Earnings summaries and quarterly performance for WESTERN ALLIANCE BANCORPORATION.

Executive leadership at WESTERN ALLIANCE BANCORPORATION.

Kenneth Vecchione

President and Chief Executive Officer

Barbara Kennedy

Chief Human Resources Officer

Dale Gibbons

Vice Chair and Chief Financial Officer

Emily Nachlas

Chief Risk Officer

Jessica Jarvi

Chief Legal Officer

Lynne Herndon

Chief Credit Officer

Stephen Curley

Chief Banking Officer for National Business Lines

Tim Bruckner

Chief Banking Officer for Regional Banking

Timothy Boothe

Chief Administration Officer

Vishal Idnani

Transitioning Chief Financial Officer

Board of directors at WESTERN ALLIANCE BANCORPORATION.

Anthony Meola

Director

Bruce Beach

Chair of the Board

Bryan Segedi

Director

Christopher Halmy

Director

Donald Snyder

Director

Greta Guggenheim

Director

Howard Gould

Director

Juan Figuereo

Director

Marianne Boyd Johnson

Director

Mary Chris Jammet

Director

Mary Tuuk Kuras

Director

Robert Latta

Director

Research analysts who have asked questions during WESTERN ALLIANCE BANCORPORATION earnings calls.

Anthony Elian

JPMorgan

8 questions for WAL

Bernard Von Gizycki

Deutsche Bank

8 questions for WAL

Ebrahim Poonawala

Bank of America Securities

8 questions for WAL

Matthew Clark

Piper Sandler

8 questions for WAL

Andrew Terrell

Stephens Inc.

7 questions for WAL

Casey Haire

Jefferies

6 questions for WAL

Jared Shaw

Barclays

6 questions for WAL

David Smith

Truist Securities

5 questions for WAL

Gary Tenner

D.A. Davidson & Co.

5 questions for WAL

Jon Arfstrom

RBC Capital Markets

5 questions for WAL

Timur Braziler

Wells Fargo

5 questions for WAL

Chris McGratty

KBW

4 questions for WAL

Christopher McGratty

Keefe, Bruyette & Woods

4 questions for WAL

Janet Lee

TD Cowen

4 questions for WAL

Ben Gerlinger

Citigroup

2 questions for WAL

Benjamin Gerlinger

Citigroup Inc.

2 questions for WAL

David Chiaverini

Wedbush Securities Inc.

2 questions for WAL

Timothy Coffey

Janney Montgomery Scott LLC

2 questions for WAL

Brandon King

Truist Securities

1 question for WAL

Jared David Shaw

Barclays Capital

1 question for WAL

John Rob

Barclays PLC

1 question for WAL

Nicholas Holowko

UBS Group AG

1 question for WAL

Samuel Varga

UBS

1 question for WAL

Recent press releases and 8-K filings for WAL.

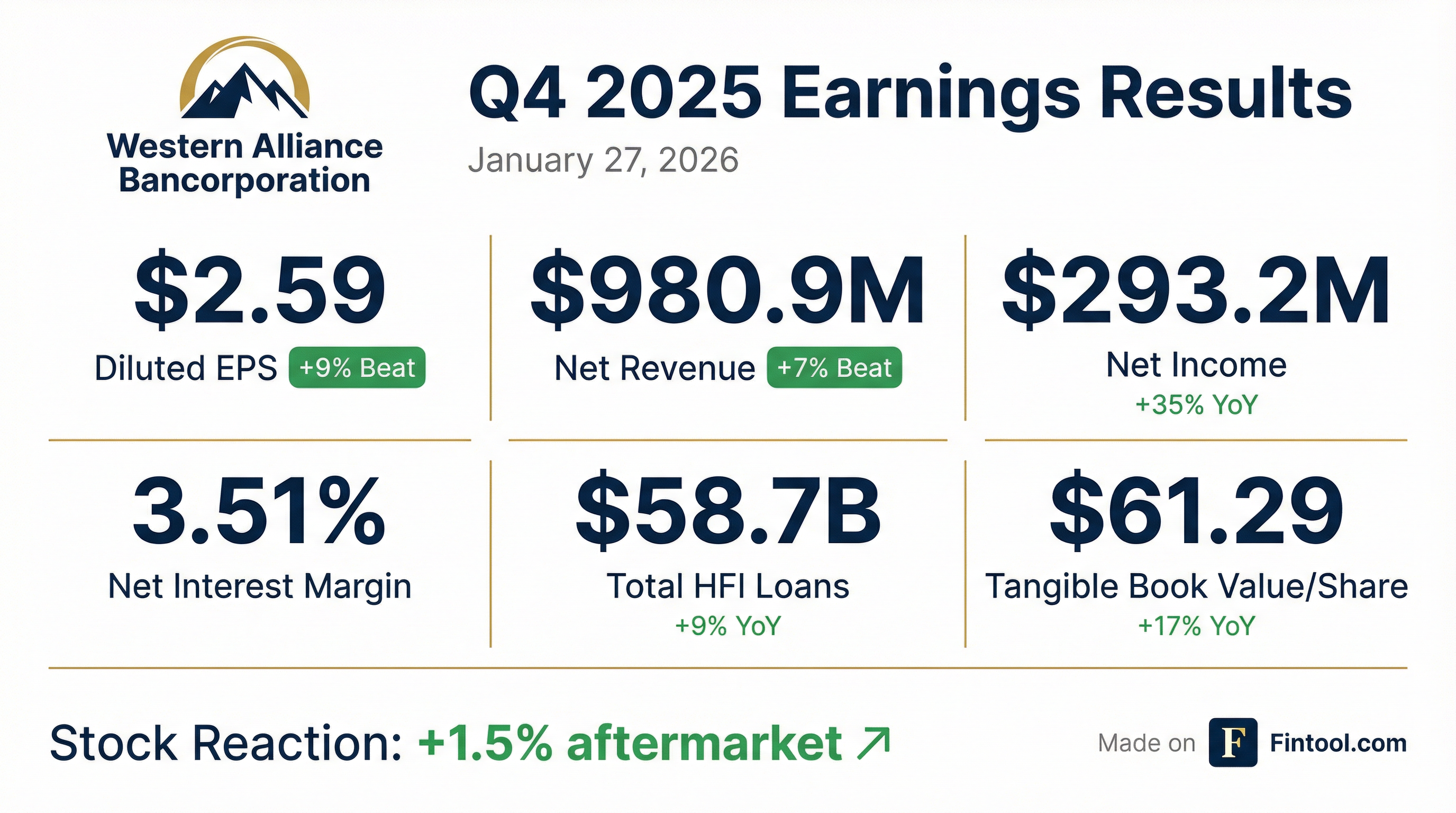

- Western Alliance Bancorporation reported record financial results for Q4 and full year 2025, with Q4 net interest income, net revenue, and pre-provision net revenue reaching record levels. Full year 2025 EPS was $8.73, and Q4 2025 EPS was $2.59.

- The company achieved significant growth in 2025, with HFI loan growth of $5 billion (9%) and deposits increasing $10.8 billion (16%). Total assets expanded to approximately $93 billion by year-end 2025.

- For 2026, Western Alliance projects loan growth of $6 billion and deposit growth of $8 billion. Net interest income is expected to grow 11%-14%, and non-interest income is anticipated to increase 2%-4%.

- Total operating expenses are projected to rise 2%-7% in 2026, and net charge-offs are expected to be between 25 and 35 basis points, with potential for higher levels in the first half of the year as non-accrual balances are proactively reduced.

- Capital levels remained strong, with a CET1 ratio of 11% at year-end 2025, and the company repurchased 0.7 million shares for $57.5 million in Q4 2025.

- Western Alliance Bancorporation reported Earnings per Share of $2.59 and Net Revenue of $980.9 million for Q4 2025, with EPS increasing 32.8% year-over-year.

- The company's balance sheet showed growth, with Total Loans (Held for Investment) reaching $58,677 million and Total Deposits at $77,159 million in Q4 2025.

- Capital metrics remained robust, including a CET1 Ratio of 11.0% and Tangible Book Value per Share increasing 17.3% year-over-year to $61.29.

- Asset quality saw a Provision for Credit Losses of $73.0 million and Net Loan Charge-Offs of $44.6 million in Q4 2025.

- Western Alliance Bancorporation delivered record financial results for Q4 and full year 2025, with Q4 EPS of $2.59 (up 33% year-over-year) and full year EPS of $8.73 (up 23% year-over-year). Net interest income, net revenue, and pre-provision net revenue all reached record levels in Q4 2025.

- For the full year 2025, the company achieved $5 billion in HFI loan growth and $10.8 billion in deposit growth.

- The company provided a 2026 outlook projecting $6 billion in loan growth, $8 billion in deposit growth, and 11%-14% net interest income growth. Non-interest income is expected to grow 2%-4%, while total operating expenses are anticipated to increase 2%-7%.

- Asset quality remained stable in Q4 2025, with total criticized assets declining by $8 million. However, net charge-offs are expected to be elevated in the first half of 2026 (full-year guidance of 25 to 35 basis points) as non-accrual loans are resolved.

- In Q4 2025, the company repurchased approximately 0.7 million shares for $57.5 million and increased its quarterly cash dividend by $0.04. It also issued $400 million of subordinated debt to bolster its total capital ratio to 14.5%.

- Western Alliance Bancorporation (WAL) reported record financial results for Q4 and full year 2025, with Q4 EPS of $2.59 (up 33% year-over-year) and full year EPS of $8.73 (up 23% year-over-year).

- For full year 2025, the company achieved $5 billion in HFI loan growth (9%) and $10.8 billion in deposit growth (16%), driving net revenue up 12% and pre-provision net revenue up 26% from the prior year.

- The 2026 outlook projects continued strong growth, with loan growth of $6 billion, deposit growth of $8 billion, and net interest income growth of 11%-14%.

- WAL's capital position remains solid with a CET1 ratio of 11%, and the company repurchased 0.7 million shares for $57.5 million in Q4 2025, with opportunistic share repurchases expected to continue.

- Western Alliance Bancorporation reported record net interest income, revenues, and pre-provision net revenue (PPNR) for the full year 2025, with net income of $990.6 million and earnings per share of $8.73, marking increases of 25.8% and 23.1% respectively over the prior year.

- For the fourth quarter of 2025, net income was $293.2 million and diluted earnings per common share reached $2.59, an increase of 32.8% compared to Q4 2024.

- The company's balance sheet showed significant growth, with HFI loans increasing by $2.0 billion during Q4 2025 to $58.7 billion, and total assets growing 14.6% year-over-year to $92.8 billion at December 31, 2025.

- Asset quality remained steady, with net charge-offs to average loans at 0.24% for the full year 2025 and a nonperforming assets to total assets ratio of 0.69%.

- During Q4 2025, the company repurchased 0.7 million shares for $57.5 million under its share repurchase program.

- Western Alliance Bancorporation reported net income of $293.2 million and earnings per share of $2.59 for Q4 2025, with full-year 2025 net income at $990.6 million and EPS at $8.73.

- The company achieved record net interest income, revenues, and Pre-Provision Net Revenue (PPNR) in Q4 2025, with net revenue totaling $980.9 million and PPNR at $428.7 million.

- The quarter was highlighted by outstanding loan and deposit growth, with HFI loans increasing by $2.0 billion quarter-over-quarter to $58.7 billion and total deposits reaching $77.2 billion at December 31, 2025.

- Asset quality remained steady, with a net charge-offs to average loans ratio of 0.31% for Q4 2025 , and a CET1 Ratio of 11.0%. The company also completed $57.5 million in share repurchases during Q4 2025.

- Western Alliance Bancorporation appointed Dr. Michael Papay and Mr. Clarke Starnes III to its Board of Directors, effective December 10, 2025, expanding the Board to fifteen directors.

- Dr. Papay, a recognized cybersecurity authority and former head of Technology Risk and Information Security at American Express, will serve on the Audit Committee and Risk Committee.

- Mr. Starnes, former Chief Risk Officer at Truist, brings expertise in risk, audit, compliance, and regulatory management, and will serve on the Finance and Investment Committee and Risk Committee.

- These appointments add expertise in cybersecurity and risk management as the company nears the $100 billion asset threshold and prepares to become a Large Financial Institution.

- Western Alliance Bancorporation reported total deposits of $77.2 billion in Q3 2025, marking a year-over-year growth of $9.2 billion and a quarter-over-quarter increase of $6.14 billion. Non-interest bearing deposits constituted 34% of total deposits.

- The company maintained strong capital levels, with an adjusted CET1 ratio of 11.3% in Q3 2025, exceeding "well-capitalized" levels. The Tangible Common Equity to Tangible Assets (TCE/TA) ratio was 11.3% in Q3 2025.

- In terms of asset quality, Criticized Loans decreased by $196 million quarterly to $1.3 billion, with Special Mention Loans decreasing by $152 million to $292 million in Q3 2025. Non-Performing Loans stood at $477 million in Q3 2025.

- Management provided a positive outlook for 2025, projecting deposit growth of +$8.5 billion and loan (HFI) growth of +$5.0 billion. Net Interest Income is expected to be up 8% - 10%, and Non-interest Income is projected to be up 12% - 16%.

- Western Alliance Bancorporation (WAL) reported record net revenue of $938 million and pre-provision net revenue of $394 million for Q3 2025, with EPS of $2.28.

- The company achieved significant balance sheet growth, with deposits increasing by $6.1 billion and net interest income rising 8% quarter-over-quarter to $750 million.

- WAL addressed specific credit exposures, including a $98.5 million note financed loan to Canter Group 5 with a $30 million reserve due to alleged fraud, and a $168 million ABL facility to Point Benita Fund 1, which remains current.

- For the full year 2025, WAL raised year-end deposit growth expectations to $8.5 billion and anticipates net interest income growth of 8% to 10%, alongside non-interest income growth of 12% to 16%.

- The company executed $25 million of its $300 million authorized stock buyback post-quarter end, maintaining its CET1 ratio comfortably above 11%.

- Western Alliance Bank reported strong financial results for Q3 2025, including record net revenue and pre-provision net revenue (PPNR) of $938,000,000 and $394,000,000 respectively, with EPS of $2.28.

- The company achieved healthy balance sheet growth, with deposits increasing by $6,100,000,000 and held for investment loans growing by $700,000,000 in Q3 2025, contributing to a 30% linked quarter annualized expansion in net interest income.

- Management provided an updated outlook for 2025, reiterating loan growth outlook of $5,000,000,000 and raising year-end deposit growth expectations to $8,500,000,000, while maintaining net interest income growth of 8% to 10% and a mid 3.5% net interest margin for the full year.

- Credit quality performed in line with guidance, with total criticized assets declining 17% and net charge-offs at 22 basis points; a $30,000,000 reserve was established for a $98,500,000 non-accrual loan related to Cantor Group V.

- Capital levels remained strong with CET1 at 11.3%, and the company initiated a $300,000,000 share buyback program, purchasing $25,000,000 through October 17, 2025.

Quarterly earnings call transcripts for WESTERN ALLIANCE BANCORPORATION.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more