Earnings summaries and quarterly performance for WASHINGTON TRUST BANCORP.

Executive leadership at WASHINGTON TRUST BANCORP.

Edward O. Handy III

Chairman and Chief Executive Officer

Dennis L. Algiere

Executive Vice President, Chief Compliance Officer and Director of Community Affairs

Kathleen A. Ryan

Executive Vice President and Chief Wealth Management Officer

Kristen L. DiSanto

Senior Executive Vice President, Chief Human Resources Officer and Corporate Secretary

Maria N. Janes

Executive Vice President, Chief Accounting Officer and Controller

Mary E. Noons

President and Chief Operating Officer

Michelle L. Kile

Executive Vice President and Chief Retail Banking Officer

Rolando A. Lora

Executive Vice President, Chief Retail Lending Officer and Director of Community Lending

Ronald S. Ohsberg

Senior Executive Vice President, Chief Financial Officer and Treasurer

William K. Wray Sr.

Senior Executive Vice President and Chief Risk Officer

Board of directors at WASHINGTON TRUST BANCORP.

Angel Taveras

Director

Constance A. Howes

Director

Debra M. Paul

Director

Edwin J. Santos

Director

John T. Ruggieri

Director

Joseph P. Gencarella

Director

Lisa M. Stanton

Director

Mark K. W. Gim

Director

Robert A. DiMuccio

Director

Sandra Glaser Parrillo

Director

Research analysts who have asked questions during WASHINGTON TRUST BANCORP earnings calls.

Damon Del Monte

Keefe, Bruyette & Woods

13 questions for WASH

Mark Fitzgibbon

Piper Sandler & Co.

12 questions for WASH

Laurie Hunsicker

Seaport Research Partners

10 questions for WASH

Laura Havener Hunsicker

Seaport Research Partners

3 questions for WASH

Ross Haberman

Rlh Investments

2 questions for WASH

Recent press releases and 8-K filings for WASH.

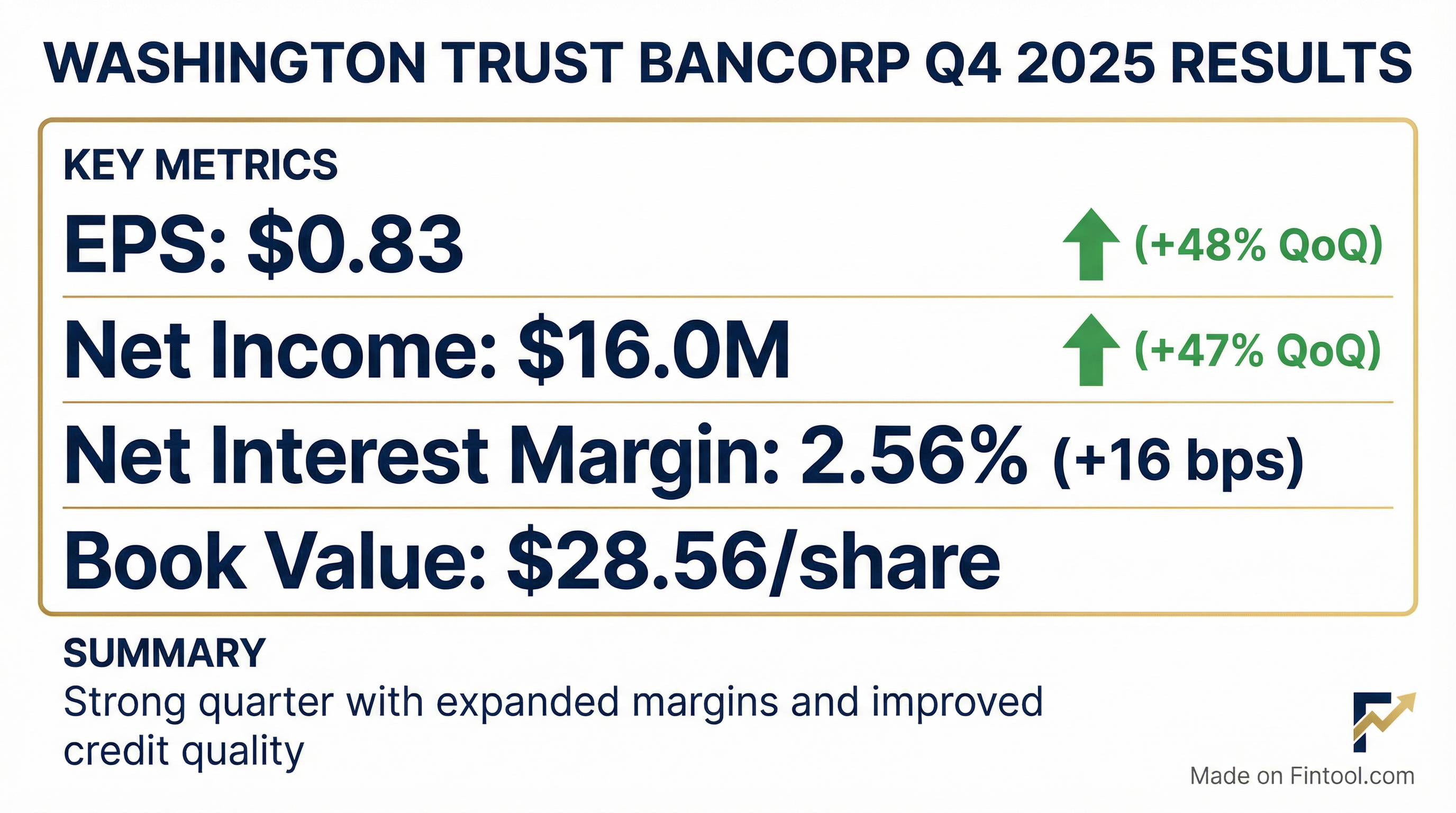

- Washington Trust Bancorp reported net income of $16 million or $0.83 per share for Q4 2025, with net interest income up 5% from Q3 to $40.7 million and net interest margin increasing 16 basis points to 2.56%.

- The company projects its net interest margin (NIM) to reach $2.78-$2.82 by Q4 2026, benefiting from a 13 basis point increase due to swap terminations by Q3 and 3-4 basis points of organic expansion per quarter.

- Strategic investments in 2025 included a wealth asset purchase and new commercial banking leadership, with further expansion in early 2026 through a dedicated institutional banking team and a de novo branch opening in Pawtucket.

- For 2026, the company anticipates 5% year-over-year loan growth, driven by 4-5% CRE growth and faster C&I growth. Q1 2026 non-interest expenses are expected to increase, with salaries and benefits up 6%.

- Washington Trust Bancorp reported net income of $16 million or $0.83 per share for Q4 2025, with adjusted EPS up 41% year-over-year, driven by margin expansion and increased revenues from wealth management.

- The Net Interest Margin (NIM) was 2.56% in Q4 2025, and is projected to increase by 13 basis points by Q3 2026 due to a swap termination, with an estimated Q4 2026 NIM of $2.78-$2.82.

- The company forecasts a "very solid 5% year-over-year" loan growth for 2026, with significant contributions expected from new commercial banking teams focusing on C&I loans.

- Strategic investments include hiring a new Chief Commercial Banking Officer, bringing on a dedicated institutional banking team, and a de novo branch opening in Pawtucket in 2026.

- Washington Trust Bancorp (WASH) reported net income of $16 million or $0.83 per share for Q4 2025, with adjusted EPS up 41% year-over-year. Net interest income was $40.7 million, up 5% from Q3, and the net interest margin (NIM) was 2.56%, an increase of 16 basis points from the preceding quarter.

- The company expects continued NIM expansion in 2026, projecting a 9 basis point increase in Q2 and an additional 4 basis points in Q3 due to a swap termination, alongside 3-4 basis points of organic expansion per quarter, leading to a Q4 2026 NIM estimate of 2.78%-2.82%.

- Strategic investments in commercial banking include the hiring of a new Chief Commercial Banking Officer and a dedicated four-person institutional banking team focused on education, healthcare, and nonprofit providers in the Northeast region. These efforts are expected to contribute to a "very solid 5% year-over-year" loan growth for 2026.

- Asset quality improved, with non-accruing loans at 25 basis points of total loans, zero non-accruing commercial loans, and net recoveries of $160,000 for the quarter.

- Washington Trust Bancorp, Inc. reported net income of $16.0 million, or $0.83 per diluted share, for Q4 2025, and $52.2 million, or $2.71 per diluted share, for the full-year 2025, a significant improvement from a net loss in 2024.

- The net interest margin improved to 2.56% in Q4 2025, up 16 basis points from the prior quarter, and the full-year 2025 net interest margin was 2.40%, up 53 basis points from 2024.

- The company experienced growth in noninterest income, with wealth management revenues increasing by 5% and mortgage banking revenues up 14% compared to Q4 2024.

- Asset quality metrics improved, with nonaccrual loans decreasing to $12.9 million, or 0.25% of total loans, at December 31, 2025, and the provision for credit losses normalizing to $600 thousand in Q4 2025.

- Washington Trust maintained strong capital ratios, with a total risk-based capital ratio of 12.95% at December 31, 2025, and declared a quarterly dividend of 56 cents per share.

- Washington Trust Bancorp reported Q4 2025 net income of $16.0 million, or $0.83 per diluted share, up from $10.8 million, or $0.56 per diluted share, in Q3 2025.

- For the full year 2025, net income reached $52.2 million, or $2.71 per diluted share, a substantial turnaround from a net loss of $28.1 million, or a $1.63 loss per diluted share, in 2024.

- The net interest margin expanded to 2.56% in Q4 2025, an increase of 16 basis points from the prior quarter, contributing to a full-year 2025 net interest margin of 2.40%, up 53 basis points from 2024.

- Performance was bolstered by a 5% increase in wealth management revenues and significant growth in mortgage banking, with originations up 21% and sales up 25% in Q4 2025.

- The company maintained stable loan balances at $5.1 billion and achieved 1% growth in in-market deposits from Q3 2025, and 9% growth from December 31, 2024.

- Washington Trust Bancorp reported net income of $10.8 million or $0.56 per share for Q3 2025, with a net interest margin of 2.40%, an increase of 4 basis points from the preceding quarter.

- The company recorded $11.3 million in charge-offs during the quarter due to the resolution of two significant credit exposures, which resulted in an elevated provision for credit losses.

- Strategic investments included the acquisition of $195 million in Assets Under Management (AUM) from Lighthouse Financial Management and the hiring of a new Chief Commercial Banking Officer.

- Washington Trust repurchased 237,000 shares for $6.4 million in Q3 2025, completing its $7 million internal buyback allocation, and plans to pause further repurchases to support capital levels for expected commercial lending growth.

- Management anticipates a 5 basis point margin expansion in Q4 2025 and projects low single-digit loan growth for the full year.

- Washington Trust Bancorp reported Q3 2025 net income of $10.8 million, or $0.56 per share, a decrease from $13.2 million ($0.68 per share) in the prior quarter, primarily due to an elevated provision for credit losses from resolving two significant credit exposures.

- Despite the credit provisions, the company saw strong performance in core business lines, with net interest income up 4% linked quarter to $38.8 million, wealth management revenues up 3% (including $195 million in AUM from an asset purchase), and mortgage banking revenues up 15%.

- End market deposits increased by $179 million (4%) from Q2 2025, contributing to a 21% decrease in wholesale funding linked quarter, and the loan to deposit ratio decreased by 3.8 percentage points to 98%.

- The company completed its $7 million internal share repurchase program, buying back 237,000 shares in Q3 at an average price of $27.18 and an additional 21,000 shares in October, and will now pause further repurchases to maintain capital levels for anticipated commercial lending growth.

- Management expects margin expansion of approximately five basis points in Q4 and anticipates low single-digit loan growth for the full year.

- Washington Trust Bancorp reported net income of $10.8 million, or $0.56 per diluted share, for the third quarter of 2025, a decrease from $13.2 million, or $0.68 per diluted share, in the second quarter of 2025.

- The net interest margin increased by 4 basis points from the preceding quarter to 2.40% in Q3 2025.

- A provision for credit losses on loans of $7.0 million was recognized in Q3 2025, significantly higher than $650 thousand in Q2 2025, primarily due to $11.3 million in charge-offs on two commercial loan relationships. Nonaccrual commercial loans decreased to $1.0 million at September 30, 2025, from $14.0 million at June 30, 2025.

- Wealth management asset-based revenues grew by 6% and mortgage banking revenues increased by 15% from the preceding quarter. In-market deposits rose by 4% to $5.2 billion from June 30, 2025.

- The company made strategic investments, including hiring a new senior executive for its commercial banking division and purchasing client accounts of Lighthouse Financial Management, LLC, which added approximately $195 million of managed assets. The Board of Directors declared a quarterly dividend of 56 cents per share for Q3 2025, and the Corporation repurchased 236,803 shares for $6.4 million.

- Washington Trust Bancorp, Inc. reported net income of $10.8 million, or $0.56 per diluted share, for the third quarter of 2025, which is down from $13.2 million, or $0.68 per diluted share, in the second quarter of 2025.

- Net interest income for the third quarter of 2025 was $38.8 million, representing a 4% increase from the preceding quarter, and the net interest margin expanded to 2.40%, up 4 basis points.

- The company experienced growth in noninterest income, with wealth management asset-based revenues increasing by 6% and mortgage banking revenues increasing by 15% from the preceding quarter.

- A provision for credit losses on loans of $7.0 million was recognized in the third quarter of 2025, compared to $650 thousand in the second quarter, and net charge-offs totaled $11.4 million. Nonaccrual loans decreased to $14.0 million, or 0.27% of total loans, at September 30, 2025.

- The Board of Directors declared a quarterly dividend of 56 cents per share for the third quarter of 2025, and the Corporation repurchased 236,803 shares at a total cost of $6.4 million during the quarter.

- Washington Trust Bancorp, Inc. anticipates its third quarter 2025 financial performance will be adversely affected by $11.3 million in charge-offs from two commercial loan relationships.

- The company expects to recognize a provision for credit losses on loans of $7.0 million for Q3 2025 as a result of these charge-offs.

- The charge-offs include $8.3 million related to a telecom infrastructure construction contractor in Chapter 11 bankruptcy and $3.0 million from the sale of a nonaccrual commercial real estate loan.

- Following these actions, commercial nonaccrual loans are expected to decrease to $1.0 million as of September 30, 2025, compared to $14.0 million on June 30, 2025.

Quarterly earnings call transcripts for WASHINGTON TRUST BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more