Earnings summaries and quarterly performance for Waterstone Financial.

Executive leadership at Waterstone Financial.

Board of directors at Waterstone Financial.

Research analysts covering Waterstone Financial.

Recent press releases and 8-K filings for WSBF.

Waterstone Financial Announces Q4 and Full-Year 2025 Results

WSBF

Earnings

Dividends

Share Buyback

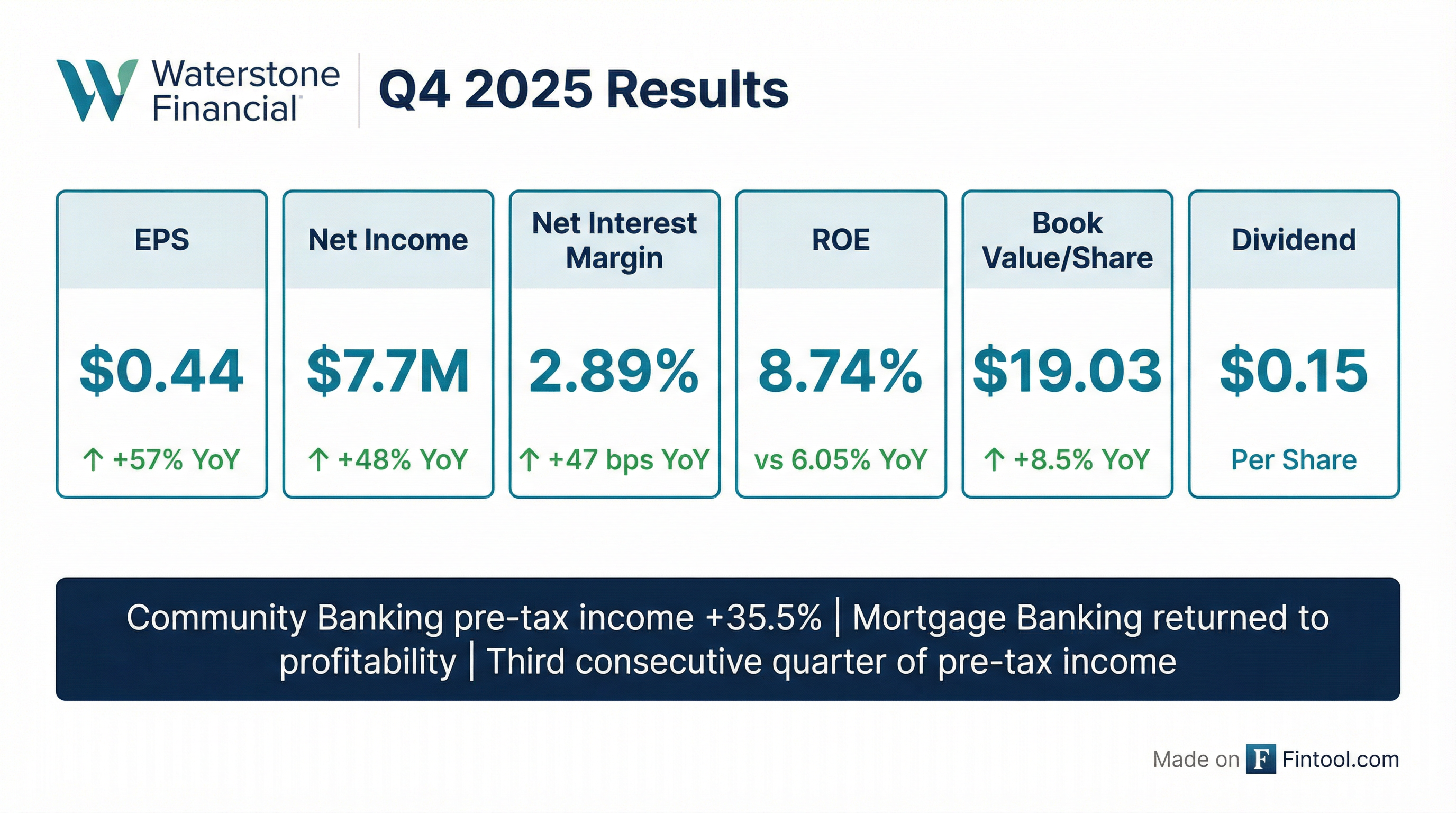

- Waterstone Financial, Inc. reported net income of $7.7 million, or $0.44 per diluted share, for the quarter ended December 31, 2025, an increase from $5.2 million, or $0.28 per diluted share, for the same quarter in 2024. For the full year 2025, diluted EPS was $1.48, up from $1.01 in 2024.

- The company's CEO highlighted net interest margin growth to 2.89%, deposit growth, and strong asset quality metrics as contributors to the best quarterly pretax income since June 2022. The Mortgage Banking segment also recorded its third consecutive quarter of pre-tax income.

- Waterstone Financial returned $5.3 million to shareholders in the quarter ended December 31, 2025, through buybacks and dividends, repurchasing approximately 174,000 shares at an average cost of $15.62 per share. Book value per share increased to $19.03 at December 31, 2025, from $17.53 at December 31, 2024.

Jan 28, 2026, 9:15 PM

Waterstone Financial, Inc. Announces Q4 and Full-Year 2025 Results

WSBF

Earnings

Dividends

Share Buyback

- Waterstone Financial, Inc. reported consolidated net income of $7.7 million, or $0.44 per diluted share, for the quarter ended December 31, 2025, an increase from $5.2 million, or $0.28 per diluted share, in the prior year quarter. For the full year 2025, diluted EPS was $1.48, up from $1.01 in 2024.

- The Community Banking segment's net interest income grew by 20.4% to $15.5 million for Q4 2025, with its net interest margin increasing to 2.89%.

- The Mortgage Banking segment recorded pre-tax income of $900,000 for the quarter ended December 31, 2025, a significant improvement from a pre-tax loss of $625,000 in the same period last year.

- The company returned $5.3 million to shareholders in Q4 2025 through a quarterly dividend of $0.15 per share and repurchases of approximately 174,000 shares at an average cost of $15.62 per share.

- Consolidated return on average assets was 1.35% and return on average equity was 8.74% for Q4 2025, both showing improvement from Q4 2024.

Jan 28, 2026, 9:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more