, providing an aggregate offset of $100 million.

- Despite these events, the company continues to project another profitable quarter, and the after-tax impact of the charge-off is expected to reduce the year-end 2025 CET1 ratio by only 7 basis points.

- Western Alliance Bancorporation will recognize a $126.4 million non-cash impairment charge in the first quarter of 2026 due to a counterparty's failure to make principal payments on a commercial loan.

- The outstanding balance of the impaired loan is $126.4 million, and the counterparties, including Jefferies and Leucadia Asset Management LLC (LAM), have discontinued future payments, leading the Bank to file a lawsuit for breach of contract and fraud.

- To offset the financial impact, the Company plans to realize $50 million in securities gains (with approximately $45 million already realized quarter-to-date) and implement $50 million in expense savings.

- Despite the charge-off, the Company projects a profitable quarter and expects the after-tax impact to reduce the year-end 2025 CET1 ratio by only 7 basis points.

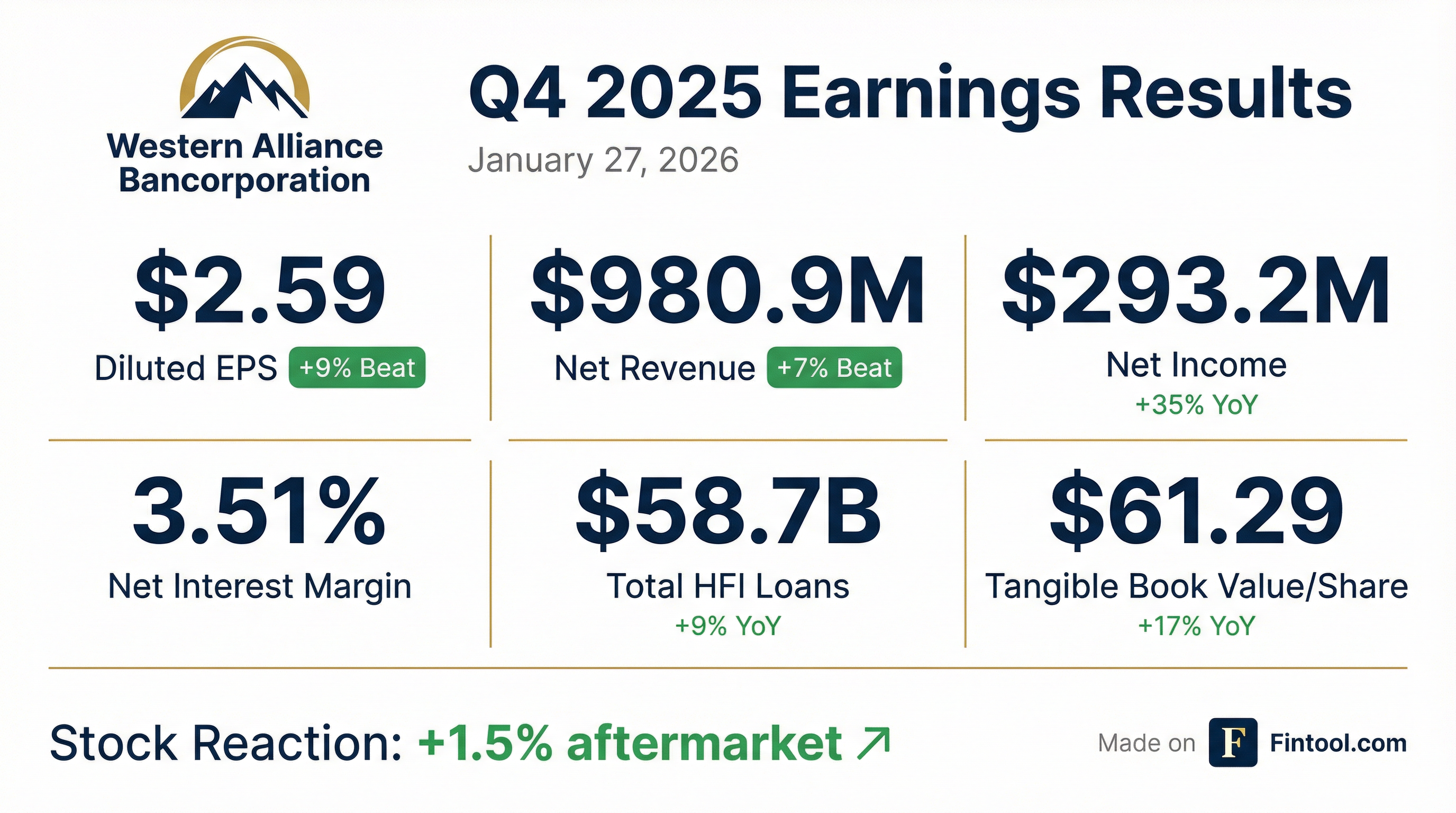

- Western Alliance Bancorporation reported record financial results for Q4 and full year 2025, with Q4 net interest income, net revenue, and pre-provision net revenue reaching record levels. Full year 2025 EPS was $8.73, and Q4 2025 EPS was $2.59.

- The company achieved significant growth in 2025, with HFI loan growth of $5 billion (9%) and deposits increasing $10.8 billion (16%). Total assets expanded to approximately $93 billion by year-end 2025.

- For 2026, Western Alliance projects loan growth of $6 billion and deposit growth of $8 billion. Net interest income is expected to grow 11%-14%, and non-interest income is anticipated to increase 2%-4%.

- Total operating expenses are projected to rise 2%-7% in 2026, and net charge-offs are expected to be between 25 and 35 basis points, with potential for higher levels in the first half of the year as non-accrual balances are proactively reduced.

- Capital levels remained strong, with a CET1 ratio of 11% at year-end 2025, and the company repurchased 0.7 million shares for $57.5 million in Q4 2025.

- Western Alliance Bancorporation reported Earnings per Share of $2.59 and Net Revenue of $980.9 million for Q4 2025, with EPS increasing 32.8% year-over-year.

- The company's balance sheet showed growth, with Total Loans (Held for Investment) reaching $58,677 million and Total Deposits at $77,159 million in Q4 2025.

- Capital metrics remained robust, including a CET1 Ratio of 11.0% and Tangible Book Value per Share increasing 17.3% year-over-year to $61.29.

- Asset quality saw a Provision for Credit Losses of $73.0 million and Net Loan Charge-Offs of $44.6 million in Q4 2025.

- Western Alliance Bancorporation delivered record financial results for Q4 and full year 2025, with Q4 EPS of $2.59 (up 33% year-over-year) and full year EPS of $8.73 (up 23% year-over-year). Net interest income, net revenue, and pre-provision net revenue all reached record levels in Q4 2025.

- For the full year 2025, the company achieved $5 billion in HFI loan growth and $10.8 billion in deposit growth.

- The company provided a 2026 outlook projecting $6 billion in loan growth, $8 billion in deposit growth, and 11%-14% net interest income growth. Non-interest income is expected to grow 2%-4%, while total operating expenses are anticipated to increase 2%-7%.

- Asset quality remained stable in Q4 2025, with total criticized assets declining by $8 million. However, net charge-offs are expected to be elevated in the first half of 2026 (full-year guidance of 25 to 35 basis points) as non-accrual loans are resolved.

- In Q4 2025, the company repurchased approximately 0.7 million shares for $57.5 million and increased its quarterly cash dividend by $0.04. It also issued $400 million of subordinated debt to bolster its total capital ratio to 14.5%.

- Western Alliance Bancorporation (WAL) reported record financial results for Q4 and full year 2025, with Q4 EPS of $2.59 (up 33% year-over-year) and full year EPS of $8.73 (up 23% year-over-year).

- For full year 2025, the company achieved $5 billion in HFI loan growth (9%) and $10.8 billion in deposit growth (16%), driving net revenue up 12% and pre-provision net revenue up 26% from the prior year.

- The 2026 outlook projects continued strong growth, with loan growth of $6 billion, deposit growth of $8 billion, and net interest income growth of 11%-14%.

- WAL's capital position remains solid with a CET1 ratio of 11%, and the company repurchased 0.7 million shares for $57.5 million in Q4 2025, with opportunistic share repurchases expected to continue.

- Western Alliance Bancorporation reported record net interest income, revenues, and pre-provision net revenue (PPNR) for the full year 2025, with net income of $990.6 million and earnings per share of $8.73, marking increases of 25.8% and 23.1% respectively over the prior year.

- For the fourth quarter of 2025, net income was $293.2 million and diluted earnings per common share reached $2.59, an increase of 32.8% compared to Q4 2024.

- The company's balance sheet showed significant growth, with HFI loans increasing by $2.0 billion during Q4 2025 to $58.7 billion, and total assets growing 14.6% year-over-year to $92.8 billion at December 31, 2025.

- Asset quality remained steady, with net charge-offs to average loans at 0.24% for the full year 2025 and a nonperforming assets to total assets ratio of 0.69%.

- During Q4 2025, the company repurchased 0.7 million shares for $57.5 million under its share repurchase program.

Quarterly earnings call transcripts for WESTERN ALLIANCE BANCORPORATION.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more