Earnings summaries and quarterly performance for Westlake Chemical Partners.

Research analysts who have asked questions during Westlake Chemical Partners earnings calls.

Recent press releases and 8-K filings for WLKP.

Westlake Chemical Partners Reports Q4 and Full Year 2025 Results, Anticipates Improved Coverage in 2026

WLKP

Earnings

Guidance Update

Dividends

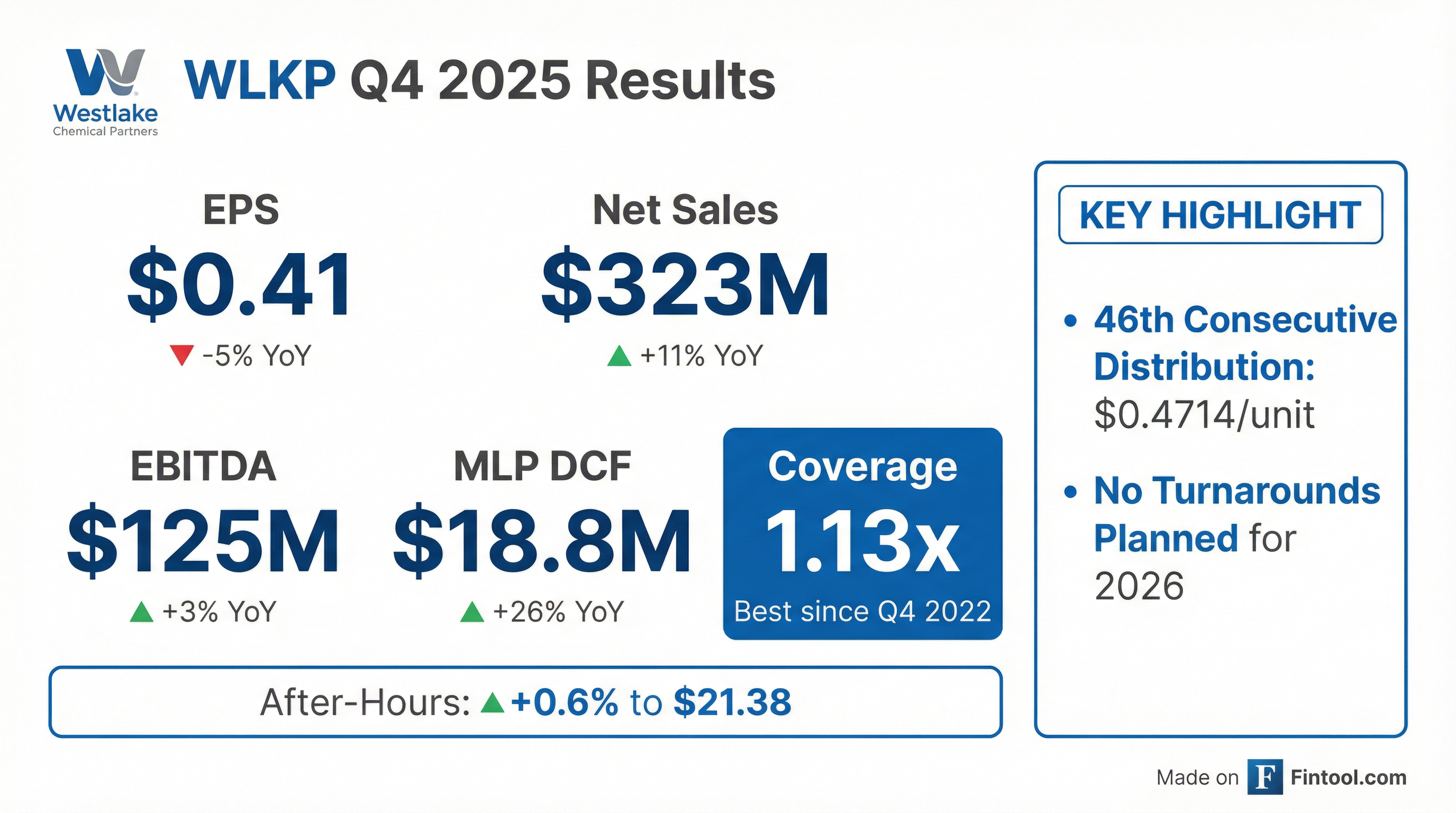

- Westlake Chemical Partners reported full-year 2025 net income of $49 million and distributable cash flow of $53 million, both decreased from 2024 primarily due to lower production and sales volumes resulting from a planned turnaround. For Q4 2025, net income was $15 million and distributable cash flow was $19 million.

- The full-year 2025 distribution coverage ratio was 0.8 times, impacted by the turnaround, but management anticipates it will rise above 1.1 times in 2026 due to no planned turnarounds and expected solid production growth.

- The partnership announced a Q4 2025 distribution of $0.4714 per unit, marking its 46th consecutive quarterly distribution without reductions. The Ethylene Sales Agreement with Westlake was renewed through 2027 with unchanged terms, and the company maintains a strong balance sheet with a consolidated leverage ratio below 1 time.

3 days ago

Westlake Chemical Partners Reports Q4 and Full Year 2025 Results

WLKP

Earnings

Dividends

Guidance Update

- Westlake Chemical Partners reported full year 2025 net income of $49 million or $1.38 per unit, and Q4 2025 net income of $15 million or $0.41 per unit.

- The partnership's full year 2025 distributable cash flow (DCF) was $53 million, leading to a distribution coverage ratio of 0.8 times, primarily due to lower production from a planned turnaround.

- A quarterly distribution of $0.4714 per unit was announced for Q4 2025, marking the 46th consecutive quarterly distribution since the IPO.

- OpCo renewed its Ethylene Sales Agreement with Westlake through 2027 without changes, ensuring stable fee-based cash flow.

- Management anticipates that the absence of planned turnarounds in 2026 will lead to a recovery in distributable cash flow and the distribution coverage ratio to above 1.1 times.

3 days ago

Westlake Chemical Partners Reports Q4 and Full Year 2025 Results

WLKP

Earnings

Dividends

Guidance Update

- Westlake Chemical Partners reported Q4 2025 net income of $15 million or $0.41 per unit, and full year 2025 net income of $49 million or $1.38 per unit, which decreased by $13 million from full year 2024 due to lower production from a planned turnaround.

- The partnership announced a Q4 2025 distribution of $0.4714 per unit, marking its 46th consecutive quarterly distribution. The full year 2025 distribution coverage was 0.8 times but is expected to recover above 1.1 times in 2026 due to no planned turnarounds.

- OpCo successfully renewed its Ethylene Sales Agreement with Westlake through 2027 with no changes to terms, ensuring stable fee-based cash flow.

- The company ended Q4 2025 with a consolidated cash balance of $68 million and long-term debt of $400 million, maintaining a consolidated leverage ratio below 1 time.

3 days ago

Westlake Chemical Partners LP Announces Q4 and Full Year 2025 Results

WLKP

Earnings

Dividends

Guidance Update

- Westlake Chemical Partners LP reported net income attributable to the Partnership of $14.5 million or $0.41 per limited partner unit for Q4 2025, and $48.7 million or $1.38 per limited partner unit for the full year 2025.

- For Q4 2025, the company achieved MLP distributable cash flow of $18.8 million with a quarterly coverage ratio of 1.13x. The trailing twelve-month coverage ratio for Q4 2025 was 0.80x, an increase from 0.75x at the end of Q3 2025.

- A quarterly distribution of $0.4714 per unit was declared for Q4 2025, marking the 46th consecutive quarterly distribution.

- Management expects increased production and sales volume in 2026, with no planned turnarounds, which is anticipated to improve the coverage ratio.

4 days ago

Westlake Chemical Partners Reports Mixed 2025 Results, Anticipates 2026 Rebound

WLKP

Earnings

Guidance Update

Dividends

- Westlake Chemical Partners reported mixed Q4 and full-year 2025 results, with a planned Petro 1 turnaround sharply reducing full-year production, net income, and distributable cash flow, though Q4 cash generation improved.

- The partnership maintained 46 consecutive quarterly distributions, with the most recent payout of $0.4714 per unit, noting the 0.8x distribution coverage ratio in 2025 was a planned, temporary dip due to the turnaround.

- Management expects production and cash flow to rebound in 2026 with coverage returning toward historical levels, underpinned by its fee-based, fixed-margin ethylene sales agreement renewed through 2027.

- Q4 distributable cash flow rose to $19 million (or $0.53 per unit), 26.7% higher than the prior-year quarter, with consolidated leverage remaining comfortably below 1x.

4 days ago

Westlake Chemical Partners LP Announces Fourth Quarter and Full Year 2025 Results

WLKP

Earnings

Guidance Update

Dividends

- Westlake Chemical Partners LP reported net income attributable to the Partnership of $14.5 million for the fourth quarter of 2025 and $48.7 million for the full year 2025.

- MLP distributable cash flow was $18.8 million in Q4 2025, resulting in a quarterly coverage ratio of 1.13x. For the full year 2025, MLP distributable cash flow was $53.4 million.

- The Partnership declared a quarterly distribution of $0.4714 per unit for Q4 2025, marking its 46th consecutive quarterly distribution.

- The decrease in full year 2025 net income and cash flows from operating activities was primarily due to lower production and sales volume and cash expenditures for the planned Petro 1 turnaround, which was completed in the second quarter of 2025.

- Management anticipates increased production and sales volume and an improved coverage ratio in 2026, as there are no planned turnarounds for the year.

4 days ago

Westlake Chemical Partners Reports Q3 2025 Results and Renews Ethylene Sales Agreement

WLKP

Earnings

Dividends

Guidance Update

- Westlake Chemical Partners reported Third Quarter 2025 net income of $15 million, or $0.42 per unit, with consolidated net income of $86 million on consolidated net sales of $309 million.

- The Partnership's distributable cash flow for Q3 2025 was $15 million, or $0.42 per unit, representing a $3 million decrease compared to Q3 2024, primarily due to higher maintenance capital expenditures and lower margins on third-party ethylene sales. The planned turnaround in Q2 2025 also impacted cash flows, but the company expects full coverage from its operating surplus now that the turnaround is complete.

- A quarterly distribution of $0.4714 per unit for Q3 2025 was announced, payable on November 26, 2025. The ethylene sales agreement was renewed through the end of 2027 with Westlake Corporation, maintaining stable pricing and sales volume protections.

- The company ended Q3 2025 with $51 million in consolidated cash and $400 million in long-term debt, maintaining a consolidated leverage ratio of approximately one time. No planned turnarounds are scheduled for the remainder of 2025 or in 2026.

Oct 30, 2025, 5:00 PM

Westlake Reports Q3 2025 Financial Results with Significant Goodwill Impairment

WLKP

Earnings

Guidance Update

Demand Weakening

- Westlake reported net sales of $2.8 billion and EBITDA of $313 million for Q3 2025.

- The company incurred a net loss attributable to Westlake Corporation of $(782) million, or $(6.06) diluted earnings per share, primarily due to a $727 million non-cash goodwill impairment charge in North America Chlorovinyls.

- Westlake achieved ~$115 million in company-wide cost savings year-to-date, including $40 million in Q3 2025, and is progressing towards $200 million in identified cost savings for 2026.

- The Housing and Infrastructure Products (HIP) segment demonstrated solid sales and EBITDA, with sales growth outpacing the market, while the Performance and Essential Materials (PEM) segment's operating rate and sales volume improved as Q3 2025 progressed.

Oct 30, 2025, 5:00 PM

Westlake Chemical Partners Renews Ethylene Sales Agreement Through 2027

WLKP

Dividends

New Projects/Investments

- Westlake Chemical Partners LP has renewed its Ethylene Sales Agreement with Westlake Corporation through December 31, 2027, maintaining the pricing formula and sales volume protections for 95% of ethylene production. This renewal is crucial for ensuring stable and predictable cash flows, enabling the Partnership to sustain its record of 45 consecutive quarterly distributions.

- Despite a decline in third quarter 2025 net income and distributable cash flow due to higher maintenance capital expenditures, the Partnership's cash flow remained stable because of the fee-based structure with take-or-pay protections in the agreement.

- The renewal also includes amendments to the Services and Secondment Agreement and Omnibus Agreement to align terms and clarify indemnification obligations, and Westlake Chemical Partners owns a 22.8% interest in Westlake Chemical OpCo LP, which operates three ethylene production facilities and an ethylene pipeline.

Oct 30, 2025, 4:13 PM

Westlake Chemical Partners LP Renews Key Sales Agreement and Reports Q3 2025 Results

WLKP

Earnings

Dividends

- Westlake Chemical Partners LP (WLKP) announced the renewal of its Ethylene Sales Agreement with Westlake Chemical OpCo LP and Westlake Corporation through December 31, 2027. This renewal maintains the same pricing formula and sales volume protections, ensuring the continued offtake of 95% of OpCo's ethylene production.

- For the third quarter of 2025, net income attributable to the Partnership was $14.7 million, and MLP distributable cash flow was $14.9 million. These figures represent a decrease from Q3 2024, which saw net income of $18.1 million and MLP distributable cash flow of $17.9 million. Cash flows from operating activities for Q3 2025 were $105.2 million, a decrease from $126.1 million in Q3 2024, but a significant increase from $9.1 million in Q2 2025 due to a decline in cash payments related to a turnaround.

- The Partnership declared its 45th consecutive quarterly distribution of $0.4714 per unit for Q3 2025. The trailing twelve-month coverage ratio for Q3 2025 was 0.75x, down from 0.79x at the end of Q2 2025, primarily due to higher maintenance capital expenditures.

Oct 30, 2025, 11:33 AM

Quarterly earnings call transcripts for Westlake Chemical Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more